Here’s What We Still Need to See

- Latest Core PCE doesn"t give reason for the Fed to pivot

- Micron could be a barometer of what"s to come

- VIX yet to indicate panic selling or "market flush"

Good riddance to the first six months of 2022!

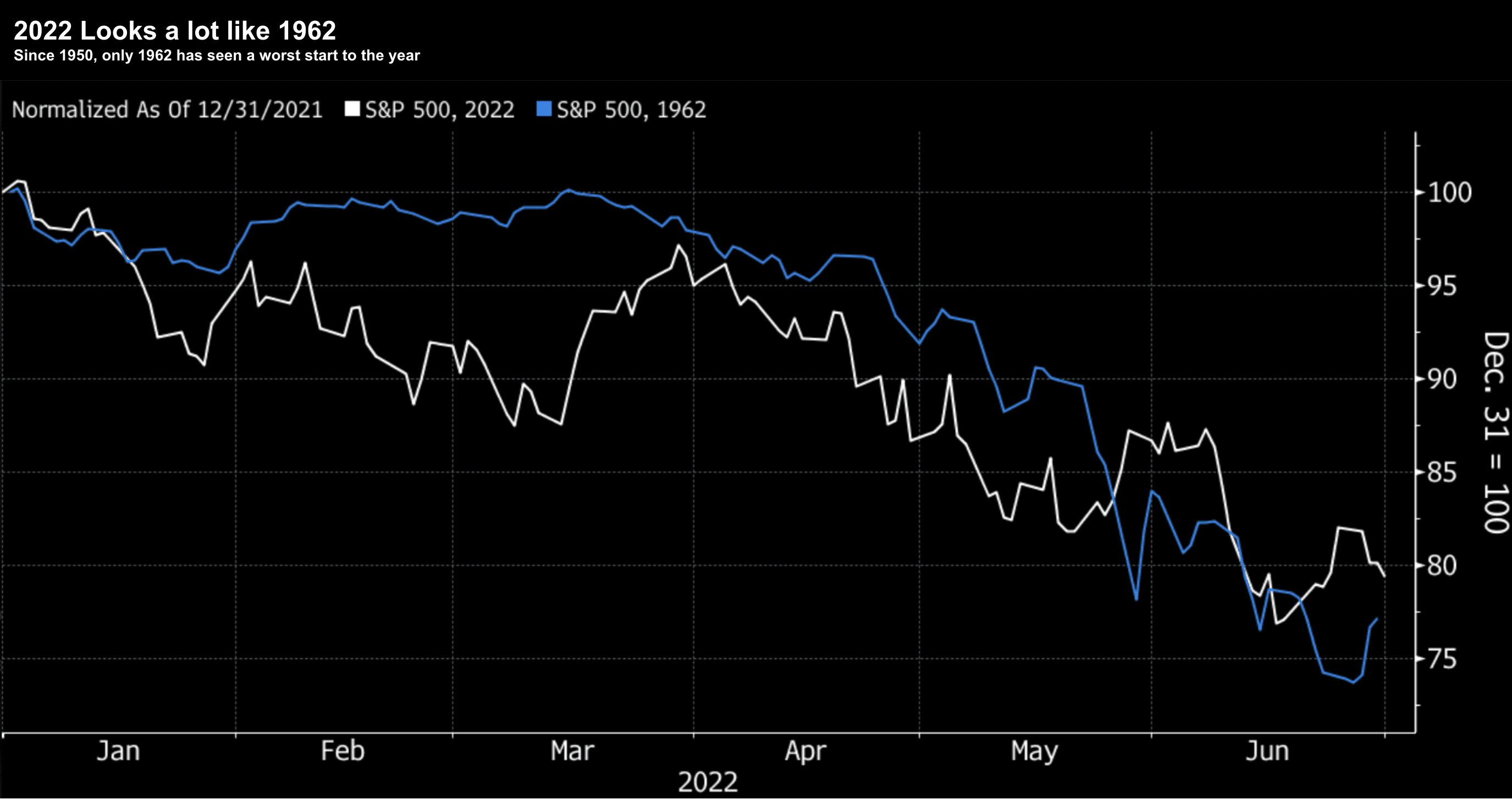

The Nasdaq lost 30%; the S&P 500 shed 21%; and the Dow Jones (the best of the three) only gave back 15%.

