Downside Unlikely Over

Words: 1,724 Time: 8 Minutes

- Trump content pushing the US economy into recession

- Largest day of selling since 2020 — unlikely finished yet

- S&P 500 and QQQ buy zones to watch

From the moment Trump announced his blanket 10% tariffs in addition to so-called "reciprocal levies" – it"s been an exodus from risk assets.

The selling was immediate and sharp – something we"ve not seen since the pandemic five years ago.

However, as I will shortly demonstrate, there could be more to come.

Beforehand, a couple of words on why Trump"s approach is deeply troubling.

In short, he"s playing a massive game of chicken with the US economy and by association – the livelihoods of its citizens.

And I highly doubt his supporters had a recession in mind when they re-elected him.

Wasn"t it supposed to be the next US "golden age"?

Trump is of the firm view the US will be far better off over the long run (whatever that means) – with this episode nothing more than a "small disruption".

It reminds me of the Australian Treasurer – Paul Keating – in 1990 when he told us this is the "recession we (Australia) had to have"

We did?

Many years later Keating admitted that was a mistake. It feels like Trump is making a similar error of judgement – however a much larger gamble.

I see it as a zero-sum game – where the US could lose a lot more than it has today – potentially undoing decades of incredible prosperity.

But should anyone be surprised by the tariff announcement (and its scope)?

I don"t think so.

Trump told us there would be tariffs – calling them the most "beautiful word" in the English dictionary prior to his election win.

What we didn"t know was to what extent he was willing to risk the growth of the economy.

Here"s the full tariff fact sheet here.

These are fresh taxes US citizens will have to pay (read this post) – and well in excess of what anyone considered.

And for what?

Very little (if any) financial gain opposite the risk of enormous downside (e.g., a deep recession)

As an aside, some countries which don"t apply a tariff on US goods (such as Australia) – were hit with a flat 10%.

However, from Trump"s lens, Australia"s non-discriminatory sales tax of 10% on all imported goods is considered a tariff (a discussion well outside the scope of this blog).

Note – hence my use of the term "reciprocal levies" earlier.

From a technical lens, the S&P 500 is back into correction territory (~12% off its Feb high) – experiencing its largest one-day loss since 2020.

Asian countries fared worst from the new tariffs – putting companies such as (not limited to) Apple, Nike and Nvidia plunging.

High-end furniture retailer – RH – lost 40% – with the CEO caught on camera saying "oh shit" – as he watched his stock in free-fall.

- Nike down 14%

- Apple down 9%

- Five Below down 28%

- Dollar Tree down 13%

- Gap down 20%

- Nvidia down 8%

Today the S&P 500 shed 4.84% with 400 of the 500 names losing ground.

Health care stocks were big winners – being (essential) domestic services based businesses.

The tech heavy Nasdaq lost almost 6.0% – registering its biggest decline since March 2020.

Let"s explore… starting with tech.

Less than Magnificent

For at least 6+ months – I"ve been warning investors to reduce exposure to the Mag7.

In short, I felt their valuations were excessive – in some cases offering forward PE"s above 35x.

The long-term term risk reward was not attractive – despite their outstanding quality (e.g. returns on capital, free cash flow, operating moats, profit margins, strength of balance sheet etc).

Apart from Google – where I reduced my holding by 25% in early Feb just under $200 – I had sold all of my Mag7 positions.

Apple was the last to go in December – at a price of $254.

In each case, it was a difficult decision.

Selling is always much harder than buying. And these are fantastic businesses in every regard. However, they did not deserve the asking price.

Put another way, Ben Graham"s "Mr. Market" was overly optimistic.

