Hits & Misses for 2021

- S&P 500 returns 26.8% for 2021

- My winning (and losing) trades this year

- And my biggest (trading) mistake

Today marks the final day of 2021.

Before I begin, here"s wishing everyone a safe and prosperous 2022.

At the end of every calendar year, I like to look back at what worked and what didn"t.

I am mostly interested in reviewing my mistakes… versus trades that worked well.

Every year there will be a couple of trades that go in your favour (I will share these shortly) – however there are always opportunities to sharpen the blade.

2021: A Remarkable 26.8% Year

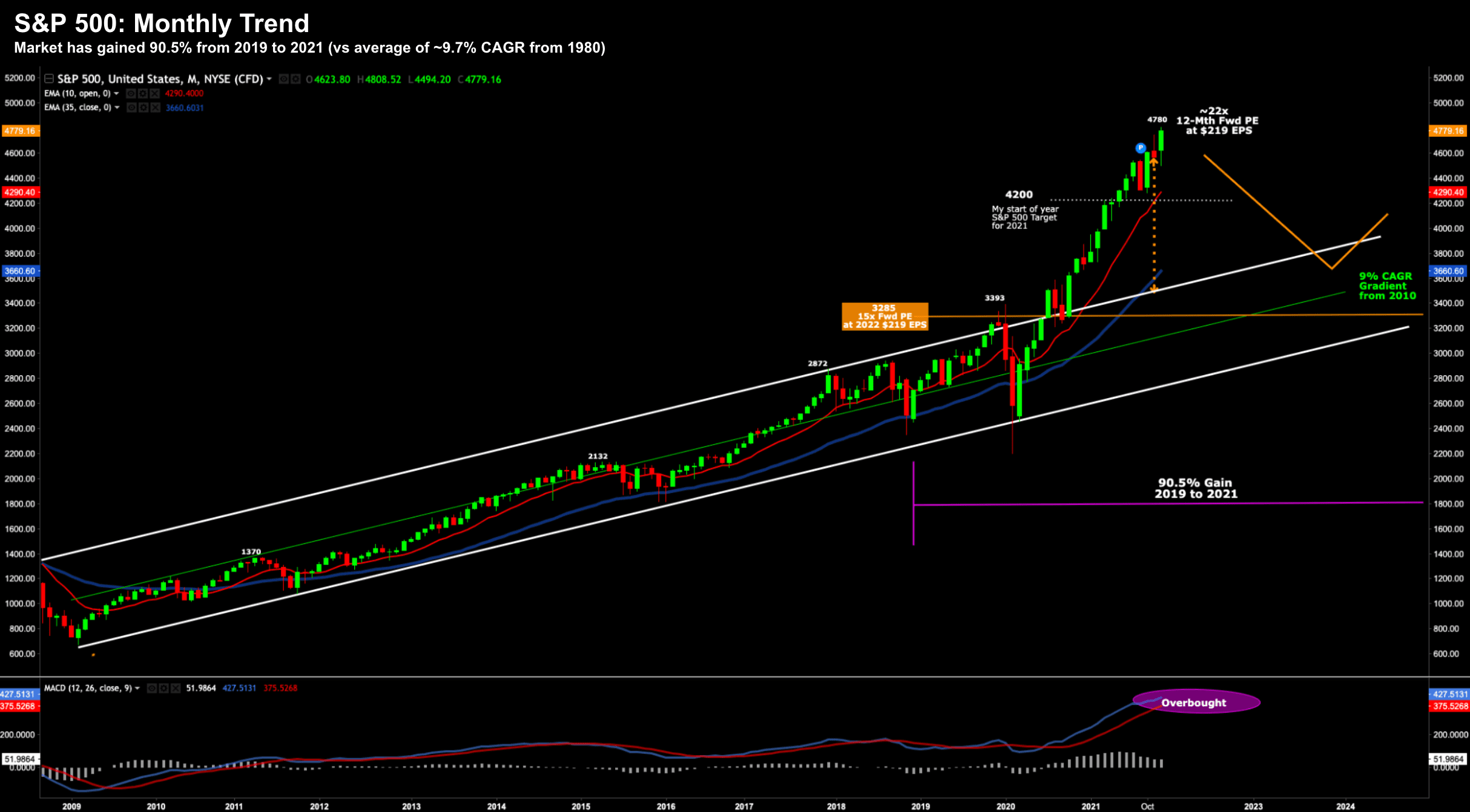

As a preface, 2021 will go down as the third consecutive year of exceptionally strong gains.

