Powell Less Hawkish… Threading a Fine Needle

- Jay Powell soothes concerns of "excessive hikes"

- Lock-in only a 25 basis point hike in March

- S&P 500 not yet out of the woods…

Today was an important day for markets…

Jay Powell testified to Congress on monetary policy, the outlook for inflation and what he sees in terms of economic risks.

This was always going to be a difficult "needle to thread" for the Fed Chair – but he passed (if your lens is the market)

I say that because equities (and bonds) like what they heard.

Both staged impressive rallies…. the US 10-year yield recovering from a sharp nose-dive yesterday.

Yesterday I felt that if Powell sounded dovish (e.g. indicating only a 25 basis point rise in March) – markets were likely to rally.

They did.

Powell"s "let"s wait and see" approach saw every sector of the market rally…. notably financials.

But this is a delicate dance…

The Chairman is way behind the curve (I will talk to that shortly) and runs the risk of perhaps 10%+ inflation later this year.

If such a number presents – he will have little choice but to pivot on his "mildly hawkish" stance.

For now however, he is willing to roll the dice.

What Did We Learn?

There were a number of takeaways from Powell"s language today.

And if we were to grade his performance – it would be via the prism of how you see the market.

For example, I would have liked to have seen him be more affirmative in terms of getting in front of inflation (i.e. hawkish).

Some will disagree with that…

It would not have been palatable for markets…. but I think that"s less important.

However, if your lens is Powell"s primary focus is to satisfy markets – you would give him an A+.

Three takeaways for me:

1/ Lock in 25 basis points for March

If there was any doubt as to whether the Fed was going to hike 50 or 25 basis points before today – the deal is done.

It will only be 25 bps.

The "positive" here is it removes one layer of uncertainty.

Markets will take it.

2/ Incrementally Dovish

From mine, there was little hawkish about the Fed"s tone.

And whilst he said "the rate train has left the station"… that train isn"t moving fast.

Lift-off will be 25 basis points less than what the market had priced in only two weeks ago.

This is why there was positive sentiment across the board today.

3/ "Excessive" Tightening off the Table (for now)

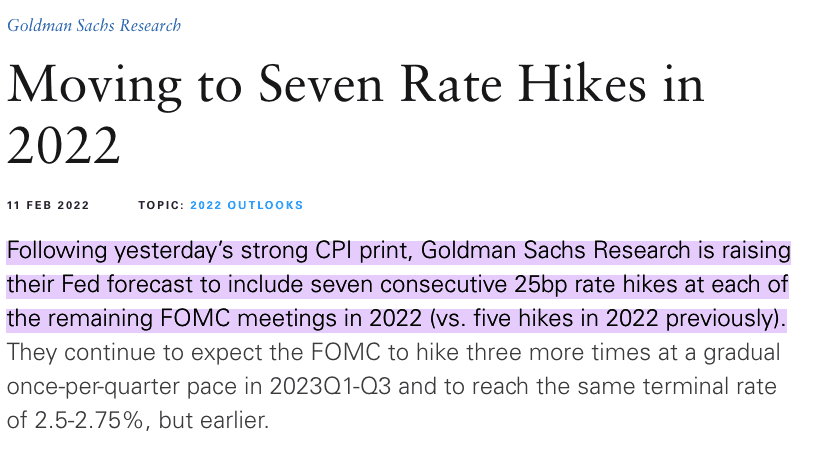

Recently markets have been pricing in as many as 6 or 7 rate hikes this year.

For example, here is Goldman Sachs just three weeks ago:

That forecast is now closer to 4 maybe 5 hikes.

Powell acknowledged the various headwinds fronting the global economy… many of which are impossible to forecast.

To that end, "excessive" Fed tightening could have been perceived as another risk.

But let me add a caveat….

It"s only March 2nd.

Forecasts for rate hikes will change as we get further inflation prints.

We get the next read on CPI March 10th.

From mine, it"s very hard to see how the Fed cannot raise rates less than 5 times with the likelihood of 6%+ inflation for the balance of the year.

And if inflation is still running at 6%+ at year"s end – that"s a problem.

