Powell’s Pivot… As Market Frets over Omicron

- Powell suddenly turns hawkish;

- The market lacks breadth (as mega-cap tech leads);

- Looking for the market to catch a bid near its 35-week EMA zone

How quickly things can change.

From the Fed pivoting on its dovish sentiment… to the "Omicron" variant arriving in California.

This has seen the market turn on a dime.

"Ready to Buy the Dip?" was the title of my last post (Nov 26th)

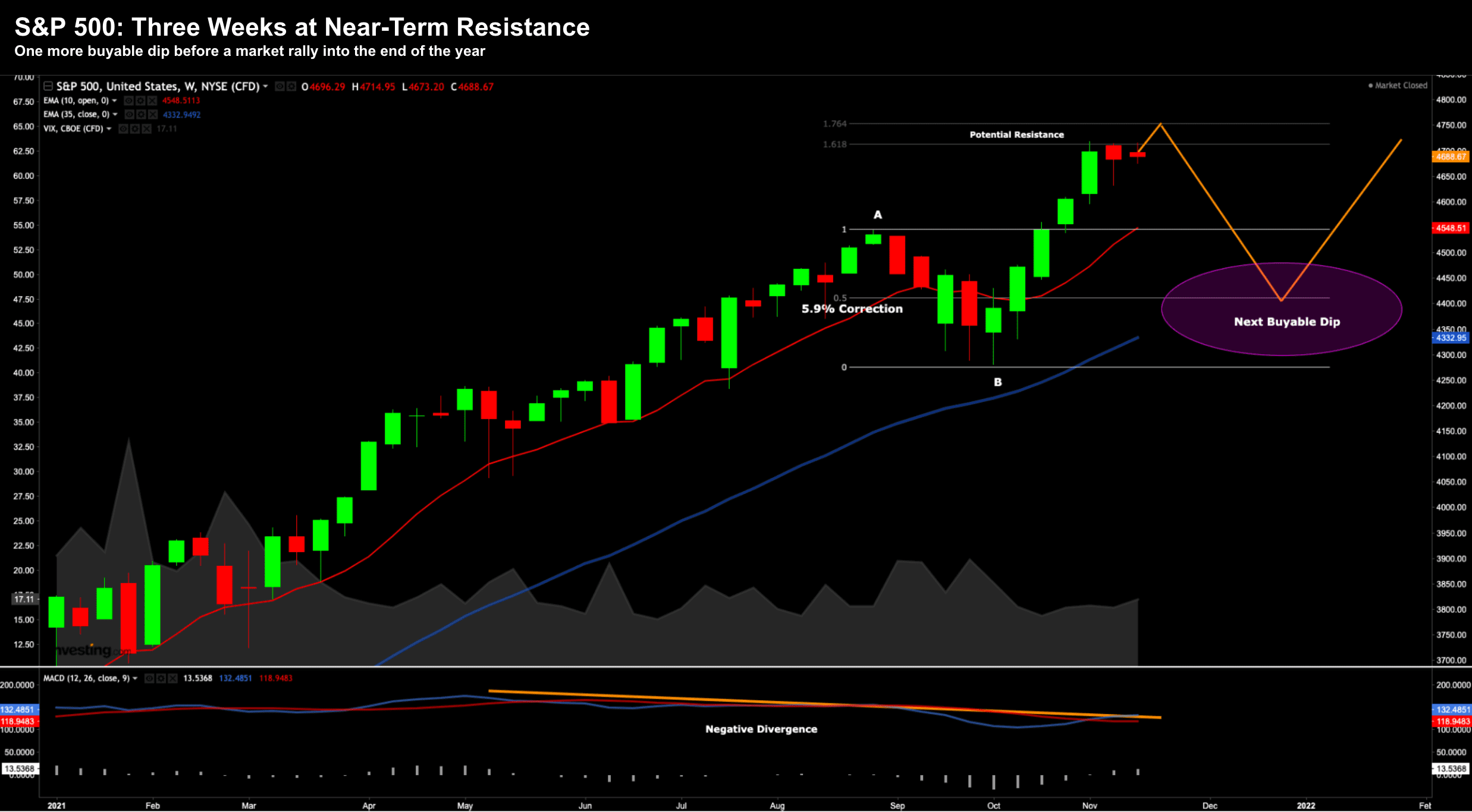

Prior to that (Nov 17th) I mentioned we could see a re-test of 35-week EMA (blue-line) – citing two things:

(a) potential resistance at the 61.8% zone outside the retracement A-B; and

(b) strong negative divergence with the weekly-MACD.

