Words: 1,412 Time: 8 Minutes

- A study covering 464 companies which produced 10x plus returns

- Valuation, size, cash generation, and disciplined investment are key

- Avoid investing with the herd; focusing less on earnings and revenue growth

This week I shared investing wisdom from Howard Marks.

His latest memo reiterated the importance of prioritizing value over price.

In my experience, most investors concentrate on the latter – with little regard to whether they are actually getting good value.

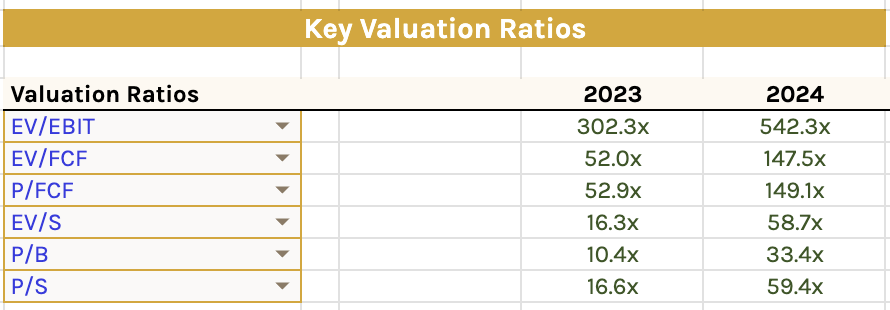

For example, is AI darling Palantir (PLTR) ‘good value’ at $156? How do you know?

Turn on the TV and many will say “yes”.

They will say something like revenue is growing at ~30% – where the bigger risk is not getting involved. In other words, buy at any price.

Palantir (PLTR) – Key Valuation Ratios (author’s calcs)

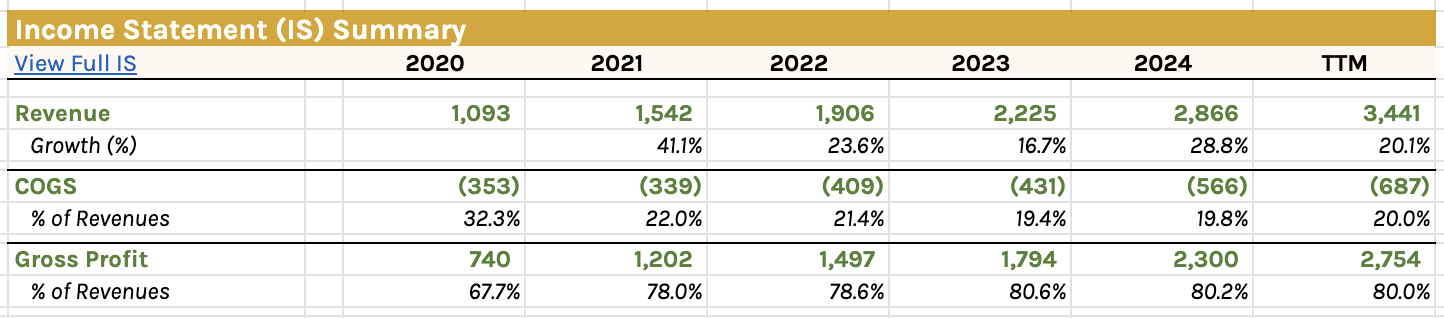

Palantir (PLTR) – Source: Company Filings

- 60x its sales revenue?

- 33x its book value? and a mind boggling

- 149x its free cash flow?

Is that good value?

If you are only look at the stock being “20% off its high” – you would not know.

Determining value requires some work (as I’ve shared above). You will need to pull balance sheets, cash flow statements and income statements.

It’s not complex – but it’s focused, deliberate work.

You cannot determine value simply by observing the price of a stock is down “20%” from the previous week or month. Price is not value.

Now earlier this year (Jan) I shared how I assess value.