For example, with the S&P 500 closing at 4766 – that locks in 26.8% annual gain.

What"s more ,the market experienced some 70 record closes during the year (i.e., 28% of all trading days). Quite something!

By itself a ~27% gain is remarkable. However, it"s even more remarkable when you consider the stellar gains of the previous two years; i.e.,

- 2020: 16.4%; and

- 2019: 28.8%

Put together, the S&P 500 has gained ~90% from Dec 31 2018 (exclusive of dividends)

The monthly chart below offers perspective:

S&P 500 – Dec 31 2021

Next week I will offer some initial thoughts on 2022…

However, the TL;DR is I don"t think this velocity is sustainable.

As a complete aside, if I measure the CAGR from the lows of March 2020 to today – it"s a whopping 51.7% over 21 months.

By comparison, in the 20 month run up to the 1929 peak, the CAGR was 42.7%

That"s the nearest parallel I could find.

Sustainable? Well you tell me.

As further context, the average S&P 500 annual gain (exc. of dividends) from 1950 is 7.9%.

If we shift that lens from 1980 through 2021 – that average is 9.7% per year (exc. of dividends).

From mine, that "lift" was due to printing presses of central banks coupled with lower and lower rates.

But that"s your benchmark when measuring your own performance (i.e. annual returns of 10%).

Put another way, if you"re not consistently generating annual returns above 10% over a long period –– then I would argue you"re better off simply putting your money in an Index fund (e.g. SPY or IVV) and letting it go.

For me personally – 2021 realized gains of ~16%

I consider it a "solid" year… and consistent with previous years.

However, as I will explain below, my biggest "miss" was being too conservative.

Trades that Worked

Fortunately, I had a few things which worked well this year.

From a high-level I was not bearish on the market (unlike many!)

In fact, my start of the year target for the S&P 500 was 4200 – or a gain of ~12% (i.e., better than average and adding to already impressive gains of 2020 and 2019)

Rates and credit spreads were very low (i.e. a low risk of default) and liquidity was plentiful. And whilst valuations were always full… there were not too many alternatives.

Your best bet was stocks.

