Market’s Litmus Test is the Next 2-3 Weeks

- Market needs to close back above the 35-week EMA

- 4100 appears to be a line-in-sand

- S&P 500 as "cheap" as we"ve seen in 2 years at 4220

Major U.S. indices staged a massive rip-for-face-off rally the past two days.

Short-traders who felt the bottom may fall out for stocks – scrambled to cover the past two days.

The Dow Jones Industrial Average posted its best day since November 2020.

The S&P 500 and Nasdaq (which led the way) both closed positive on the week after being smashed to start the week.

Question:

Is this going to be a year where the anticipation of "xyz" risk is worse than the actual event itself?

Whilst it"s still early – this might be the case with the Russian / Ukraine conflict.

The next test will be Fed…

There is every anticipation for an aggressively hawkish Fed this year… but what actually happens could be very different.

For example, maybe we only see 4-5 rate hikes of 25 bps?

Personally I think this would be a mistake – but it"s plausible.

The Fed might try and "thread the needle" of balancing slowing growth with unwanted inflation via a "gently gently" approach.

Let"s start with how the S&P 500 finished the week… it was a massive turnaround.

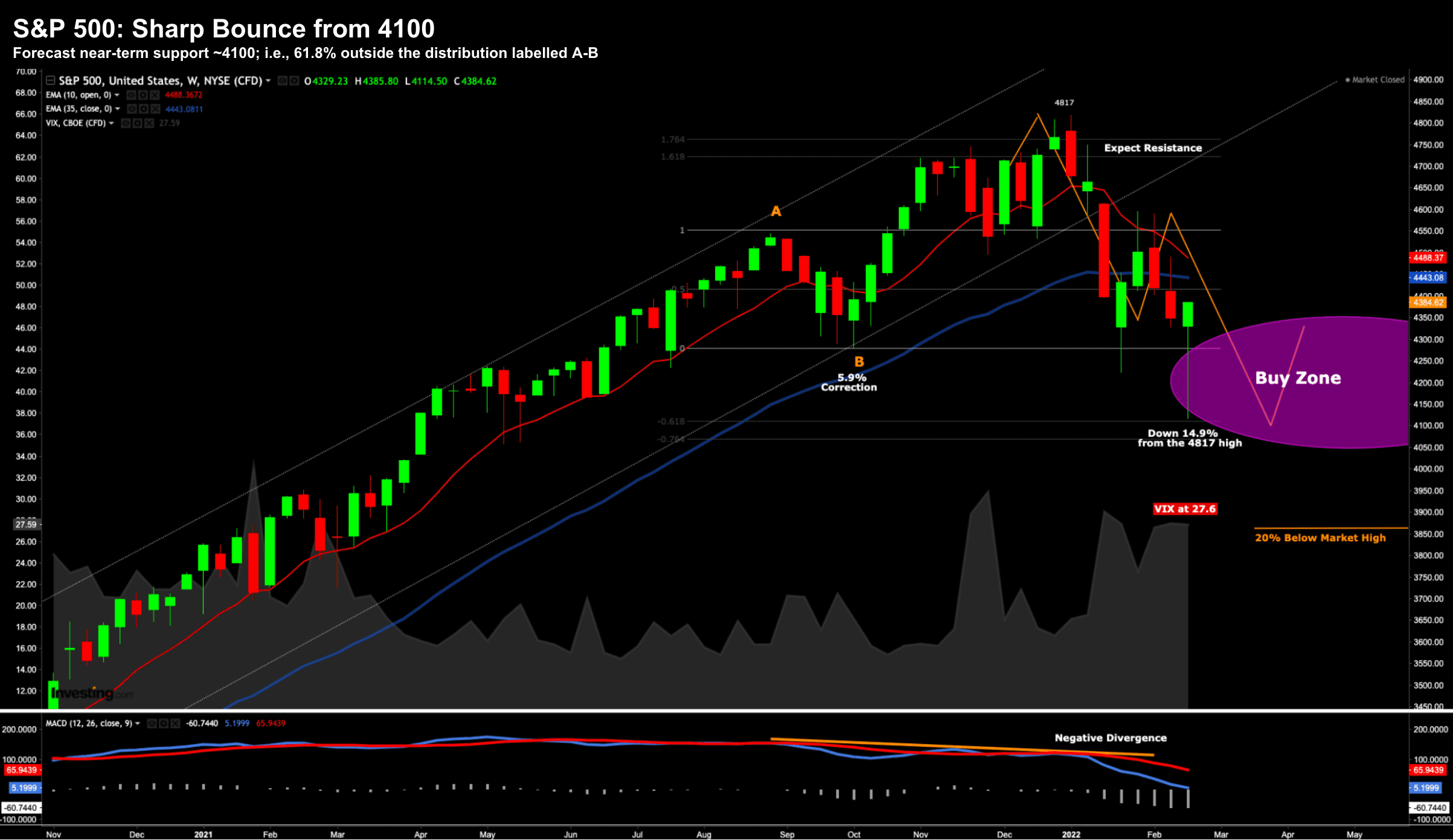

S&P 500 Finds Expected Support

If you refer to the weekly chart below – the S&P 500 found support "to the penny" at the level I flagged in Q4 2021.

That zone is 61.8% outside the retracement labelled A-B; or around 4100…

Five things worth calling out.

- First, is the length of the candlestick "needle" down to 4100. This represents a fall of 15% from peak-to-trough

- Second, this corresponds to the 61.8% zone where I was looking for support (i.e. my "buy zone")

- Third, the strong negative divergence with the weekly-MACD – which suggests there was a high probability of downside

- Fourth, 20% below the all-time high is a level of around 3850 – which would indicate a "bear market"; and finally the litmus test

- Fifth, we need to see the market close back above the 35-week EMA (i.e. 4443) before we call this ferocious 2-day rally a victory

The final point is what"s key.

And whilst I was happy nibbling at a few quality stocks this week (e.g., Home Depot, Shopify, and Meta Platforms) – I am not completely convinced we have a bottom.

But we are certainly closer…

For example, I would be surprised to see the market trade through the level of 3700.

However, I would be a massive buyer in this zone (for fundamental reasons I will explain in a moment).

Focus Shifts to Inflation

The market is effectively balancing two concurrent uncertainties:

- Russia"s evil invasion of Ukraine (and its consequence); and

- Inflation and subsequent monetary policy action

For now, the market is looking past the worst-case scenario with Russia.

But it"s early… the conflict is intensifying as I write.

Next week the market will turn its focus to inflation (and the Fed).

