Powell in No Hurry to Cut Rates

Words: 1,111 Time: 6 Minutes

- Strong dissent in the Fed…

- What"s the compelling reason for Powell to cut?

- The slowdown is coming… tariffs will be the catalyst

I don"t envy Fed Chair Jay Powell…

In the lead up to this week"s FOMC meeting – the pressure was on the world"s most watched central banker to cut rates.

Not only does the market want rate cuts – the President has been demanding it with enraged tweets like this:

To Powell"s full credit – he ignores the relentless diatribe – separating the noise from the signal.

The Chairman reiterated his narrative – signaling the need for a more cautious stance amid ongoing economic uncertainty (largely caused by #47 himself).

In addition, he emphasized the Fed needs to maintain credibility and its independence.

However, there was some dissent within the ranks…

There was debate about the timing of rate cuts from two Fed members – despite full employment and a "robust" economy (more on this below when I assess the health of consumer spending)

Powell dampened hopes of near-term cuts – choosing to defer any further guidance until the Fed meets at its annual Jackson Hole symposium.

Here"s Powell"s prepared remarks:

"Higher tariffs have begun to show through more clearly to prices of some goods, but their overall effects on economic activity and inflation remain to be seen,"

A "reasonable base case" could be that effects to inflation will be "short lived." But he also cautioned that levies could cause inflationary changes that are "more persistent."

"Our obligation is to keep longer term … inflation expectations well anchored and to prevent a one-time increase in the price level from becoming an ongoing inflation problem,"

"For the time being, we"re well positioned to learn more about the likely course of the economy and the evolving balance of risks before adjusting our policy stance. We see our current policy stance as appropriate to guard against inflation risks."

As I"ve said all year – if it were not for the risks to inflation from tariffs – Powell would have the option to cut rates.

That"s not to say he would be cutting – but at least he would have the flexibility to.

However, Trump"s draconian policies have taken that option away.

What"s The Compelling Case to Cut?

If I was Powell – I would ask critics to outline the clear (and compelling) case to cut rates.

Today it"s difficult to find one… however we can say growth is slowing.

For now, the U.S. maintains higher interest rates than other developed economies because its economy is stronger and more exposed to inflationary pressures from tariffs.

Still, inflation remains contained, and the economy continues to grow despite tariffs and higher borrowing costs.

Thus, the case for cutting rates is not compelling, even if some, like Fed Governor Christopher Waller and Michelle Bowman dissent in favor of doing so (note – both Waller and Bowlman were Trump appointees).

Market Reaction…

Following the Fed"s hawkish statement – the market reaction was largely muted.

The dollar index rallied slightly (from deeply oversold levels) – where stocks and bond yields were largely unchanged.

Futures pricing reflects steady expectations for the fed funds rate – with the prevailing view that any rate cuts are more likely in 2026 rather than this year.

And this has been my expectation all year (e.g. one – perhaps two at best – rate cuts)

Inflation swaps show the market agrees with Powell"s earlier claim that tariffs would cause only transitory inflation.

Since tariffs were imposed in April, the market sees a temporary bump in inflation peaking around 3.5%, before falling again — justifying the Fed"s patient stance.

However, my guess is CPI could move as high as 3.9% next year should the average blended tariff rate come in around 18%.

My assumption is every 1% increase in the blended tariff rate will add 0.1% to inflation.

But what matters more is what markets expect…

From mine, they remaining largely sanguine about any potential (negative) impacts from inflation (and in turn consumer spend) from 15%+ tariffs.

Speaking of which….

Consumer Spending Slows

Investors would be well served to keep one eye on consumer spending trends.

Consumption makes up around 70% of GDP.

