One Big Beautiful Inflation Bill

Words: 1,350 Time: 6 Minutes

- Core inflation continues to rise (above 3.0%)

- Why companies are trying to absorb cost increases

- Market feverish over the promise of cheaper money

Speculators were eagerly anticipating the latest consumer price inflation data.

A hot or cold print would likely change the probabilities for a rate cut.

With markets at record highs – clearly they were betting on a softer print.

But is that what they got?

As it turns out – the headline CPI number was softer than expected (I will explain why below)

However, the Fed"s preferred measure of core inflation continues to tick higher.

In other words, outside food and energy, US prices are picking up.

But rate cuts are coming… right?

Be Careful What You Wish For

Coming into the print – there is a lot of political pressure for the Fed to start cutting rates.

Not only has Trump been relentless with his attack(s) on Fed Chair Powell – it"s also coming from within the Fed Board of Governors.

For example, recently (Trump) appointed Steven Miran, told CNBC there is "zero macro-economically significant evidence of price pressures from tariffs."

And if there were any effect, he said, it would be a "one-time price shift," as happens when governments raise sales taxes, and not an enduring regime change.

Mmm… so a bit like COVID perhaps?

Where prices suffered a one-time jump of about 20% over 3 years and never went back… now "only" acclerating 3% per year on top of the 20% increase.

Great news!

I would argue the full price increase from tariffs are coming down the pike… and we have only seen a fraction of the full impact.

But it get"s better…

Adding to Miran"s narrative – Treasury"s Scott Bessent added that the Fed should consider cutting by 50 basis points next month.

Wow – 50 bps – things really must be in trouble? Jumbo rate cuts are normally reserved for an emergency… where is it?

But coming back to Miran"s (flawed) rationale that there was "zero" evidence of any inflation impact from tariffs.

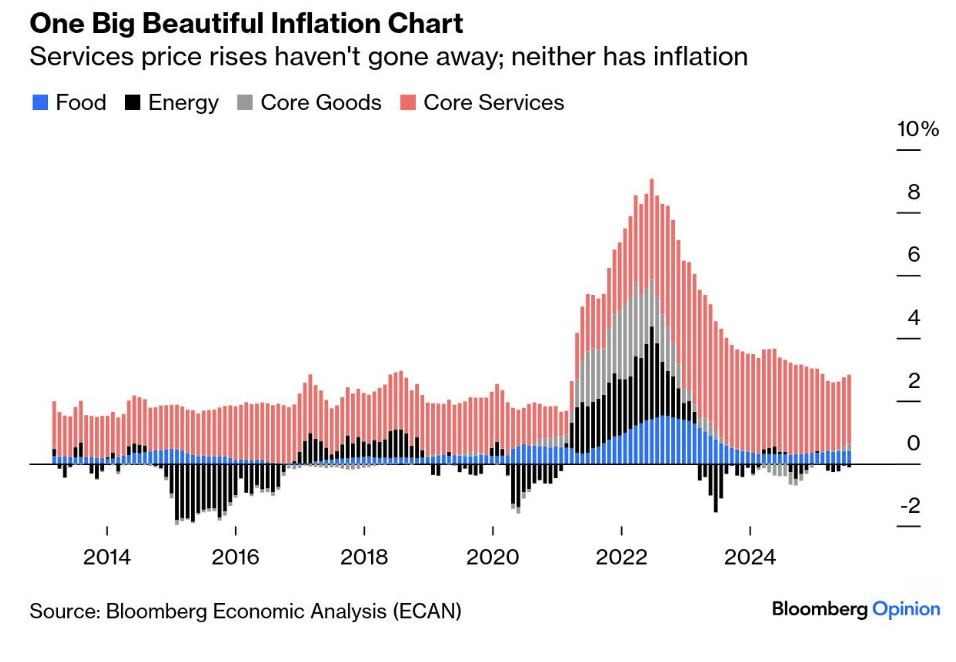

Bloomberg reported tariffs have their most evident effect on core goods, which are scarcely visible in the big chart.

