Large Cap Tech: Cautious on Guidance

Words: 1,563 Time: 7 Minutes

- Large cap tech reluctant to offer guidance

- Meta, Amazon, Apple and Microsoft all report "solid" Q1 EPS

- How I deal with Mr. Market"s (predictable) wild mood swings

Investors are feeling a little more optimistic…

Trump appears to be softening on tariffs and large cap tech have reported solid earnings for Q1.

Microsoft (MSFT) surged 8.8%, while Meta Platforms (META) rose 5.4% as both companies delivered strong earnings.

With respect to MSFT, I was specifically interested in their CapEx spending (especially as it pertains to Artificial Intelligence (AI)).

For example, MSFT quarterly CapEx (inclusive of financial leases) was ~$21.4B in Q1 – which represents a decrease of ~5.3% or $1.2B Q/Q.

This is noteworthy – as it marked the first Q/Q decline in their capex since 2022.

Are we seeing the early stages of AI indigestion?

Solve first… then scale.

Amazon (AMZN) experienced a decline in post-market trading (down about 3%) despite reporting Q1 revenue, earnings per share, and operating income above expectations.

What stood out to me was not only their cloud growth (up 17% YoY) – it was advertising revenue.

AMZN posted +19% revenue growth YoY for ads – despite the retail side of their business slowing down (potentially due to a more cost conscious consumer).

Ads has become a meaningful contributor to AMZN"s bottom line (lifting their overall margins) – as it leverages more of its surfaces (e.g., increasing the number of ads on Prime Video)

Overall it was another good quarter – however their cautious guidance weighed on the stock.

Which brings me to Apple (AAPL)…

Whilst iPhone sales were solid ($46.84 billion vs. $45.84 billion estimated) – their higher margin services division (which to many – helps justify their very high multiple) – came up light ($26.65 billion vs. $26.70 billion expected).

Gross margins came in as expected at 47.1% – a reflection of their pricing power.

Apple said they expect tariffs to add $900 million to its costs for the current quarter, assuming no other major changes occur.

However, what troubled the market was the lack of clear guidance.

CEO – Tim Cook – told CNBC "it"s very difficult to predict beyond June because I"m not sure what will happen with tariffs"

As I"ve stressed recently – the second half of the year remains highly uncertain – as we begin to experience the "lag" effects from the indecision in the first half.

Cook added that Apple is already sourcing about half of the iPhones for the U.S. from India, and most of its other products for the U.S. from Vietnam, where tariffs are lower than they are from China.

Put together, I think investors would be wise to exercise some caution heading into the second half of the year.

Weighing the Risks

Earlier today I re-read "What Could Possibly Go Wrong" from Jan 7th.

My missive focused on carefully weighing the risks (or downside) of any investment decision.

At the time, markets were optimistic, with the S&P 500 trading above 6,100.

Various banks and investment houses were forecasting the S&P 500 to finish the year closer to 7,000. However I offered this:

"It would not surprise me to see 2025 repeat the drawdowns we saw in 2022. And we could see 10-15% lower in the first half.

For example, longer-term readers will recall that during Q4 2021 – I warned of excessive valuations (specifically in tech / AI)"

I felt the majority of investors were expecting the stellar returns to continue in 2025 (i.e., "trees grow to the sky") – with very little regard for downside risks.

Two sources of possible misjudgment came to mind:

1. Analytical: Potentially using incorrect information or applying the wrong analytical processes; and/or making calculation mistakes; and/or

2. Psychological: Succumbing to self-defeating behaviors such as greed, fear, envy, ego; and/or conformity when making investment decisions.

From mine, it was more likely the latter.

In the words of Warren Buffett – investors are wise to be "fearful when others are greedy; and be greedy when they"re fearful" .

When herd psychology is strongest – we get market extremes.

This results in short-run outcomes diverging from the long-run probabilities.

