Netflix: It’s Now Worth ‘Subscribing’

- Netflix is as cheap as it"s been since 2014

- Valuing Netflix on a per subscriber basis

- A solid 5-year bet on a clear market leader

Netflix announced their Q1 2022 earnings after the close today.

It wasn"t pretty…

The stock is down 26% at the time of writing… trading around $258 per share.

They reported a loss of 200,000 subscribers last quarter… and it sent traders scrambling.

Already well off its $700 highs of last year…. Netflix cratered to lows not seen since 2019.

The question is whether it"s worth buying here?

What Goes Up… Must Come Down

Let"s start with the incredible rise of the streaming leader founded in 1997:

April 19 2022

Netflix (NFLX) was the "poster child" of the so-called FAANG names.

From just $3.00 in 2008 (a year after it first started streaming content) – to a high of $700.99 November last year – the company could do no wrong.

However, all that changed in 2022.

Competitive streaming services from Apple, Disney and Amazon – combined with the end of the pandemic – saw investors challenging Netflix"s whopping forward PE of ~60x earnings.

And rightly so…

I was also critical of the excessive multiple – despite the strong market position of the business (more on this in a moment)

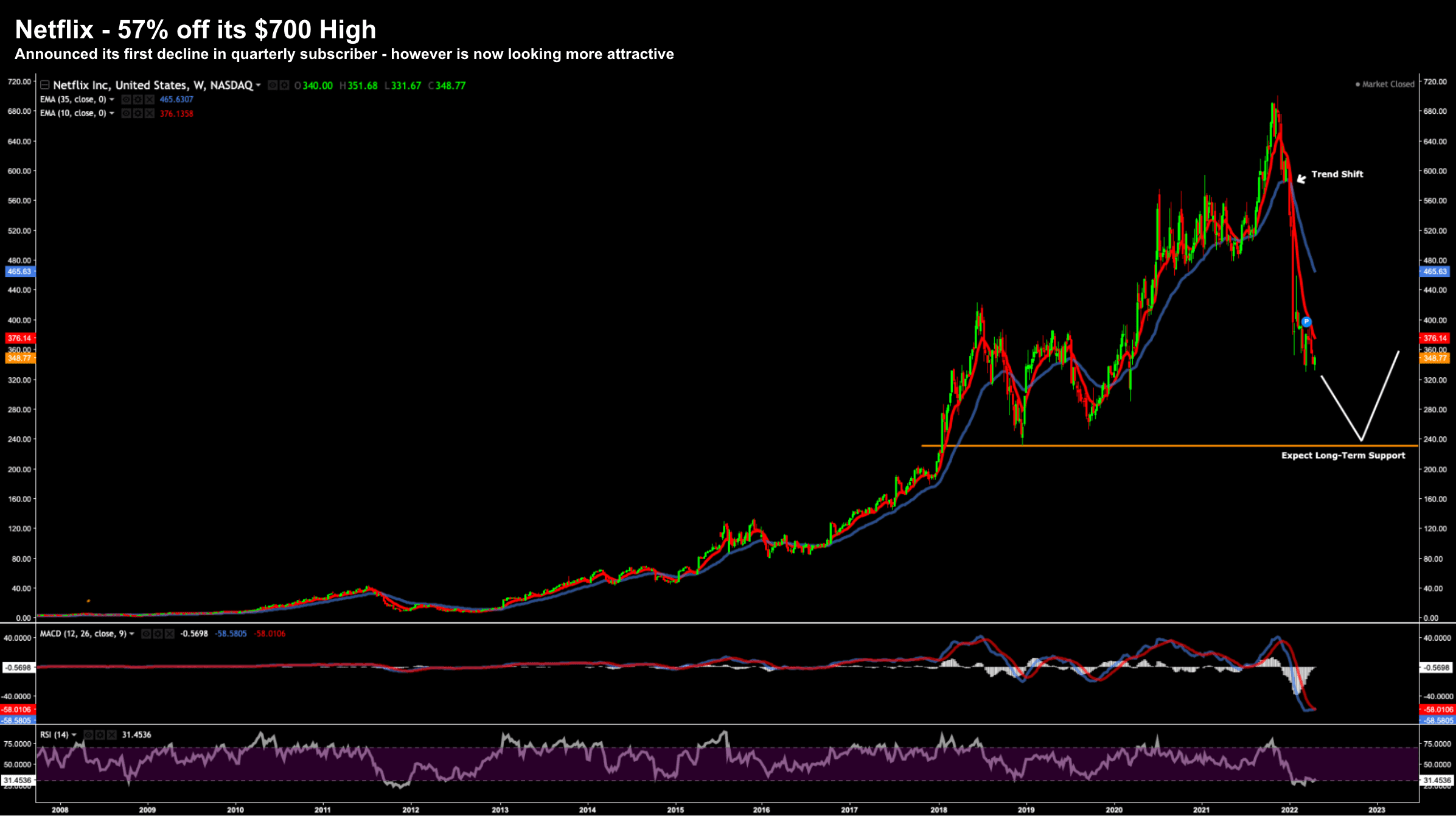

From a purely technical perspective, the weekly trend warned of further downside in January with the stock around $530 (i.e., where the 10-week EMA traded below the 35-week EMA).

