FB, GOOG and MSFT Report – What Did we Learn?

- Over $5T in market-cap across these three stocks

- Three incredible free cash flow machines

- But which one is the best value?

Whilst it"s only Tuesday…. we have had a torrent of earnings this week.

Tonight we are looking at the tech trifecta:

- Alphabet (Google)

- Facebook; and

- Microsoft

Recently I"ve been saying the bar has been set extremely high for these stocks (given the recent price action)

As a result, I felt it would take some "blowout" numbers to see them push materially higher.

Let"s see what we have learnt so far… and if there"s an opportunity.

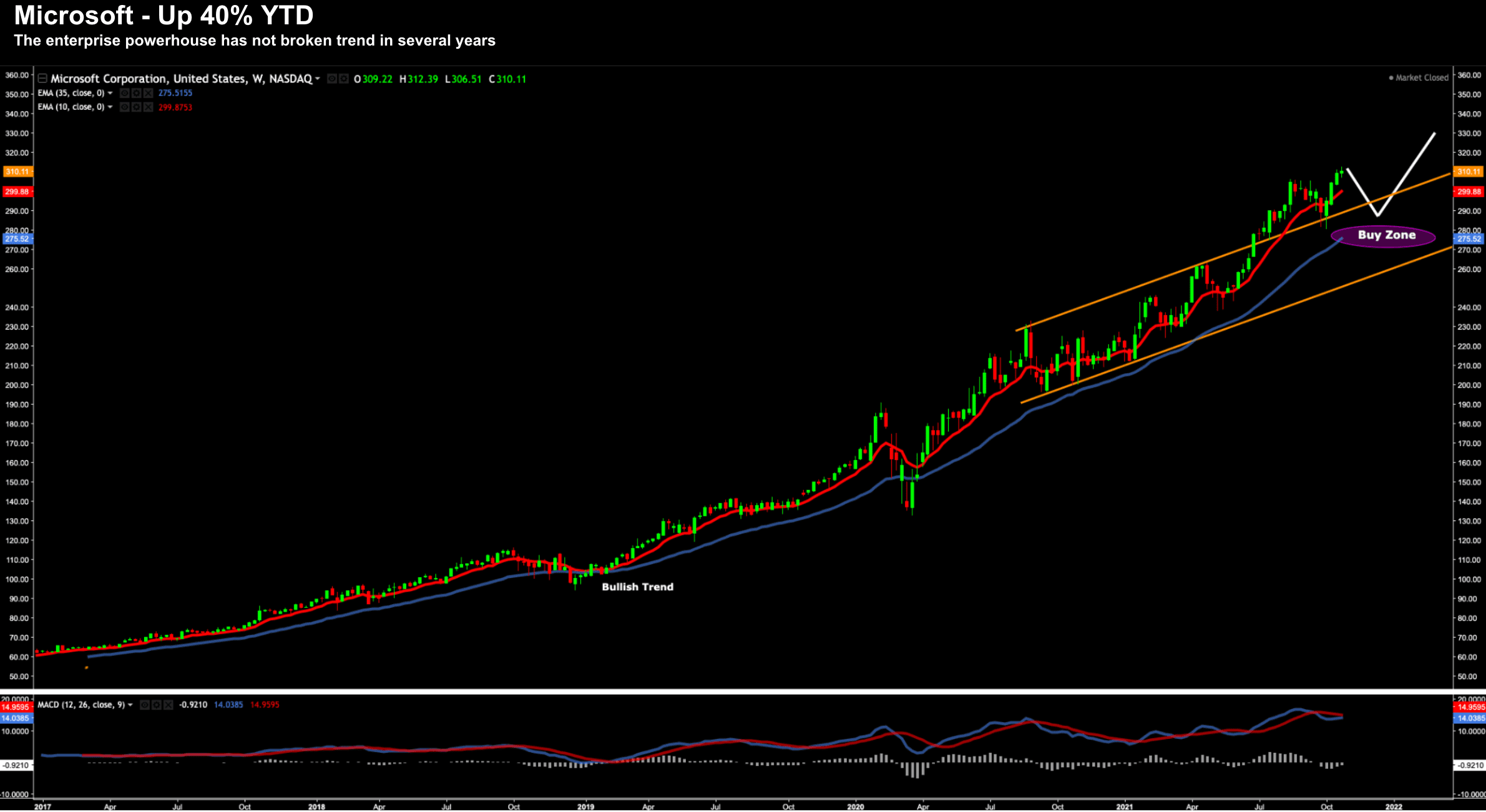

1. Microsoft (MSFT)

First the weekly chart…

MSFT – Oct 26 2021

Before I touch on the numbers – the stock touched another all-time high in today"s trade.