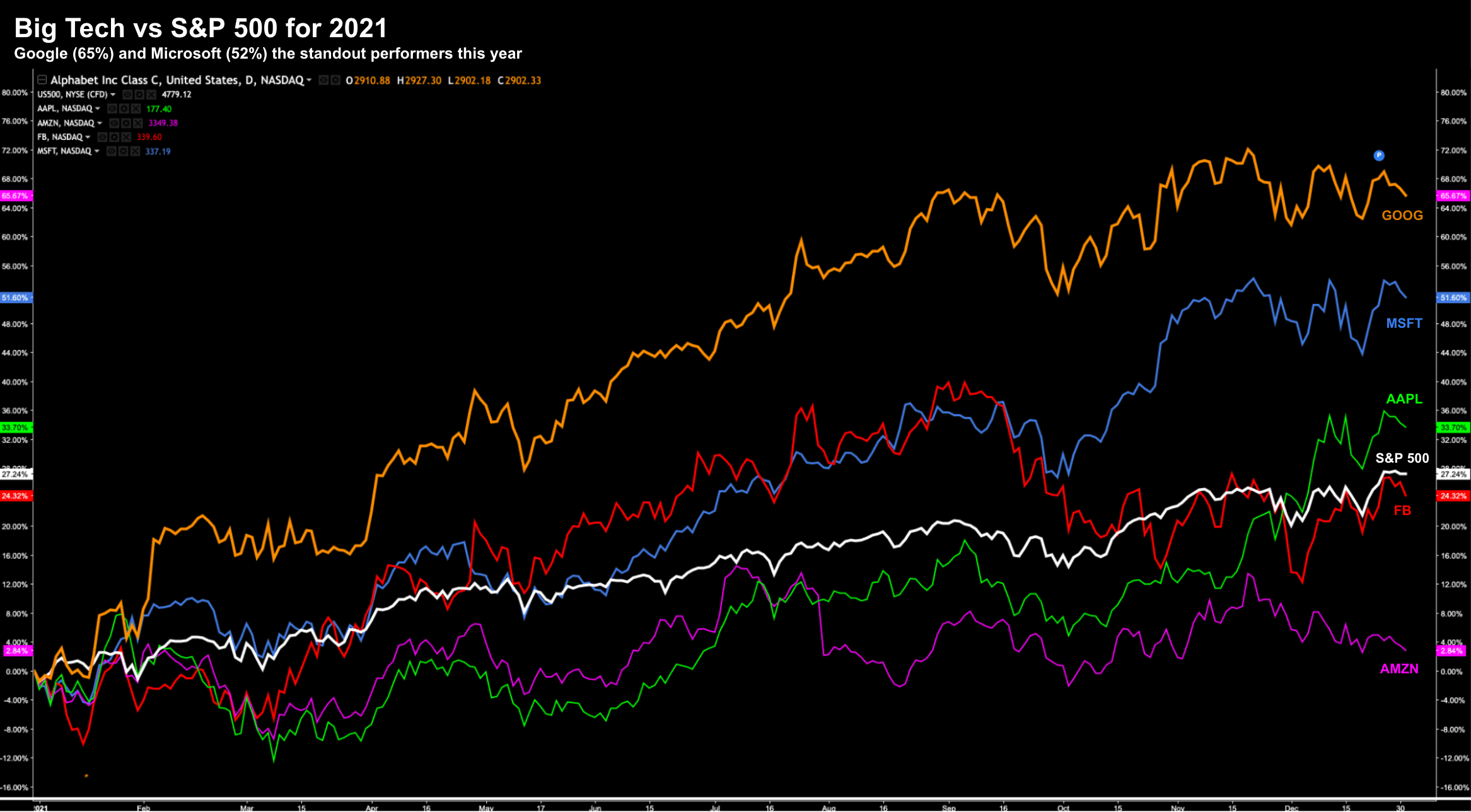

Perhaps the best trade for me this year was having meaningful exposure to big-tech (as the core of my portfolio)

Apple, Amazon, Google, Microsoft and Facebook comprise ~50% of my holdings.

Of these, Google was the standout for 2021 – with 65% gains:

Only Google, Microsoft and Apple Exceeded the S&P 500 27% Gain

Here we find the index in white.

For 2021, Google was (and still is) my single largest holding at ~16%.

Microsoft is second at 10%

From there, Apple, Amazon and Facebook make up a further 24% combined.

Amazon was the exception this year – returning 24% less than the Index.

However, during September of this year I increased my stake in the e-commerce and cloud giant as I think it"s set up well to have a great 2022. We will see.