This told us the bullish run had finished and more downside was likely.

However, it was straight down.

When the market opens for trade tomorrow morning – NFLX will likely be trading in the realm of $250 to $260 – approx 57% off its high.

Technically it"s likely to go even lower (as stop losses are triggered)

Longer-term support looks to be the major low of December 2018 of $231

However, if we do see a price of $230, I think we will see value oriented investors (not growth) start coming in here for reasons I will explain below.

Valuing Netflix

Netflix is an interesting business to value.

For example, if we lean into more standard valuation metrics (at a price of $260) it trades at:

- Forward PE: ~22x

- Price to Sales: ~3.9x

- PEG Ratio: ~1.38 (assuming avg 5-Year 16% growth)

At $260, none of these metrics are unreasonable for a company expected to grow earnings in the realm of 16% for the next 5 years.

However, there is another metric less cited.

And that"s its value relative to its subscriber base.

In other words, what is Netflix"s 222M subscribers worth (who pay something like ~$180 per year)?

As a benchmark, when AT&T acquired TimeWarner – the valuation of HBO was $1,000 per subscriber.

At the time, the market felt this was reasonable.

So how does that compare with Netflix today (at $260 per share)?

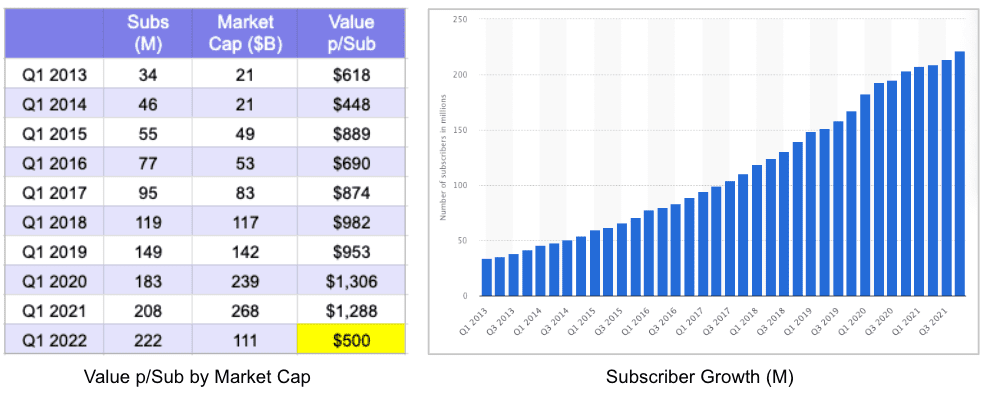

To calculate this, I reviewed the number of subscribers by year vs its market capitalization from 2013:

Using this metric, the cheapest Netflix traded on a subscriber basis was 2014 at $448.

At the time, its market cap was $21B and it had grown to 46M subs.

However, a year later Netflix market cap jumped to $49B however subs were only 55M – meaning the value per subscriber jumped to $889.

Now assuming Netflix trades at $260 tomorrow (or less) – it"s priced at half of what AT&T were willing to pay for HBO.

Note – at the time of the deal the TimeWarner deal (2018) – Netflix also traded just below $1,000 per subscriber value.

But is $500 per subscriber expensive?

From mine, the answer is no.

As the 11-year history demonstrates above – the market has been willing to pay an average of $894 per subscriber for Netflix"s business.

At its peak, the market was paying as much as $1,306 per subscriber.

Today that price is $500.

Given the average user is paying almost $200 per year for the service – $500 is a low multiple.

And this doesn"t factor in any potential advertising opportunities – which could present in years to come should Netflix consider that path (as most others have successfully done).

Putting it All Together

Over the past few years, I felt Netflix traded at a very high multiple relative to its growth and earnings.

However, with a forward PE closer to 22x and an expected growth rate of ~16% – investors are now paying a 1.38x PEG (Price-to-Earnings-Growth

Where 22 / 16 = 1.38

That"s not unreasonable for a (dominant) market leader with 222M paying subs.

What"s more, the price you"re paying per subscriber (assuming a share price of $260 or less) is now down to just $500.

That"s around half of what AT&T were willing to pay for HBO only four years ago.

It"s also 44% less than the average "subscriber" multiple the past 11 years.

To be fair, the most recent quarter from Netflix was disappointing.

However, if you remove the 700,000 lost subscribers from Russia — they added around 500,000 subscribers for the quarter.

That said, they are facing increasing pricing pressure from strong competitors.

Netflix is arguably still the leader in the streaming wars and is considered by most to be the cheapest and best value.

What"s more – it has pricing power (e.g., 5 price hikes in 7 years)

If your view is long-term (5 years) – I think buying Netflix between $230 and $260 represents an excellent risk/reward opportunity.

What"s more, I also think it could start to look like an acquisition target if it falls further. For example, do you think Disney might be interested? Apple?