Post World War II, only 1962 has seen a worst start to the year:

Source: Bloomberg

For what it"s worth, June was the bottom in 1962, and many are hoping we could see something similar in 2022.

60 years ago the S&P 500 added 15% in the second half – reducing full year losses to ~11%

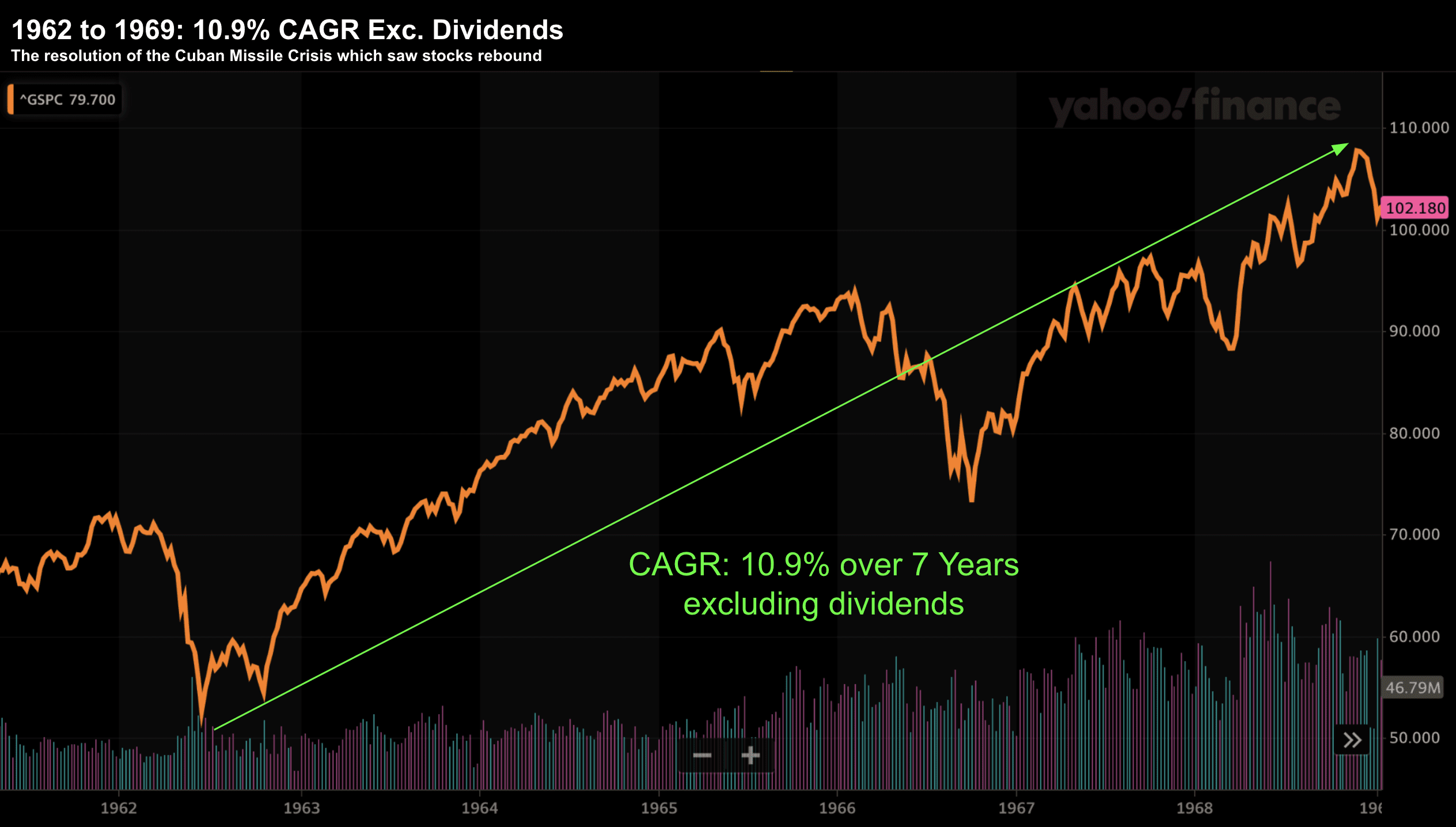

However, over the course of the next 7 years – the market returned ~10.9% CAGR (exclusive of dividends) – if buying near the 1962 June lows.

As regular readers know, I think we"ll see something very similar over the next "7 years" if buying the S&P 500 around 3500 or less (as detailed in previous missives).

S&P 500 from 1962 to 1969

The turnaround for 1962 was the peaceful resolution of the Cuban missile crisis.

Could we see something similar in terms of a resolution between Russia and Ukraine?

Maybe.

And if so – what would that do for market sentiment? And the price oil? Inflation?

But these are the types of catalysts the market will need to reverse exceptionally low sentiment.

Moving on…

A Time Not to Lose (Too Much) Money

In the game of asset speculation, these are two periods we oscillate between:

- A time to make money; and

- A time not to lose too much money

Knowing where we are on this spectrum has a large bearing on how you allocate capital.

For example, a time to make money is typically when we find:

- tax rates are lower (or falling);

- interest rates are trending down;

- bond yields are low;

- business regulations are friendly (or at least being reduced);

- consumer confidence is high;

- money supply is expanding; and

- economic growth is on the rise.

In other words, a business or investment friendly environment (i.e., where risk is rewarded).

We saw this from early 2017 through late 2021 – where the path of least resistance for stock was higher and market dips were bought.

Fast forward to today… and what do we find?

Interest rates are rising; business regulations are much tougher; inflation sits at 40-year highs; money supply is contracting; and economic growth has stagnated (possibly in reverse).

What"s more, consumer confidence is the lowest we"ve seen since WWII; and the longer-term trend for stocks is decidedly bearish.

Translation: this is a time not to lose too much money.

Here"s some back of the envelope math…

Let"s say your portfolio or 401K was lower by 25% in the first 6 months. From there, it will need to gain 33.3% to get back to square.

And if that drawdown was 30% (i.e., the Nasdaq in 2022) — that number increases to a whopping 43% to recover the lost ground.

However if you are wearing a drawdown in the realm of single digits (par for the course in any given year) – it"s not a difficult pathway back.