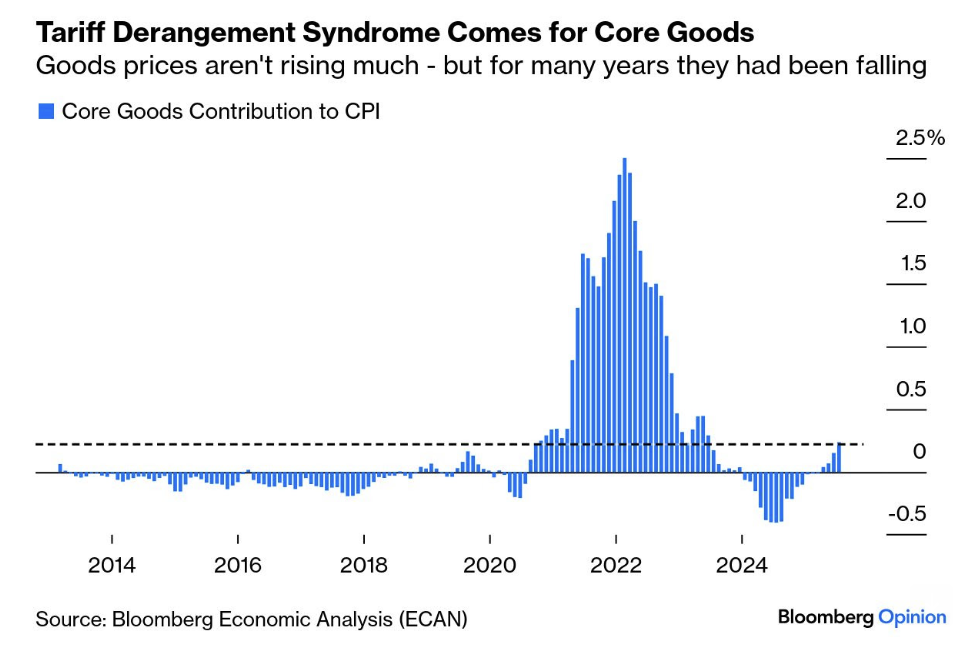

To demonstrate where tariffs are starting to show up – Bloomy offer this chart in isolation

From Bloomy again:

- First, core goods aren"t contributing much to the overall price burden

- Second, their prices usually have a tendency to go down, so even if they add only two-tenths of a percentage point to bring core CPI to 3.1%, a trend has turned.

- Third, some tariffed products (like home furnishings) are already showing signs that the levies are being passed through, and others (notably new cars) aren"t.

