Massive Bond Exodus to Start ’22

- A new "supply / demand" dynamic for treasuries in 2022

- Wage inflation surges 4.7% YoY; and

- Will CPI show a 7%+ increase for December?

"Where bonds go… so go equities"

That"s an old market saying… but will it hold true in 2022?

Whilst we are just one week into the new year – the selling in bonds has been nothing shy of ferocious.

A combination of red-hot inflation (more to come with CPI this week) and a hawkish Fed has sent bond investors racing for the exits – sending yields (and rates) sharply higher.

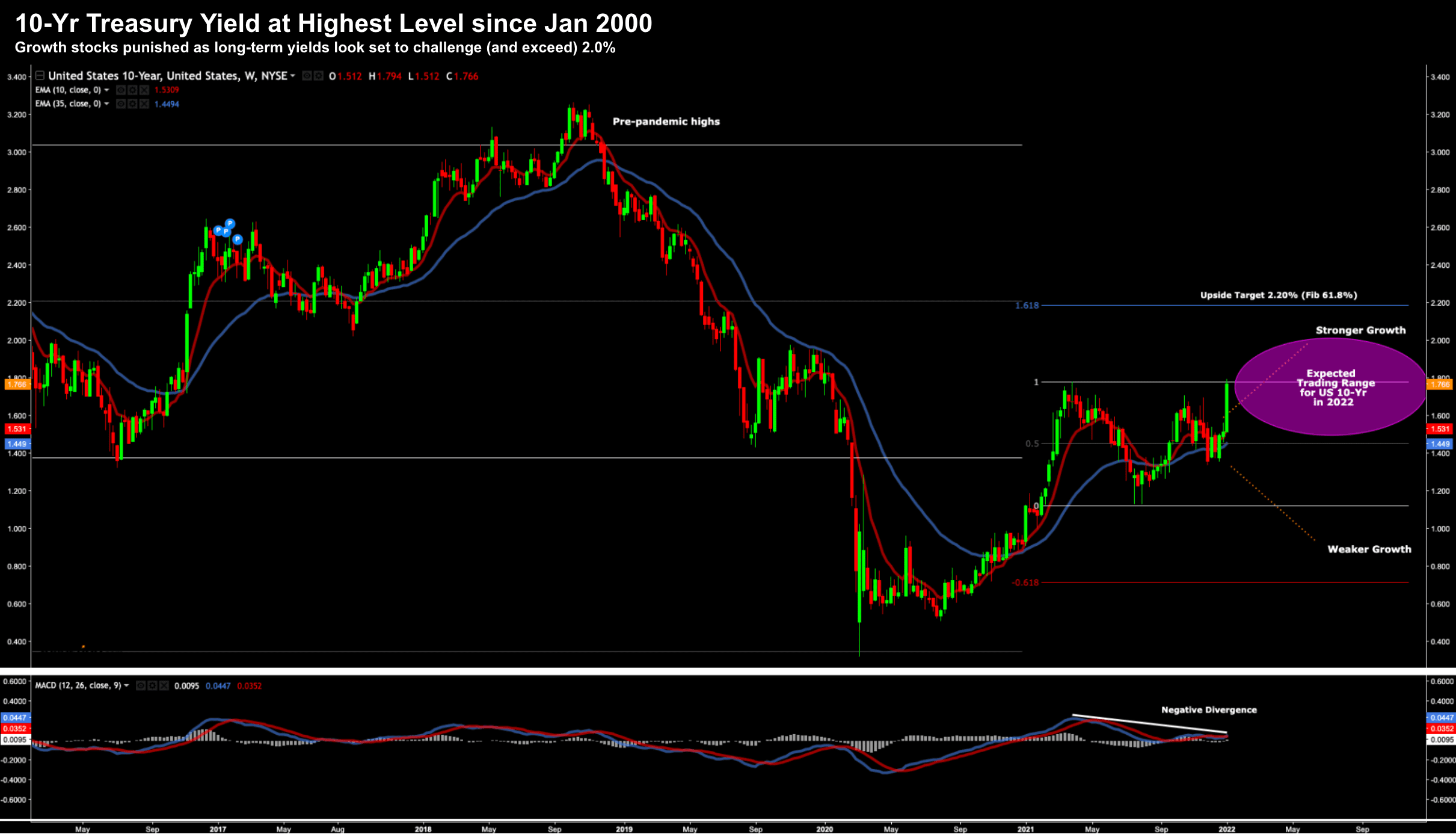

Below is what we see with the all-important US 10-year treasury:

