- Market volatility a function of digesting Fed policy vs inflation

- Money supply growth: still far too high

- S&P 500 could easily trade with a ‘3-handle” the next few weeks

Greetings from Australia!

And it’s great to be home.

The last time I flew home (~12 months ago) – there were just 15 people on the flight.

At the time, on arrival I was greeted by young men in camouflage — airport staff in hazmat suits — where I was shipped off to an unknown location (hotel jail) for 2 weeks at a charge of $3,000.

The entire experience was surreal.

A Sketch from my Novotel Hotel Room – Dec 2020

This time around things were more civilized (thank goodness!)

I’ve been off the air the past couple of days… catching snippets of market activity.

As an aside, as I waited in the (over-crowded) Qantas lounge at LAX – I saw the market had rallied sharply after the Fed’s 50 basis point decision.

I began to pen a missive titled “Don’t trust this (short covering) bounce”.

However, I didn’t get it finished in the hour I was there.

Today those gains were given back… with leading indices having their worst day in two years.

Let’s dive in…

S&P 500: Digests Fed Tightening

Heading into the Fed decision – some feared we could see a 75 basis point rise.

However, Jay Powell soon put those fears to rest.

But the relief didn’t last long…

The 10-year treasury ripped above 3% as the market digested what a combination of (far) higher nominal rates (e.g., 3.50% within 12 months) combined with $95B per month (commencing July) in quantitative tightening could mean.

The thing is – I am not sure this will be enough.

But let’s start with the weekly S&P 500 chart:

May 06 2022

Here we see the ‘length’ of the most recent green candle.

The candle shows the range the market has moved this week; i.e., from a low of 4062 to a high of 4307 – a range of 6%.

However, with the weekly trend bearish, probabilities skew to the downside.

Therefore, expect rallies to be sold.

The sell-off was broad today with more than 90% of S&P 500 stocks falling.

Two things here:

- First, we still haven’t seen a market “flush”. For example, the VIX remains “low” at just 31x (i.e., no panic selling yet); and second

- the zone of 4100 continues to act as support.

Re 4100 – that’s not to say this level doesn’t break in a meaningful way.

It could.

For example, I would not be surprised if the S&P 500 traded with a 3-handle over the course of the next few months.

And if it does – I am a buyer.

10-Year Yield Exceeds 3.0%

According to Powell – inflation is far too high and the Fed needs to be move “expeditiously”

Unfortunately, the ‘inflation’ awakening came 12+ months too late from Powell… but here we are.

Here’s the Fed Chair this week:

“Inflation is much too high and we understand the hardship it is causing. We’re moving expeditiously to bring it back down… we’re strongly committed to restoring price stability.”

Question is – is it expeditiously enough?

From mine, no.

Powell also indicated the Fed will begin reducing its $9 trillion balance sheet (i.e. quantitative tightening or ‘QT’).

Translation:

The Fed will shift from being a “buyer of bonds” (quantitative easing) to one that is no longer participating (i.e., electing to reinvest in maturing securities). More on this below…

This will have the intended effect of driving the bond yields (i.e. interest rates) on longer-term duration securities higher (e.g. the US 10-year treasury).

US 10-Year Yield now above 3.00%

The Fed’s QT plan consists to two phases:

Starting June 1, the plan will see $30B of Treasurys and $17.5B on mortgage-backed securities roll off.

After three months, the cap for Treasurys will increase to $60B and $35B for mortgages.

Again, this was largely priced in.

But from mine, I still question whether these “expeditious” plans will curb CPI in excess of 8.5%.

Has Inflation Really Peaked?

This is a question which has many vexed.

And pending what you believe or read – you will hear varying opinions.

For example, below is commentary from Charles Schwab:

“No surprises on our end,” said Collin Martin, fixed income strategist at Charles Schwab.

“We’re a little bit less aggressive on our expectations than the markets are. We do think another 50 basis point increase in June seems likely…

“We think inflation is close to peaking. If that shows some signs of peaking and declines later in the year, that gives the Fed a little leeway to slow down on such an aggressive pace.

Schwab are not alone thinking inflation is close to peaking.

But I remain less convinced…

For example, flexible prices are likely to ease year on year (e.g., hotel rooms, flights, used cars etc).

But what about “stickier” (more persistent) factors such as rent and wages?

Are they likely to come down in the near-term?

I doubt it.

Now the reason I question whether the Fed’s plan is “aggressive” is what we see with money supply.

Remember: inflation is simply excess money chasing too few goods.

