August Wasn’t Kind… Don’t Expect Sept to be Better

August Wasn’t Kind… Don’t Expect Sept to be Better

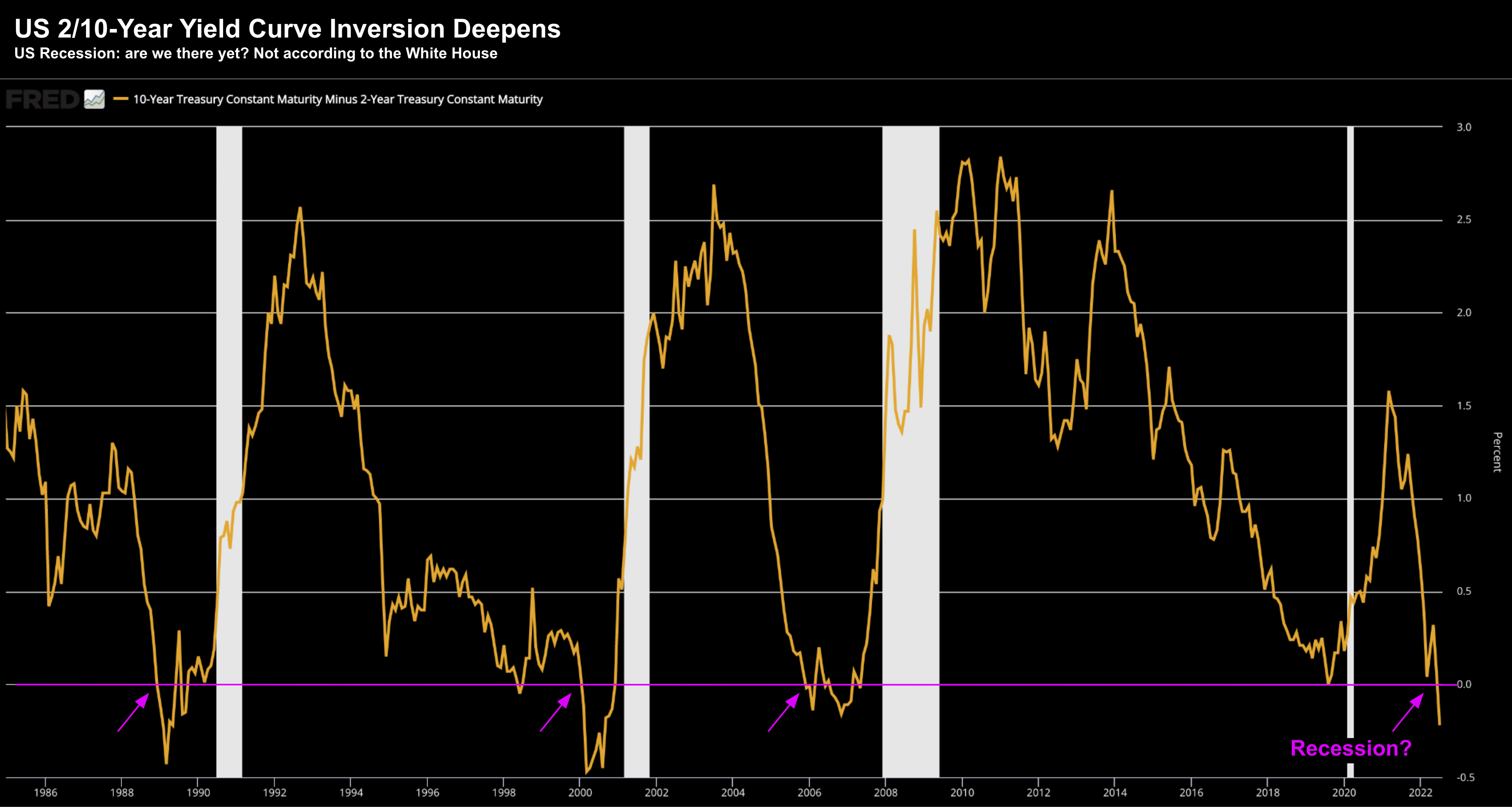

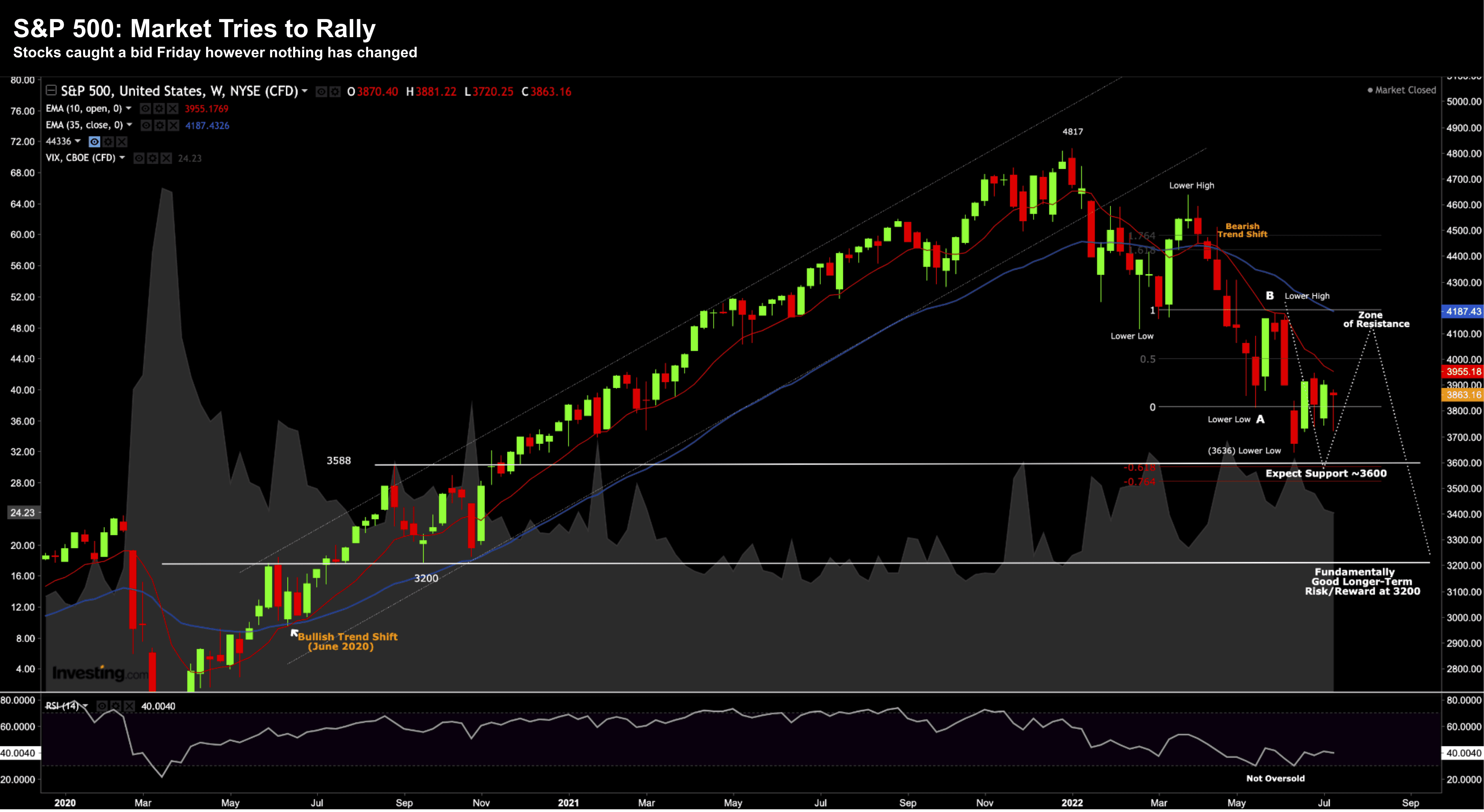