Nov 17 2021 – Looking for the S&P 500 to Pullback

Whilst neither are direct "sell signals" – they warn of selling pressure ahead.

What"s more, two weeks ago the VIX was overly complacent (trading around 16).

I suggested that all traders could be "leaning to one side of the boat".

The so-called fear index has now surged back above 31x – a level not seen since January.

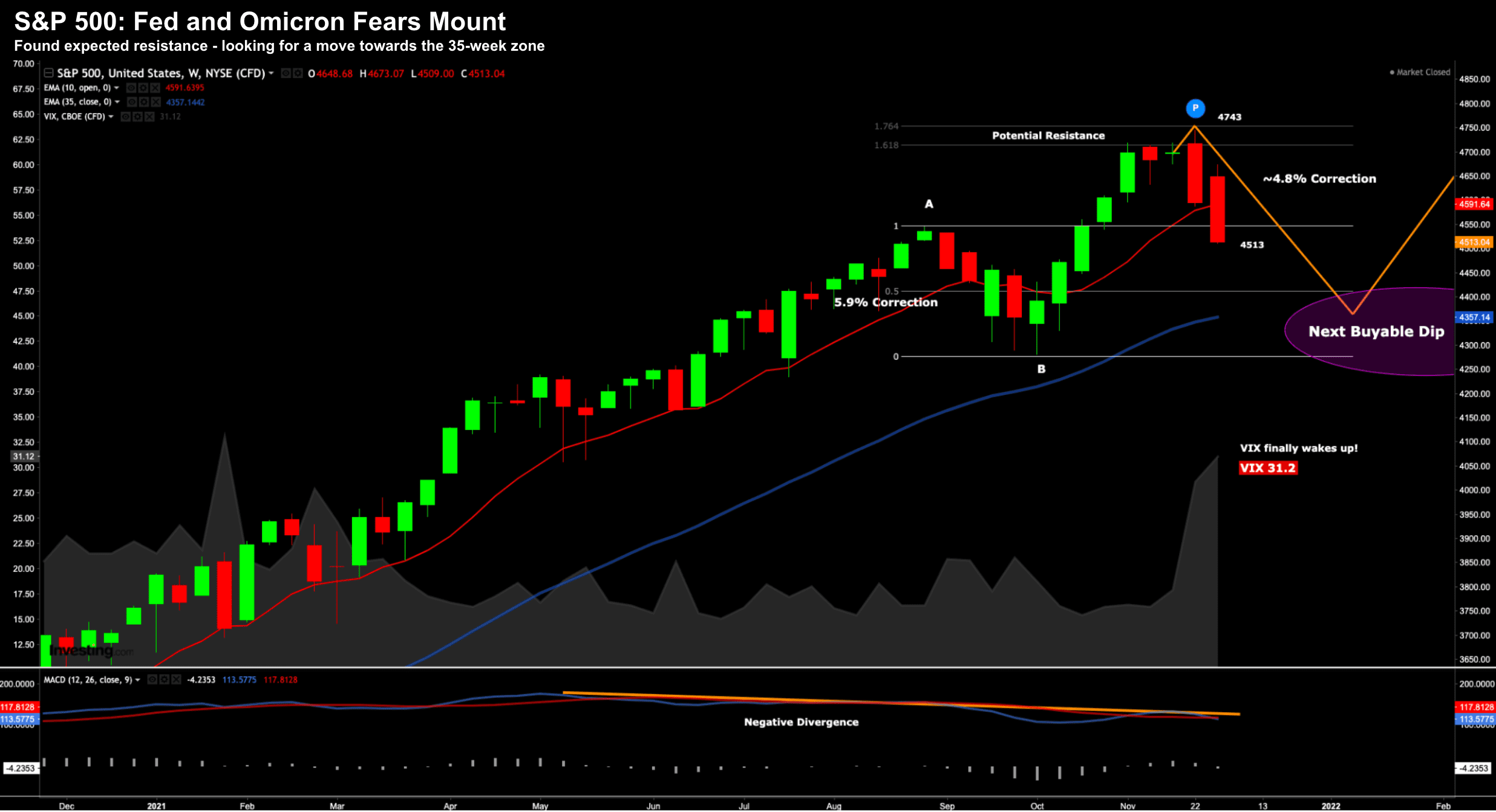

Let"s update the weekly chart for the S&P 500:

Dec 1st 2021

As you can see, it"s been 12+ months since we have seen two consecutive (solid) red candles.