And whilst there are many ways to determine whether an asset trades at (or below) its intrinsic value – one of my metrics is price to free cash flow (P/FCF)

P/FCF provides insight into how much investors are willing to pay for each dollar of FCF generated by the company.

It’s also one of the metrics Warren Buffett rigorously applies (see “How Warren Buffett Built a $1.1T Cash Machine”) – prioritizing this over earnings and revenue growth.

We define this ratio as the company’s market capitalization (i.e. determined by its price x shares issued) divided by its FCF — that is, the cash flow available for distribution to stakeholders.

So what brought this to mind?

The Alchemy of Multi-bagger Stocks

Earlier this week I read a fascinating 2025 study by Anna Yartseva – The Alchemy of Multibagger Stocks

In short, Anna’s study is one of the most comprehensive academic investigations into what drives extraordinary stock returns (e.g., 10x plus).

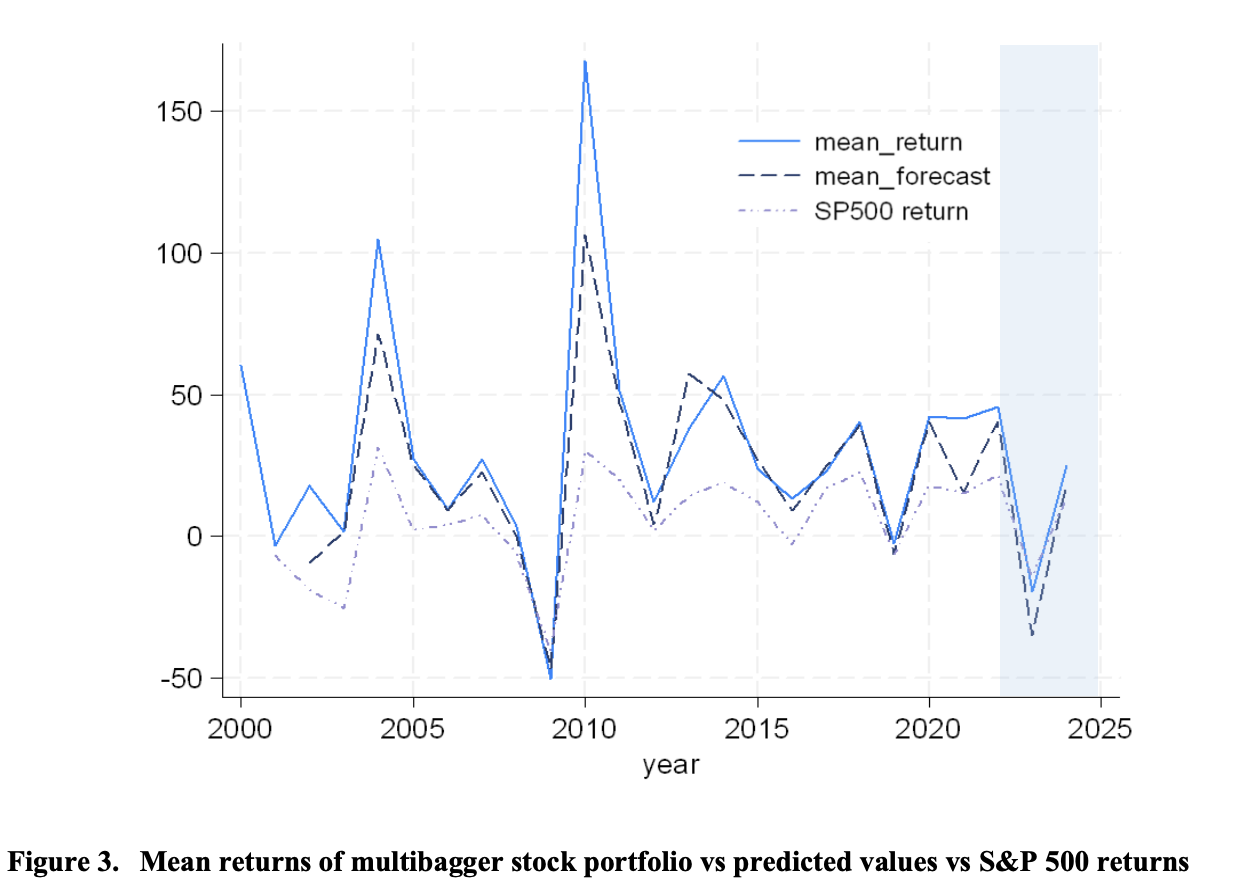

Anna looked at 464 companies on the NYSE and NASDAQ that delivered at least 10-fold gains between 2009–2024 – where she tested over 150 variables across 11,600 company-year observations.

Her approach combined factor modeling, portfolio sorting, and predictive testing against out-of-sample data (2023–2024) – making it methodologically rigorous.

So what did she find?

Free cash flow yield is one of the strongest indicators of future returns (among other things).

Contrary to popular opinion it’s not revenue growth; and it’s not earnings.

