Does the Bullish Case Hold Water?

Does the Bullish Case Hold Water?

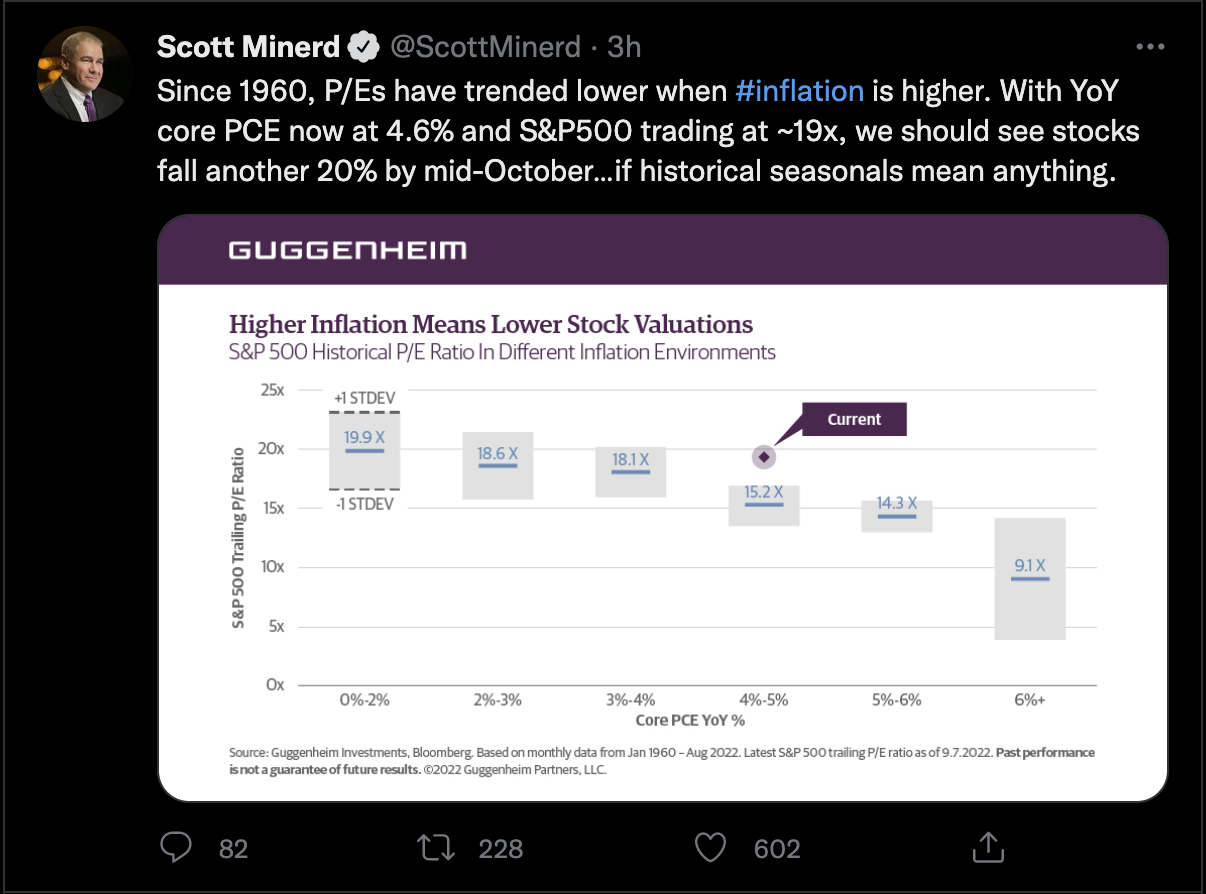

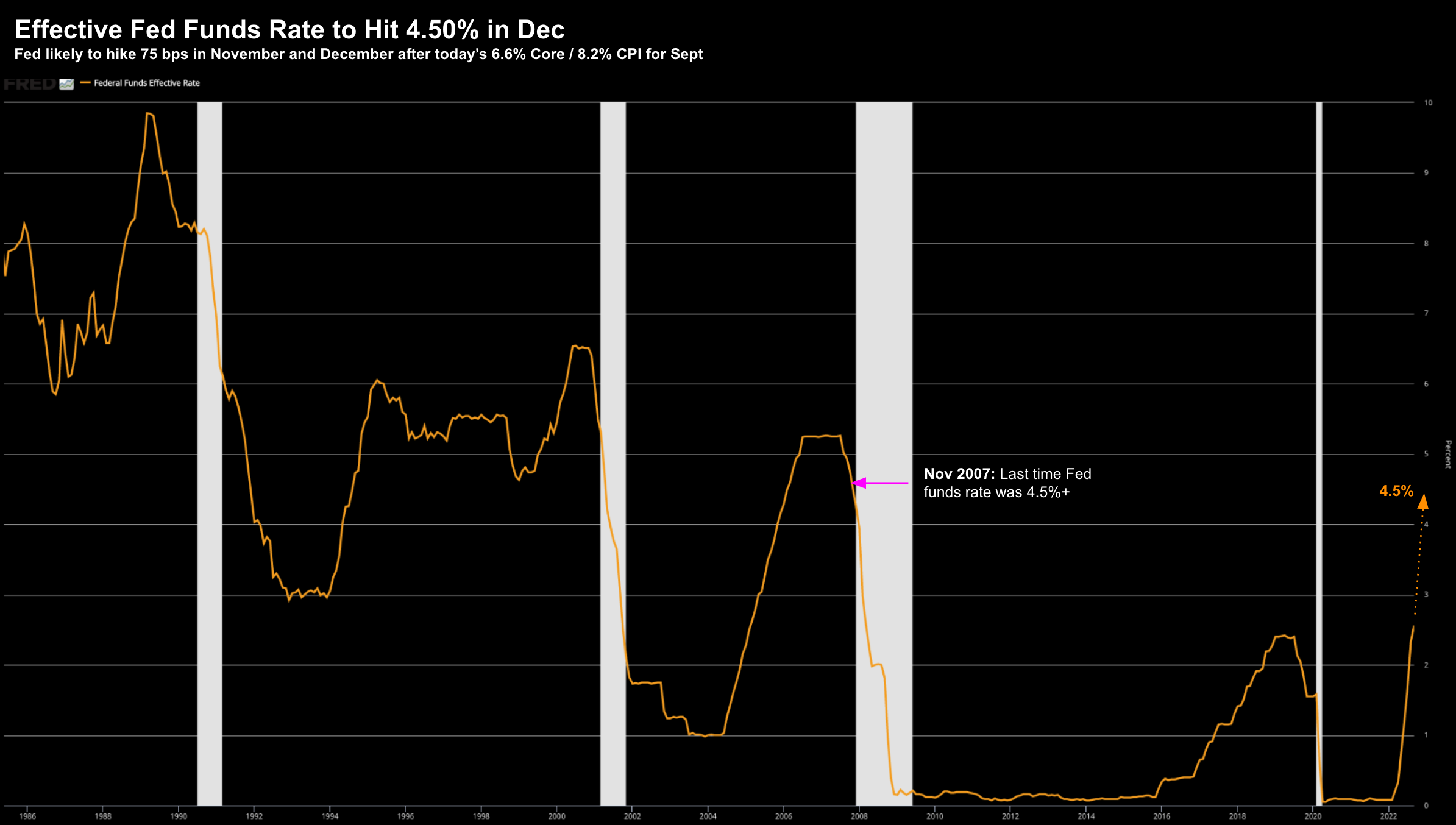

Markets tried hard to rally this week - but was met with strong selling. I lay out both the bullish and bearish case... where I favor lower prices with a S&P 500 target of 3200