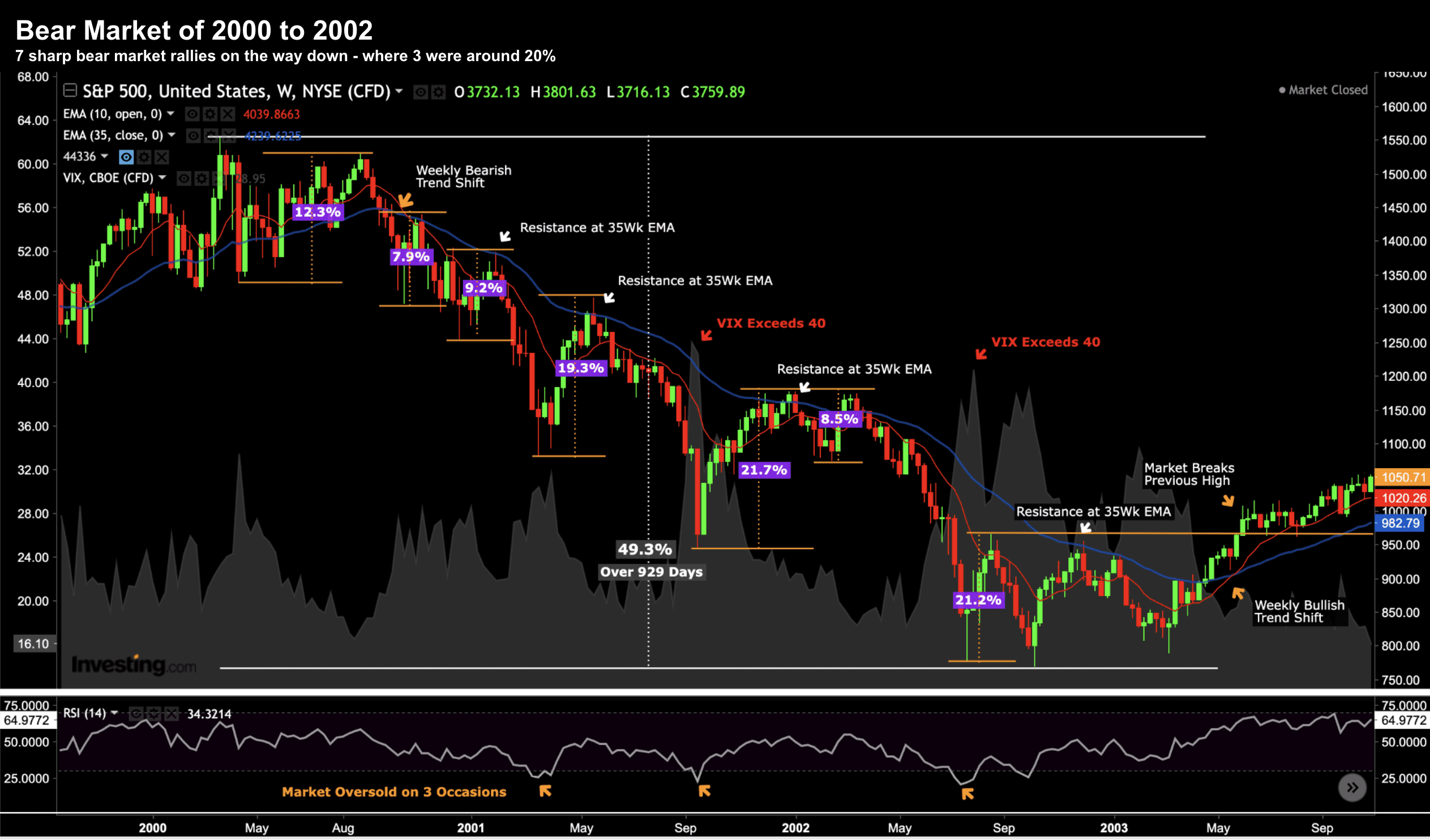

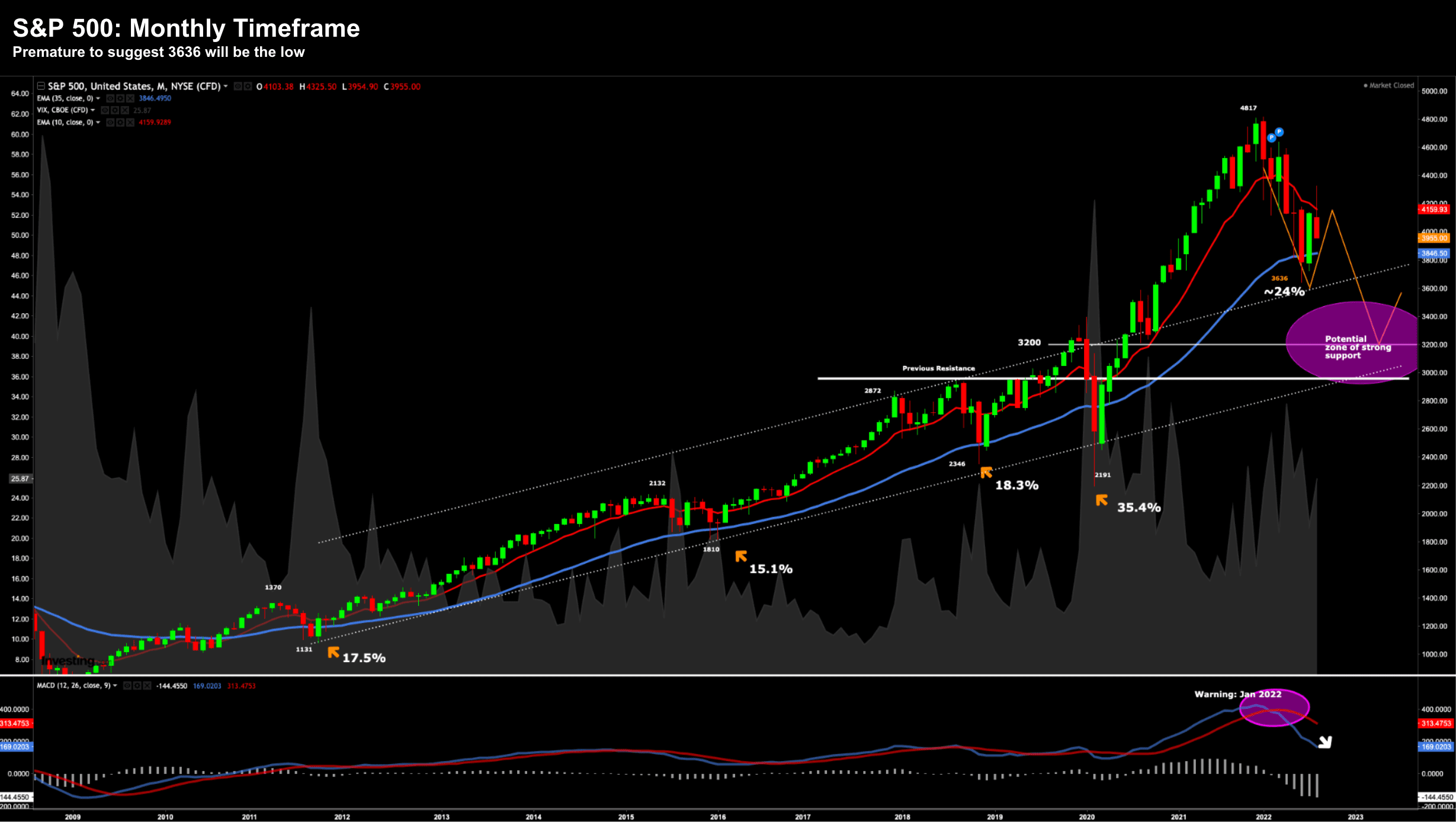

August wasn't kind for stocks - with the S&P 500 losing 4.2%. The market is now just 8.8% off the June 3636 low... expect this to be retested