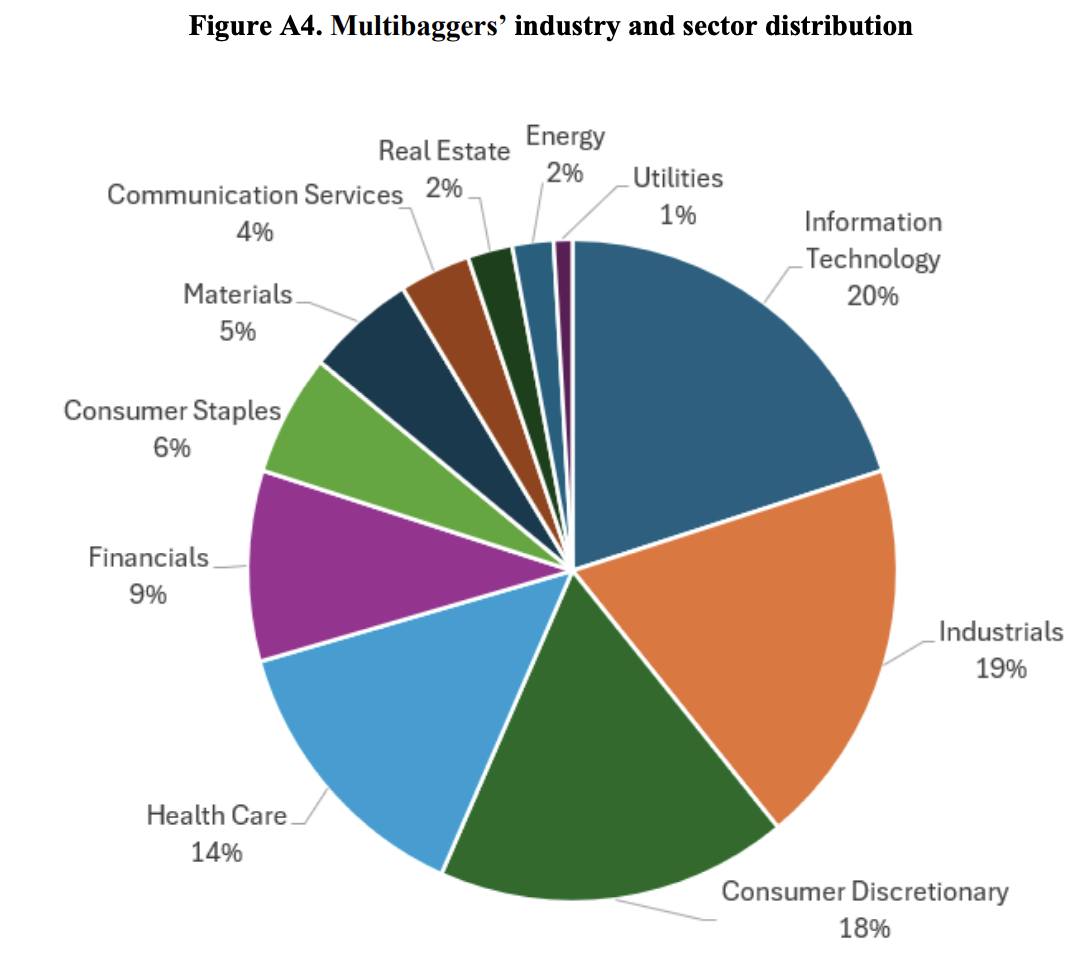

And guess what – it does not need “hot stocks” that center on technology. Quite the opposite.

But let’s explore how you can leverage this study when finding your next 10x stock.

Challenging Conventional Wisdom

Anna’s comprehensive study challenges conventional investment wisdom.

For example, contrary to popular belief, earnings growth and revenue expansion did not predict “multi-bagger” (10x) outcomes.

Instead, structural factors like valuation, size, cash generation, and disciplined investment emerged as dominant predictors.

In addition, Yartseva showed that timing and macroeconomic conditions significantly influence success, with market entry near lows and favorable rate environments amplifying returns.

In other words, it’s what you pay which will be the largest determinant of your returns (see “Patience Alone Won’t Get it Done”)

The research further found that 10x plus returns were not restricted to “hot” sectors like technology.

Instead, they emerged across every industry, including utilities, staples, and materials—highlighting that investors should focus more on fundamentals and valuation than sector trends.

One of the surprises was Yartseva’s model also successfully predicted future returns, correctly identifying major market turns in 2023 and 2024, even if it modestly underestimated overall performance.

- Offers a practical roadmap for identifying those companies which are likely to significantly outperform; whilst also

- Emphasizing the importance of patience, contrarian timing, and a focus on free cash flow over accounting earnings and/or revenue growth.

Finding 10x Return Stocks: Top 5 Findings

As a preface, I would highly encourage you to download Anna’s research. But for those who want a summary before they go further – below are my key takeaways:

#1. Earnings Growth Is Irrelevant

- One of the most surprising results were factors such as earnings growth (EPS, EBITDA, Sales, FCF Growth) showed no statistical significance in predicting future multi-baggers.