However, look at the weekly trend from 2017.

It has not broken stride.

We have only seen the 35-week EMA challenged twice – and both times it was quick to find support.

There have been very few pullbacks – as the stock goes from strength-to-strength each quarter.

And this is why (as we look at the results for the previous quarter):

- Earnings: $2.27 per share vs. $2.07 as expected

- Revenue: $45.32 billion vs. $43.97 billion as expected

- Total company revenue climbed almost 22% year over year — its fastest growth since 2018

- $20.5 billion in net income, growing at 48%.

The final point is a standout…48% growth on net income (especially given how large this stock is).

Note – Microsoft is running gross margins of around 70%.

Incredible!!

With respect to Q4 guidance, Microsoft called for $50.15 billion to $51.05 billion.

Across the board, it was another incredible quarter. Specifically its Cloud business is powering the company ahead. Cloud was up 34% in total – with Azure up 48% and Office 365 up 21%.

Now Microsoft is an expensive stock… trading at something like 35.4x forward PE (which is a record multiple)

And it"s deserved.

So would I buy it 35.4x?

No.

The stock is one of the very best out there… it really is. But do you pay 35x?

I wouldn"t

However, this is a stock you want in your portfolio as part of your Top 5 holdings (it"s my third largest holding behind Google and Apple)

This company is exceptionally well positioned in terms of enterprise computing… in addition to its other (growing) businesses such as gaming etc.

The stock may pull back a little… but that will be a (rare) opportunity to buy.

Expect double digit revenue growth from this stock for years to come (and at margins most companies can only dream of).