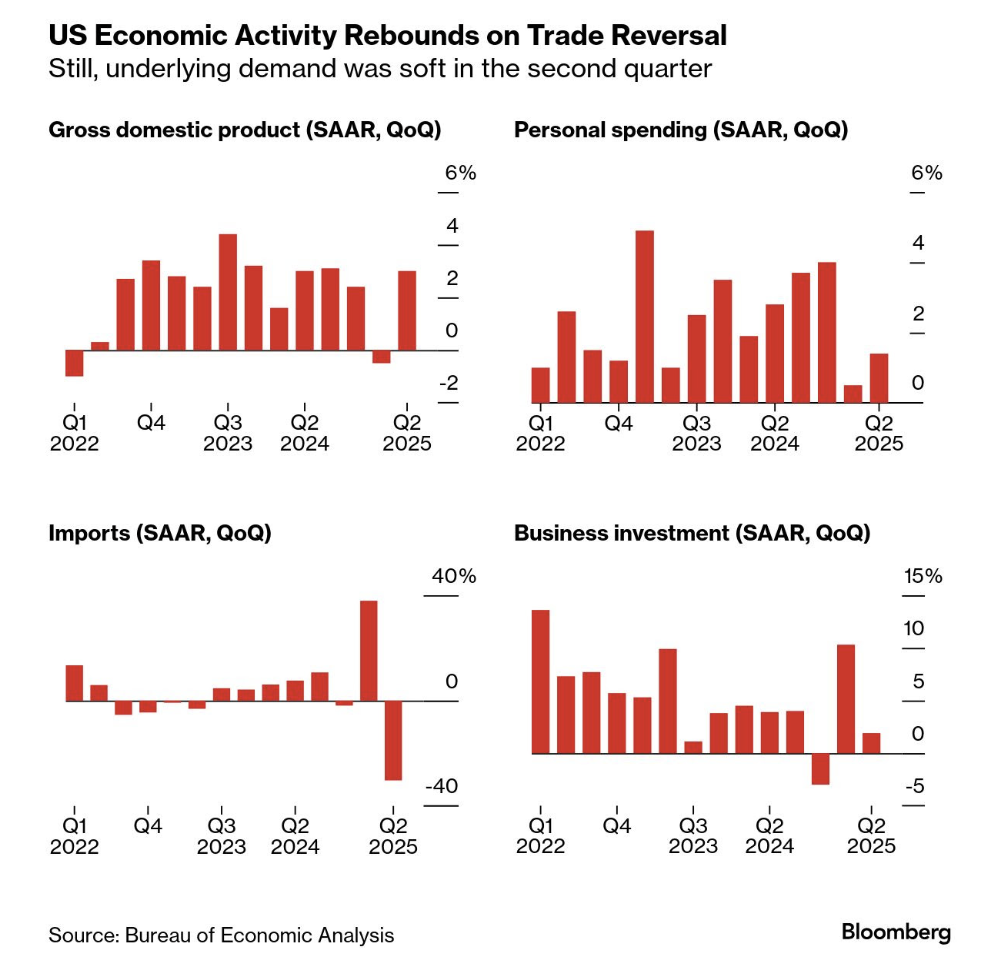

Just on this, this week we learned that consumers reduced spending last quarter – as companies sought to inoculate themselves from Trump"s (volatile) shifts in trade policy.