Jan 7th 2022

Earlier this week I said the US 10-year would challenge 2.0% this year (most likely exceed it) – however I didn"t think it would be this month.

The 10-year is now trading around the 1.77% high we saw in March… and likely headed higher.

Question is where to from here?

A few factors (or variables) to consider…

Wages + CPI to give Fed "Green Light"

Today we received the December monthly payrolls data.

The headline number was below expectations – up 199,000 for the month vs an estimated 422,000.

What"s more, the unemployment rate fell to 3.9% from 4.2% in November.

Good news… we"re now very close to full employment.

However, it wasn"t the "weak" headline number which concerned the market. The devil (as they say) was in the detail…

For example, the job revisions for October and November saw another 140,000 jobs added.

If we put the three months together – job gains are per expectations.

The key snippet (from mine) was average hourly earnings data (i.e. wage inflation)

For example, wages surged 4.7% year-on-year:

- Avg hourly earnings, month-over-month: 0.6% vs. 0.4% expected and a revised 0.4% in November.

- Avg hourly earnings, year-over-year: 4.7% vs. 4.2% expected and a revised 5.1% in November

And this is why the 10-year yields shot higher – as this effectively gives the Fed a "clear pathway" for:

- more aggressive tapering;

- three (maybe four) rate rises in 2022; and

- possible balance sheet reduction later this year.