For me (and this will be a function of lens) — things are "trading per the script".

Put another way – there"s no need for alarm.

If anything, this represents opportunity in pockets of the market (e.g. my recent pick on SNOW if we saw the price in the $310 – $340 zone – which we saw today)

But here"s the thing:

Whilst the mainstream headlines night read "carnage on Wall St." – it"s important to remember the broader market is only ~4.8% off its all-time high (4743)

That"s nothing.

For example, after today"s close (4513) – the S&P 500 is still up an incredible 20.2% for the year.

If we finish anywhere near this level (and I think we will)- that"s roughly double the average market return of around 11% (including dividends).

So where to?

My best guess is the market could trade another 2-3% lower before catching a bid.

For example around 4400.

Now it could go lower than this (I don"t pretend to pick bottoms or tops); or we might be at the bottom for the year?

But I think the market catches a bid around this zone.

And from there, I think the market rallies towards the end of the year.

However, there is something which "bears" (pun intended) watching…

The Market has "Bad Breadth"

Not breath… breadth.

One of the consistent themes I"ve maintained on this blog is staying with mega-cap tech.

They remain a core part of my long-term portfolio – with 5 names (i.e., FMAGA) constituting 50% of my portfolio.

One thing I"ve observed as part of this (small) sell-off is how well these names have traded.

Apple for example (which I added to recently around $138) actually made ground!

You might say some traders see Apple as safe as "bonds"!

However, outside these names, many stocks are being mauled.

For example, those with excessive multiples or smaller market caps are down 40%, 50% and more.

