The Three Stages of a Bull Market

The Three Stages of a Bull Market

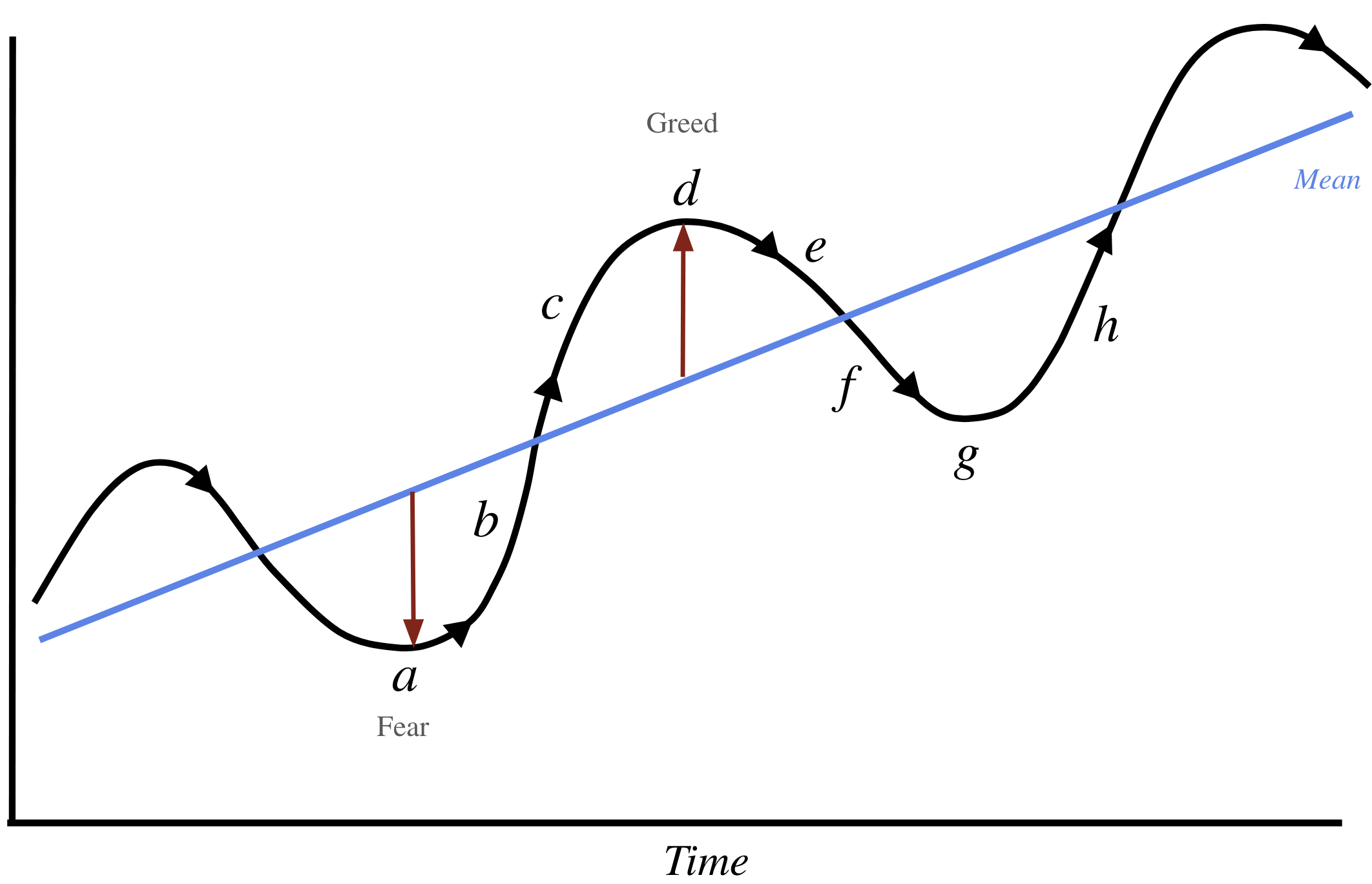

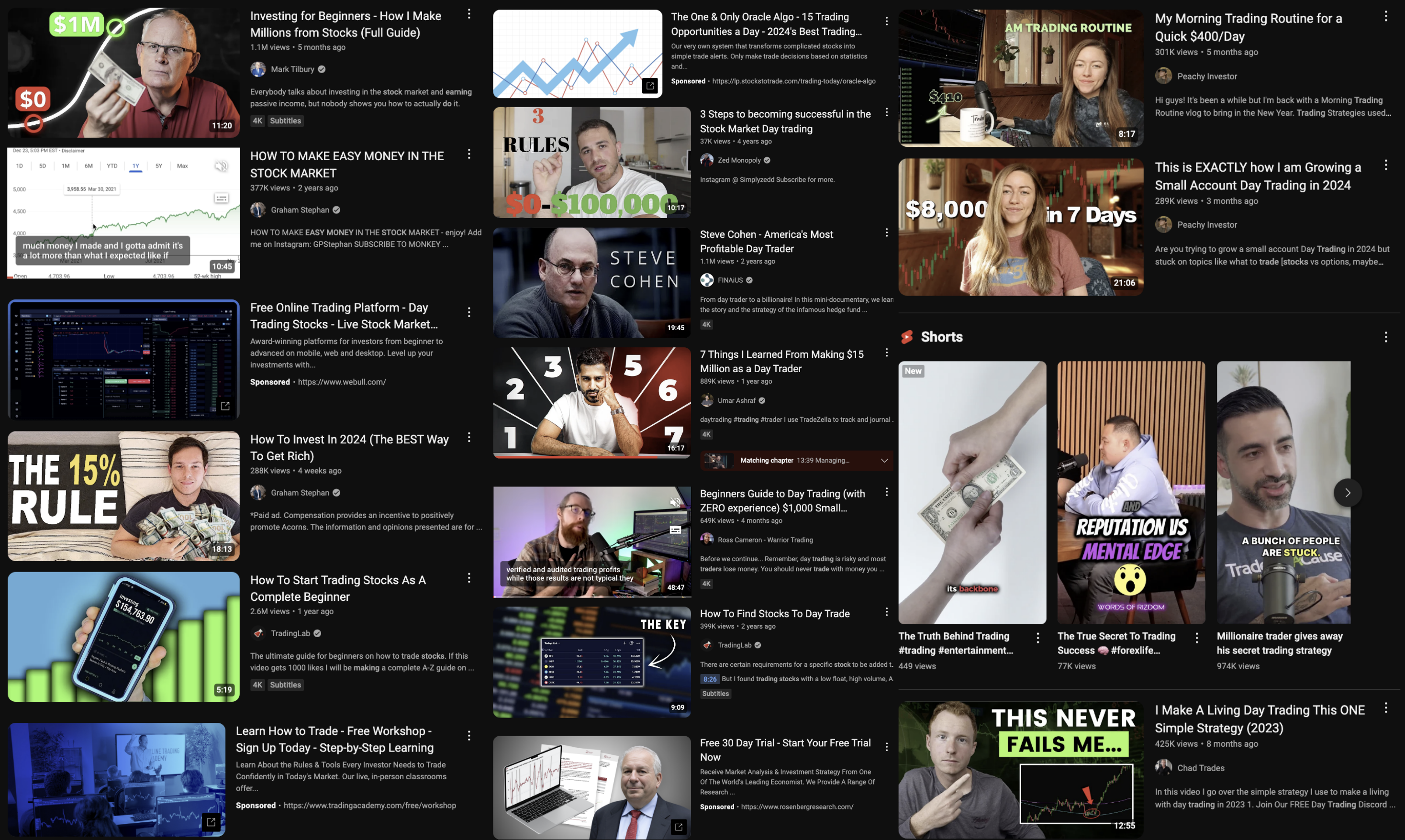

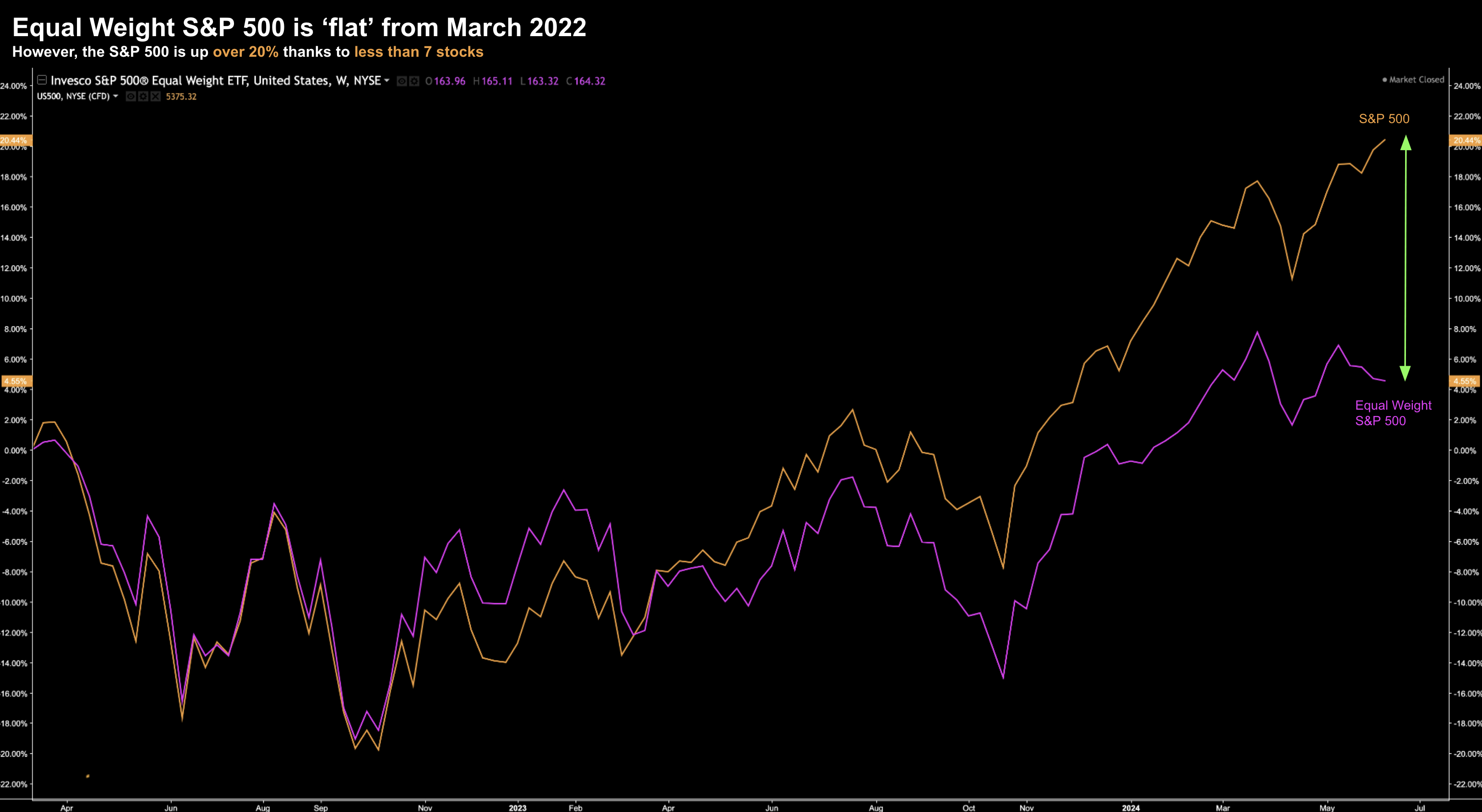

Charlie Munger once warned us when wishful thinking takes hold - investors tend to believe that good times will be followed by more good times. This mentality feeds on itself - driving momentum - pushing prices higher. It's what fuels the final stages of a bull market. Attributes such as independent thought, logic, rationale and objectivity give way to herd behavior. That's when your internal alarm bells start ringing... and you start thinking differently from the crowd. Very few people have the ability to do that... but it's what's required.