Dow’s Worst Day for 2022

- Volatility here to stay

- PPI hits 9.7% Year-on-Year

- Why the Fed will be on the "front foot" in March

2021 will be remembered for its unusual lack of volatility.

Markets offered traders only two pullbacks which barely hit 5%.

2022 is shaping up to be the opposite.

January saw the S&P 500 pullback 12.4% from the high before catching a bid.

The index bounced 8.9% from its 4220 low.

But now things are reversing… with the Dow Jones suffering its worst day for the year.

Make no mistake…

With "more Fed" comes "more volatility".

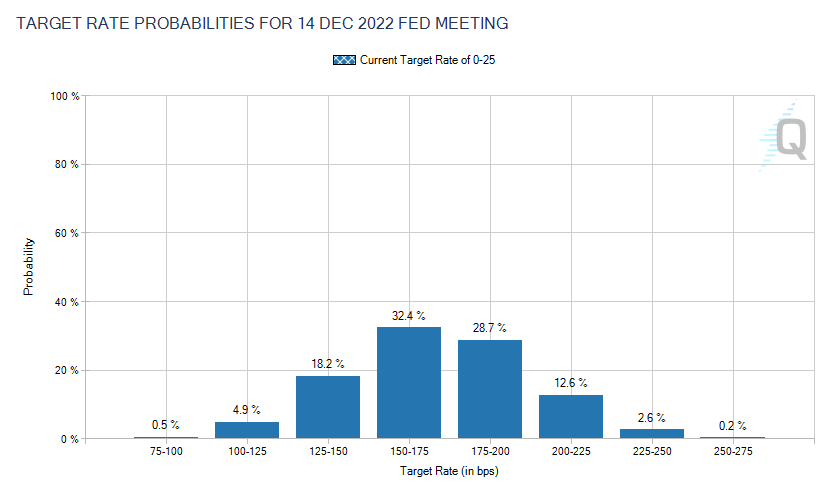

For example, this year is likely to see the world"s largest central bank hike rates at least 7 times (according to the CME Fed Watch Tool)

This would see the cash rate closer to 150 basis points in nominal terms.

However, in real terms (i.e. when adjusted for inflation), rates will remain deeply negative.

But it's not so much rate hikes which are bothering the market…

It's the upcoming discussion around the inevitable reduction in the Fed"s balance sheet of over $9 Trillion.

In other words, when the Fed pivots from becoming a buyer of bonds (in turn lowering yields) to a net seller of bonds.

That is not typically conducive to higher risk assets…

S&P 500 Pulls Back

Trading this year has been a little more difficult than last year.

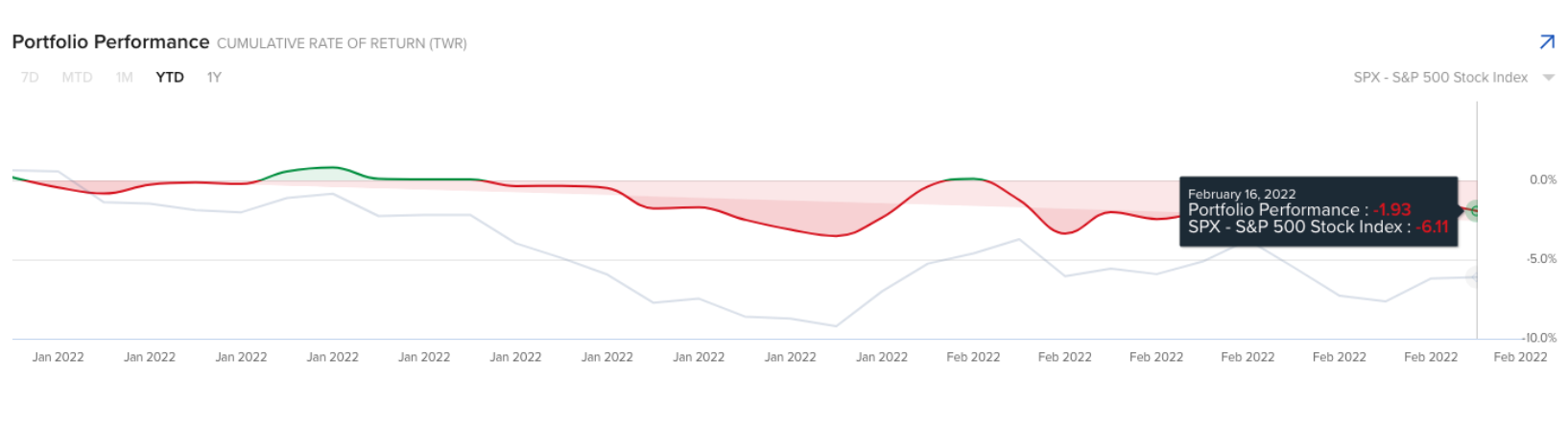

For example, my own portfolio has started the year down around 1.93% (red line below).

