In Warsh We Trust

- Money is trust — when faith weakens, prices don"t adjust, they convulse.

- Warsh"s nomination steadies Fed independence, not rate expectations.

- Gold"s 20%+ plunge was profit-taking, not the death of the debasement trade.

Billy Joel probably wasn"t thinking about central banking when he wrote "It"s a Matter of Trust", but he might as well have been.

Every fiat monetary system ultimately rests on belief — belief that central banks will preserve purchasing power, that governments will honour contracts, and that rules won"t be rewritten arbitrarily when they become inconvenient.

For more than two centuries, developed economies have enjoyed a near-monopoly on that trust.

Their currencies became reserves, their bonds became "risk-free," and their financial systems became the global plumbing of capital.

When that trust holds, money behaves calmly. When it fractures, prices do not merely adjust — they convulse.

History offers brutal reminders.

France"s assignats collapsed in the 1790s. The Confederate dollar vanished with defeat. Weimar Germany and post-war Hungary turned paper into confetti.

In each case, the mechanism was not mysterious inflation math, but a simple loss of confidence in the stewards of money.

What makes the current moment unusual is that these dynamics are now appearing — in milder but unmistakable form — inside developed markets that were once assumed immune.

"In Warsh We Trust"

Kevin Warsh"s nomination as the next Federal Reserve chair landed on the same day silver suffered the largest one-day fall in recorded history (~30%) and the dollar staged a sharp rally.

Coincidence?

Markets immediately reached for a narrative:

- Warsh is widely said to be a "hawk" when it comes to interest rates.

- It follows that hawks equals higher rates.

- Higher rates equal a stronger dollar and weaker gold.

Sure. But it falls short…

Prediction markets show that traders had been steadily pricing in a Warsh appointment well before the metals rout, even as the dollar continued to weaken.

Rate futures, meanwhile, moved toward expectations of cuts following his nomination — flying in the face of the simple explanation above.

At the time of writing, the market expects Warsh to cut rates twice this year. The debasement of the dollar continues…

Warsh"s real significance is not ideological, but institutional.

His appointment is an implicit admission that the White House cannot bend the Fed to its will (a very good thing).

As I was saying only recently – when it comes to the new Fed Chair – the chairman is only one vote among twelve.

He (or she) alone does not set rate policy.

The good news is the noise regarding the legal and political fight over Fed independence could be behind us.

And that"s important…

Markets are fine with the Fed adopting a dovish policy.

And if that means running the economy "hotter" for a while (i.e., with core inflation above 3.0%) – that"s not a problem.

However, what they cannot tolerate for extended periods is the suspicion that monetary policy has become a branch of the executive.

That does not hold water.

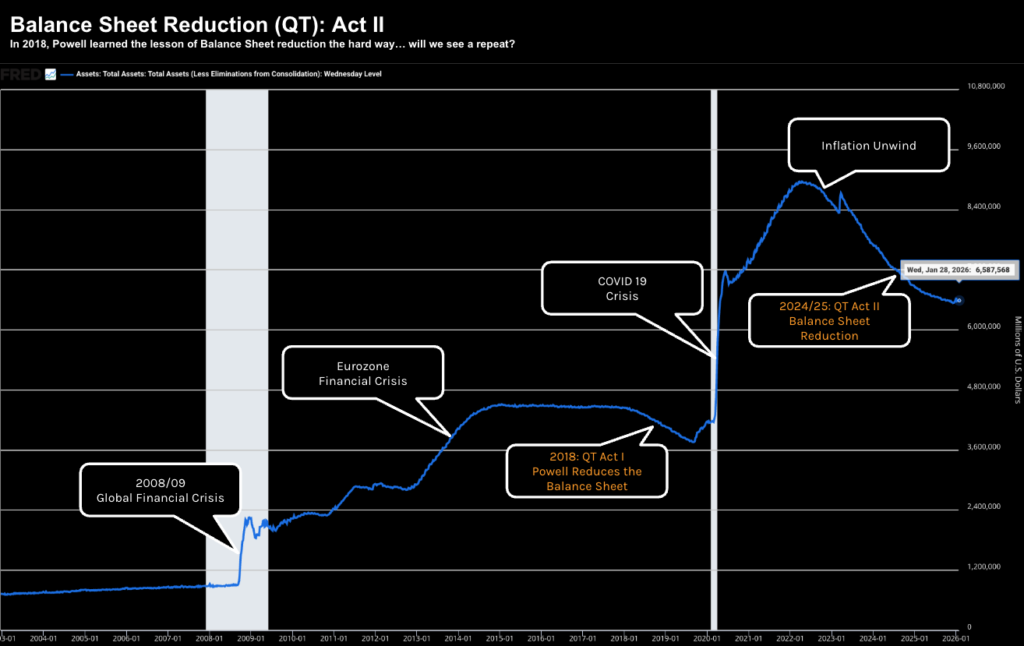

The Ghost of 2018

If Warsh has a signature issue, it is his longstanding opposition to quantitative easing (QE) and his desire to (further) shrink the Fed"s balance sheet.

