How to Know When Markets are Panicky

Words: 986 Time: 4 Minutes

- Markets are not yet in a panic – only 6% off their highs

- Assessing the VIX for "real fear"

- Key levels I"ll be watching to add more exposure

Are markets panicking?

That depends on who you ask. What"s your investing timeframe?

From mine – panic isn"t here yet.

Tonight"s post will be brief – focusing on the VIX (aka "fear index") and what I see with the weekly chart for the S&P 500.

Yes, there are many (valid) reasons markets are ~6% off their record highs.

Most of which I have covered ad nauseam in previous posts (see here, here and here).

S&P 500 Trades Per the Script

To set the scene – things are trading as expected.

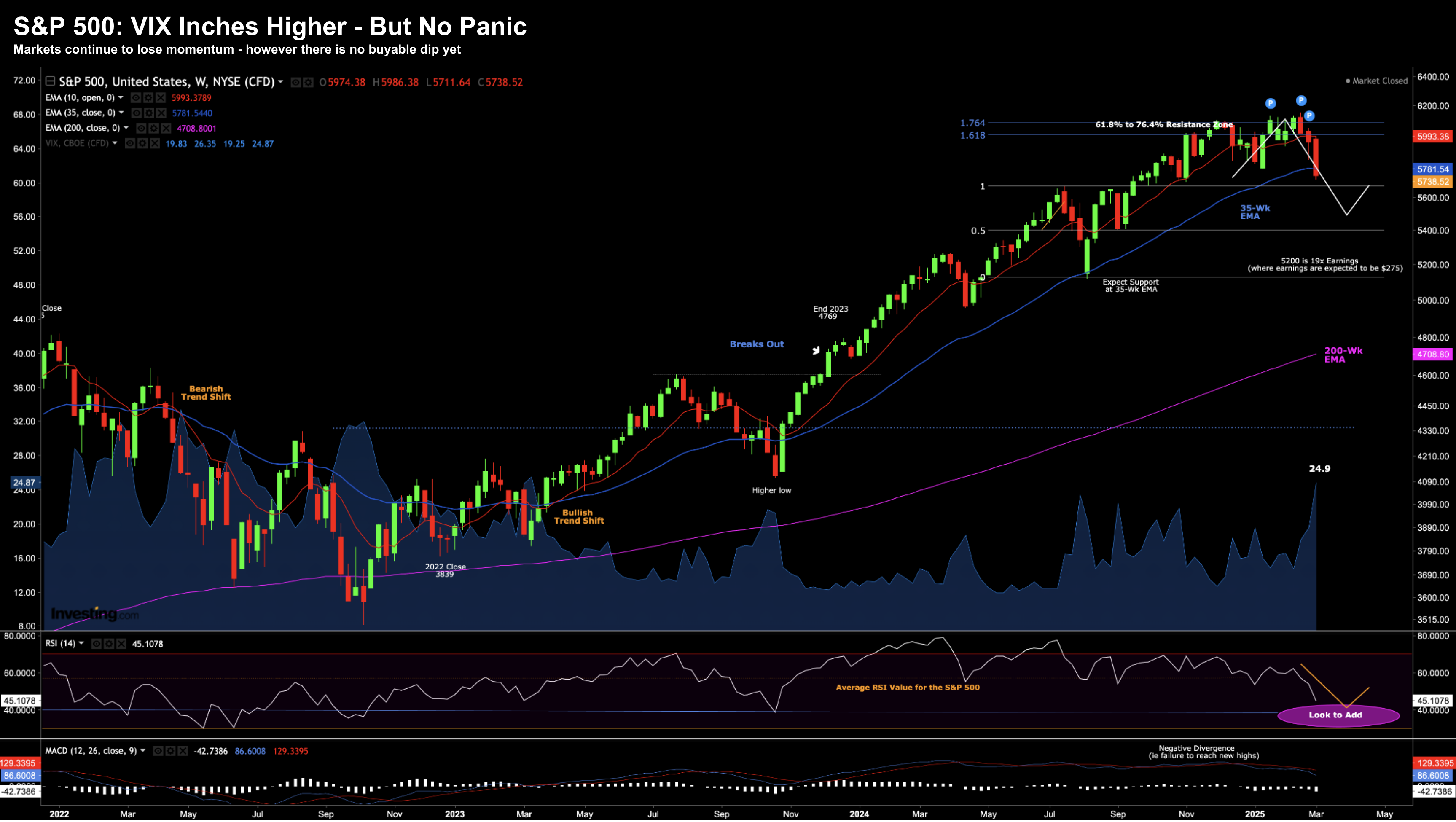

For example, we traded up to a flagged area of resistance before retreating.