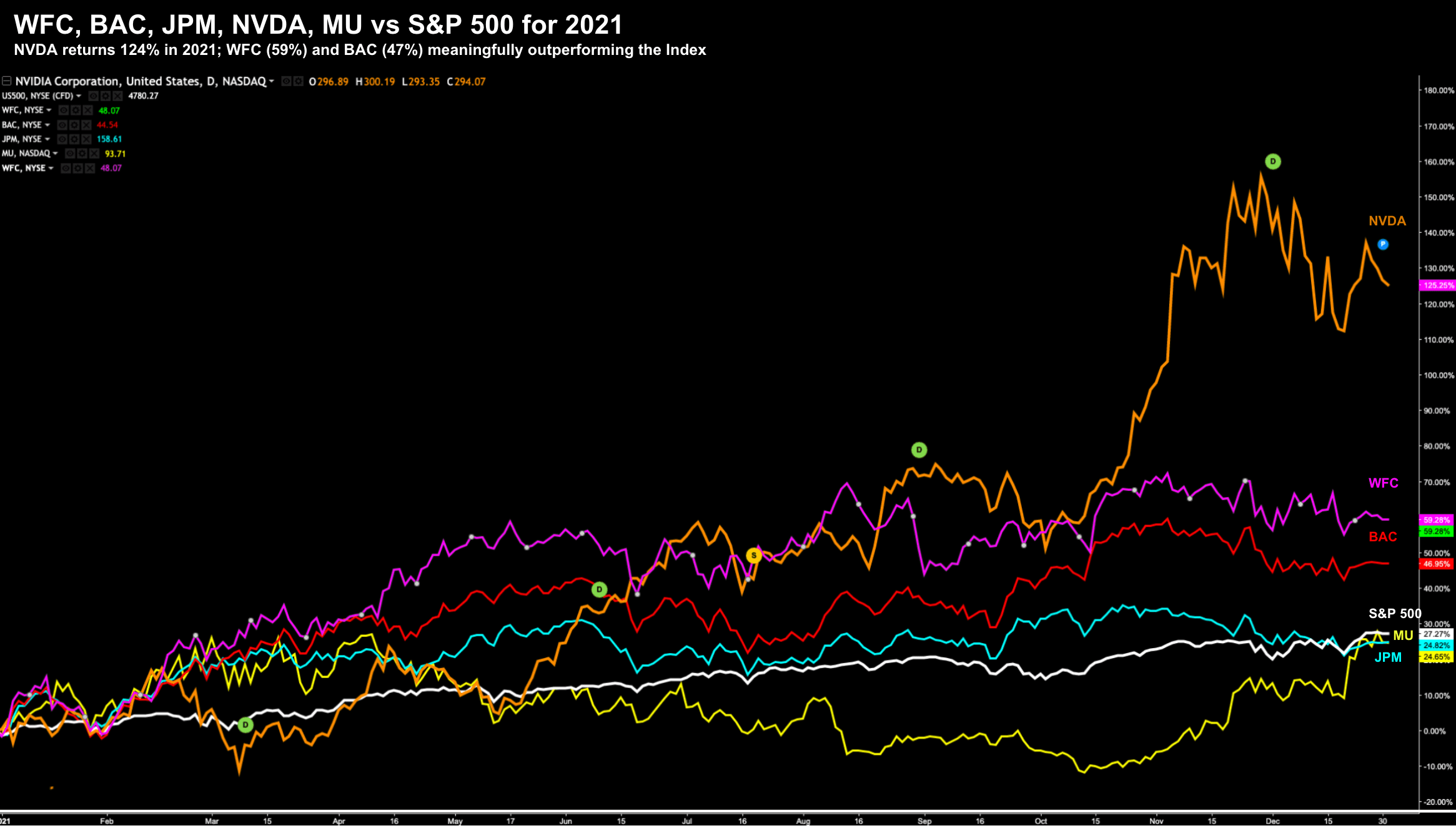

Outside of "big-tech" – other trades which worked reasonably well included banks (JPM, BAC and WFC); Micron (MU) and NVIDIA (NVDA)

NVDA, BAC and WFC had excellent years

Approximately a year ago I flagged NVDA is one of my Top 10 growth picks.

And that"s still the case today.

And whilst the stock only represents 2.40% of my portfolio… it warrants this position despite its excessive multiples.

I think NVDA is one of the best placed "chip stocks" over the next decade.

To that end, we are only going to see increasing demands on things like AI, ML, AR, VR and all things "omniverse" (i.e. mixed reality) and NVDA are best positioned.

With respect to the banks… I liked this trade as the yield curve steepened.

JPM and BAC have always been stalwarts in my portfolio (a total weight of 4% across the two) and that remains into 2022.

However, I am less optimistic on these positions outperforming as the yield curve flattens.

WFC traded at a significant discount to JPM and BAC and the chart looked strong in February of this year (around $36.00). It had broken above its previous high and reported very strong earnings. I still hold the position.

Micron (MU) was a recent add and has done well in the past three months – adding over 45%. I continue to hold this position.

Beyond that, I did well on a few short puts. Here I sold put options on quality companies hoping to get exercised at a price I liked. These trades averaged gains of between 9-12% annualized.

What Didn"t Work?

Plenty!

Every year I will have trades that are either cut or reduced.

Beyond specific trades, it"s worth highlighting that at no point this year was I "all-in" with equities.

Perhaps one of the major errors I made this year was holding too much cash in anticipation of a meaningful (e.g., 10-15%) pullback where I could add to quality companies.