For those less familiar – shrinking the Fed"s balance is a sound monetary policy.

For example, excess liquidity from QE will:

- distort prices (e.g., unwanted inflation)

- reward leverage and speculation; and

- mask risk signals.

The end result is excessive capital misallocation; i.e., the "boom and bust" behaviour.

Jerome Powell learned this lesson the hard way in 2018, when balance-sheet reduction was described as running on "auto-pilot."

Markets interpreted it not as a technical adjustment, but as tightening.

The result was a violent market selloff that forced the now-famous Powell Pivot.

Warsh is not a stranger to what happened eight years ago.

Any attempt to shrink the balance sheet will require extreme caution and coordination with the Treasury (Scott Bessent)

Liquidity is not an abstract variable; it is the oxygen of modern markets.

Take it away too quickly and the patient stops breathing.

But from mine, the deeper issue will always be trust in modern monetary policy.

Balance-sheet policy only becomes destabilizing when markets doubt the framework behind it.

When investors believe central bankers are disciplined, consistent, and independent, they tolerate tightening.

When they do not, even neutral actions like QT feel like threats.

The Metals "Panic"

Which brings me the convulsive price action in gold and silver.

The moves in precious metals the past few weeks has been nothing short of extraordinary.

From mine, these did not collapse more than 20% in two days because the "debasement trade" suddenly died.

No.

This was profit taking.

Silver"s ~30% created history – but we know that parabolic moves rarely unwind gently.

What goes straight up generally comes straight down.

Silver was no exception.

Prices driven by fear and momentum require only a modest removal of uncertainty to trigger profit-taking.

Warsh"s nomination was simply the small spark which lit the fire.

Despite the pullback in these metals – prices remain elevated.

Technically they are still well above key moving averages and far above levels consistent with recent inflation data.

I don"t see the current re-pricing as the bursting of a bubble — it was an expected reset within a larger repricing.

It"s reversion to the mean.

Based on this, anything around US$3,500 looks like a reasonable bet for gold (if held over the next 5+ years)

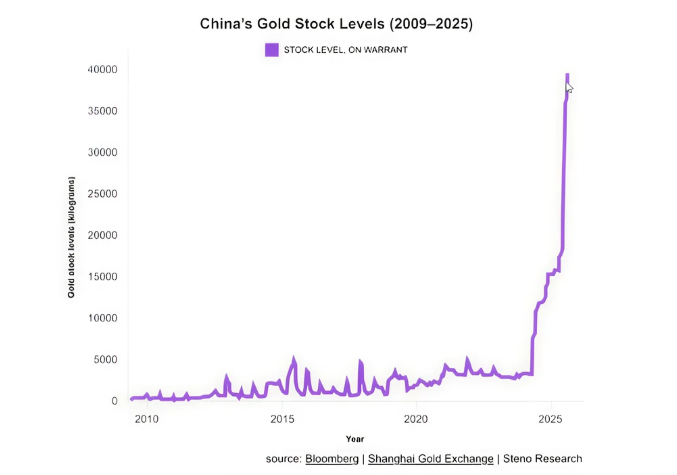

For what it"s worth – the underlying driver has been Chinese buying, both official and private.

This chart reflects a portion of the global diversification away from dollar-centric reserves and toward assets with no issuer, no balance sheet, and no vote.

As an aside, it also helps explain why crypto failed its moment.

Remember when Bitcoin was marketed as "digital gold"?

Mmmm…

If you ask me – crypto behaves more like high-beta tech stocks than it does a hedge.

When trust frays in our central planners – large investors reach for what has worked for 5,000+ years.

Putting it All Together

One of the more interesting aspects of the past year has been the divergence across asset classes.

For example, despite the various turmoil – bond markets remain calm.

This tells me investors are not expecting some imminent government default and/or runaway inflation.

On the other hand, the price action in currencies paints a different story.

The trade-weighted dollar fell more than 7% – weakening more against developed peers than emerging markets.

Why?

That is not a vote against U.S. solvency — it is a vote against U.S. institutional stability.

This is coming from Trump"s administration (who wants a weaker dollar)

Kevin Warsh"s nomination may have helped stabilize one critical fault line: Fed independence.

That could be why we are now seeing an unwind in hedges. But his appointment cannot fully restore trust.

Trust, once strained, repairs slowly.

For investors, the lessons are simple (and certainly not limited to):

- Do not try and predict collapse – but respect fragility;

- Diversify cash across jurisdictions;

- Focus on businesses that generate internal capital and do not rely on cheap money (i.e., strong balance sheets and cash flows); and finally

- If you are tempted by crypto (I am not) – treat it as pure speculation – not insurance.

As Billy said "It"s a Matter of Trust"