- To be clear, these factors likely enjoy a strong correlation for sustainable (steady) returns over time – however this study is looking those stocks which returned more than 10x .

- Companies with high FCF yield (i.e., cash relative to share price) had far higher odds of becoming multibaggers. Note – this lesson applies for investing more broadly (as shared in previous posts).

- With respect to 10x return stocks – a 1% higher FCF yield correlated with 46–82% higher annual returns.

- Whilst investing in the S&P 500 is generally far safer for investors – most of these companies typically began as small-caps.

- Those stocks which showed the highest returns were typically ~$348M market cap – and traded at deep value multiples. For example, low valuation multiples for multi-baggers were (on average):

- Price to Sales (P/S): 0.6x

- Price to Book (P/B): 1.1x

- Forward Price to Earnings (P/E): 11x.

- These multiples are not what you would see from a “growth stock”. In my experience, many (over) hyped stocks will trade at P/S ratios of 5-10x or more; and/or forward P/E ratios in the realm of 20-30x (or higher). Buying assets at “30x” forward earnings will rarely generate outsize returns over the long run (as their growth is already priced in; where the risks are they don’t deliver).

- Beyond applying a razor of strong free cash flow yield with low valuation multiples – disciplined growth resonates loudly..

- In this case, aggressive asset growth should be backed by EBITDA growth (i.e., avoid investing in stocks where the incremental capital deployed is not showing an increased return.

- Those firms which expanded assets faster than profits (which is what I think we see today in the AI space) – generally suffered steep underperformance.

- Last but not least, you need to be contrarian if you are to enjoy multi-bagger returns. Following an existing (bullish) trend (where the herd all believe something is going higher) won’t get it done.