That didn"t happen.

2021 only witnessed two ~5% pullbacks… the second of which I added to both Apple and Amazon.

That in itself is highly unusual.

And whilst I averaged between 65% to 85% "long" all year — it led to my returns trailing the Index.

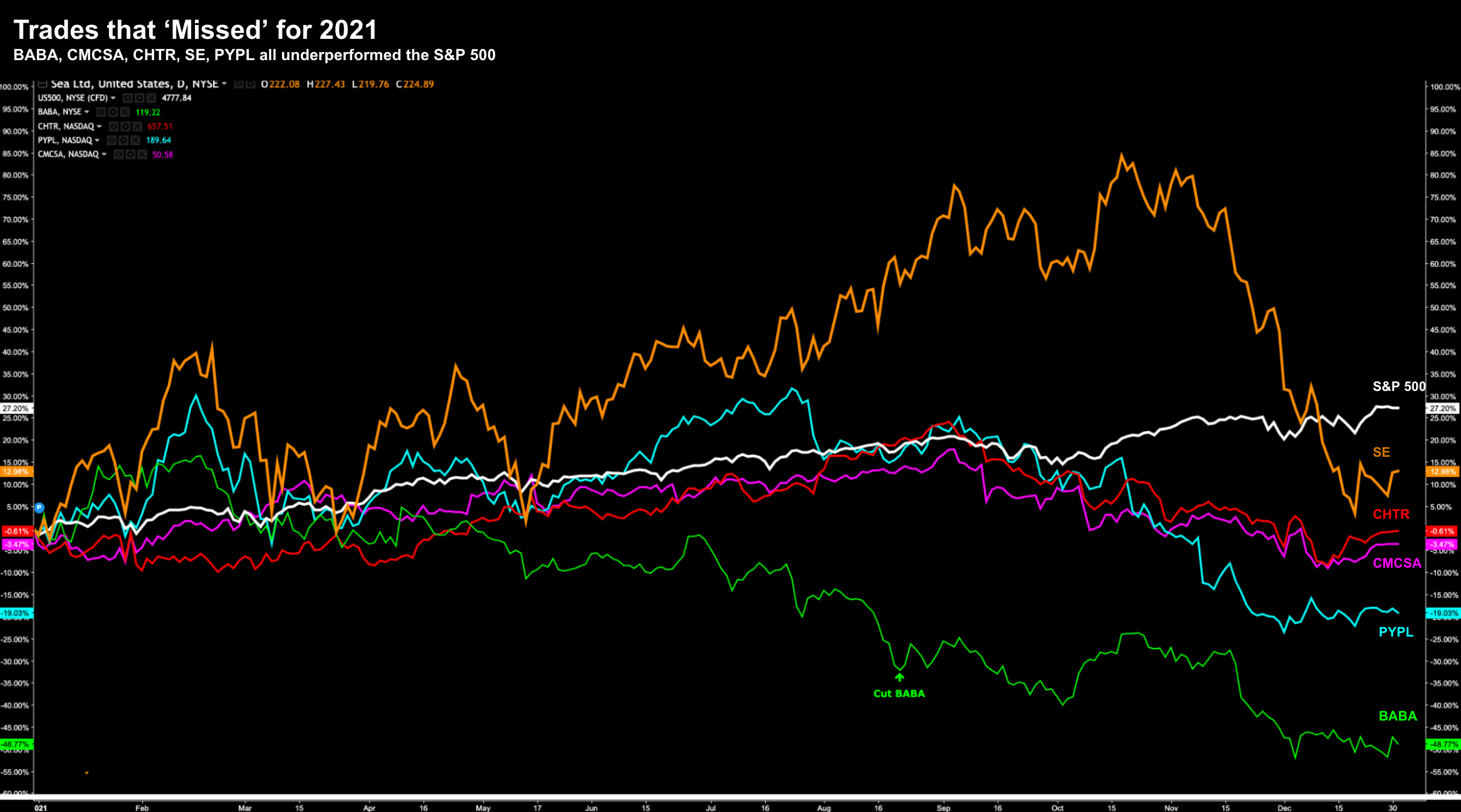

With respect to specific trades (and positions) – my biggest "miss" this year was Alibaba (BABA).