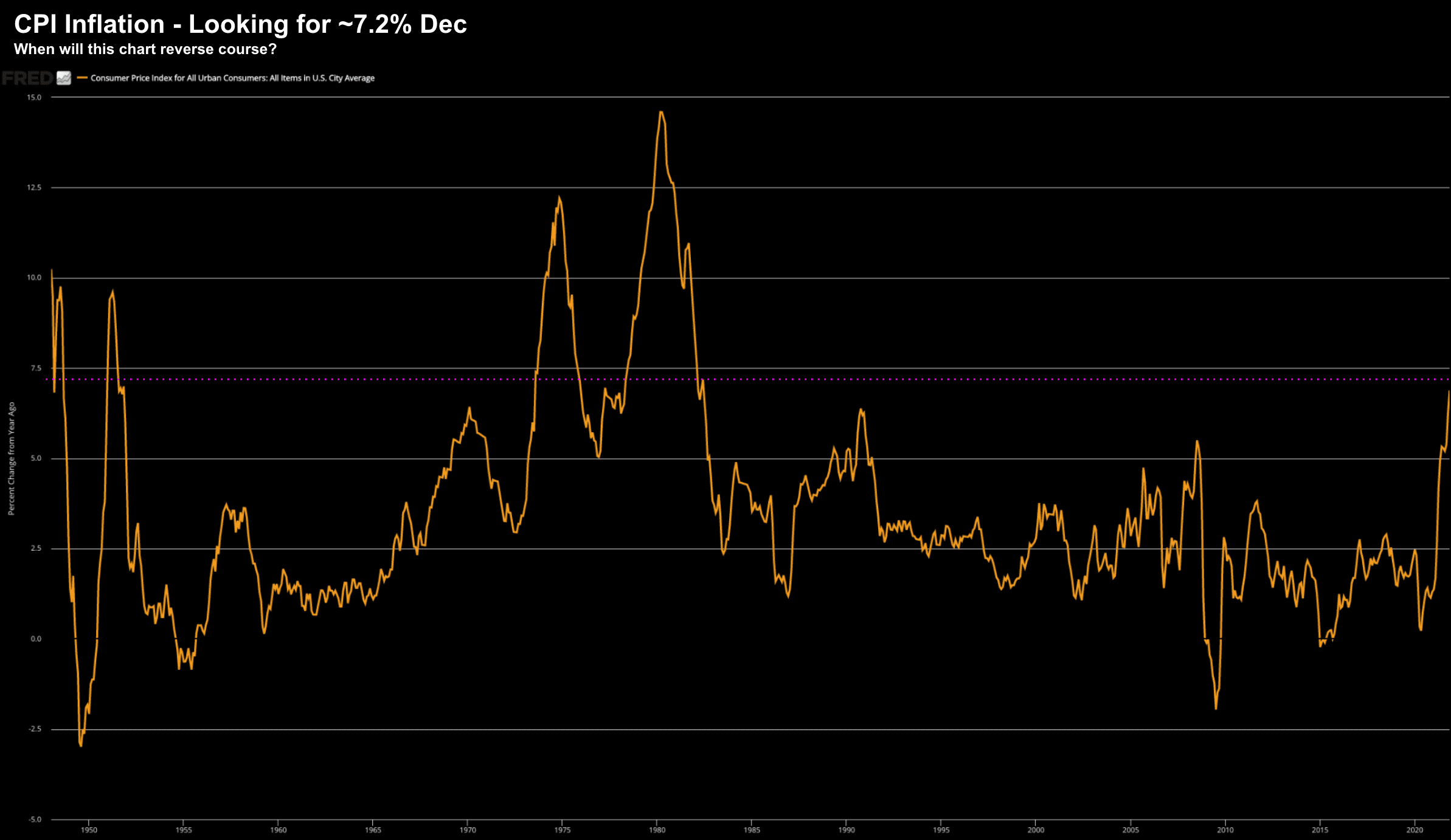

Now the other data point to watch will be December"s CPI print.

Jan 7th 2022

The market knows this is going to come in at a new 40-year high… expecting something north of 7.0%

And if so – also helps pave the way for the Fed.

For example, a number around 7% will almost ensure a March rate rise of 25 basis points.

The problem is… there are a couple of wildcards in the equation which could see further upward pressure on rates.

Wildcards in the Rate Equation…

Towards the end of November – Jay Powell started conditioning the market for possible 2022 rate increases and a more aggressive pace of taper.

This was largely taken in-stride… as prices adjusted.

But there are still a couple of unanswered questions the market is wrestling with.

And here I"m talking about two things:

(a) the demand mechanic (i.e., a bond market absent the Fed); and

(b) what we see in terms of treasury supply?

For example, the latter could be especially important opposite Biden"s aspirational $2 Trillion "Build Back Better" program (which isn"t quite dead)

More fiscal stimulus programs will massively increase treasury issue.

Will there be demand?

And more importantly – at what price?

From mine, any meaningful new debt issuance is only likely to add more pressure on rates.

Now this week there were not a lot of buyers lined up… as treasury"s sank.

Bonds were in free fall which saw their yields spike.

The question is what level will bond buyers step up?

From mine, I think that will be around 2.0% to 2.2% (as they start to compete with equity yields)

And all going well – this potentially puts a limit on these yields rising too far.

