Forget Snap… There’s a Much Bigger Picture

Forget Snap… There’s a Much Bigger Picture

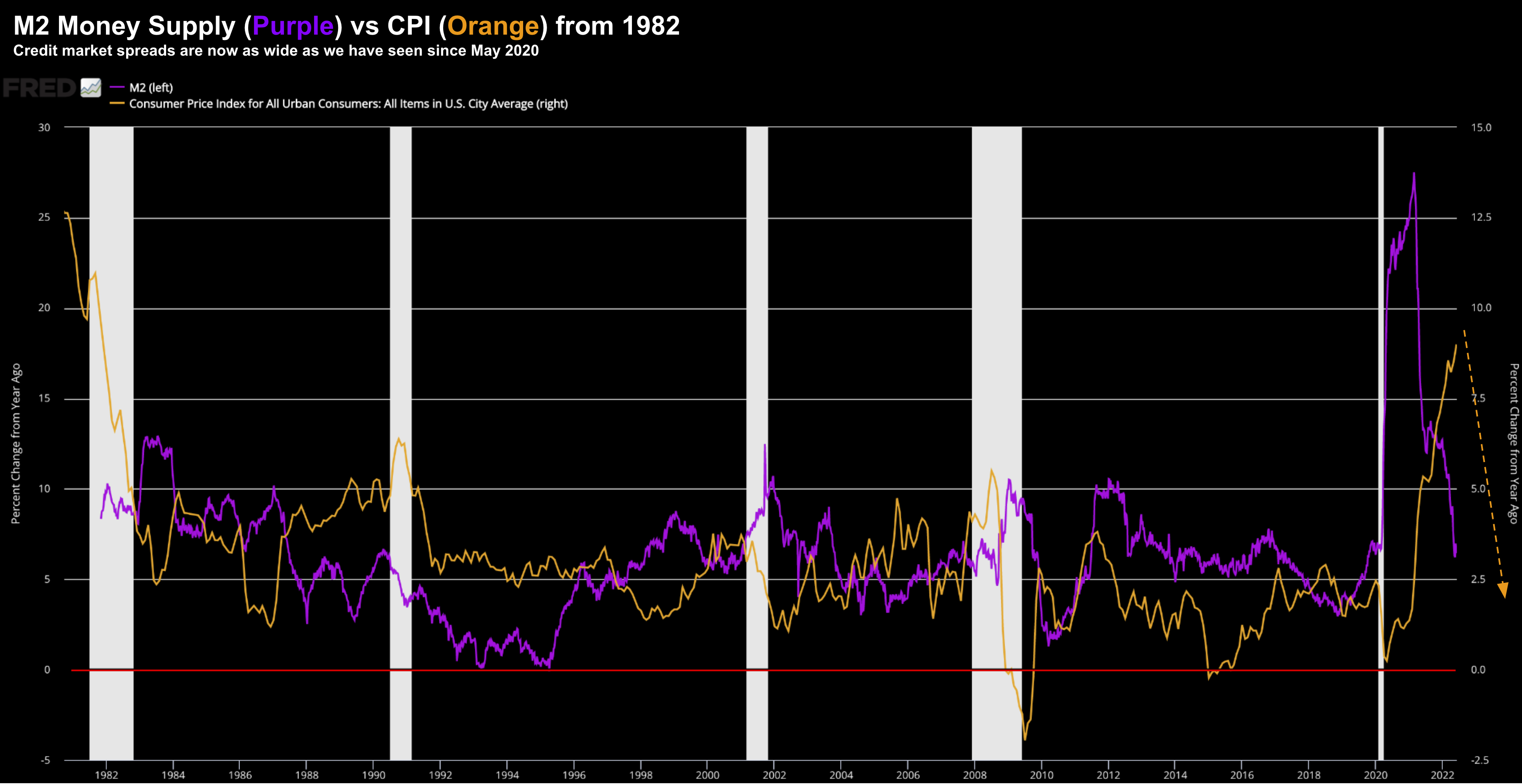

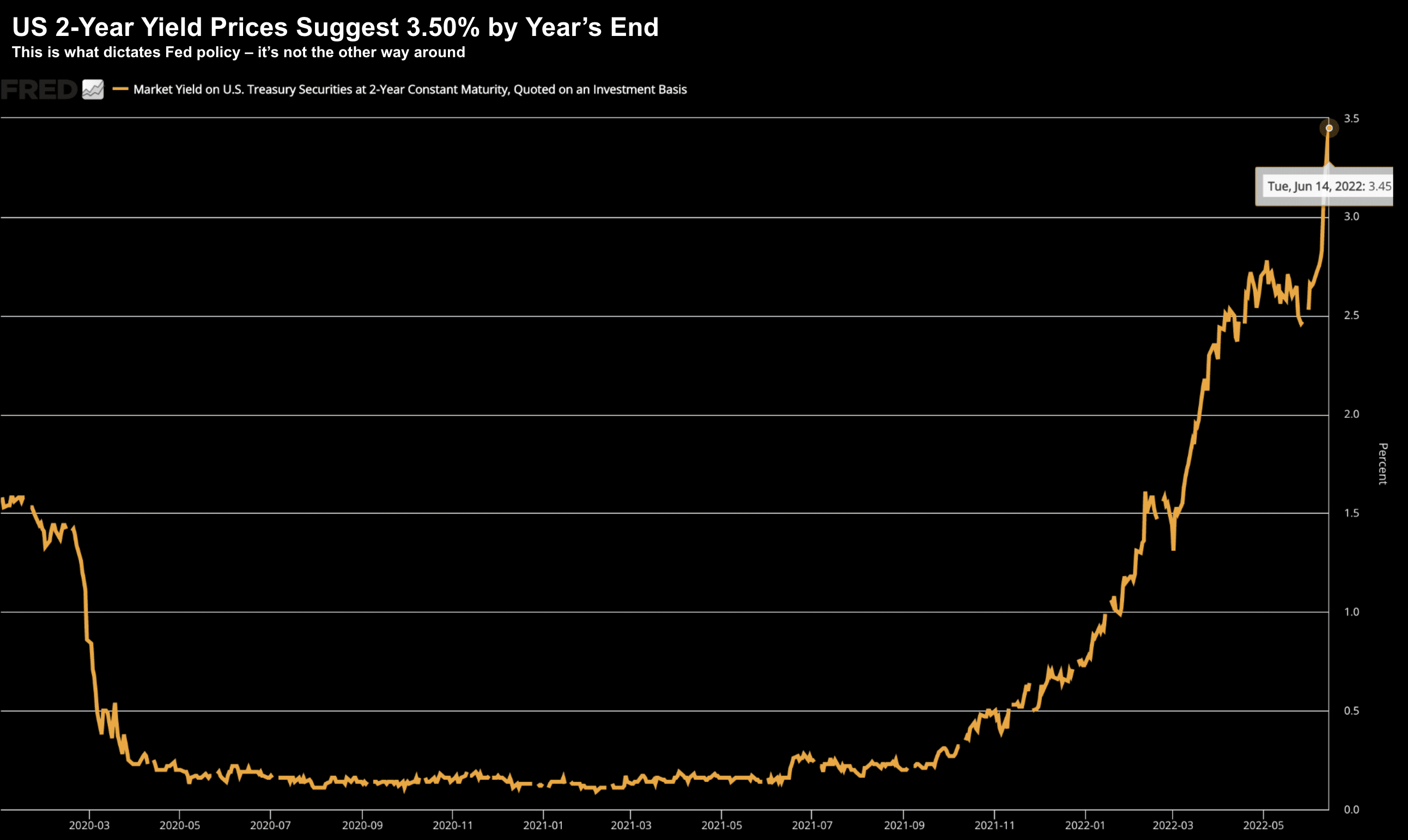

Next week we have the Fed (expected to raise 75 bps) and big-tech earnings. Both will move markets - but I give more weight to what we hear from Apple, Amazon, Google and Microsoft.