I got that completely wrong.

For example, earlier in the year, I felt BABA offered "solid fundamental" value around $200.

However, I underestimated just how far the Chinese Communist Party would go to destroy their most innovative and profitable businesses (e.g, Pinduoduo, Tencent, JD and Baidu).

The lesson learned was regardless of fundamentals – it matters for little if the country"s government does not want them to be successful.

But with respect to BABA – here were my comments in August (with the stock at ~$155):

- My call here is don"t touch this name yet... all signs point to lower prices in the near-term. However, I will be watching what the stock does around the $150 level (where its forward PE is around 12x – based on $13 EPS) – if we can read anything at all into future earnings?) And that"s the point – we can"t.

- We would want to see strong buying support here if tempting fate. That said, you will be buying into a weekly bearish trend. Therefore, look for any rally to be met with stiff selling pressure around the 10-week and 35-week EMAs.

- My advice: If taking this risk/reward – limit your total capital exposure to no more than 2% of your overall portfolio (which is a loss anyone can afford to take with trading).

My long position in BABA was less than 2% of my portfolio – limiting the damage.

I cut the position as the stock dropped below $150 and may revisit it if we see a more "bullish tone".

For what it"s worth – that could be several months (or years) yet.

Now I continue to hold a few "underperforming" stocks – which include the likes of SE, CHTR, CMCSA and PYPL.

Each of these failed to exceed the returns of the Index (shown in white)

For what it"s worth, I think PYPL, CMCSA and CHTR offer attractive entry points heading into 2022.

SE still trades at an extremely high multiple however is meaningfully off its record high in October.

Other "Macro" Observations

A couple of "macro views" I got largely right were with respect to interest rates, the US dollar index and gold.

For example, I was neutral to bearish gold this year on the view the dollar was most likely headed higher.

To that end, I remained long the US dollar (effectively short risk currencies).