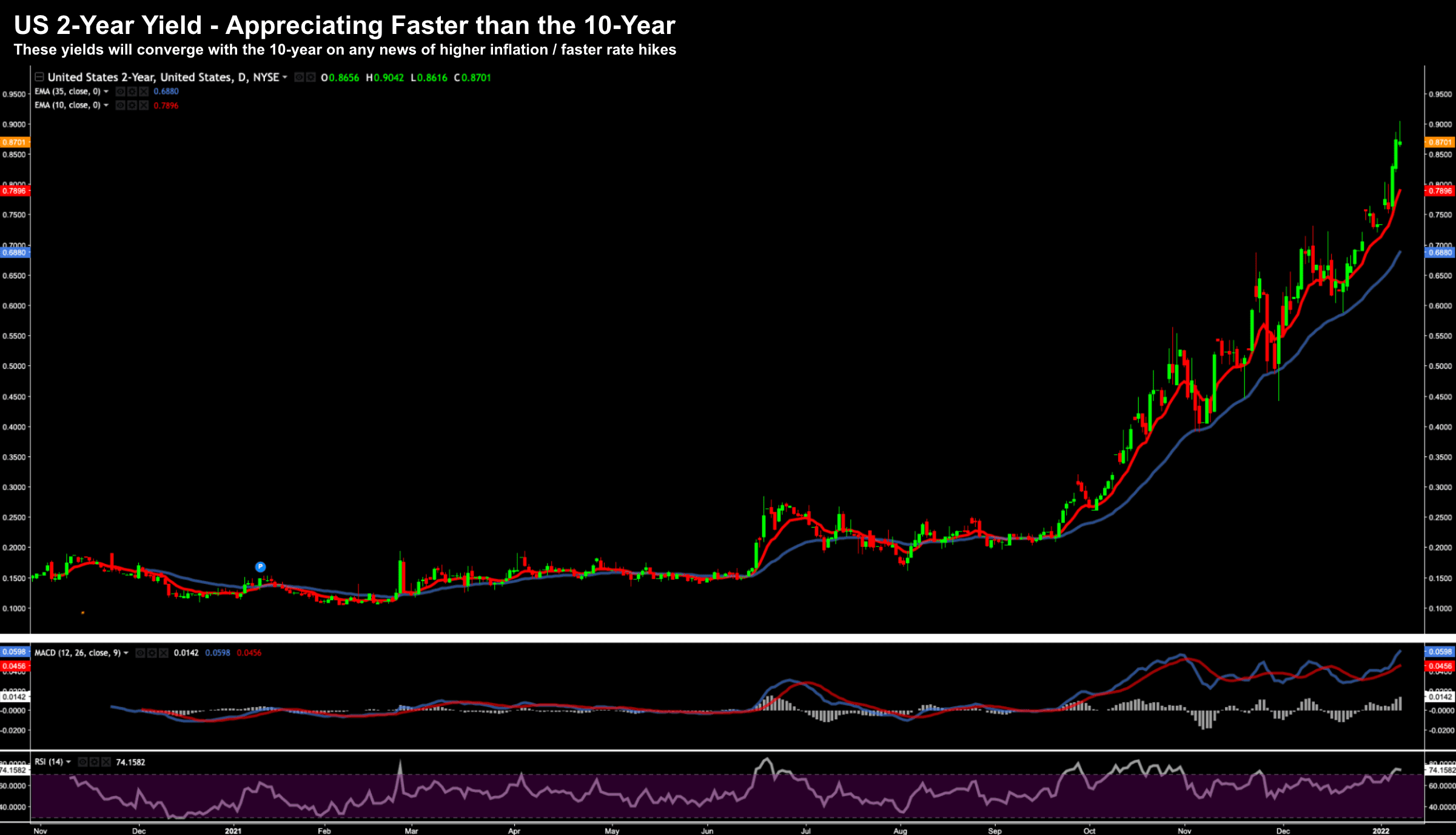

But we also need to be mindful of the (faster rising) 2-year note (which reacts more to the effective Fed funds rate)

2-year yields touched 90 basis points this week… as they continue their rapid ascent from September…

Jan 7th 2022

At the time of writing – the 2/10 yield curve trades around 90 basis points.

That"s a "reasonable" spread – however will compress should the 2-year accelerate in absence of relative appreciable gains in the 10-year.

And this is why I think the new "supply / demand" wildcards with the 10-year could throw a spanner in works.

Putting it All Together…

From an equity perspective – nothing has changed.

That is, the rotation we see from growth to value continues.

Again, this will be a major investing theme if we"re to see higher rates / tighter monetary environment.