And today – we have ample (Fed) liquidity and far fewer goods

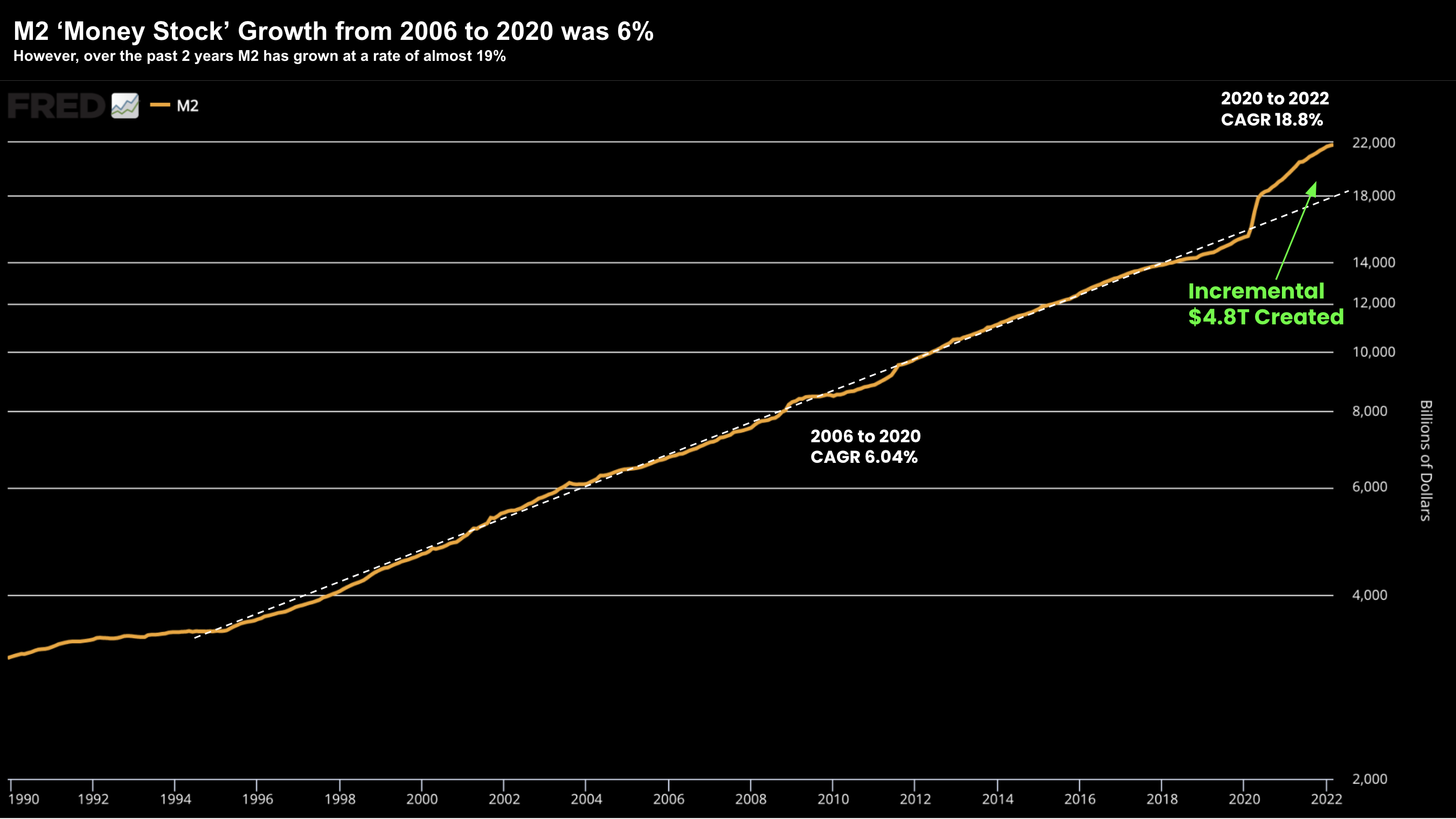

This is a chart I’ve cited often post March 2020.

Prior to the pandemic, M2 money supply grew at constant rate of ~6% over the past 30 years (white dashed line)

However, post 2020, the Fed increased money supply at a rate of almost 19% – creating around $4.8 Trillion in additional reserves.

This is what they will be “rolling off” to the tune of $95B per month from September.

For example, if we assume they maintain this rate – it will take close to 4 years to revert to the long-term growth rate of ~6%.

Now what’s interesting is virtually no-one in mainstream talks about what we see with money supply growth.

For example, you will hear inflationary forces such as excessive fiscal spending, Russia’s invasion of Ukraine; the price of oil; or low interest rates… but rarely money supply.

Why not?

That said, some have been beating this drum for a while (e.g. Wharton’s Jermey Siegal, Ed Yardeni, Bill Dudley and Scott Grannis). But they are the exception.

Scott Grannis recently said:

M2 today is running about 28% above trend, which equates to more than four years of normal growth.

If you were to have asked any monetarist back in 1995 about the consequences of such a rate of M2 growth, they would undoubtedly have said your question was too preposterous to even consider.

Regardless, this chart provides all the evidence one needs to explain why inflation in the past year has far surpassed expectations—and is likely to continue to do so.

Grannis also argues that whilst some believe the Fed are being “aggressive” – more needs to be done.

For example, he said the Fed will look to achieve their balance sheet objectives initially by choosing not to reinvest maturing securities.

However, the outright sales of securities, when they do occur, won’t be large and should be easily digested by the bond market.

Grannis offers the following basic math exercise to make his point:

Suppose M2 continues to grow at 6% per year, the public reduces its money balances to the pre-Covid level of 70% of GDP over the next three years, and real GDP grows by 2% per year.

What would the annualized inflation rate be for the next three years?

Answer: about 10%.

That gives you an idea of the inflationary potential of the current level and growth rate of M2.

As Lady Macbeth once said:

“If it be done, best that it be done quickly”

Right?

TL;DR is the bond market is taking a big leap of faith in the Fed they can bring inflation below levels of 4-5% within two years (best evidenced by 5-Year TIPS).

It’s a bold assumption.

As some “basic math” suggests otherwise.

Putting it All Together

Before I close, pay close attention to what we see on the US 10-year yield.

It is the most important rate in finance without question.

The market has now taken this above a level of 3% – however can it hold?

But the upward trend in long-term yields will almost certainly begin to slow economic activity (and possibly inflation); i.e., less money in people’s pockets chasing fewer goods.

From mine, I would not read too much into the price action in equities the past two days.

They are still processing what a 3.25 to 3.50% nominal rate looks like in ~12 months with ~$1 Trillion less on their balance sheet.

Put simply, the market is slowly adjusting to a new (monetary) reality.

And with that – comes volatility.

Regards

Adrian Tout