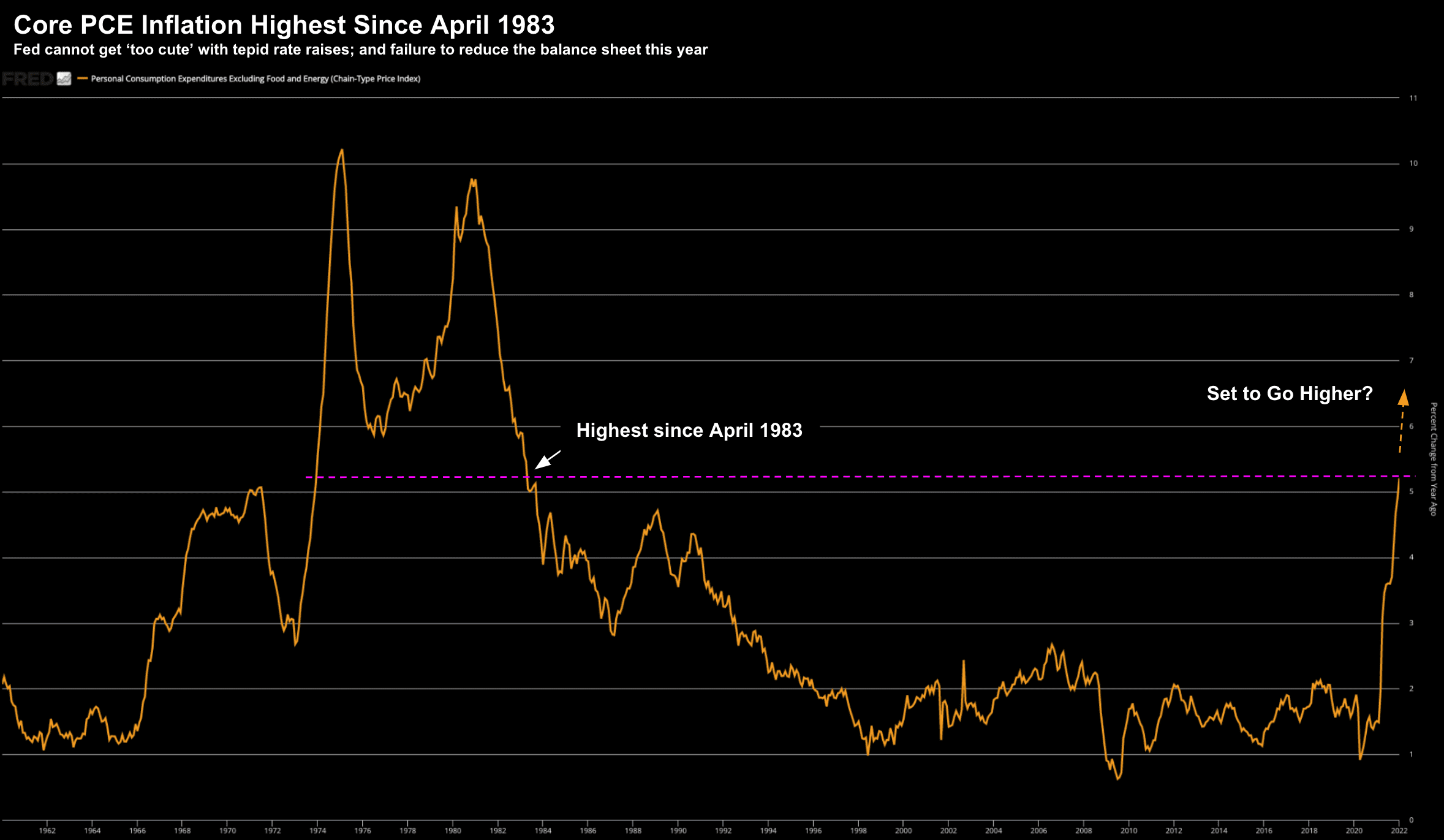

Today we learned the Fed"s preferred inflation gauge (Core PCE) rose 5.2% in January from a year ago.

That was the biggest rise since April 1983.

From CNBC:

- The core personal consumption expenditures price index, the Federal Reserve"s primary inflation gauge, rose 5.2% from a year ago, slightly more than the 5.1% Dow Jones estimate. It was the highest level since April 1983. Including food and energy prices, headline PCE was up 6.1%, the strongest gain since February 1982.

- The same report showed that consumer spending accelerated faster than expected, rising 2.1% on the month against the 1.6% estimate. The spending increase reversed a 0.8% decline in December.

Below is Core PCE inflation mapped over the past 40+ years:

I"ve explained at length what the Fed needs to do here to bring this down.

In short, they are way behind the curve.

They don"t have the luxury of a tepid approach… otherwise this chart continues to soar.

That said, the read out on consumer spend should give the Fed confidence to be more aggressive.

The economy remains on solid footing. It"s not recessionary.

But if the Fed is to only raise the effective short-term rate to 1.50% to 1.75% (i.e. 5 to 6 rate rises of 25 bps) this year… I see no reason why Core PCE continues to trade north of 6-7% through 2022.

That would be a disaster.

S&P 500 Fwd PE Hits 18.5x

Now earlier I said I would buy the market with "both hands" if we saw 3700.

I don"t think we will – but who knows.