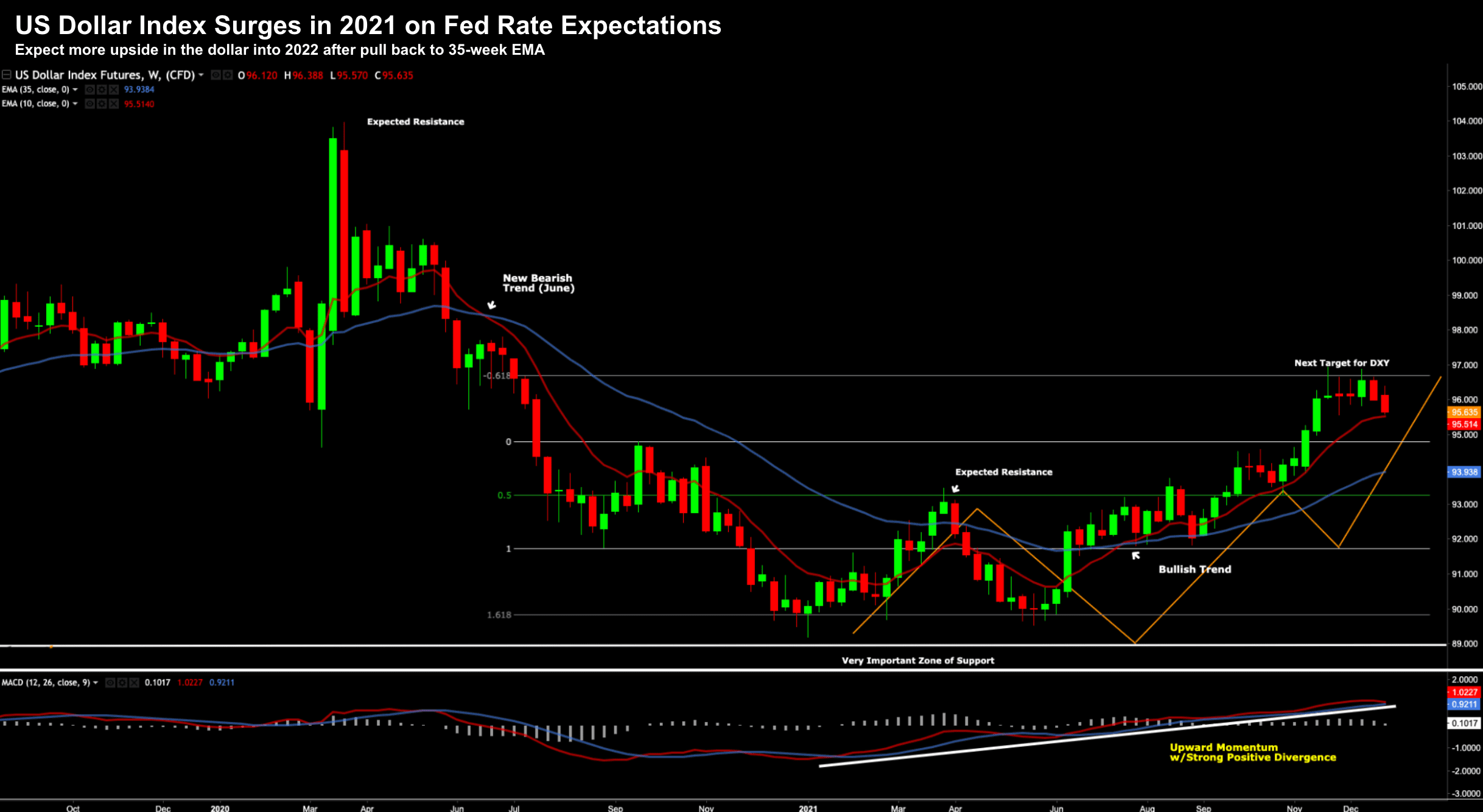

2021: A Strong year for the US Dollar

As regular readers will know, these lines were penciled in 12 months ago… targeting levels of above 96 for the dollar index.

The DXY is now trading in an expected zone of resistance – where I think the dollar will pullback to the 35-week EMA.

However, I still believe it sets up well for a strong dollar in 2022 (as the Fed hikes rates at least three times)

Coupled with the bullish view on the dollar… I felt the Fed was likely to go sooner than what the market assumed.

For example, in August the Fed advised they had no intention of hiking rates through 2023.

I wasn"t buying it.

I felt they were "behind the curve" and will have their hand forced.

Sure enough – that came to fruition in November.

Inflation persisted and the Fed decided to drop the term "transitory".

Oops.