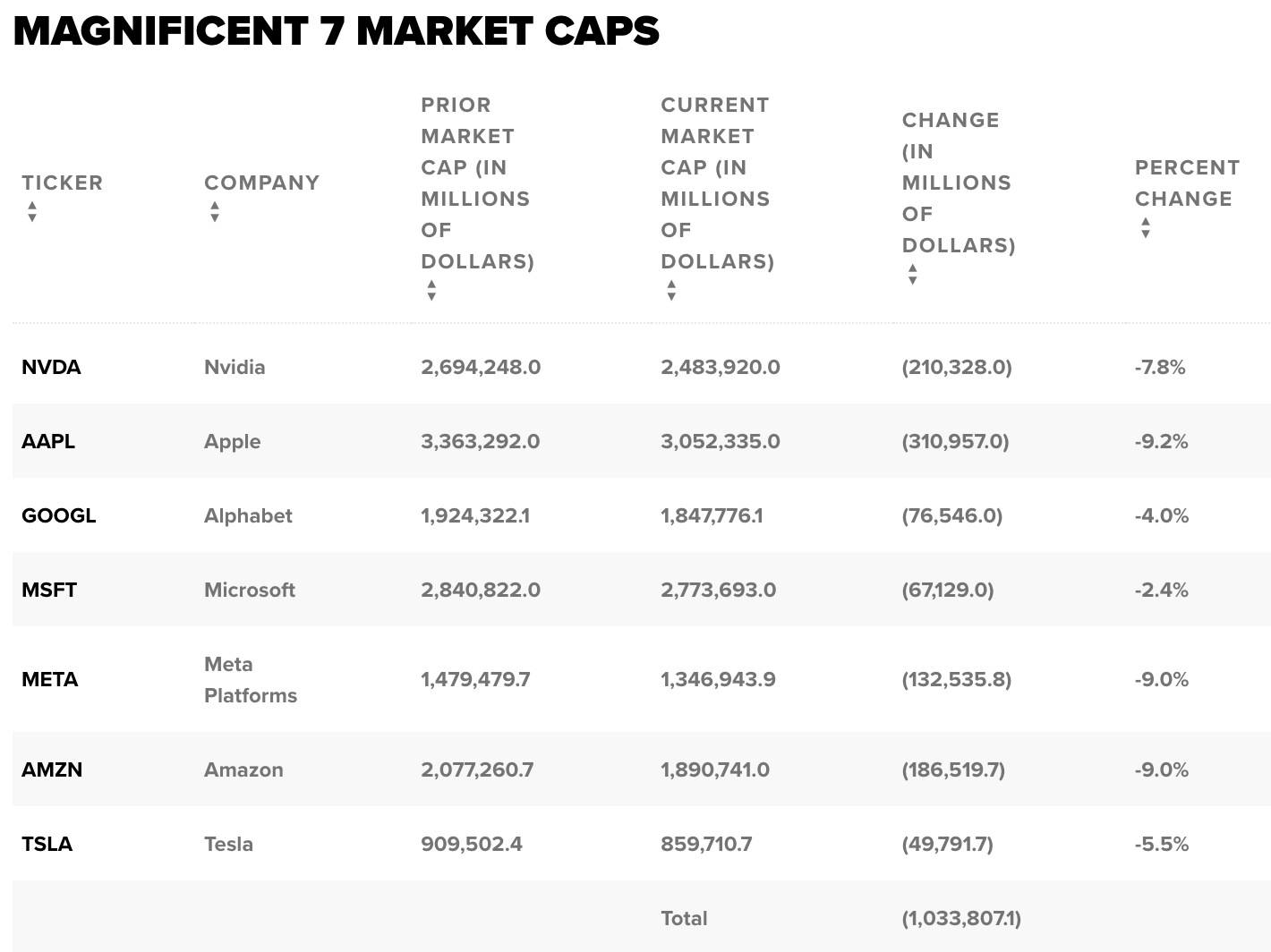

Today the "market generals" finally caved. Trump"s tariffs was the tipping point. Put together, they shed more than $1 trillion.

The Mag7 Index lost ~6%

As mentioned earlier – Apple was in the firing line given its supply chain tariff risks – losing ~9%.

It was the iPhone maker"s worst day in more than 5 years.

For what it"s worth – I am still not a buyer of Apple at around $200.

I will get more interested in the stock at levels between $160 and $180 (on the basis it will earn around $8.17 per share or ~18x mutiple).

18x is a reasonable multiple to pay for a company of Apple"s quality. 15x would be a steal (e.g., ~$122)

A stock that I am very interested in – Amazon – also lost ~9%, marking its biggest one-day decline since 2022.

I will start nibbling at Amazon between $150 and $170 (on earnings of ~$8.00 – a forward PE of around 19x to 20x).

The same logic I used for Apple applies to the cloud and retailing giant.

The AI darling of the market (or perhaps former darling?) – Nvidia sank 7% – given the tariffs on semiconductors.