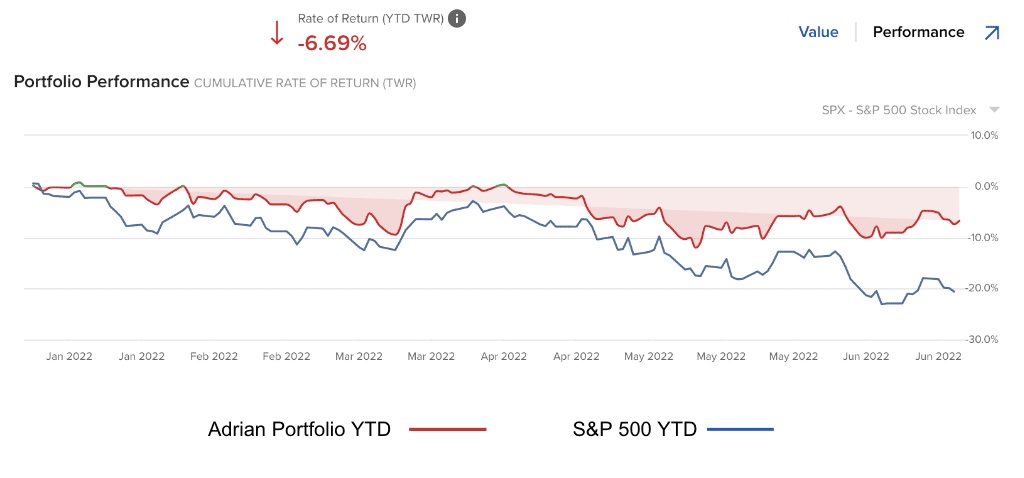

My portfolio was lower by 6.7% for the first half. Therefore, I need to generate a gain of 7.2% in the second half to show an annual positive return.

By comparison, the S&P 500 needs to produce gains of 26.6% in H2 to get back to where it began the year.

Below is my YTD performance in red vs the S&P 500 in blue

For the first 6 months of the year – I outperformed the S&P 500 by ~14%.

Let"s see how we go for the balance of 2022… as I"ve recently been establishing "core" positions in high quality stocks (at what I feel are good long-term levels).

Always a Bull Market Somewhere

From mine, there have been very few places to "hide" so far in 2022…

For example, whether you had exposure to stocks, bonds, gold or even Bitcoin – you will have seen drawdowns.

For me, it was exposure to high quality tech stocks (not bonds, gold or BTC)

Even in cash was getting "eaten alive" by inflation (losing some 8.6% on an annualized basis)

Consider gold, it was down ~2% for the first six months – despite its inflation hedge status.