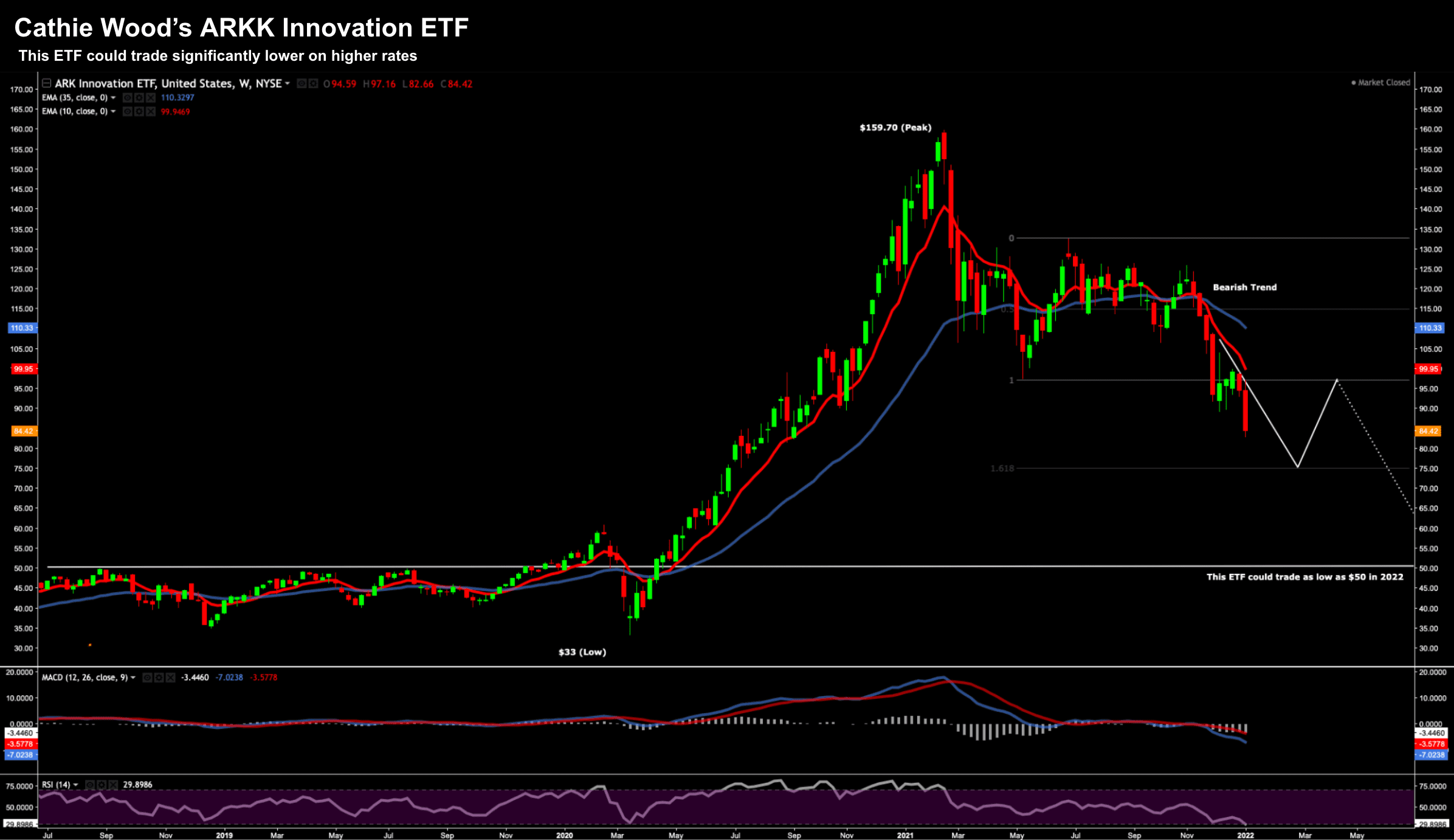

For example, one of my favourite "high multiple" proxies is Cathie Wood"s ARKK innovation ETF:

Jan 7th 2022

Wood became a household name in 2020 – with her fund surging from $50 to $160.

It wasn"t the same story last year – as the fund saw a massive exodus – falling from $160 to below $90.

This week ARKK is down a further 12%… and I don"t think it"s finished yet.

My approach is to avoid most of the hyper-growth names (specifically no earnings) – as we"re yet to see any real "blood" in the water.

That"s still to come.

On the other hand, health care, financials and energy are likely to do well.