Not bad given the strength of returns last year.

And it"s to be expected – given my weighted exposure to stocks like Google, Microsoft, Amazon and Apple.

Note: I continue to add to these on any meaningful dip.

And whilst being slightly in the red for the year – it"s significantly better than the market (gray line) which is down over 6.1%

What I have avoided (for the most part) is the "50% plus" thumping we"ve seen in excessively overpriced tech stocks.

I felt that was an accident waiting to happen.

Sure enough.

To that end, I think this year will be a stock picker"s market.

The momentum trade that worked so well for 2020 and part of 2021 is done.

Over the next few years, it will be quality that shines.

And as Buffett says "when the tide goes out… you get to see who was swimming naked"

It"s not pretty.

Companies that traded more on the "promise of tomorrow" (low-to-no earnings) will struggle in a less accommodative environment until they prove they have scalable, viable businesses that generate strong free cash flow.

But let's check in with the broader market… is there more downside ahead?

The orange lines were sketched a few weeks ago…

I saw resistance at the 61.8% zone early in the year; and a possible 10-15% move lower.

From there, I was looking for markets to catch a bid.

They did.

However, I stressed the importance for markets to follow-through on the bounce.

We didn"t get it.

What we have seen is rejection at the 10-week EMA (red-line).

To that end I think this "zone" will be hotly contested between the bulls and the bears.

For example, one day stocks will thunder lower on a headline (e.g. "Russia to invade Ukraine"); and the next they could rip higher.

My thesis here is stocks will be bought around the 4100 to 4200 zone.

I maintain this is a good risk/reward zone.

And whilst we will have to deal with a lot more volatility in the first half of the year – I think the market rallies in the second half.