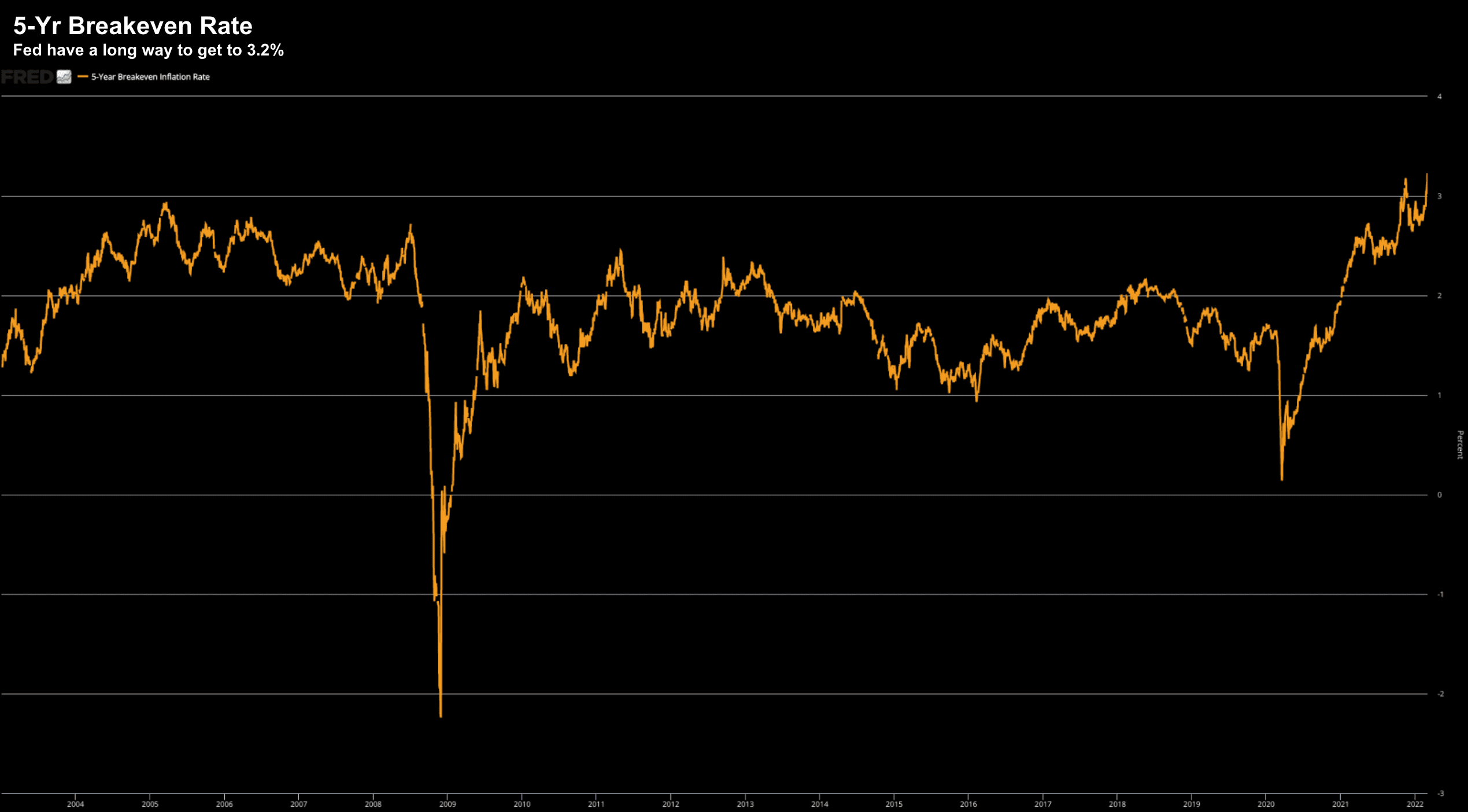

Inflation Breakevens

For clarity, this simply means they have a long way to go in terms of hiking rates to tame inflation.

For example, take the 5-year inflation breakeven rate; i.e., a measure of expected inflation derived from 5-Year nominal yields.

This tells us that market participants expect inflation to average around 3.2% in the next 5 years.

The 2-year breakeven inflation rate sits around 4.3% today.

So let"s assume the Fed raises rates 6 times over the course of the next 12 months (which now feels aggressive)…

That will only lift the effective Fed funds rate to 1.50%

They are not even in the ballpark!!

