Global Bond Markets Warn

- Japanese bond yields surge, reviving fears of fiscal discipline

- Political uncertainty accelerates global bond market volatility

- Markets question fiat credibility amid rising yields and falling dollar

Despite a strong start to January – markets are now in the red year-to-date.

U.S. markets suffered their worst session since October – with the S&P 500 shedding 2%, the Nasdaq 2.4% and the Dow 1.8%.

Why the nerves?

Many in the mainstream put it down to the new tariff threats Trump has tied to his intended purchase of Greenland.

But I would not read too much into that…

Geopolitical events like Greenland are generally temporary. However, markets are more prone to react to monetary and fiscal events.

In that context – investors are increasingly anxious about the trend they see with global bond yields.

From Tokyo to Treasuries.… the bond vigilantes are stirring.

Bond Vigilantes Stir in Tokyo

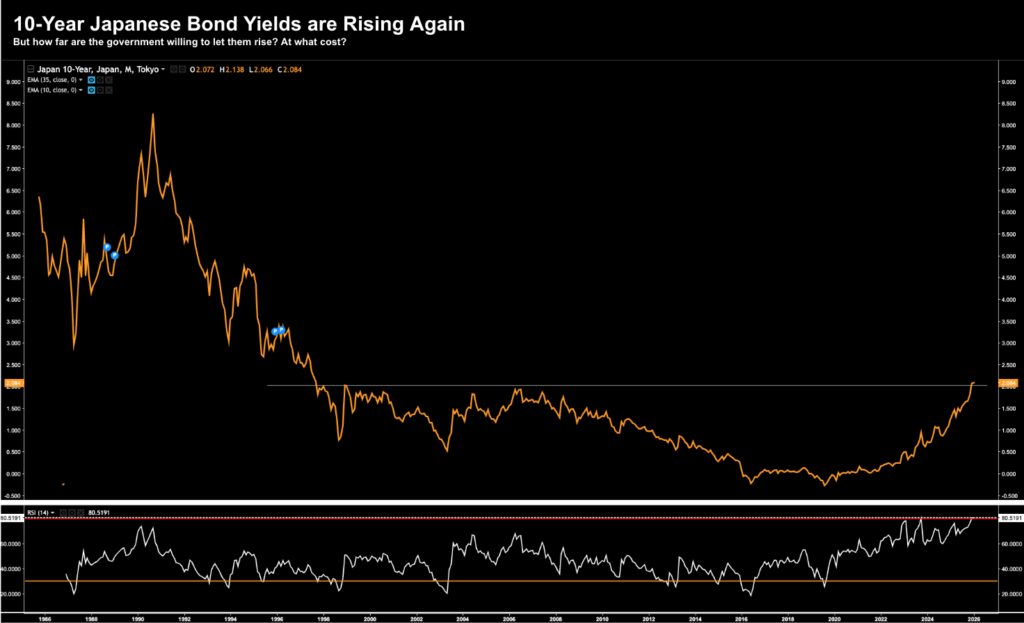

Jan 12th I shared "Japan: Land of the Rising Yields"

It was not widely read (with readers more interested in my $209 to $220 target for Apple)

But I felt the post was important…

It talked about a familiar – but long-dormant threat – which has re-emerged in Japan: surging government bond yields.

After decades in which betting against Japanese Government Bonds (JGBs) proved ruinous (known as the "widow maker"), the market is stirring (repeating my JGB long-term chart):

Beyond what we see with 10-year yields – the 30-year JGB yields have recorded their largest daily jump on record.

Investors would be remiss to ignore these moves.

Sharp exits from bond markets raise the risk of discontinuities—moments where liquidity evaporates, prices gap lower, and financial stress accelerates.

Japan (not unlike the US) has spent decades avoiding such moments through yield-curve control (QE) and ultra-easy monetary policy.

However, the sheer velocity of this (debt) repricing suggests something more than a gentle normalization is underway.

Yet the immediate catalyst appears to be domestic.