Mar 6 2025

For those who don"t regularly read the blog (or are new) – take a look at this post (and chart) from January 4th

Below is the annotated chart I shared (see the white penciled line; and negative divergene with our momentum indicators):

Jan 4 2025

Repeating some of my observations:

From a technical lens – I penciled in a move down towards the 35-week EMA zone (blue line). At the time of writing, that zone is around 5600 or about 6% lower than today. Again, this is a zone.

For example, it might end up being "5% lower to 10% lower". It makes no difference… it"s arbitrary. The idea is not to be too cute. The more important point is that there"s risk to the downside.

As mentioned earlier – we"re trading around 6% lower.

That"s not a great deal given how far we have rallied the most two years.

However, I think there"s potentially more downside ahead before investors consider "buying the dip"

When To Buy Panic

March 18th 2022 I wrote a post titled "Why It Makes Sense to Buy Peak Fear"

The gist was to show readers how annual returns are amplified over 3-4 years if buying during peak fear.

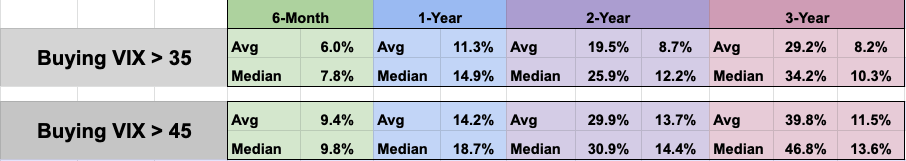

Here"s a summary of my findings

Note: the right-hand percentage column for 2-year and 3-year returns are CAGRs. The left hand column is the annual return that year.

The average returns of 3-years vastly exceed that of the average Index returns.

