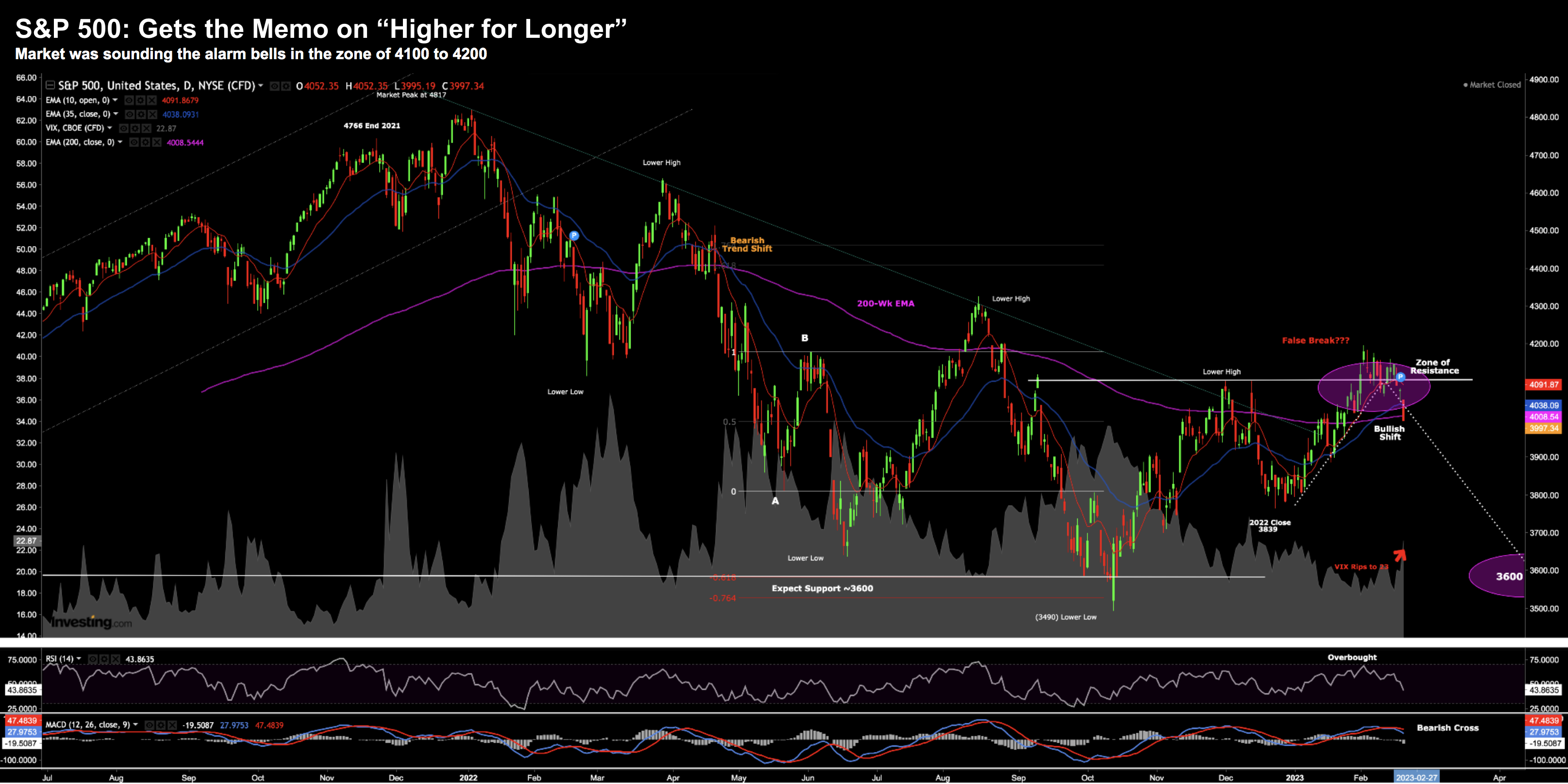

S&P 500 Meets Resistance

S&P 500 Meets Resistance

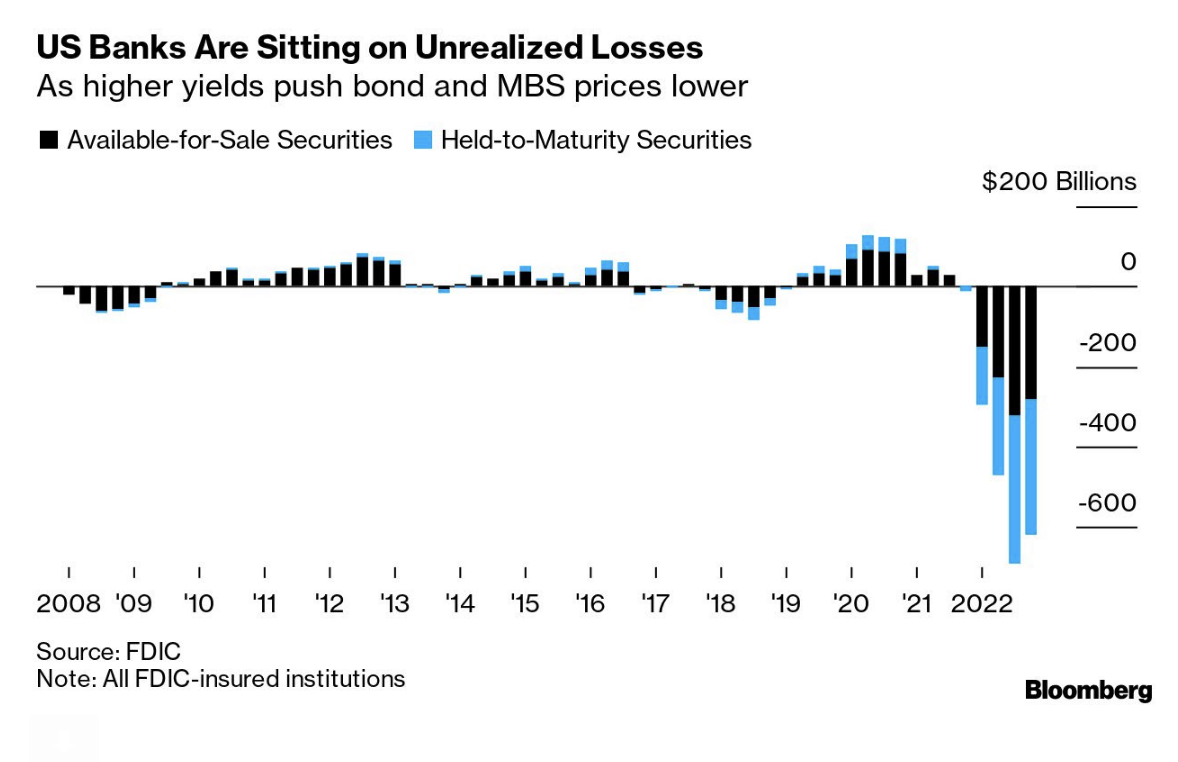

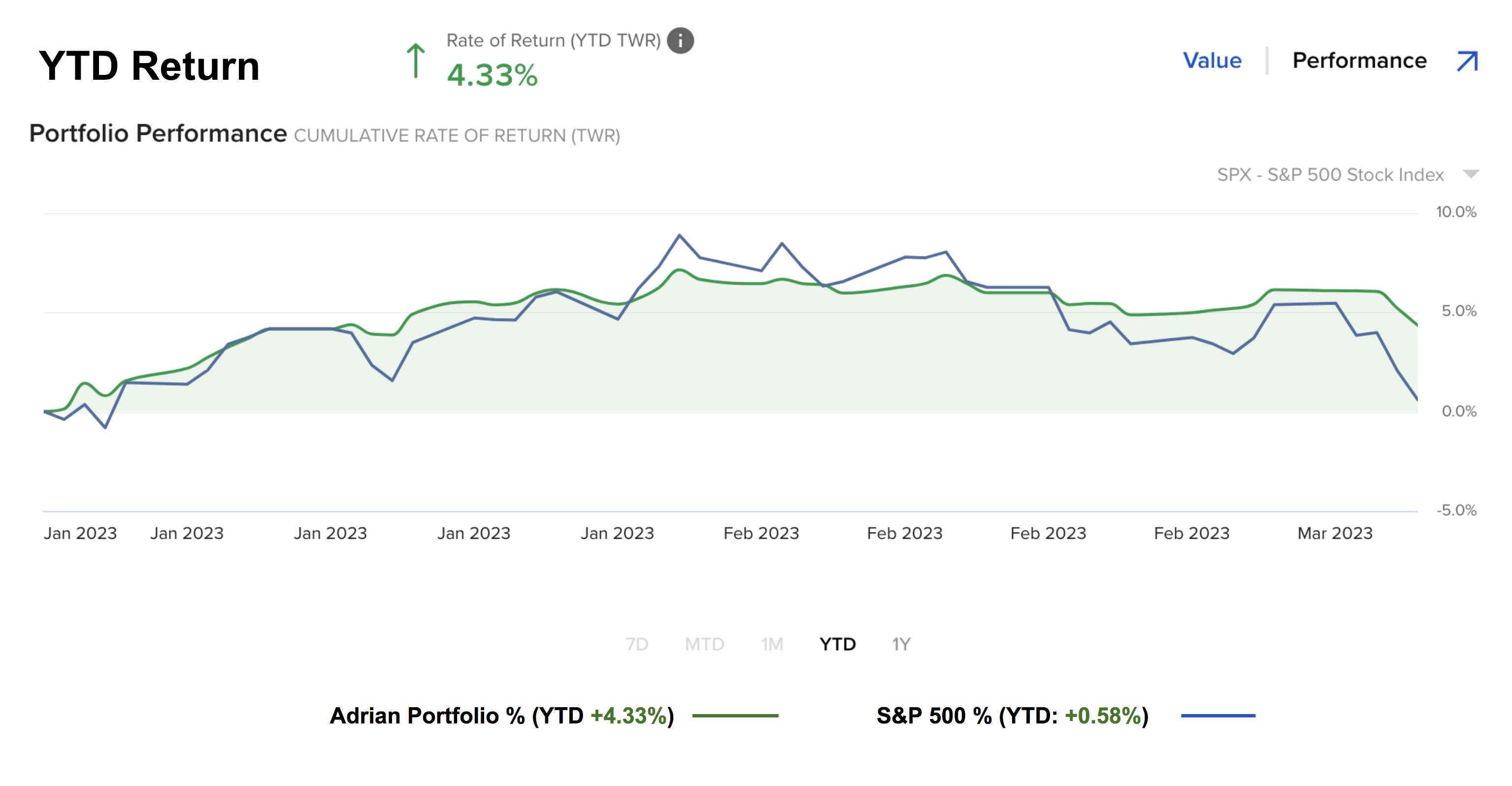

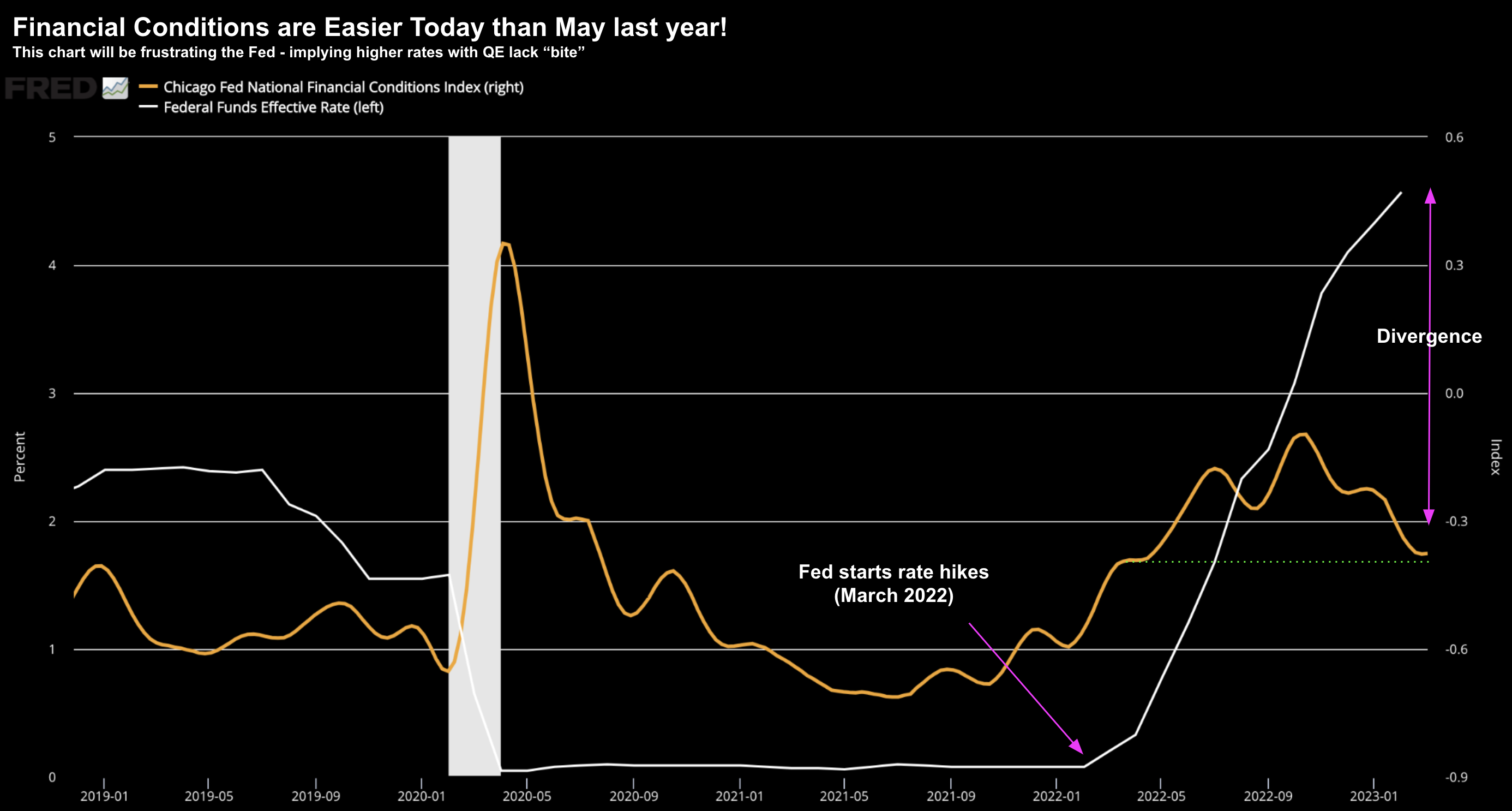

There's a few good reasons to be bullish: (i) Q1 earnings were better than feared; (ii) Bank deposits have stabilized; (iii) Inflation is slowly (but surely) working its way down; (iv) The Fed is closer to its terminal rate; and (v) We're yet to see any major deterioration in credit. All of those are positives for risk assets. However, stocks have run a long way fast and are due to take a pause. I think that's what we will see...