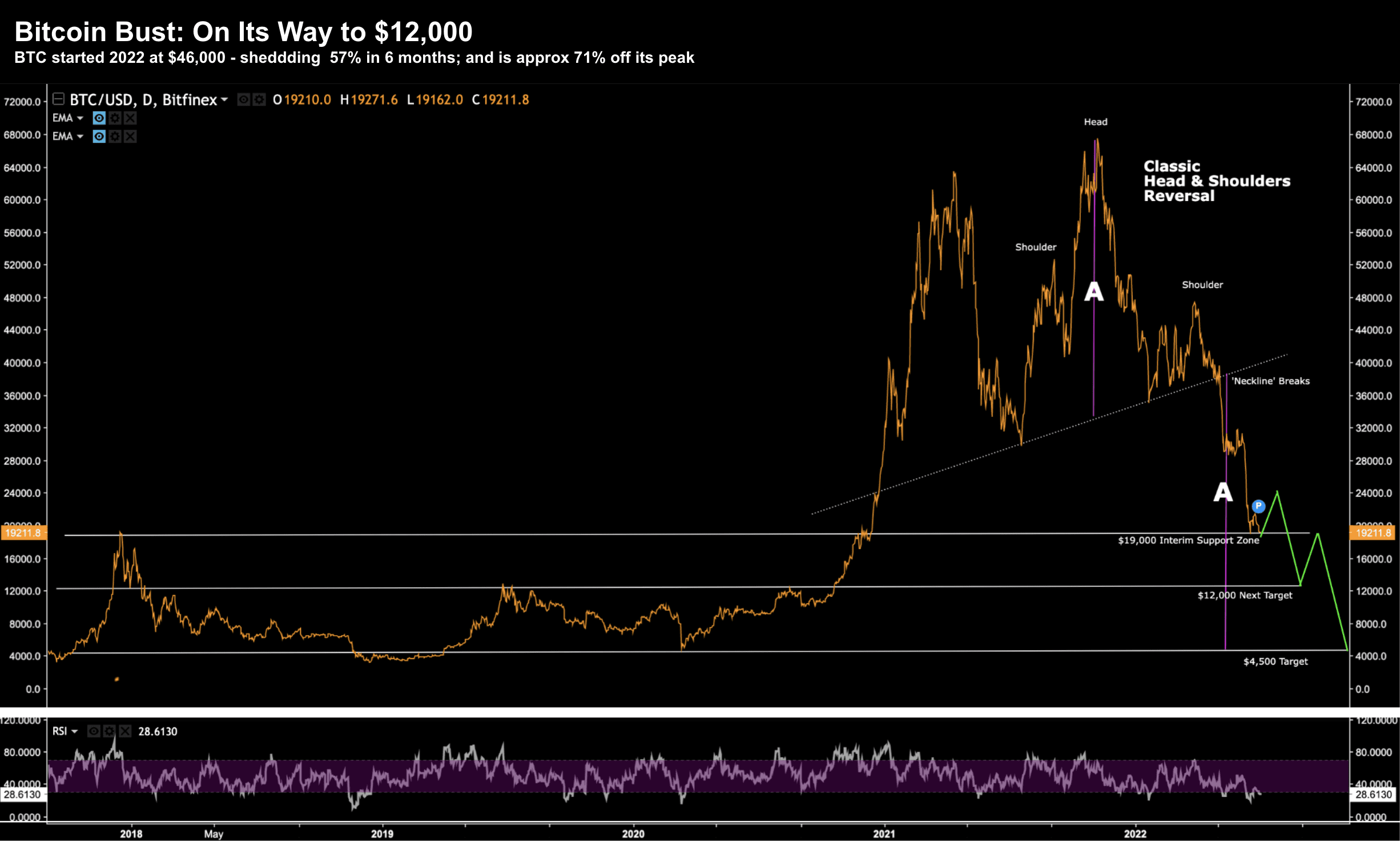

How about Bitcoin (BTC)?

Some people have taken to calling it "digital gold" and an alternative inflation hedge.

So far that "hedge" has seen their investment down ~57% in the first half of 2022; and ~71% off its 2021 peak.

From mine, technically I think $12K is the next stop for BTC (after expected interim support ~$19K) – as it works to complete what is a near-perfect "head and shoulders" reversal:

July 3 2022

But there was one investment which had a great 6 months…

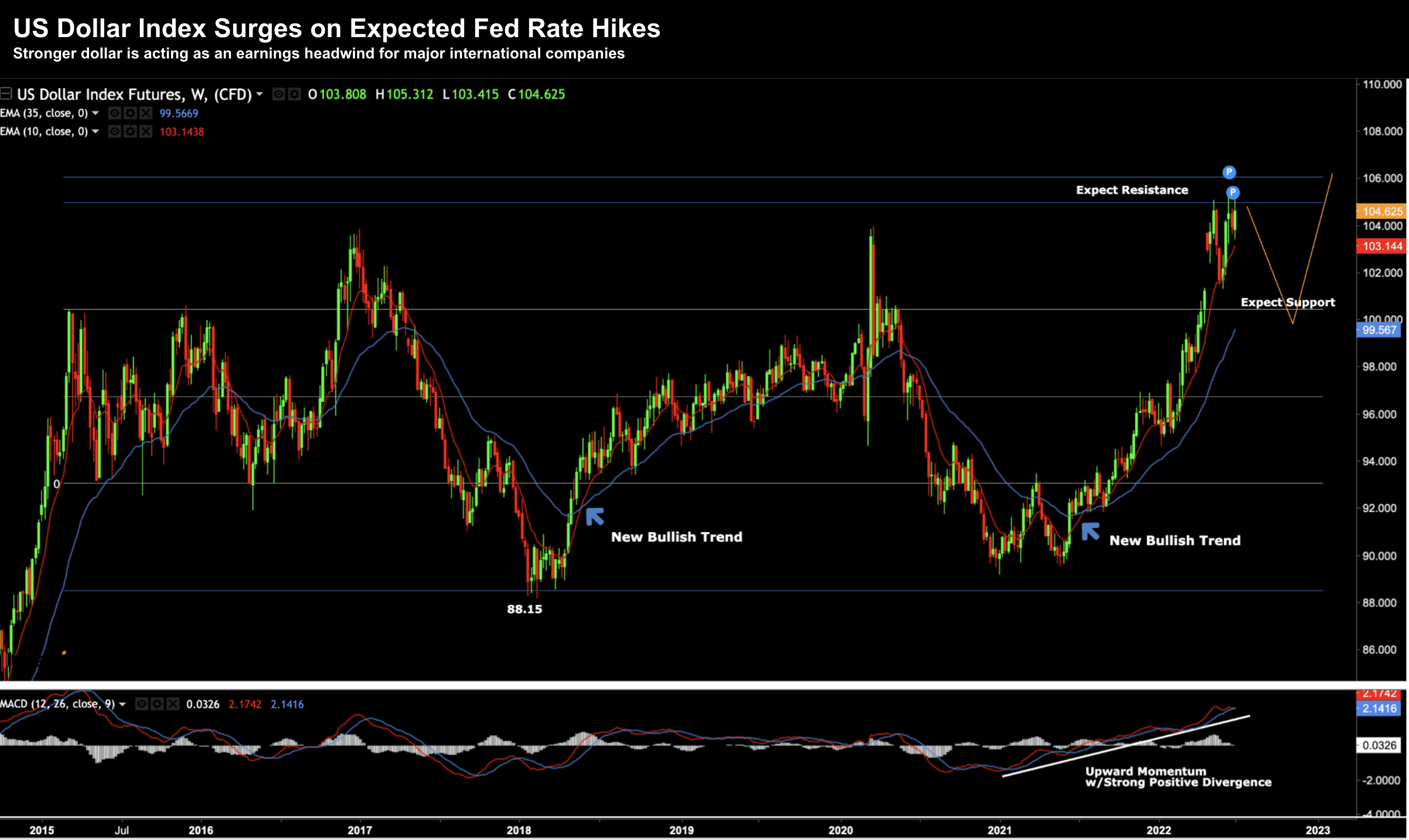

Outside of oil (and energy) – it was the US dollar index ("DXY")

King Dollar continues to trade higher driven by:

- The Fed"s commitment to raising interest rates (in turn higher bond yields);

- A generally weaker EUR and European economy (due to the events in Ukraine); and

- The US economy as a global safe-haven (or at least the "best of a bad bunch")

The DXY has seen a ~9.5% gain so far this year – a meaningful move in currency terms.

Personally, I remain long the US dollar index and short risk currencies (like the AUD – which I feel is headed towards 60c)

July 02 2022 – US Dollar Strength

For what it"s worth, this is exactly what the Fed want to see…

For example, not only will this act as a major headwind for global corporate earnings (sinking the stock market bubble) – a stronger dollar is deflationary for the US economy.

Unfortunately for risk currencies like the EUR or AUD – they"re likely to trade lower.

Naturally this will be inflationary for their respective economy"s — pressuring central banks to keep raising rates well into 2022.

Three Things I Need to See

If we think about the second half outlook – I think there"s a good chance we echo what we saw in 1962.

That is, the market stands to recover some (not all) of its 21% drawdown.

However, there are three key things I need to see that indicate things could reverse.

In order, they are:

- The Fed to pivot on their aggressively hawkish language

- Earnings revisions to come down; and

- The VIX to (ideally) trade above 40

I will start with the most important… monetary policy.

1. Monetary Policy Pivot

There"s an old saying which has never been more true: "don"t fight the Fed"

If you are aggressively long today – you are fighting the Fed.

From mine, there is no indication (yet) that the Fed is about to change course on monetary policy.

That will most likely come early 2023 (e.g., as the US tips into recession) – however we have not seen it yet.

For example, the latest Core PCE inflation print (which removes food and energy) "dropped" to a 4.7% annual rate from 4.9% last month.

Including food and energy, annual inflation, measured by the PCE price index, remained unchanged from the previous month at 6.3%

Whilst we could argue there are signs of inflation peaking (if you squint for long enough) — it"s still unacceptably high by any measure.

Therefore, this changes nothing from the Fed"s perspective.