The move has been "Made in Japan" reflecting a shift in expectations around policy, politics, and inflation rather than contagion from abroad.

But this deserves closer scrutiny…

When long-dated sovereign yields move violently, markets begin to question fiscal credibility, not just central bank policy.

Another "Liz Truss Moment"?

Prime Minister Sanae Takaichi"s decision to call a snap election has injected risk into a market that prizes stability above all else.

While she remains popular, changes in coalition dynamics raise the probability of an upset, increasing uncertainty just as bond investors are reassessing Japan"s debt trajectory.

Further to my opening preface – financial markets are (always) more concerned with fiscal policy.

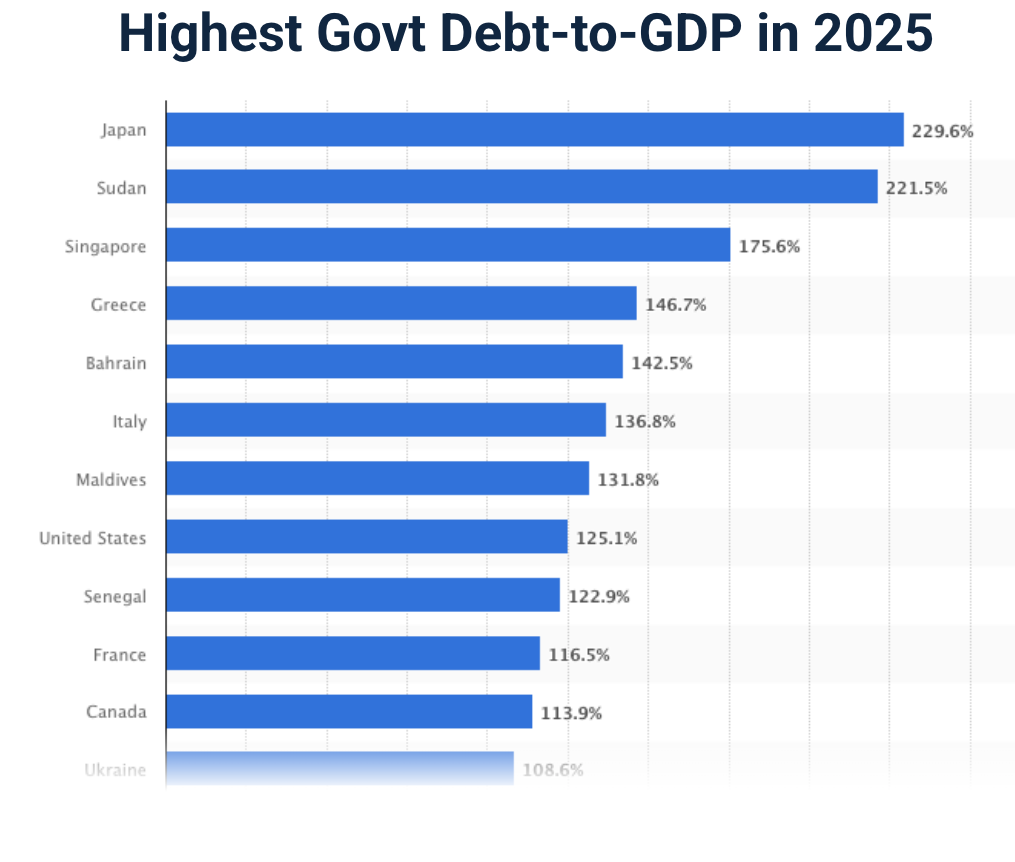

Takaichi"s proposal to eliminate the consumption tax on food would meaningfully improve household affordability, but at the cost of widening deficits and complicating efforts to stabilize Japan"s already massive public debt burden (the highest of all developed countries).

Investors remember that past attempts at fiscal tightening—particularly consumption tax hikes—often derailed recoveries.

And whilst avoiding that mistake may be considered "populist" – it"s not without unintended consequences.

This has prompted comparisons to the UK"s 2022 "Liz Truss moment," when unfunded tax cuts triggered a gilt market crisis.