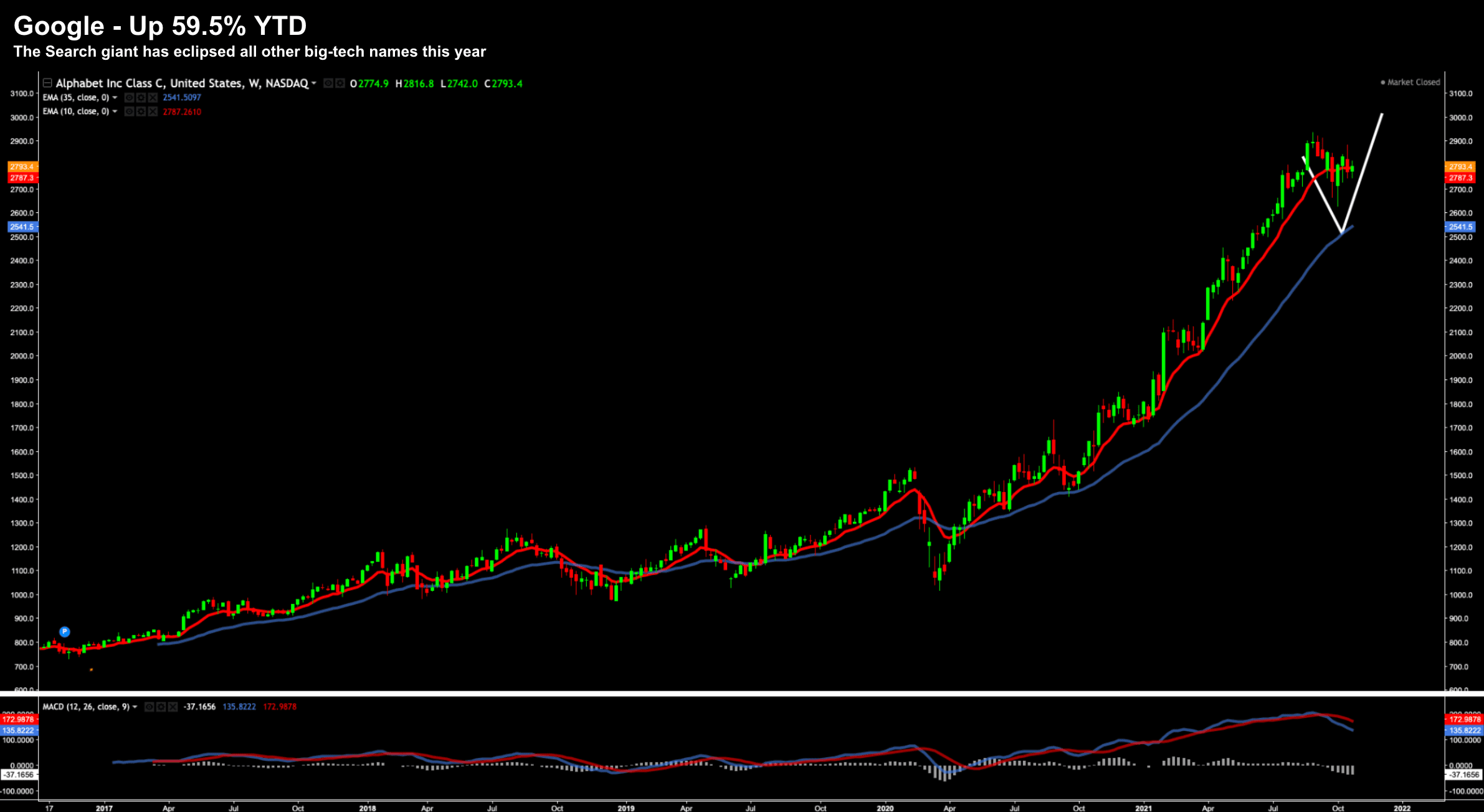

2. Alphabet (Google)

Full disclosure – I work for Google so I will try not to add any bias.

It is also a core holding of my long-term portfolio.

Again, let"s start with the weekly chart to help offer perspective post any move on earnings:

GOOG – Oct 26 2021

Whilst MSFT is up 40% YTD – it trails Google which is up an incredible 56% as it lagged other mega-tech peers last year.

It"s outperformed the Nasdaq index by 40% this year!

It"s been difficult for new investors to get into the stock – with the last real opportunity the crash of 2020.

Since then, the stock hasn"t looked back as more businesses strive to strengthen their online (and data) presence.

For example, Google"s CEO Sundar Pichai said today:

"Search remains at the heart of what the company does"…

Yes it does… and it was Search advertising which drove the incredible revenue growth number.

It"s also what gives Google is its trove of first party data – which enables to it to largely avoid the (iOS privacy) issues which hit both Facebook and Snapchat.

From mine (and this a personal observation) – this is what sets companies like Microsoft, Apple and Google apart.

They each own their operating systems; i.e., iOS (Apple); Android (Google); and Windows (Microsoft)

This is an enormous advantage over the likes of various social media "apps" like Facebook, Twitter, Snap, Pinterest, TikTok and so on.

Here"s the recent quarter numbers:

- Earnings per share (EPS): $27.99 per share vs $23.48 per share expected

- Revenue: $65.12 billion vs. $63.34 billion expected

- YouTube advertising revenue: $7.20 billion vs. $7.4 billion expected.

- Google Cloud revenue: $4.99 billion (up 45% YoY) vs. $5.07 billion expected.

- Traffic acquisition costs (TAC): $11.50 vs. $11.16 billion expected.

But it was advertising which was the standout.

As an aside, Google commands a whopping 30% of all advertising spend globally. That"s a staggering number.

Its advertising revenue rose 43% to $53.13 billion, up from $37.1 billion the same time last year and slightly higher than the prior quarter. YouTube ads rose to $7.21 billion, up from $5.04 billion a year ago.

Perhaps the only slight was softer YouTube and Cloud revenue.

So do you buy it here?

My answer is similar to what I said to Microsoft.

Expectations were extremely high going in. Therefore, I was expecting some softness post the results.

This is a stock which should be in your long-term portfolio however look to add on the dips (when they present).

In closing, I remain incredibly excited at what we"re investing in and the opportunity ahead (n.b., I work in areas such as AI, ML, Augmented Reality, Computer Vision)

Phillip Schlinder (Chief Business Officer) touched on some of these exciting new areas today (e.g., applications in commerce) looking ahead.