For example, the Fed will need to see at least 3 or 4 months of meaningfully lower inflation to think there is a possibility they are getting back in-front of the curve.

Oxford Economic lead U.S. economist Lydia Boussour is expecting a 75 basis point increase at the July and September Fed meetings before scaling back to a pace of 0.25.

However, the "good news" (from the Fed"s lens) is consumer spending is slowing.

Granted that is bad news in terms of company profits (and GDP) – it"s exactly what we need to see to cool unwanted inflation. For example, consumer spending rose by 0.2% in May, down from 0.6% in April.

Adjusted for inflation, the measure dropped by 0.4% — the first decline since January.

As I say, this echoes the negative guidance we have received from the likes of NIKE, Williams Sonoma, Restoration Hardware (RH) and most recently – Micron (in terms of falling smartphone demand)

Here"s Barrons:

"American consumers are rapidly spending down their stimulus-augmented savings, and actually spent less last month than the month before," said Patrick Anderson, CEO of economic consulting firm Anderson Economic Group.

"One thing I always remember when looking at economic data: Listen to the consumer. Right now, the consumer is scared."

Which is a great segue to earnings revisions…

2. Earnings expectations still need to come down

If there"s a theme to what I"ve heard so far (early) in earnings season – it"s a combination of the following:

- slowing consumer demand;

- excess inventory;

- higher input costs;

- a surging US dollar; or

- supply chain issues…

… company after company is guiding for much weaker revenue and earnings.

And yet, the street has not yet revised down its numbers.

Analysts are generally late to the party (that"s not new)… but when they do… stocks will come down.

Look for this to occur over the next few weeks.

3. VIX Remains Low

The final thing we need to see a genuine market flush (i.e., signs of panic)

So far, stocks have "meandered" their way lower.

For example, the VIX touched a level of 35 in recent weeks; however nothing like that panic we have seen ahead of previous recessions / crises.

Take a look at this long-term chart:

July 03 2022

For me, when we see the VIX trading somewhere in the realm of 40 to 45, it will be more indicative of the "market flush" I"m looking for.

And that flush will come in the form of the highest quality stocks being sold.

By way of example only – that could be Apple trading closer to $125; Amazon trading ~$90; or perhaps Google falling below ~$2,000.

And I think that could be still in front of us… but would be a good sign of a market working its way closer to a long-term bottom.

Putting it All Together

Once we can tick those three criteria – it"s a stronger signal we"re nearing the market bottom.

And as I"ve mentioned in previous posts – at a guess we"re at about 70% of the way.

But it"s merely guess.

I don"t know if 3,666 will be bottom… 3200… or if it"s 2500?

However, if you"re buying the market around 3500 – I believe it will work out to be a rewarding longer-term entry (for e.g., CAGR"s in the realm of at least 10% over the next few years).

Again, it"s ok to start adding around this zone.

However, be sure to keep some powder dry, as I think there"s another leg lower in the third quarter. For example, the guidance we received from Micron (MU) confirmed these fears:

The largest US maker of memory semiconductors said it is moving swiftly to stave off a chip glut. That"s a big reversal in trend in an industry that suffered from a crunch since 2020, when the pandemic created a combination of high demand and supply-chain bottle necks hurting production of everything from home appliances to cars.

The second half of the year is off to a rather inauspicious start following downbeat commentary from Micron, which had negative implications for smartphones, data centres and overall demand for consumer discretionary goods," said Jim Dixon, a senior equity sales trader at Mirabaud Securities.

"The disappointing guidance might be the prelude to an "earnings recession"."

And an "earnings recession" is not yet priced in.

As I say, at $235 EPS assumes earnings growth of 4% year on year (the current expectation according to Factset).

However, I won"t be surprised to see earnings decline to the tune of 10% (possibly more) – putting us closer to $205 per share for the S&P 500

For what"s it"s worth – $205 EPS x 15.5 (fwd PE) offers a target of 3200.

Let"s see how we go…

And here"s to a much better second half in 2022.