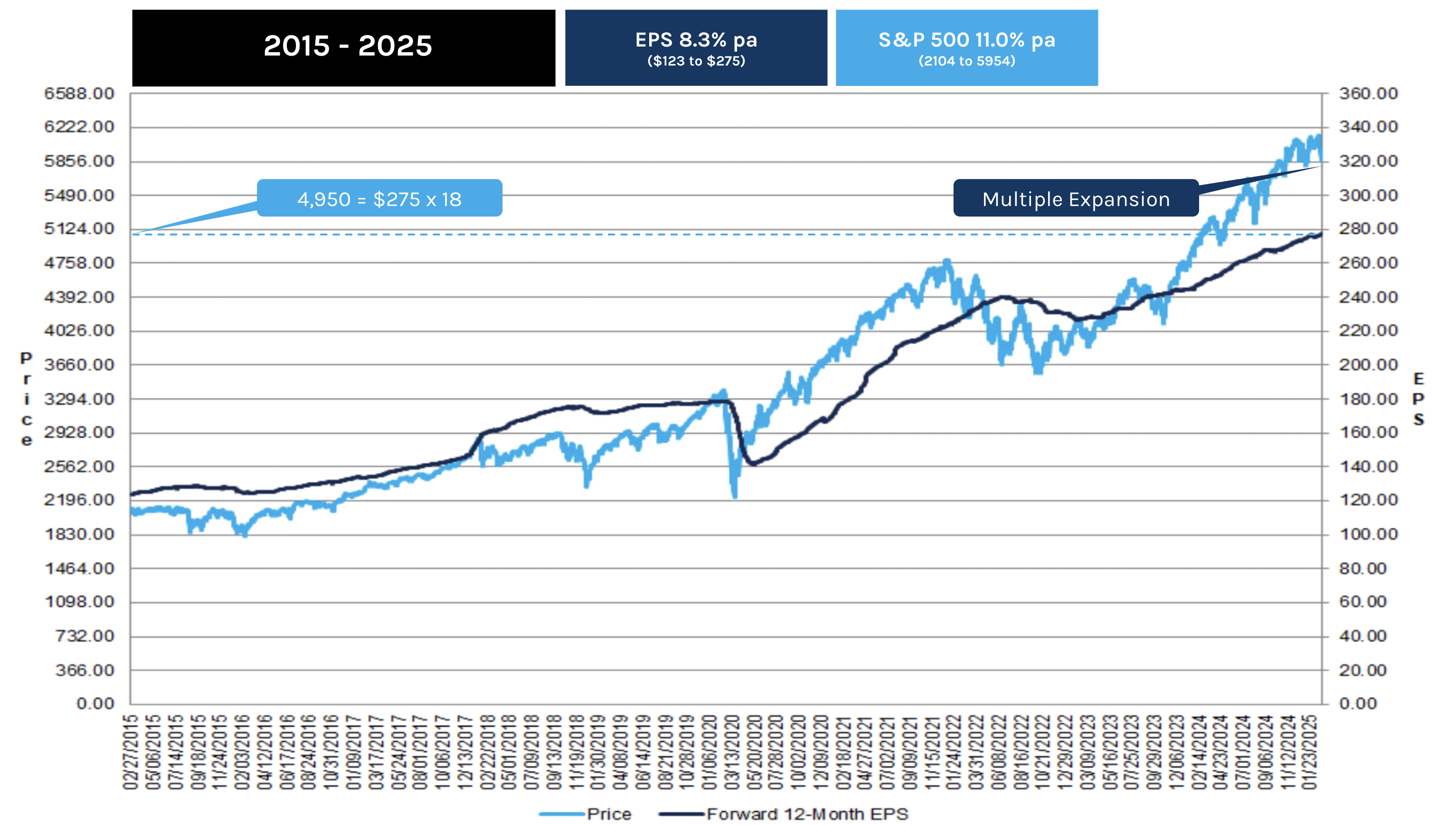

In this case, the price being paid diverging a long way from earnings (and the risks to come). Here I pointed to a chart from Factset – showing the divergence:

For me, it came as no surprise that the S&P 500 found its way back below 4,900 (i.e., working its way back to the dark-blue line)

But for some, it may have come as a painful surprise.