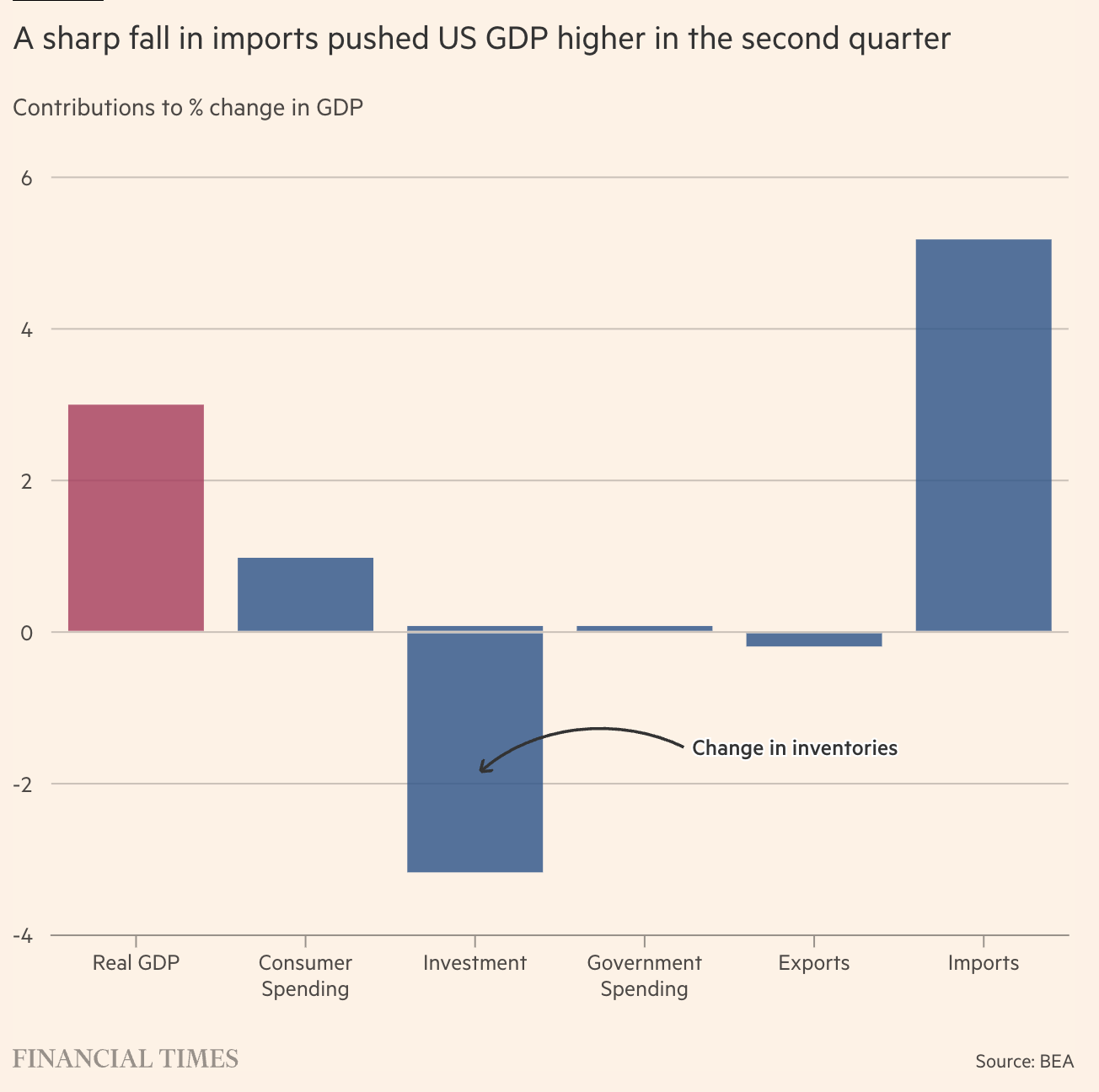

Bloomberg reported that inflation-adjusted gross domestic product, which measures the value of goods and services produced in the US, increased an annualized 3% in the second quarter.

But….

Actual economic growth averaged 1.25% in the first half, a full percentage point below the pace for 2024.

The takeaway here is the large unusual swings with trade and inventories.

They are distorting overall GDP by a good margin.

As a result, we need to pay closer attention to final sales to private domestic purchasers, a narrower metric of demand.

This measure rose at a 1.2% pace in the second quarter, the slowest since the end of 2022.

And if anything – that provides some ammunition for those in the rate cut camp (i.e., the dissent from Waller and Bowman).

Here is Scott Anderson, chief US economist at BMO Capital Markets:

"The trend of cooling demand is very clear over the past two quarters, and growth now appears to be slipping below its longer-term potential pace.

We believe this will soon give the Fed the room to start cutting interest rates again before too long"

Putting It All Together

Whilst demand is slowing – the consumer continues to hang in there.