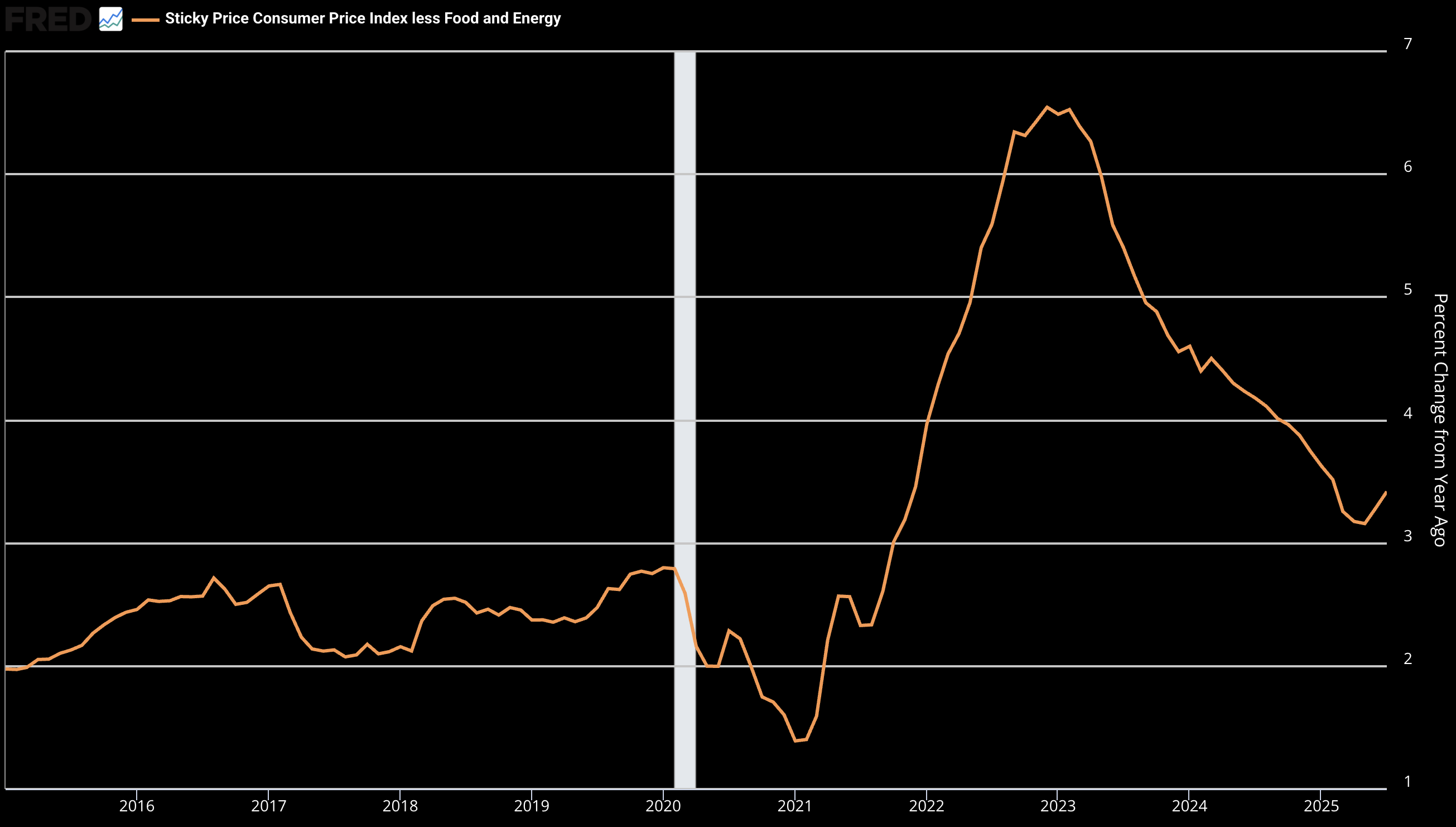

However, if we look at stickier prices less food and energy (e.g. rent, utilities, education, healthcare, insurance) – they are starting to turn higher also:

But we won"t mention this chart to Mr. Miran! In his view, the headline CPI reads 2.7% and that"s reason enough to cut.

The reason we are seeing a low-ish CPI figure (note: 2.7% is not that low) – is the drop in the price of oil.

Cheaper prices at the pump makes people smile – it"s front and center – people see the price everyday.

But if we exclude energy – everything else is at 3%.

Reason to slash rates "50 bps"? That"s what the Treasurer thinks….

So Who is Paying the Bill?

A few months ago I said it will be consumers who ultimately pay the price of tariffs.

Buffett said "it won"t be the tooth fairy"

However, so far, it"s been companies who are trying absorb the price rises (as they work through non-tariff inventory). And we heard this many times on earnings calls.

