Powell Pop… Don’t Get Too Excited

Powell Pop… Don’t Get Too Excited

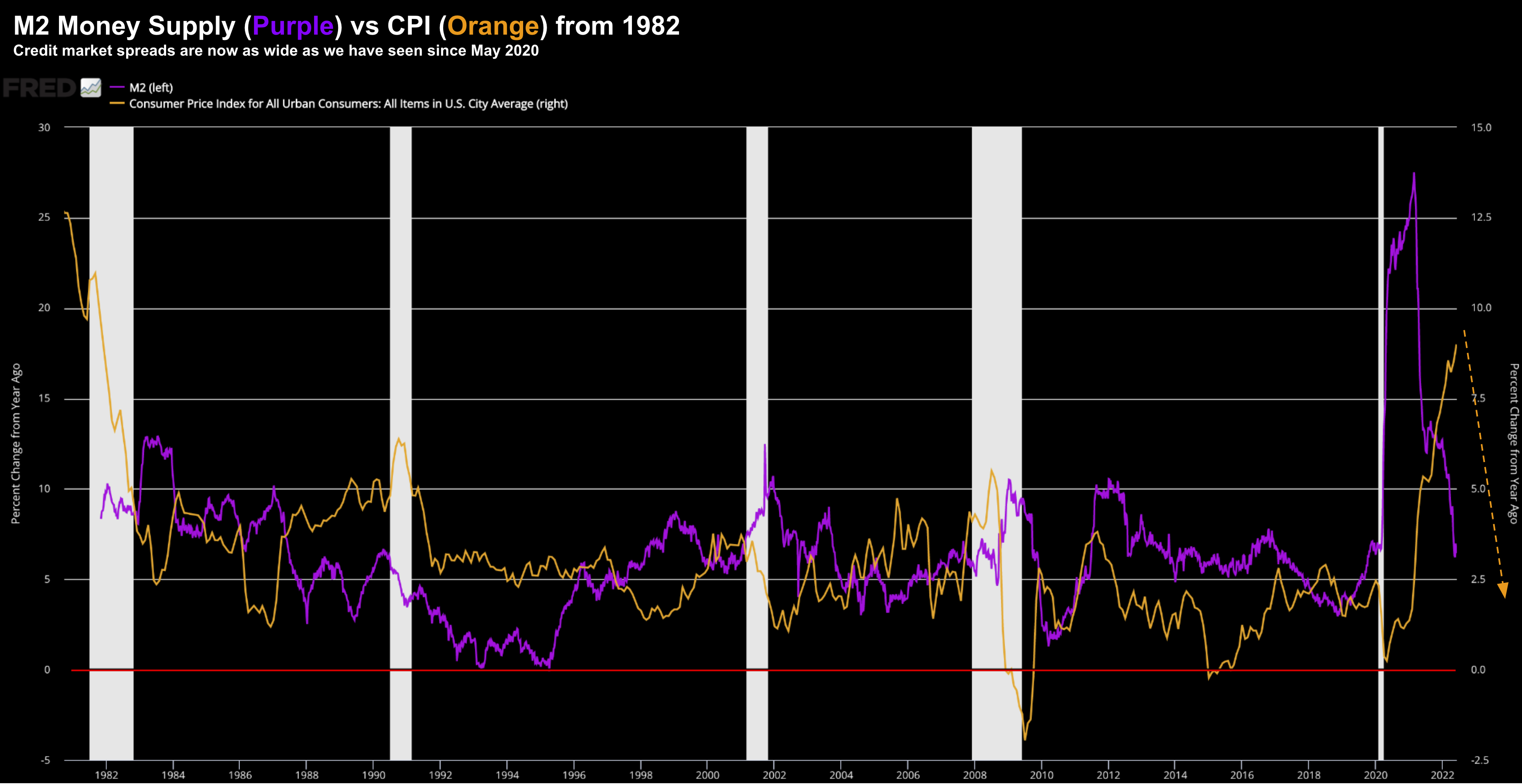

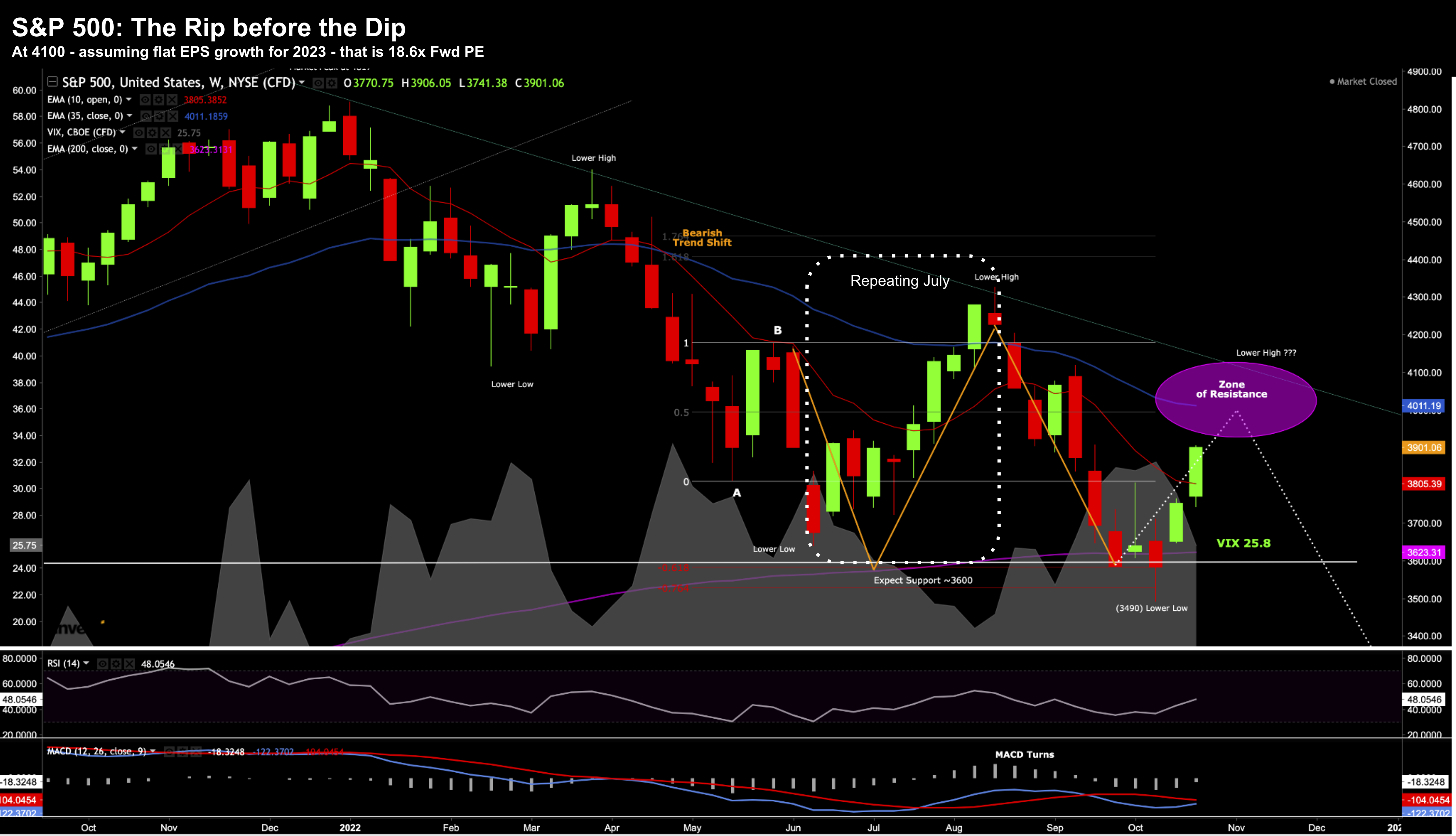