Japan"s situation is not identical, but there are parallels.

For example, bond markets do not tolerate perceived fiscal recklessness, even in countries long insulated by domestic savings and central bank credibility.

However, some analysts argue Japan"s economy has finally normalized.

What does that mean?

They will argue inflation is positive, nominal growth has returned, and a neutral interest rate closer to 3.5–4.0% may be justified. In other words, there"s nothing to see here.

If true, rising yields reflect rational repricing rather than panic—and the Bank of Japan may simply be late in tightening policy.

I have my doubts…

The sharp move in bond yields does not feel like "normalization". From mine, it feels a lot more like a debt scare.

And they are not alone…

Bond Yields are Rising Globally

As we wrapped up 2025 – I offered my thoughts on 2026 and what I felt were the key risks. Whilst not intended to be exhaustive – they included:

- A rise in U.S unemployment rate (above 4.50%);

- Inflation remaining stubbornly high (with core ~3.0%)

- The Fed cutting rates less than expected (with core inflation remaining sticky)

- Poorer returns on invested capital (specifically fully valued hyper-scalers); and

- Rising longer-term bond yields

This post touches on the last point…

For example, US Treasury yields broke key technical levels recently – rising to five-month highs. And if I were to guess – are headed higher.

However, the rise in Treasury yields cannot be easily explained as capital fleeing Japan.

For example, if that were the case, US yields should fall (i.e., investors would be buying US debt sending yields lower).

From mine, this is money fleeing fiscally irresponsible governments and finding a (safer) home elsewhere.

Where?

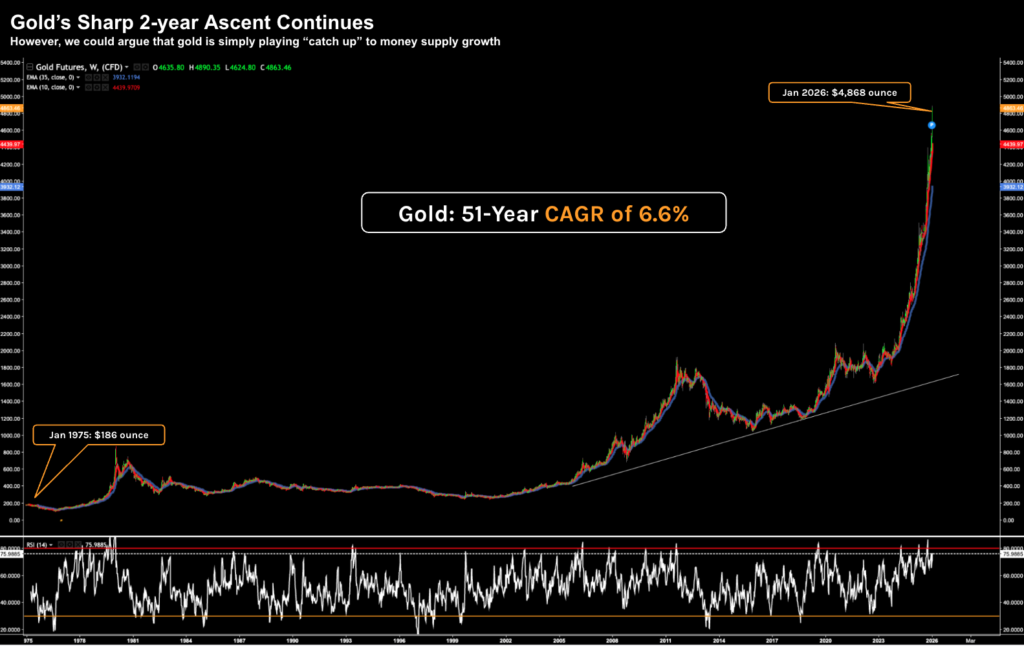

Look no further than precious metals — surging to levels last seen during the stagflationary turmoil of 1980.