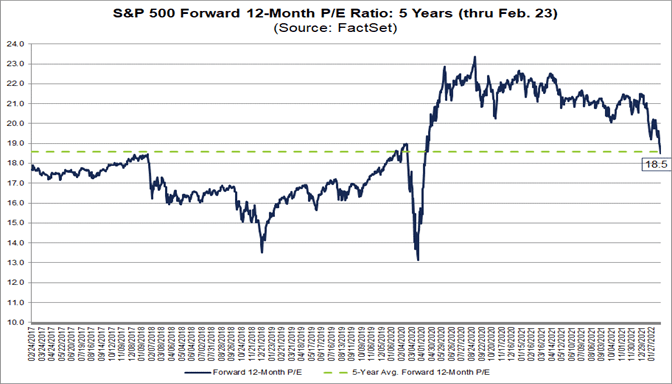

Just on this – today I read a note from Factset regarding the market"s valuation.

Here"s their preface:

- On February 23, the closing price for the S&P 500 was 4225.50

- The forward 12-month EPS estimate for the index was $228.85.

- This places the forward 12-month P/E ratio for the S&P 500 (on that date) at 18.5x

What Factset point out is a forward PE of 18.5x is below the five-year average of 18.6 — but still above the next four most recent historical averages:

- 10-year (16.7x)

- 15-year (15.5x)

- 20-year (15.5x); and

- 25-year (16.5x).

But the thing to remember with things like PE ratio is the rate environment in which they exist.

For example, a 16.5x at an average 5% interest rate is not the same as 16.5x at effectively negative rates.

Today"s market – where rates are deeply negative – commands a ratio of at least 18.5x (if not 20x)

So what"s going on here?

My take is we are now in a long-term transitory environment.

That is, we have a Fed that has no choice but to meaningfully tighten rates over the course of the next 3+ years to fight (prolonged) 6% plus inflation.

What"s more – they will reduce their balance sheet by as much as $3 Trillion dollars (pending inflation)

This monetary shift will likely result in the following:

- Earnings growth to slow from the current rate of 30%+ YoY

- Profit margins to come down (i.e., given higher overall input costs); and

- Price-to-Earnings multiples to reduce as rates rise.

This has not been the play book the past 5 years… it was the opposite.

Therefore, your strategy needs to be tweaked as well.

For example, there should be greater emphasis on companies with the following:

- Strong balance sheet strength

- Strong free cash flow (the best "health metric" of all);

- Healthy profit margins; and

- Pricing power in an inflationary environment (i.e. companies which exhibit strong moats)

Do each of your investments fit this checklist?

Over the past few years with a zero-rate environment (with unlimited QE) – investors were free to largely ignore most basic business criteria – paying any multiple for growth

For example in some cases, investors were paying 20-30+ x sales for companies that only showed a potential pathway to profitability.

As readers will know, my basic litmus test for a high-quality growth company (doing all the right things) is around 10x sales.

And whilst some high-multiple names are good to have in your portfolio – these positions should be small (e.g. at most 1% of your portfolio)

Those companies have since been shredded to the tune of 50% or more (i.e., ARKK ETF stocks)

Growth is still vitally important… but not at any price!

In summary, a forward PE multiple in the realm of 19x is not unreasonable should rates normalize to 2.50 to 3.0% (nominal) in the next 2 years.

And if we assume two years of 10% EPS growth (a conservative estimate and inline with historical averages) – that would see the S&P 500 at 5200

That is $229 x 10% (for 2 years) = $277 EPS.

$277 x 19 = 5200

Therefore, if buying the Index around 3700 (if it presents) could represent an upside of 40% over 2-3 years (where the downside risk is low)

However, as rates rise to a normal rate of closer to 5% (i.e., above that of inflation) – forward PE multiples (and margins) will come down sharply.

Putting it All Together…

The two-day rally to close the week was impressive.

However, the bounce from 4100 was not unexpected.

We found resistance at 61.8% on the upside (i.e. 4800) and support at 61.8% on the downside (4100)

And whilst I am long the market, I really want to see the market close back above its 35-week EMA.

Ideally I want to see that over the next 2-3 weeks.

What I don"t want to see is rejection in this zone.

If we see that, then there"s every chance we re-test the 4100 lows.

And if that"s the case – I won"t be a seller of my quality stocks – I will be on the hunt for more long-term opportunities.

That is, companies which satisfy each of the key criteria I outlined.

Regards

Adrian Tout