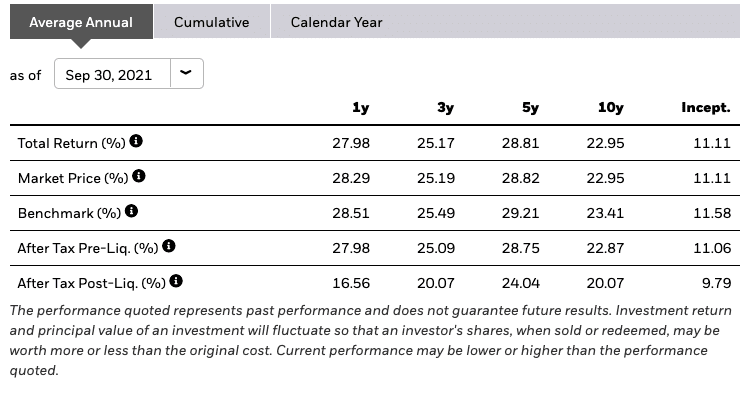

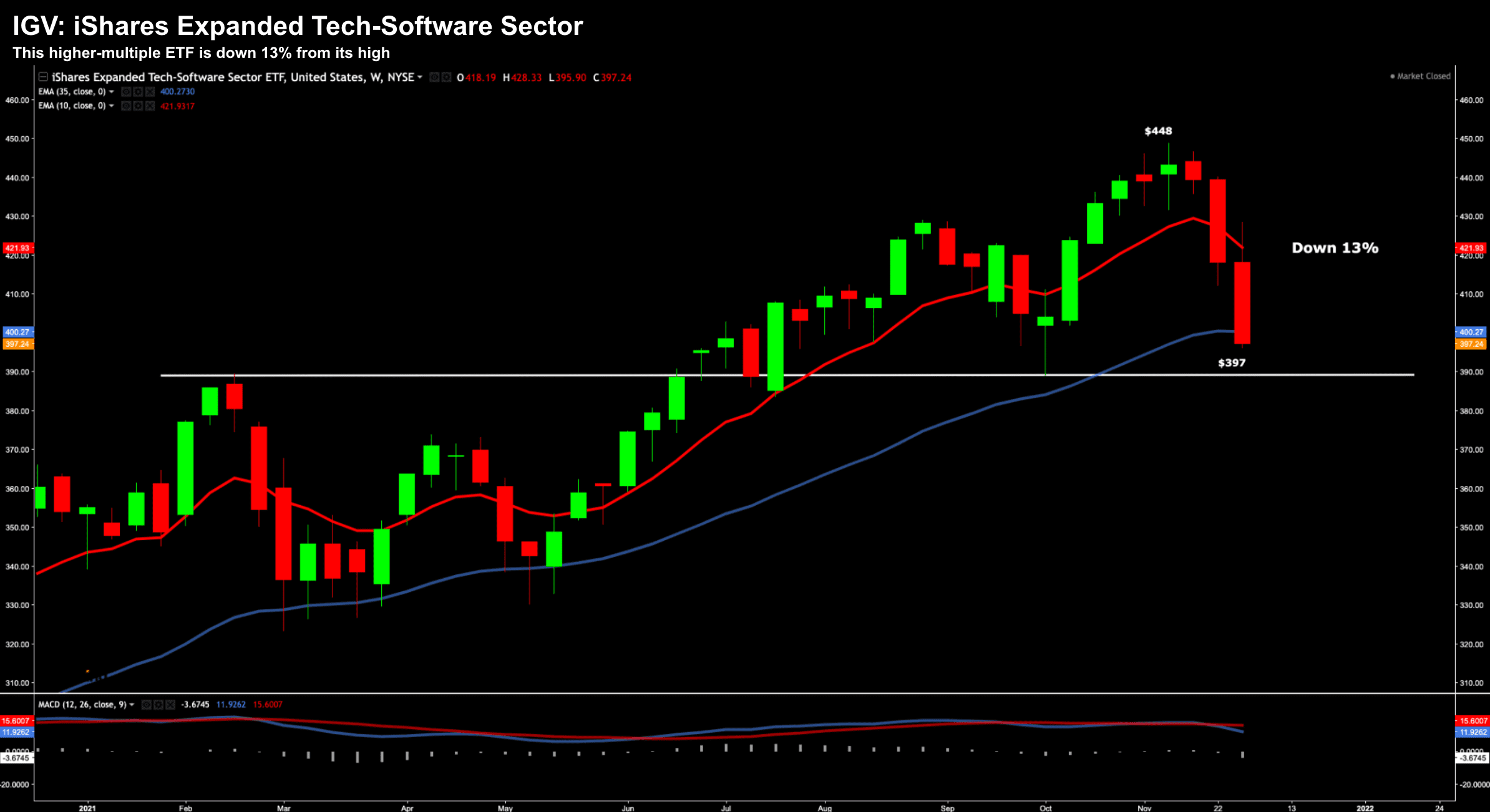

By way of example, take look at the popular ETF IGV.

This is an ETF which represents high-multiple names – with Salesforce (CRM) its largest holding (10%)

To be fair, the IGV has performed exceptionally well the past 10 years – doubling the average returns of the index (see below).

This high-growth ETF does exceptionally well in a (very) low interest rate environment.

However, the past two weeks it"s given back ~13%

Dec 1st 2021

Watch this one to see if it holds around the 35-week EMA (where it trades today).

I think it will catch a bid soon… but that"s a guess.

Now if it doesn"t – there could be a lot more pain in this sector.