There"s a lot more runway here… what more can I say!

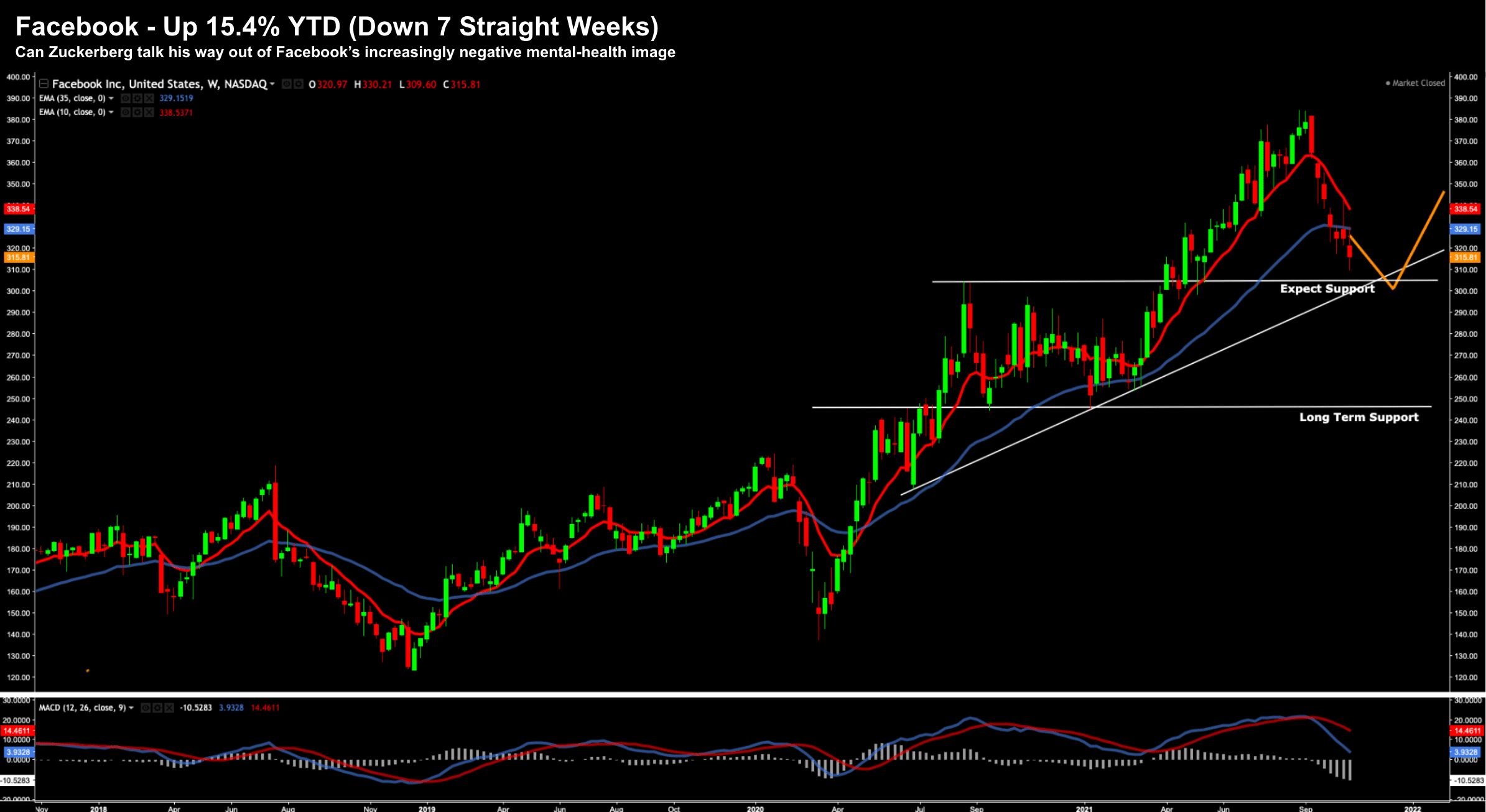

3. Facebook (FB)

Of the three (tech) companies I was watching this week – Facebook was (and has been) the biggest disappointment.

Let"s start with the weekly chart:

FB – Oct 26 2021

I covered my sentiment on Facebook as part of my last post.