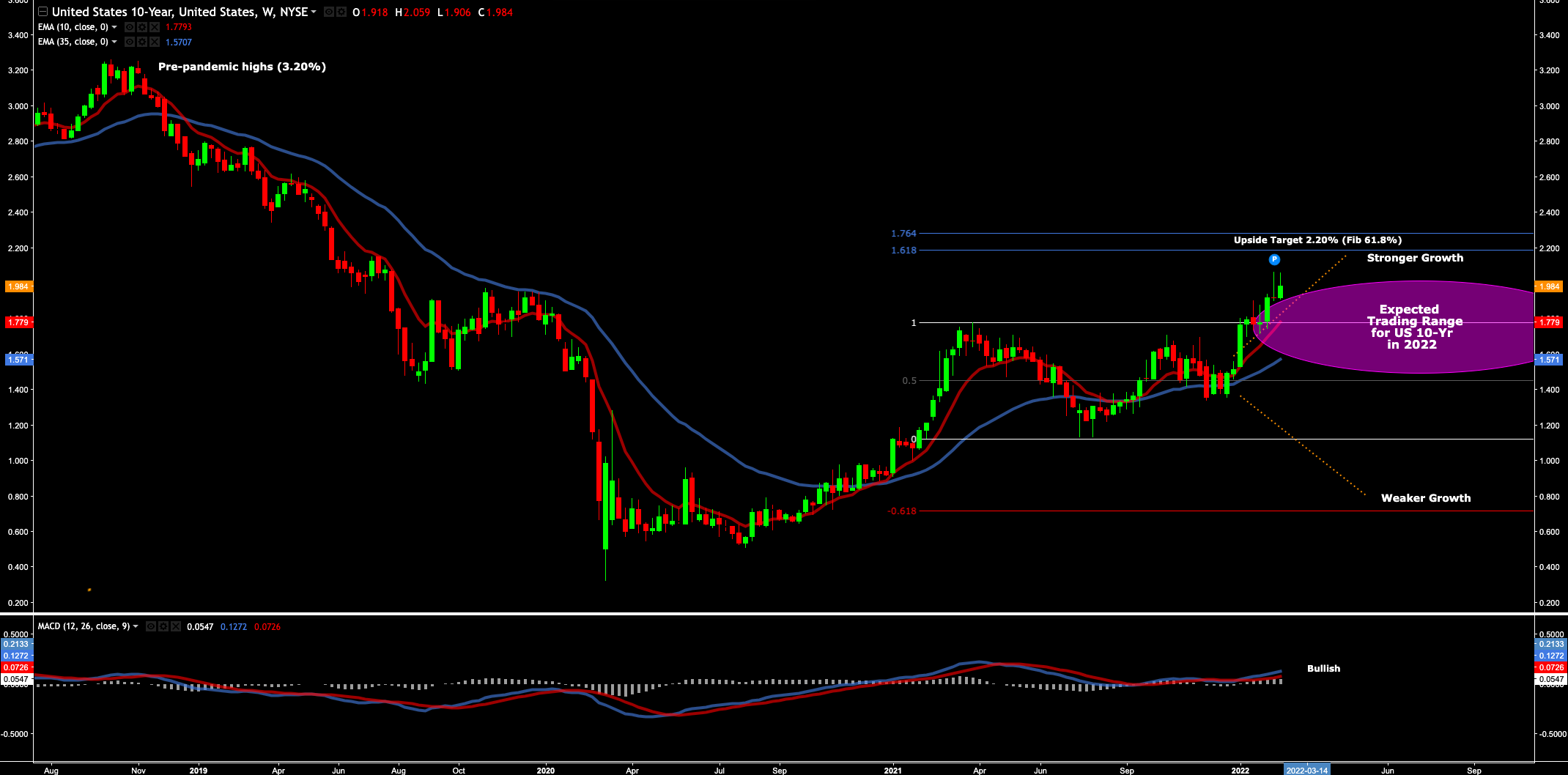

10-Year Yield Wrestles with 2.0%

Perhaps the most interesting development of the past few trading sessions is what we see with the all-important US 10-year yield

Over the past two years, the US 10-year was wrestled with the level of 2.0%

Yields have continued their advance as St. Louis Fed President James Bullard reiterated his call for the central bank to take aggressive steps to fight inflation in the first half of 2022.

He suggested that the Fed should "front load" the tightening of monetary policy.

From mine, I think the 50 basis point rise in March is now 100% priced into the market.

In fact, I think the market sees a 50% chance of the Fed hiking at every meeting (starting March) – which could see the effective cash rate at 2.0% by year"s end.

- March 15-16 (50 bps)

- May 3-4 (25 bps)

- June 14-15 (25 bps)

- July 26-27 (25 bps)

- September. 20-21 (25 bps)

- November 1-2 (25 bps)

- December 13-14 (25 bps)

If that"s true – then we will need to see the US 10-year sharply higher than 2.0% in order to preserve the steepness of the curve.

For example, should the 2-year yield (as a proxy for short term rates) exceed that of the 10-year – the yield curve is said to be inverted.

An inverted yield curve has been the precursor to every recession post 1950.

Now fresh data out Tuesday morning showed prices at the wholesale level jumped twice the expected level in January.

For example, the producer price index, which measures final-demand goods and services, rose1% for the month, against the Dow Jones estimate for 0.5%.

Over the past 12 months the gauge rose an unadjusted 9.7%, close to a record in data going back to 2010.

Excluding food, energy and trade services, co-called core PPI increased 0.9% for the month, well ahead of the 0.4% estimate

And this is Bullard (and others) are pushing for the Fed to be more aggressive at the "front end"…

They are well behind the curve…

Putting it All Together…

Last week I explained how the supply / demand equation for money is about to shift.

This is the first phase of that shift

And it must if we are to combat unwanted (sustained) inflation.

PPI prices gaining almost 10% YoY is a sharp reminder of how aggressive the Fed needs to be.

On the one hand the Fed needs to increase the demand for money by making it attractive.

A cash rate of negative 7% (in real terms) isn"t attractive.

No-one wants to hold cash during times of high inflation (i.e., why risk assets do so well).

On the other hand, they will need to lower the supply of money by reducing their balance sheet.

That"s coming.

Stocks are largely okay with the Fed raising rates as many as "7 times" this year.

Rates will still be historically low by any measure.

And I think they are ok with the 10-year trading anywhere between 2.0% and 2.5% (as long as the slope of the curve remains positive)

However, once the Fed starts to suck money out of the system we might see a much larger calibration.

That"s more likely next year.