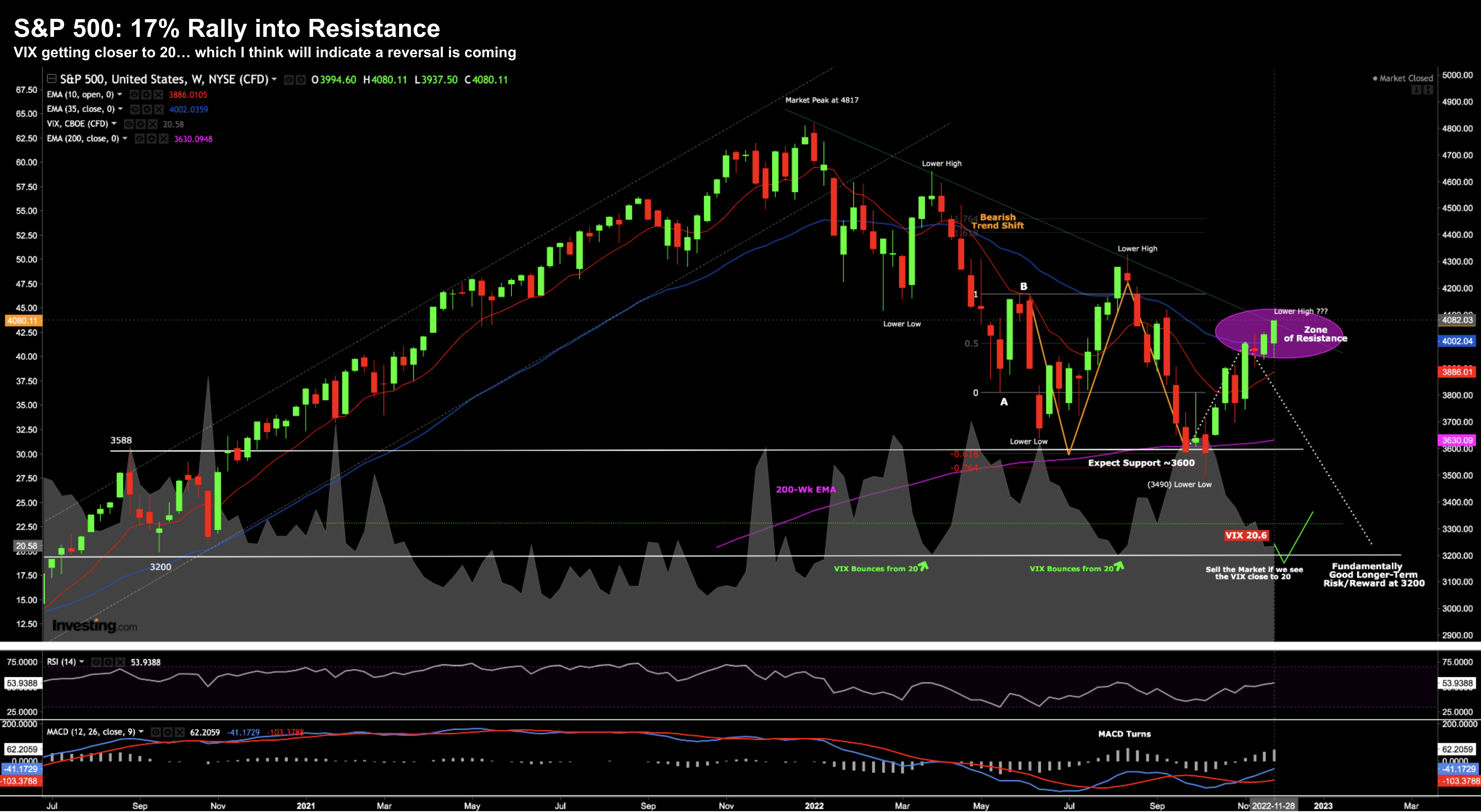

The market is popping on the hope of a more dovish Fed going forward. Chairman Jay Powell gave the market 'hope' by saying the Fed is likely to moderate the pace of hikes. But is that 'really' that bullish?