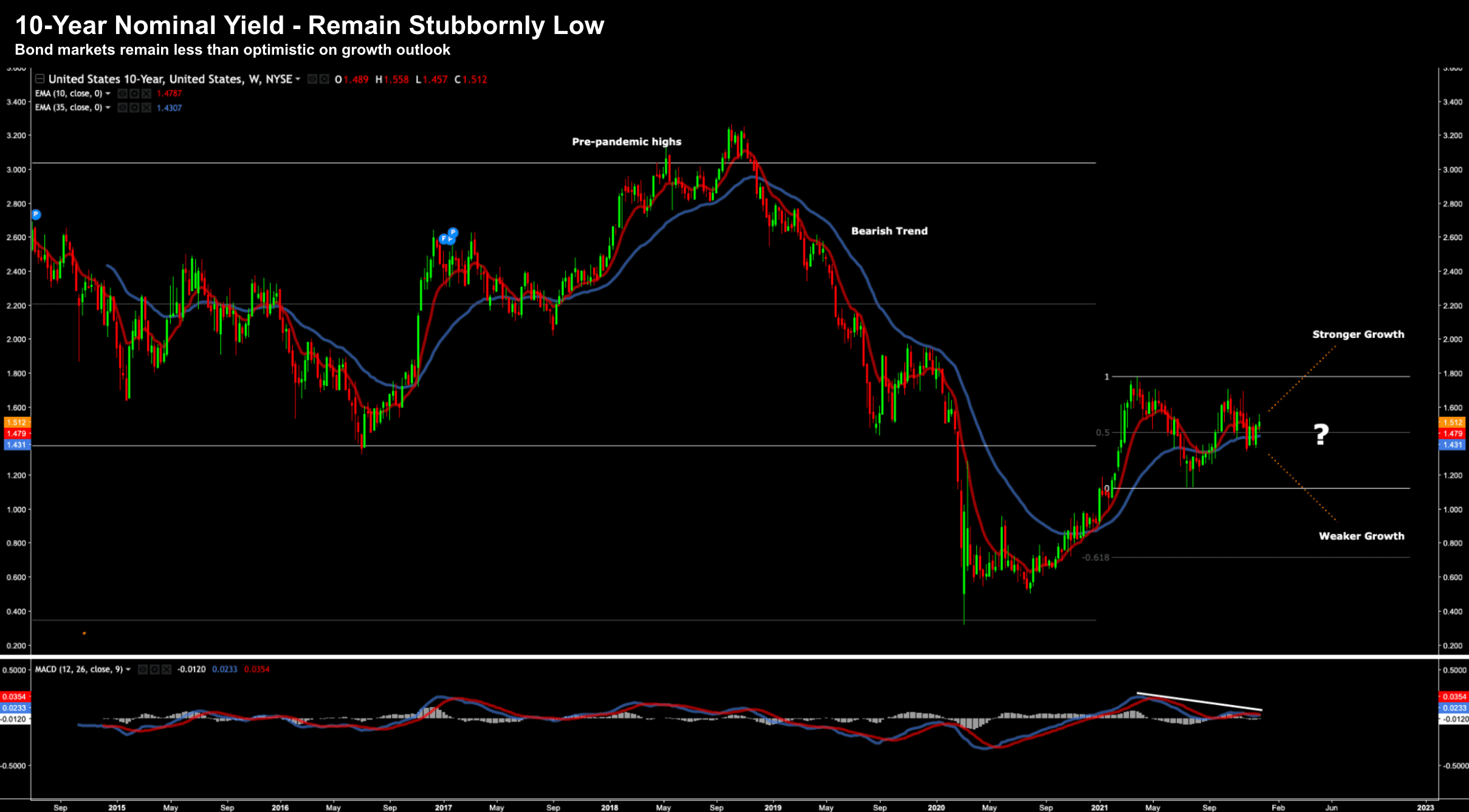

On the flip-side, one observation which I didn"t get right was 10-year yields.

For example, I felt the 10-year would be trading closer to 2.0% by year"s end… and not around 1.5% that we find today.

US 10-Year Yield – Dec 31 2021

From mine, this will be the chart to watch in 2022 (in addition to the 2/10 year spread)

Today, the US 10-year yield suggests the bond market does not see strong growth in the years ahead.

If the market was optimistic on growth – these yields would be trading significantly higher (i.e. well above 2.0%)

Note: this is the risk to banks in 2022… a flatter yield curve / lower margins.

Putting it All Together…

Fortunately, 2021 was more "hits" than "misses".

That"s the silver lining.

However, I failed to beat the index return of near 27%.

My error this year was (at times) was reducing my exposure in anticipation of a meaningful pullback (e.g. 10% plus) which never came.

That said, my ~50% exposure to big-cap tech did well (as it has done for many years).

Will that same set up do well in 2022?

For the most part, I think so.

For example, I think Amazon, Facebook and Google are positioned to do well.

They will most likely continue to grow their top and bottom lines at double-digits — maintaining exceptional strong free cash flow.

However, Microsoft feels full in terms of its valuation – as does Apple (given the massive 30% run higher from September)

That said, they deserve a solid place in your overall portfolio.

Other names I own heading into 2022 include UNH, PYPL, V, CRM, SNOW, DASH, TSM, TSLA, SCHW, DIS, DHR, FISV, NKE, NVDA and ORCL.

Some will be winners and I am sure some will underperform.

I like healthcare and companies with exposure to cloud services (e.g. SNOW, AMZN, MSFT, GOOG, CRM).

I also think semi-conductors are set up well for 2022 (e.g. NVDA, MU, TSM, AMD etc)

In a separate post I will offer some initial thoughts on 2022.

I don"t think returns will be anywhere near 27%. In fact, I don"t even think they will be double-digit.

However, I think investors will be offered a great opportunity to buy in the first half of the year (as the Fed prepares for rate "lift off").

Once again, thanks for reading and wishing everyone a safe and prosperous 2022…