Nvidia is a stock I will get very interested in between $70 and $80 – as I"m far less bullish on the growth projections many subscribe to.

Meta, Google and Microsoft also did not escape without loss.

Meta for example is now more than $200 off its Feb highs.

For what it"s worth – March 10 – I offered this post "Buckle Up Buttercup"

As part of the post – I looked at the technical setup for the ETF QQQ (one which is very popular for broad based tech exposure).

For reference, this was the chart and price targets I offered – suggesting there was likely more downside to come:

March 10 2025

At the time, some talking heads on TV (so called expert analysts) were calling for a bottom in tech and to buy the dip.

I was less convinced and offered (tech) investors this:

I think there"s more downside to come for the QQQs.

Now timing the market is very difficult to do. We can"t pick bottoms and we may not get to the areas identified on my chart.

Therefore, you may want to establish a third of your ideal position size around today"s level ($472)

And from there, if we see the price move lower to the upper trend channel – buy your next third (i.e., $400 to $440)

And should we trade down to the lower trend channel – e.g., a price b/w $380 and $400 – take your final third position.

Given today"s $1 Trillion loss of market cap across these seven names – is it time to be aggressive?

April 3 2025

From mine, I think investors can start adding here with a caveat.

I would with one-third of your intended position size.

For example, at ~$450 – this is around ~$10 above the zone where I think it represents an attractive initial entry point.

If we also observe the RSI (lower window), we"re still not yet oversold at 33.8.

Ideally we want to see this below 30 – which would indicate a wash-out in the stock.

We saw this in the late part of 2022 – which proved to be a great opportunity.

When (not if) we find the QQQ"s between $400 and $400 – this sets up as a more attractive long-term risk reward entry point.

S&P 500 – More Work to Do

If you were (or are) over-exposed to stocks from the long-side – days like today feel rough.

However, for those who exercised patience (i.e., reduced exposure last year or earlier this year – putting a good amount of cash aside (30%+) – days like today are great.

This is precisely the price action we want – even if it means some of the stocks you hold go into negative territory. It"s the old saying:

"You buy when there is blood on the streets – even if some of that blood is your own"

Let"s take a look at the weekly chart to see where investors may be willing to wade back into the market.

However, this is purely a technical view.

I offer that preface as my firm view (as it has been through the entirety of 2025) is stocks are overpriced from a valuation perspective.

For example, on the basis we trade down to a zone of ~5,000 – with earnings likely to come in ~$260 per share (which is 5% below the current $275 consensus) – that"s a multiple of ~19x.

19x is above the 10-year average of around 18x.

However, I do think the zone of 5,000 is where you can start to add some exposure – but it would not be a full position.

The market is not oversold yet.

April 3 2025

Since Trump won office in November – things have traded very much to the script.

That is, I felt we would trade up to around the zone of 6100 where I suggested stocks may struggle to go further.

As stocks challenged highs – momentum waned (see "Markets Hedge as Momentum Wanes")

We noted the strong negative divergence with both the RSI and MACD – an indicator which failed to confirm the all-time highs.

Since then, the index has moved about 12% lower over 7 weeks.

Some technicians may suggest stocks are oversold and could be due for a bounce.

My answer to that is it"s a function of your timeframe.

From my lens, stocks are not yet oversold, with the weekly RSI at 34

As I highlighted looking at the chart for the QQQ – what I would prefer to see is a weekly RSI below 30.

This would be more indicative of a washout and perhaps a price closer to the zone of 5,000

Putting it All Together

My own portfolio was 65% long coming into this week.

Then again, I will always have some long exposure. It"s rarely less than 50%

My largest position is Google – which saw my portfolio slip to being down ~2.0% year-to-date.

That"s par for the course in this environment.

Personally, I will be using the sharp selling over the coming weeks to add back to the quality names I sold last year (and earlier this year).