- Her study suggests the optimal entry points occurred when stocks traded near 52-week lows, often after recent declines. In other words – buying when there is fear and pessimism.

- The study showed that buying near highs consistently led to underperformance. This echoes what Howard Marks shared in his latest memo “‘The Calculus of Value”; i.e. While finance theory says an asset’s price equals the present value of future cash flows, in practice psychology dominates.

- Optimists push prices above value, while pessimists drag them below. Thus, prices fluctuate far more than underlying values, creating opportunities and risks

- Beyond the trend – it was found that rising interest rates reduced next-year returns by 8–12%. This underscores that stock performance is subject to macro sensitivities

What You Can Do

If you’re looking to allocate a smaller portion of your investing capital (e.g., less than 1%) to smaller-cap (higher risk) to stocks where you are targeting 10x returns – one should:

- Prioritize Cash Yield: Screen for small-cap companies with high free cash flow yield rather than chasing headline earnings or revenue growth

- Seek Value, Not Hype: Favor businesses trading at lower valuation multiples (P/S <1, P/E <12, P/B ~1) while avoiding firms with negative equity

- Investment Discipline: Target those smaller cap firms reinvesting aggressively only if EBITDA is expanding (i.e., you should avoid asset-heavy expansions unsupported by profits).

- Be Contrarian: Enter positions when stocks are weak (ideally near yearly lows) – especially during neutral or falling rate environments. “Buy when others are fearful; and be fearful when they are greedy” – Warren Buffett.

- Diversify Across Sectors: Don’t limit searches to tech or trendy “AI” industries—multi-baggers emerge broadly, including in staples, industrials, consumer discretionary and health care.

Putting It All Together

10x plus return stocks generally come from smaller, undervalued, cash-generating companies bought at unpopular times.

And whilst this survey does suffer from survivorship basis — by focusing on those companies which produce cash flow (vs those earnings) vastly increase the odds in your favour.

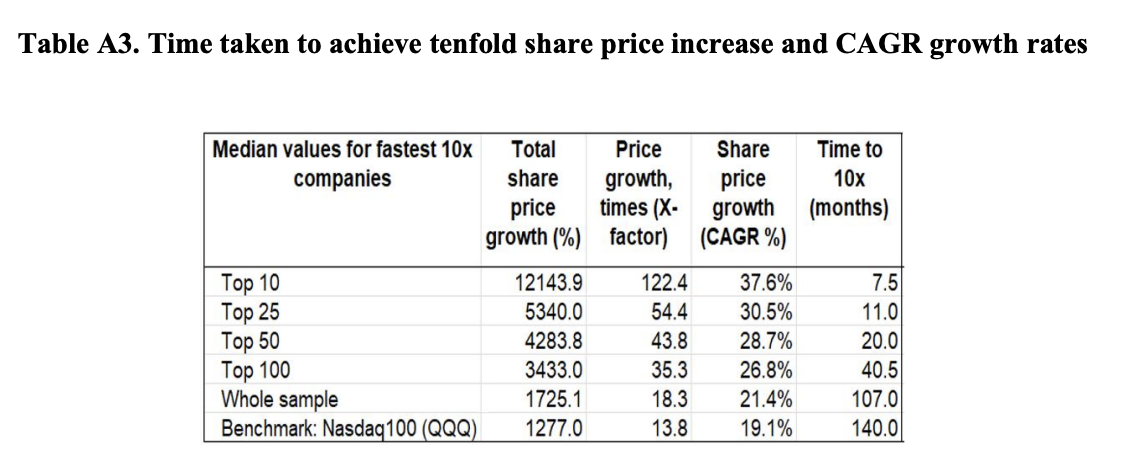

For example, the entire sample set studied saw an average CAGR of 21.4% with an average time of 9 years (107 months).

The Top 10 saw CAGRs of 37.6% – realized in only 8 months.

For optimal results, investors should combine value discipline with contrarian timing to maximize the odds of catching the next 10x (or more) return stock.