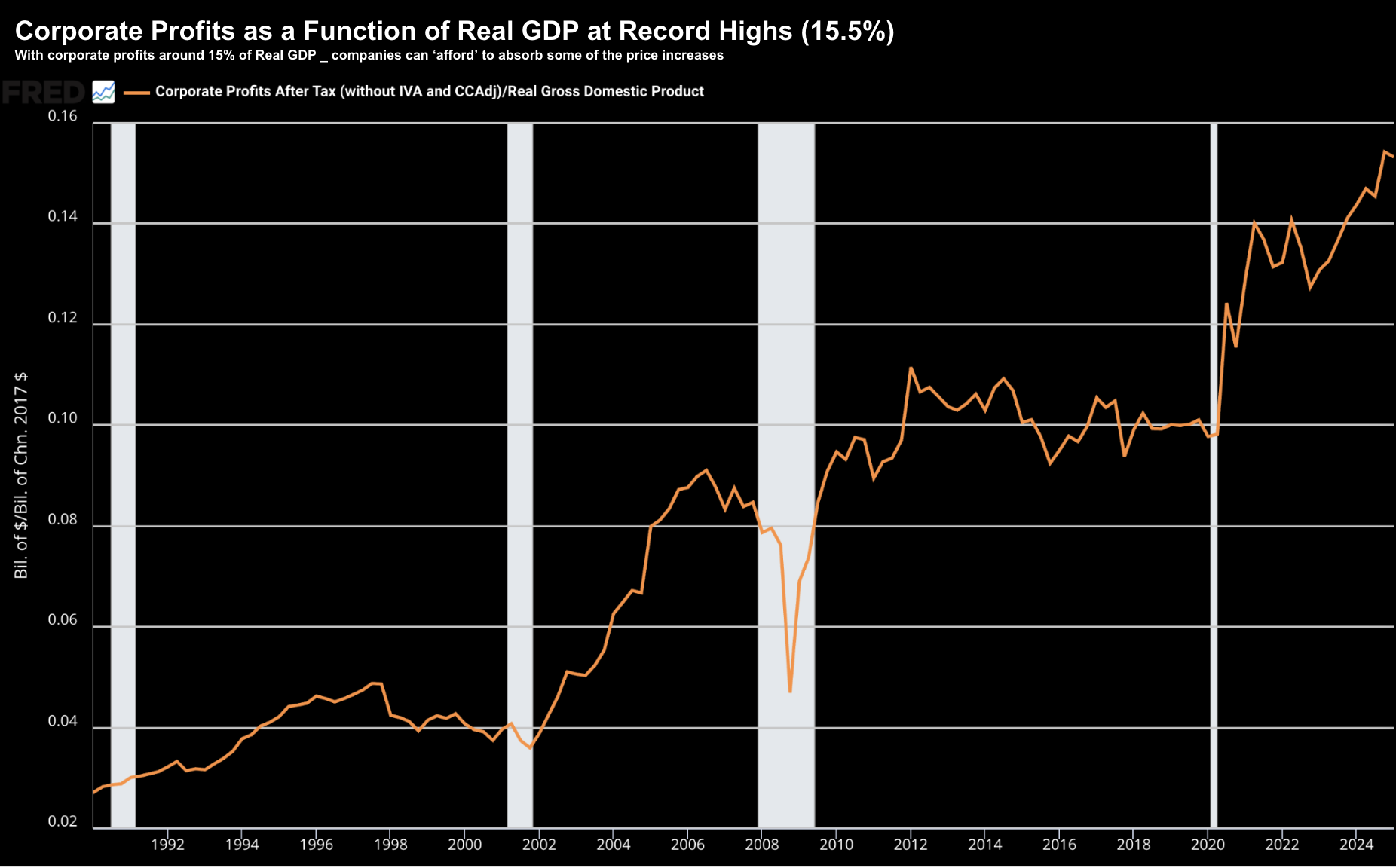

Given very healthy (and record high) profit margins – this gives them a bit of wiggle room to soak up the extra tax.

For example, corporate profits as a function of Real GDP stand at 15.5%

For corporate America – it"s difficult to find a time when things were better?

But with consumers being exceptionally price-sensitive – companies are cautious to raise prices.

Now if we also consider the fresh corporate tax cuts in the Big Beautiful (Inflation) Bill coming down the legislative pike – it makes sense why corporations are soaking up some of the pain (for now).

The Market Salivates at a Cut

If it were not for the softening labor market – where last month"s print was a disaster – the Fed would not be considering a rate cut.

For example, Jim Bianco of Bianco Research pointed out that the Fed has only once cut rates when core inflation was above 3% and the three-month change was greater than 0.3%.

That was between October 1990 and March 1991 when the economy slipped into recession.

But where"s the recession today?

That"s my question to Scott Bessent arguing the case for a massive 50 basis point cut. Where"s the emergency? I don"t see it…

However, this is what"s driving stocks to record highs and stretched valuations.

Here"s some quick valuation math for your next dinner party:

- The forward EPS expected to be ~$285 (12% higher than last year)

- At 6445, the S&P 500 at a forward PE of 22.6x

- If we take the inverse of 22.6x – we get an earnings yield of 4.4%

- The risk-free US 10-year is trading with a yield of 4.30%

So what"s the better bet?

Stocks are not cheap – where investors are not being paid any risk premium to own shares at these lofty levels.

Rarely in history has this bet turned out well longer-term (where we are receiving zero risk premium).

Now if interest rates (and yields) are set to plummet – then maybe a forward PE of 22.6x can be justified.

But even with rates at say "1%"- 23x is still a stretch.

In short, with the S&P 500 above 6,000, it"s not a (long-term) valuation I feel comfortable with.