In short, I said this is a company you really have to "hold your nose" to buy.

And I"m sure some investors will….

That said, the fundamentals are as strong as any listed stock on the market… but there are some genuine ethical hurdles you need to be comfortable with.

For example, I personally don"t believe any of its platforms (excluding WhatsApp) are good for anyone"s mental health (the least of which being teenagers and kids).

Then again, this is a function of my lens. I am not a fan of social media. Period.

I think the negatives far outweigh any positives.

But that"s a subject for another day (and only my view)…

If we turn to the chart, the stock has been crushed the past seven weeks, failing to post a "green" candle.

Technically the stock remains in a bullish trend. However, this might be at risk if the selling continues.

I think it will find support around the $305 level – which was the previous high of August 2020.

Quite often previous resistance will act as new support.

This also coincides with the rising trend line – formed from the two most recent lows.

However, if $305 fails then it might be a quick trip down to $250 (which would be incredibly cheap for the stock)

Let"s look at the numbers:

- Earnings: $3.22 vs. $3.19 per share expected.

- Revenue: $29.01 billion vs. $29.57 billion expected

- Daily active users (DAUs): 1.93 billion vs. 1.93 billion expected

- Monthly active users (MAUs): 2.91 billion vs. 2.93 billion expected .

- Average revenue per user (ARPU): $10.00 vs. $10.15 expected by analysts, according to StreetAccount.

What"s noteworthy is that Facebook is making some strategic changes.

For example, as short-form video platforms like TikTok lure away eyeballs, they are going to increase their investment in its "Reels" feature.

It"s part of an effort to make Facebook and Instagram more appealing to users between the ages of 18 and 29.

Here"s Zuckerberg:

"Over the last decade as the audience that uses our apps has expanded so much and we focus on serving everyone, our services have gotten dialed to be the best for the most people who use them rather than specifically for young adults"

He warned that "this shift will take years, not months, to fully execute" and that ultimately it will be as significant to Facebook as the adoption of the News Feed and Stories features.

"Reels has the potential to be something of that scale," he said.

The other strategic shift from Zuckerberg was peeling out his new bet on the so-called "Metaverse" (a term I dislike – and one which is over-used)

For those less familiar, think of the movie "Ready Player One"…

It"s the buzzword of the year, yet it doesn"t really exist!

The thing is, it"s nothing more than a few ideas that probably won"t happen in ways we expect. It reminds of Bill Gates in the early 90s with his new "information super highway."

What happened to that?

Well we got the internet. And guess what – it turned out in ways we never expected.

I suspect the so-called "Metaverse" will be similar.

But for now, there are plenty of people wanting to believe in it… with new hardware, content and experiences.

For example, we learned that Facebook invested $10B into his "Metaverse" strategy last year and something they will be reporting on separately going forward.

It"s a big bet but I think it (potentially) does two things:

- Gives Facebook an opportunity to create its own platform (who knows if anyone will want to use it?); and

- Differentiates the "old" Facebook from the "new" (i.e., potentially one free from the many issues it faces today)

In fact, don"t be surprised to see these two companies one day be split.

So do you buy Facebook here?

There"s no doubt Facebook is cheap on a valuation basis compared to its mega-tech peers.

It"s trading at something like a 21x forward PE when you strip out the cash.

That"s cheap given its earnings growth and free cash flow.

I also think news of its $50B buy back will work to help put a floor under the stock around the $300 level.

Again, if you are prepared to hold your nose, Facebook is a good bet around the $300 price level.

Yes, you may hate what they do (most people do)…

But in terms of its revenue, free cash flow and earnings growth at the price on offer… it"s worth considering.

Putting it All Together…

Microsoft and Google are two standout stocks which should be in anyone"s long-term portfolio.

Then again, I"ve been saying that on this blog for over a decade.

It hasn"t changed.

Facebook is a different animal.

It"s not in the same league as these two companies (or the likes of Apple and Amazon – who we will hear from this week)

But it warrants a place in your portfolio.

For me, it"s about 6% of my total allocation. It"s a reasonable holding but well short of the names above.

Let"s now wait and see what Amazon and Apple report.

I"m also long both these names – adding to my positions in both a few weeks ago when Apple dipped to ~$138 and Amazon to ~$3,100.

We will soon see if those additions made sense…