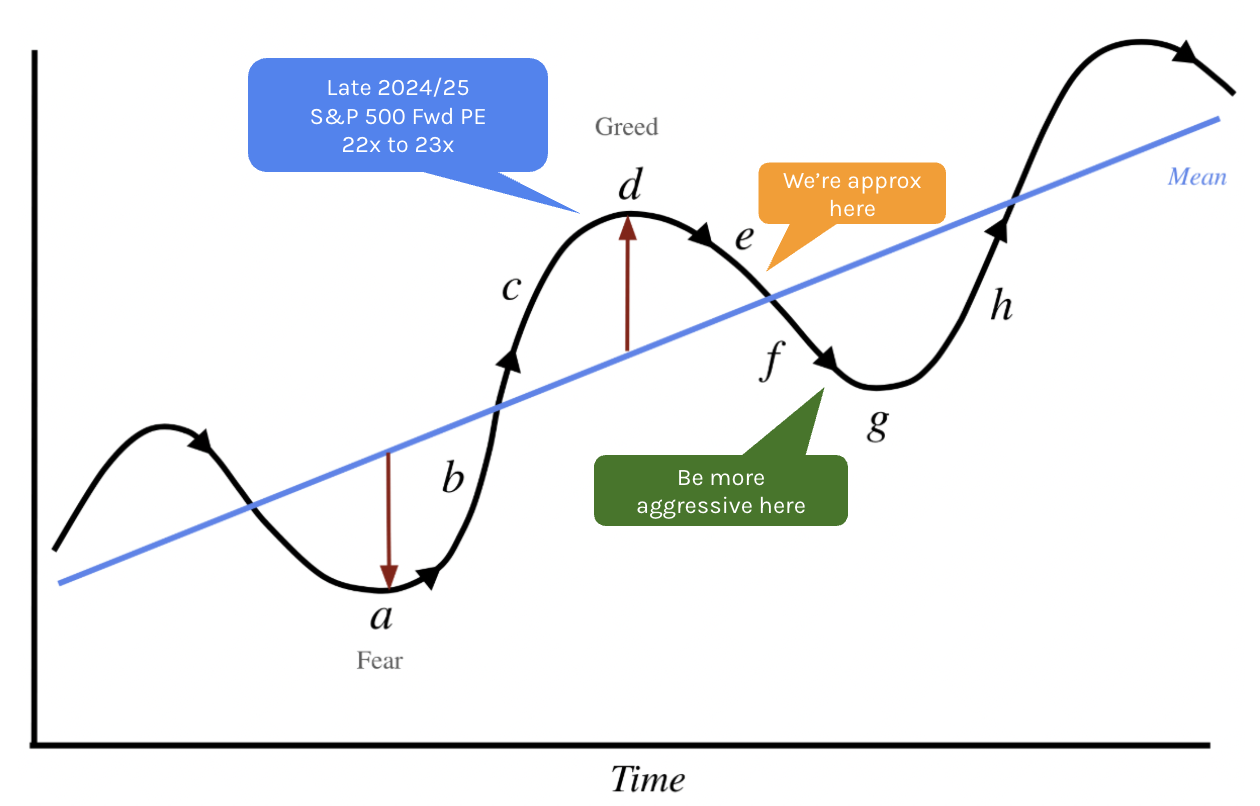

It"s also timely to revisit one of my favorite sentiment models (helping us to assess the more opportune times to buy or sell)

We saw peak greed at "d" late last year and earlier this year – where the S&P 500 traded near a forward PE of 23x – on the assumption that "trees can grow to the sky" (e.g., names like Nvidia, Meta, Tesla, Apple and a host of others)

We"re now moving towards point "e" – however still above the long-term mean (e.g. a 18x fwd PE for the S&P 500 if using the past 10 years average)

And whilst there can be some attractive stocks to buy – the Index as a whole – is not yet offering a very compelling risk reward.

When we start to see the S&P 500 trade down towards 5,000 (and below) – then we will be making our way towards point "f" (potentially).

And should we see the VIX rise from a level of ~21x (e.g., spiking to levels closer to 35x) – there will be widespread panic selling.

And that"s what we want to see…

At that point we require the courage to buy quality at a reasonable valuation (despite the widespread fear) – and not worry about trying to pick the bottom.

For example, your preferred quality stock may fall another 20% or 30% after you buy it.

That"s more than fine.

Use the opportunity to add to the position – assuming nothing fundamentally has changed. It may have. That"s the work only you can do.

If you"ve done the work – and your analysis is sound – then sit tight for 3-4 years and you"ll likely be rewarded.

And for those trading the Index (and not individual names) – more patience is required before adding any meaningful exposure.