Dealing with "Mr. Market"s" Moods

Whilst this is more "art than science" – if I were to estimate the effort required to be successful at this game – it would be:

- 20% analytical / intellectual

- 80% psychological

Sure, you need some basic intellect. However, if you passed "Grade 8 math" (and most of us did) – you possess more than enough intellectual smarts to be very successful.

But the psychology required is not something that is easily taught.

When prices surged to 6,100 earlier this year, it was mostly due to psychological forces.

For example, earnings were not being revised drastically higher… if anything they were being lowered.

However, the asking price continued to rise ("multiple expansion"). Investors were paying a handsome price to own risk assets.

In his book "The Most Important Thing" – Howard Marks talked to this:

"Average investors are fortunate if they can avoid pitfalls, whereas superior investors look to take advantage of them."

For example, when psychological forces push prices too high earlier this year – average investors focused on not buying overvalued assets (poor investors added exposure)

However, a superior investor will either actively sell (or short) overpriced securities.

Similarly, when fear drives prices below true value (e.g., Google trading at just 15x forward earnings) – average investors might simply avoid selling while superior investors look to buy.

Investors who recognize this gap between price and value are able to make superior returns over time.

However, it"s the market"s predictable inefficiencies that allow (more) skilled investors to outperform the market over the long-term.