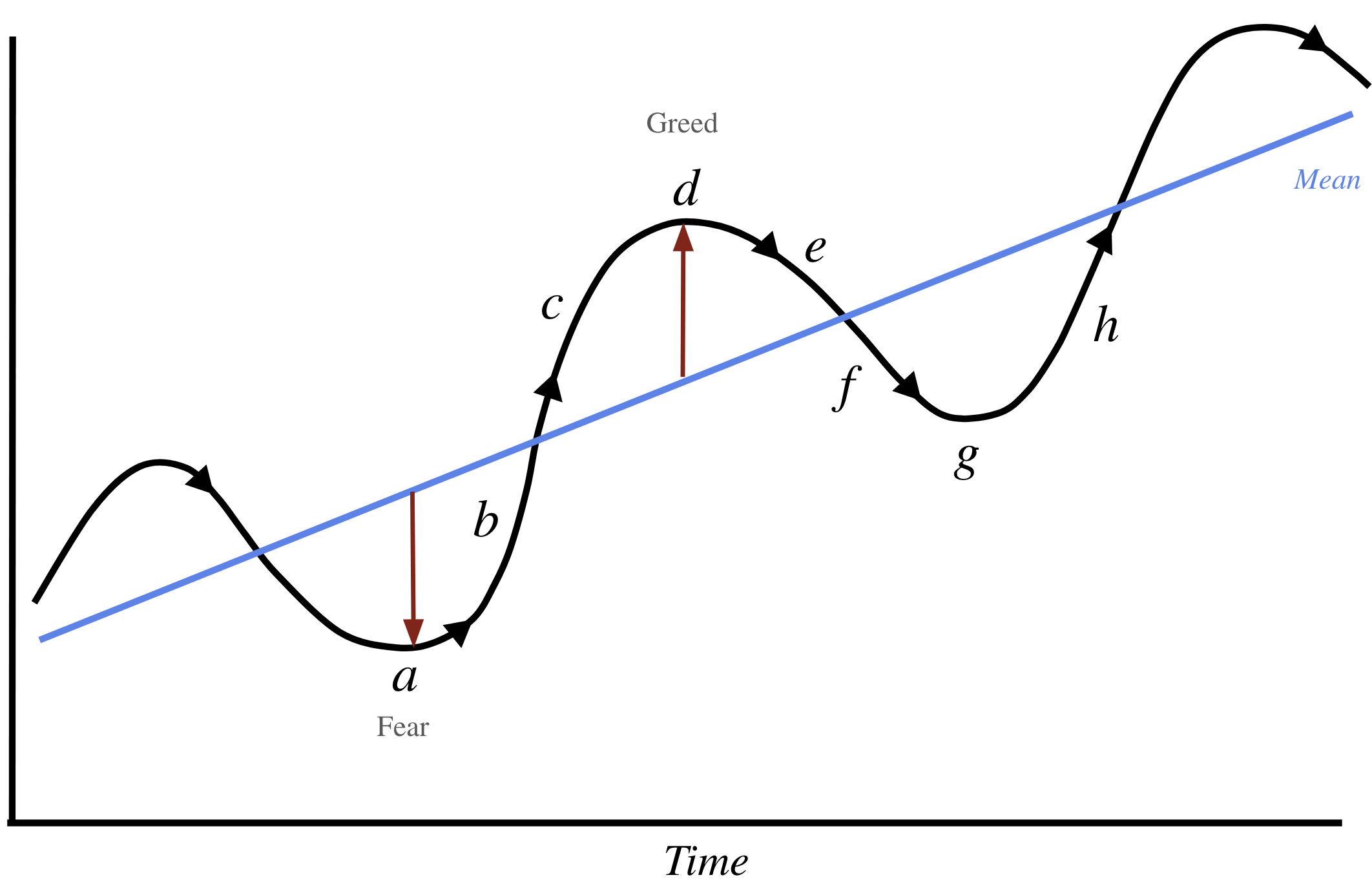

And it can be explained with this "sentiment" model:

Point "a" and "g" (fear) is the equivalent of when the VIX trades above 35.

With that, let"s examine where things stand in terms of investor panic.