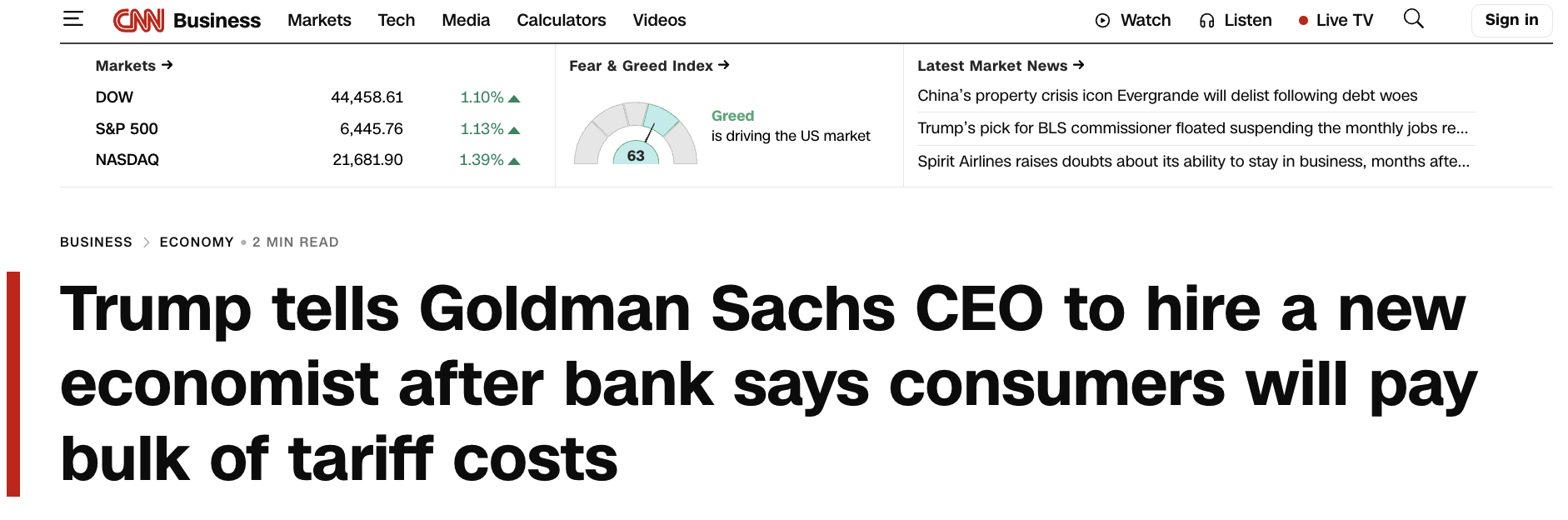

Goldman: Trump"s Next Target

It seems if you dare publish a contradictory opinion to Trump – you are his next target.

Today"s bullseye was on the back of Goldman Sachs" CEO:

Goldman sees the impact of tariffs through the same lens I do; i.e. higher prices for consumers.

Here's #45:

"Tariffs have not caused inflation, or any other problems for America, other than massive amounts of CASH pouring into our Treasury"s coffers"

"David Solomon and Goldman Sachs refuse to give credit where credit is due. I think that David should go out and get himself a new Economist or, maybe, he ought to just focus on being a DJ, and not bother running a major Financial Institution," Trump added.

You can drive a truck through both arguments.

Let me start with Trump"s childish jab at Solomon being a part-time DJ.

During his (almost) 7-year term as CEO – he has delivered a 22% CAGR – making Goldman one of the best performing financial stocks on the market.

Its stock now trades at a record high:

If I was Solomon I would respond with the chart above with the title "spin that wheel Mr. DJ"

But with respect to "tariffs have not caused inflation" – well I explained most of that earlier.

We are barely "5 minutes" into the tariff trade.

Let"s see what happens with inflation over the coming 6-12 months.

We are already seeing some prices tick higher.

Here"s Goldman:

Goldman estimated Americans "absorbed 22% of tariff costs through June," but that this share will rise to 67% by October if tariffs "follow the same pattern as the earliest ones."

Precisely… they are coming.

What"s more, the prices of essential (sticky) goods such as rent, utilities, insurance, healthcare and education are starting to rise again – failing to fall below 3.0%.

What"s happened is oil prices are falling due to lower expected growth and weak demand.

And that is having the effect of bringing down CPI.

If that"s the so-called "credit where credit is due" that your after – sure – I will give you credit for slowing growth.

Putting It All Together

We"re watching the very early stages of Trump"s terrible tariffs come through.

But there"s a long way to go…

So far companies are choosing to absorb most of the price increase given their healthy profit margins – which sit near (or at) record highs (as a function of Real GDP)

And with corporate tax cuts on the way – they will be made "whole" on the back end.

From mine, there was nothing in the latest inflation print to suggest the Fed had ample room to cut rates.

Bessent and others seem to ignore that core inflation still sits above 3.0% – well above the Fed"s 2.0% target.

The only time the Fed cut rates with core above 3.0% was the recession of 1990.

We are in rarified air (in many ways).

But given the weak jobs report – and immense political pressure – they will most likely cut this year (and more than once).

And stocks will most likely rally on the news. But that does not make them a good bet.