Rates have a long way to go…

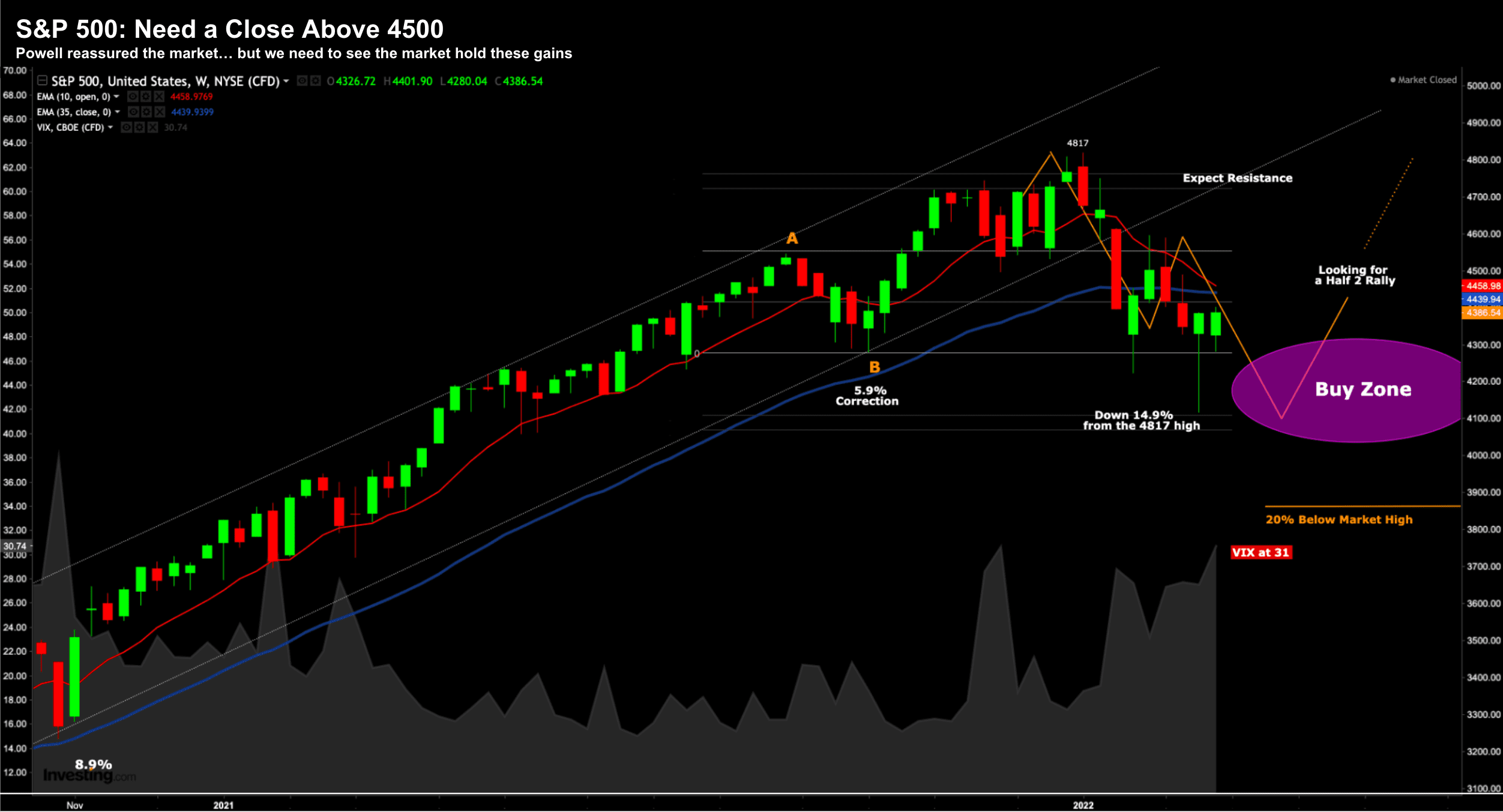

More Work to do for the S&P 500

Before I close, let"s quickly turn to the bullish tone we saw today.

Last week I showed how the bulls tried to wrestle back control… after finding (expected) support around 4100.

This week we opened lower – but staged another rally post the Fed…

But as I stated two weeks ago – we need a weekly close back above the 35-week EMA (blue-line)

In the short-term – if we fail in this zone – then expect a quick re-test of the lows.

To that end, it promises to be extremely choppy the next couple of months.

There are simply too many moving parts…

Sanctions against Russia; impact on the European economy; credit risks; rising inflation; revisions to growth; monetary policy and so on.

But if we are to test the zone of 4000 to 4100 – I feel we are closer to the lows of the year.

With monetary policy to remain accommodative (and the 10-year to remain below 2.25% in 2022) – stocks remain the best alternative.

And in this zone – I feel the upside reward (e.g., up to ~15% in H2) offsets the downside risk.

Putting it All Together…

Powell"s language today was more dovish than what the market was pricing in.

But they are still a long way from what could be considered "normalization".

6 rate hikes will only equal a nominal rate of just 1.50%

Adjusted for inflation – we are still negative.

Normalization won"t occur until well into 2023…

To close, there are two equally valid prisms you could apply when trying to assess this market:

- fewer rate hikes (where real rates are negative) is likely to support stock prices (i.e., TRINA); or

- 20x forward earnings still isn"t "cheap" – where multiple contraction has further to go (e.g., down to 16x)

Both sides of the coin are valid – but I lean towards the former in a zero rate environment (especially with some $9 Trillion on the Fed"s balance sheet).

That said, there are market risks longer-term.

Growth is slowing and the Fed is becoming less accommodative. This is a multi-year transition that will ultimately see multiple contractions.

And that means you shift your focus to quality.

And whilst there will always be a premium associated with quality (like everything in life) – it"s where you need to be.

Regards

Adrian Tout