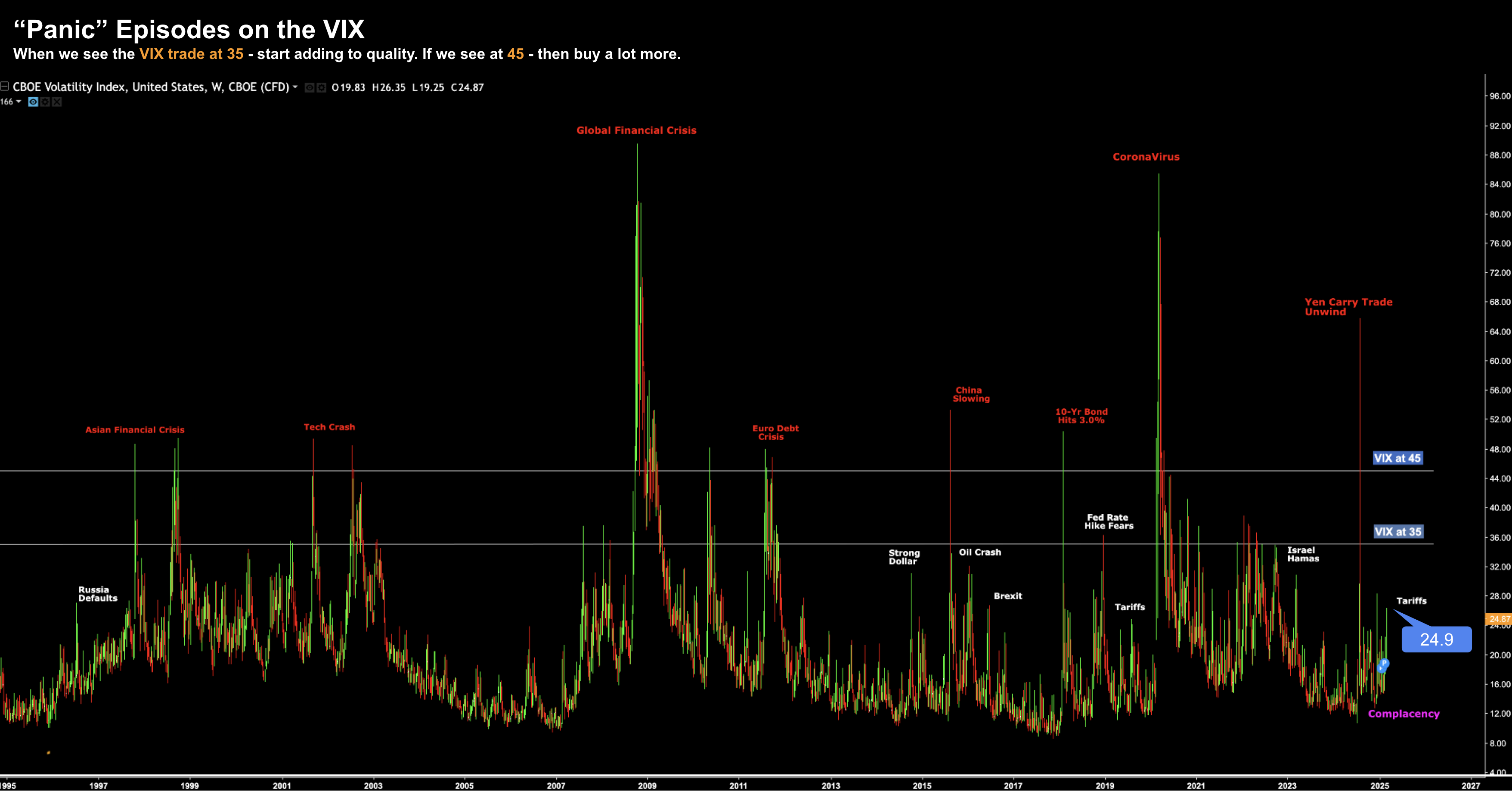

Mar 6 2025

Since 1995 – there has only been 9 times when the VIX ripped above 45.

That"s outright panic.

However, on more than 20 occasions it has traded above 35x – giving investors many great buying opportunities.

Today that level is ~24.9x

Yes, it"s elevated from the overly complacent levels of around 12x a month or two ago (which I warned).

At that point all traders leant to one side of the boat (i.e., bullish) – which generally suggests the boat is likely to tip.

But as the historical chart shows – it"s not yet at panic levels. Things are trading lower and in a very orderly fashion.

Volatile? Yes.

But signs of panic? No.

Again, we are just 6% off the all-time highs – which is no cause for alarm.

From mine, if we see the VIX spike to 35 (or above) it will coincide with sharper selling.

That"s when the baby starts to be tossed out with the bath water.

At that point, consider adding to quality names. For example, those companies which boast:

- Strong balance sheets with little to no debt;

- High levels of free cash flow growth over 10-years;

- High levels of above average return on invested capital over 10-years; and

- Above average net income margins (which suggest pricing power)

If you"re unfamiliar with quality analysis (see this post) – consider adding to the Index.

For example, you can do this via Vanguard"s ETF VOO – the lowest cost Index fund.

Now to be clear – we may not get to see a VIX at 35 during this "cycle".

For example, tomorrow we could rally some "1-2%" on better tariff news. Who knows?

Things seem to change every 10 minutes with Trump.

But I do think we are in for a large growth scare over the coming weeks and months.

We"re seeing it already in terms of employment, fiscal spend and consumer confidence.

And that"s what"s more likely to trigger any material selling.

Putting it All Together

It"s hard for some people to buy peak fear.

It will feel like the entire world is starting to collapse.

There will be widespread talk of recession risks; earnings estimates will be revised lower; unemployment will be increasing and so on.

Most people will sell – fearing even more downside.

However, as has been the case throughout history, that"s when savvy investors step in and buy quality.

The emphasis here bing quality.

You can"t determine quality just by looking at the price and its trend. That will simply give you sentiment.

Now as Buffett says "only when the tide goes out – you will see who is swimming naked"

Put simply:

Stocks which are not of high quality will generally benefit from a rising tide. However, when sentiment changes, lower quality stocks are exposed.

Here"s the thing when things get panicky:

- Don"t expect to buy at the bottom. It"s luck if you do. Expect stocks to fall after you buy; and

- You need to have the mindset you"re in the position for at least 3-4 years.

When you"re buying stocks that are out of favor (i.e., there"s generally fear) – expect them to fall further.

That"s fine.

In fact, in my personal experience, your position may be still underwater for a year or more after you buy it.

Knowing that I cannot pick a bottom, I rarely take a full position when I initiate a new stake.

I do that because I expect to stock to keep trading lower.

Most of the time I hope the stock falls another 20% or so – allowing me to take a full position.

And knowing that I"ve bought the highest quality stocks at reasonable valuations – it allows me to sit comfortably for a few years.

However, I"ve already done the work to know I"m in a very strong stock.

More often than not – this model is highly profitable over this timeframe – however it requires a lot of sitting and waiting. It also requires conquering your emotions.

That"s difficult for some people.