S&P 500: Monthly Chart

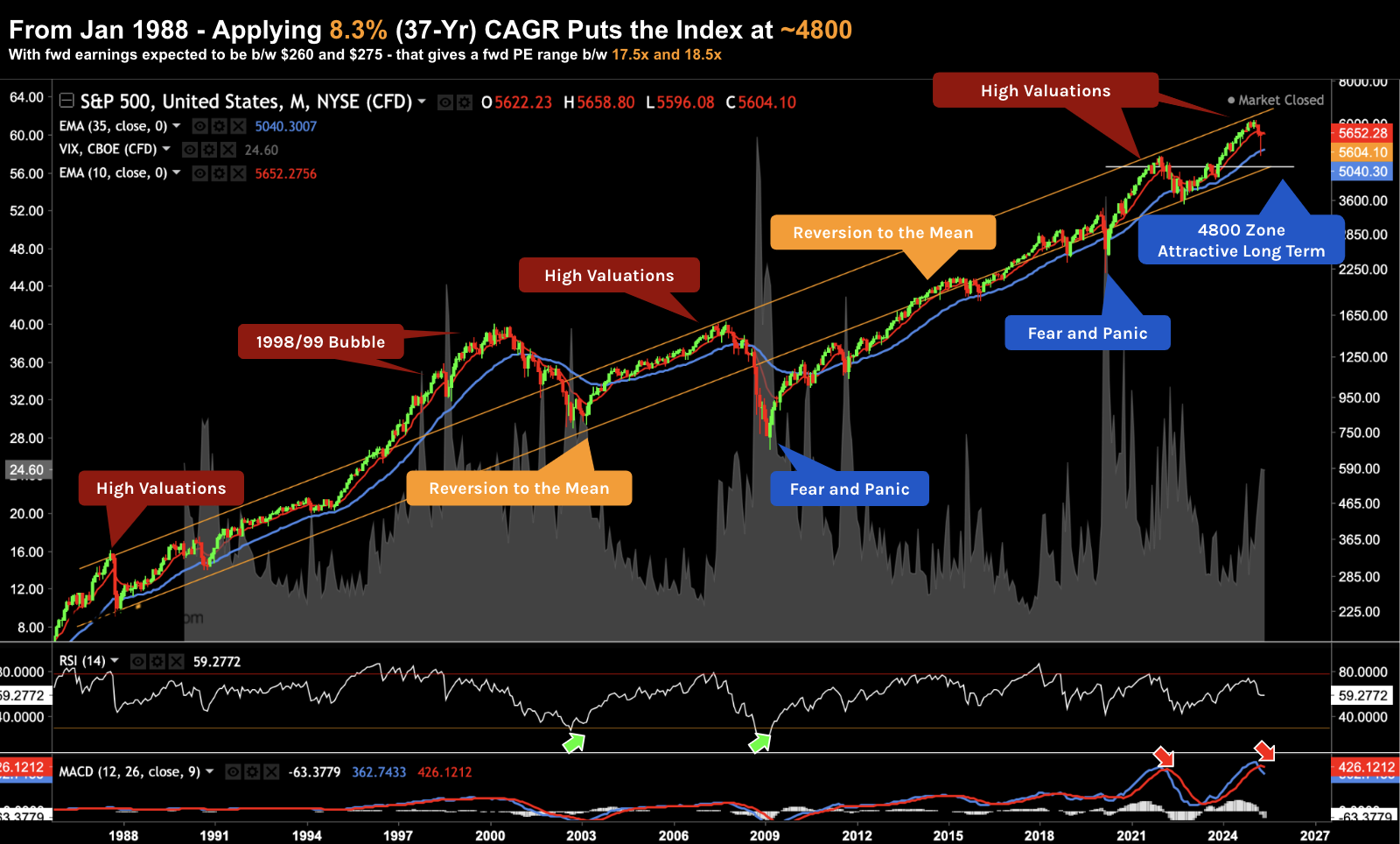

Before I close, I like to revisit the monthly chart at the conclusion of every month.

This offers investors a valuable perspective… eliminating much of the (excess) noise we find with the more "whippy" weekly chart.

What"s more, we"re able to getter a better sense of the larger cycles (and inefficiencies) which regularly take place (giving us opportunity to buy and sell)

For example, if we apply an 8.3% CAGR over 37-years from 1988 – this puts the S&P 500 at a value of 4800.

From mine, this is representative of the long-running mean.

And if we add the average 2.0% dividend to this return – it aligns with the long-running total return of the index of around 10.3%

As you can see below, there are numerous times where the market extends wildly above and below this (slowly rising) 8.3% CAGR.

May 1 2025

For clarity, the lower of the two orange parallel trend lines represents the 8.3% CAGR from January 1988.

When prices test the upper band – we find valuations are higher than the mean.

If they exceed this band – as we saw during the internet bubble of 1998 to 1999 – that"s dangerous. You"re potentially overpaying.

Similarly, when the test the lower of the two orange trend lines – prices are closer to their long-running mean (arguably fairer value)

Today that value would around the 4800 to 4900 zone (and where I added to both the Index and quality names)

And if they diverge well below this value (e.g., during 2008 and again in 2020) – prices are at a considerable discount to the long-term mean.

Earlier this year (and late last year) we were testing the upper limit of these two trend lines. Forward PE ratios were in the realm of 23x.

What I expect to see is prices test the lower of these two lines – which offers investors a much more attractive long-term risk reward.

If we are fortunate enough to see the Index plunge down to a zone closer to 4500 (e.g., if a recession were to eventuate) – then you should be sure to capitalize on this opportunity.

Putting it All Together

When Charlie Munger was asked the secret to his success – he answered "I"m rational."

Rational is not paying "33x forward earnings" for a company like Apple or Microsoft – despite their quality.

Rational is also not selling the S&P 500 when it plunges to trade at just 16x forward earnings – because you are worried about a possible recession.

Rational is adding exposure to high quality assets when they are at or below their long-term mean.

And the more below the mean they trade – the stronger your (long-term) conviction should be.

Rational is also selling assets (even those of higher quality) when the asking multiple is far too high (i.e., when others are greedy). For example, superior investors will:

- not only avoid the panic that leads to selling at the worst possible moment by selling when others are greedy; more importantly

- they also ensure they have buying power when it matters.

I think that opportunity is coming for investors who have the firepower.

We were given a small (brief) opportunity to add exposure recently – when the Index dipped below 4900 – but I think another opportunity will come.

Remember:

It"s the price you pay which determines the success of your returns (less so the quality of the asset).