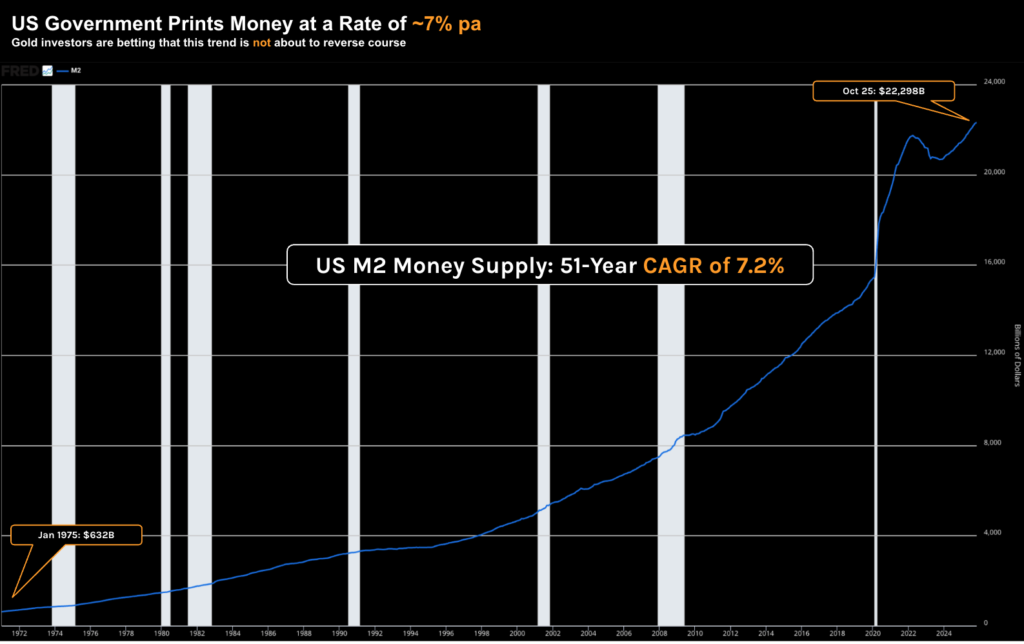

Consider the following.. from 1971 to today:

- Gold"s CAGR is 6.6%;

- U.S. M2 Money Supply CAGR is 7.2%

Put another way – for over 50 years these two enjoy a strong correlation. However, in the past two years – gold is playing catch up.

Below is the 51-year trend in M2 money supply:

Therefore, it"s my (casual) view the moves in precious metals suggest eroding confidence in fiat currencies, not just risk aversion.

What"s more, the rise in (global) bond yields points to a broader unease about fiscal discipline, political risk, and the long-term credibility of (deteriorating) advanced-economy balance sheets.

3 Key Takeaways for Investors

- Bond markets are reasserting discipline. After years of central bank suppression (through emergency programs like QE) – long-term yields are moving rapidly when credibility is questioned. Japan is no longer an island. Its bond market now trades in line with global norms, reducing its shock-absorber role.

- Fiscal promises, elections, and policy uncertainty are now market-moving variables.

- Falling dollars alongside rising yields point to confidence issues, not just rate dynamics. Remember – normalization can still be destabilizing pending its speed. Even "healthy" repricing can break leveraged strategies and expose hidden fragilities.

Putting it All Together

I"ve been consistently surprised at how complacent investors were heading into 2026 (see this post)

For example, up until recently, the VIX traded at just 14, suggesting traders saw very little risk of anything going wrong in the near-term.

However, the volatility index is now starting to wake up.

To be clear, we are nowhere near panic levels (e.g., VIX above35) – however if bond yields continue their rapid ascent – we could get there quickly.

Four questions to consider if allocating capital:

- Are rising yields reflecting genuine economic normalization—or early signs of a sovereign debt confidence problem?

- Can central banks manage this transition without triggering liquidity shocks or political backlash?

- If bond vigilantes are back – how far will advanced economy bond yields rise (and will central banks intervene)? and

- What are equities pricing in with respect to the long-end of the curve?

My take: equity markets are not braced for a 10-year near 5.0%