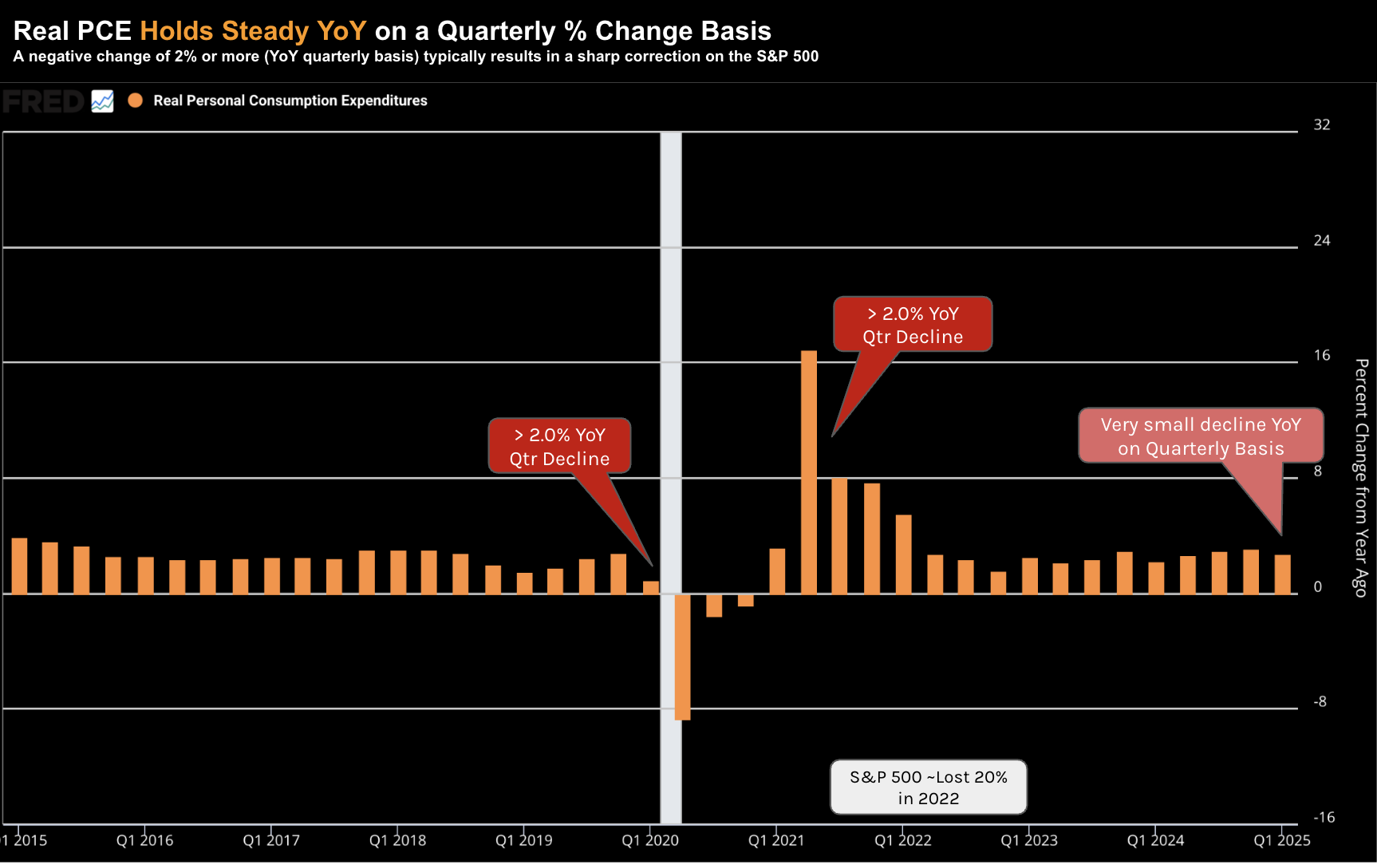

My preferred measure for spending health is what we see with Real PCE year-over-year changes on a quarterly basis.

This measure is adjusted for inflation and captures the longer-term trend (vs noisy monthly data – often subject to various revisions)

My research has shown that over the past 50+ years – when we experience a decline of 2.0% or more on a quarterly basis year-over-year – a sharp correction in stock markets generally follows within the next ~6-9 months.

For clarity, we do not need to experience a recession in the economy for stocks to correct sharply.

For example, we saw Real PCE plunge YoY in Q2 2021 – where the S&P 500 went on to experience a full year decline of ~20% over 2022

We also experienced something similar with Real PCE change in Q3 2019 – where stock falls were exaggerated by the pandemic.

Looking at Q1 2025 vs Q1 2024 – we see a decline of only 0.4% (i.e., no real cause for alarm). We will get the data for Q2 2025 tomorrow (July 31).

This will show us in real-terms how much the consumer has reduced their spending year-over-year on a quarterly basis.

As a precursor – May showed a decline of 0.8% YoY on a monthly basis – therefore look for the quarter to be soft.

Last Update was for Q1 2025

From mine, the slowdown was happened below the surface.

However, the ~15%+ tariffs will likely be the catalyst to take us there.

For example, someone is going to have to pay the $400B to $500B price tag – it"s only a question of who.

Regardless, with the S&P 500 trading at ~22x forward earnings, it is largely complacent about any future risks to growth.

Time will tell…