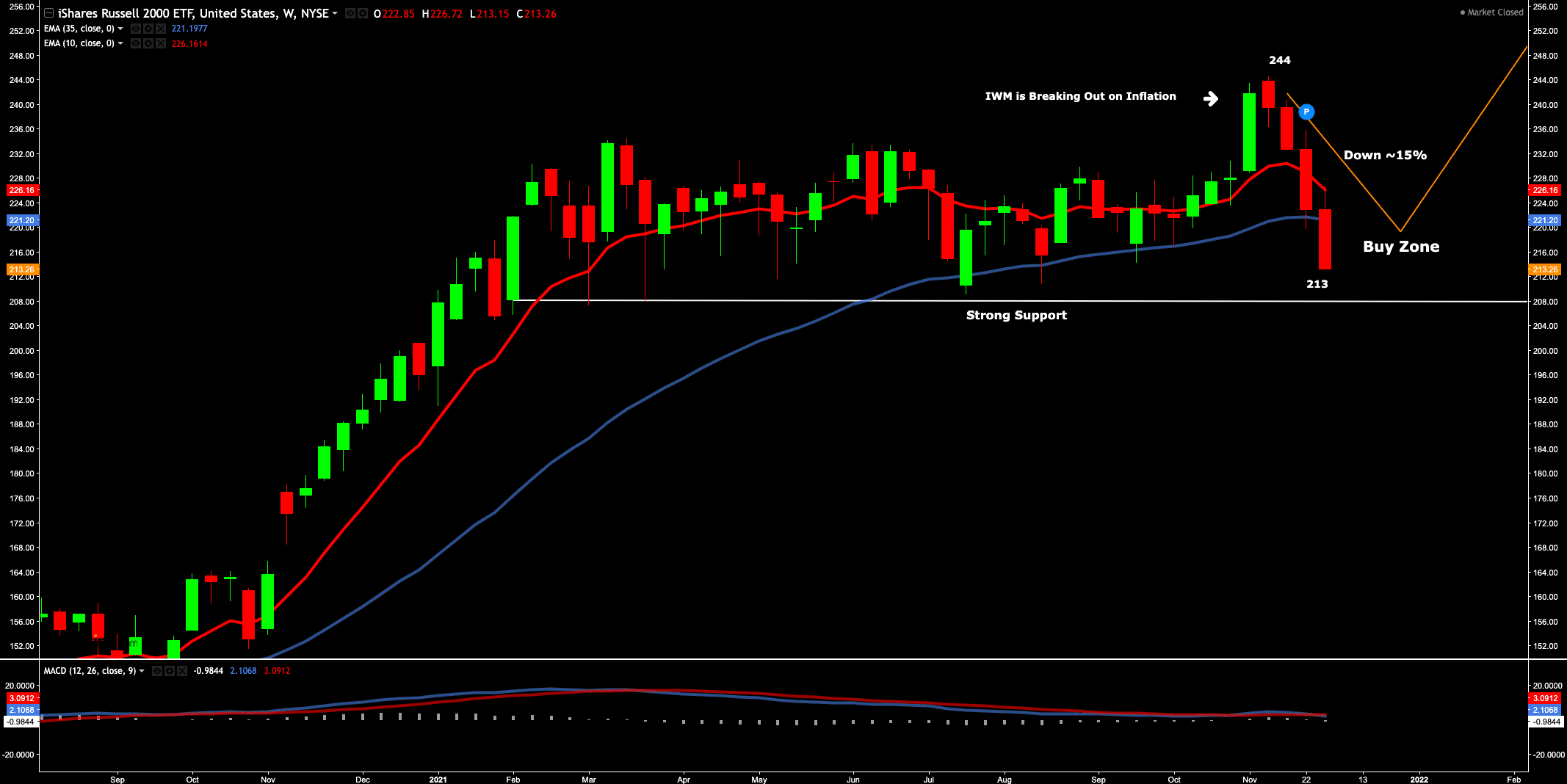

As a second example of "bad breadth" – below is the weekly chart for the iShares ETF IWM – The Russell 2000

Dec 1st 2021

Approx. 5 weeks ago – I said this ETF looked like breaking out on news of higher inflation (with the Fed downplaying any accelerated tightening).

Well that all changed!

It has given back almost 15% as:

(a) Jay Powell turned hawkish (more on that in a moment); and

(b) Omicron becoming a major threat to any economic re-opening.

My nominated buy zone for this ETF was ~$220 (some ~$24 lower than where it was trading).

After the sell-off — we"re now trading just below that level at ~$213 and close to where I think we see support.

Support for the Russell 2000 will be a welcomed development.

For example, if this market is to rally (and I think it does)… we need to see this ETF move higher.

I say that because you can"t just have "4 or 5 names" only taking the market higher.

At some point, they will likely give back strong gains too.

Then you get market capitulation.

What we want to see are all corners of the market rallying.

Powell"s Unwelcome Pivot

Whilst the headlines are more focused on the threat of Omicron… the market is equally concerned about the pivot from Jay Powell this week.

In testimony to the Senate Banking Committee on Tuesday, Powell reversed his sentiment from just a few weeks ago.

In short, he went from being a dove to a hawk.

For example, he said it"s appropriate to consider wrapping up the tapering of bond purchases by possibly a few months sooner than expected.

In particular, Powell cited a "very strong economy" and "high inflation" pressures.

What"s more, he added we should consider removing reference to the term "transitory" – when talking to inflation.

I wasn"t surprised – as my central thesis the past few months is the Fed will need to move sooner than expected.

I felt they were behind the curve…

What"s more, I felt the market has not priced this in.

Well, I might be close, as this hawkish pivot sent both stocks and bond yields reeling…

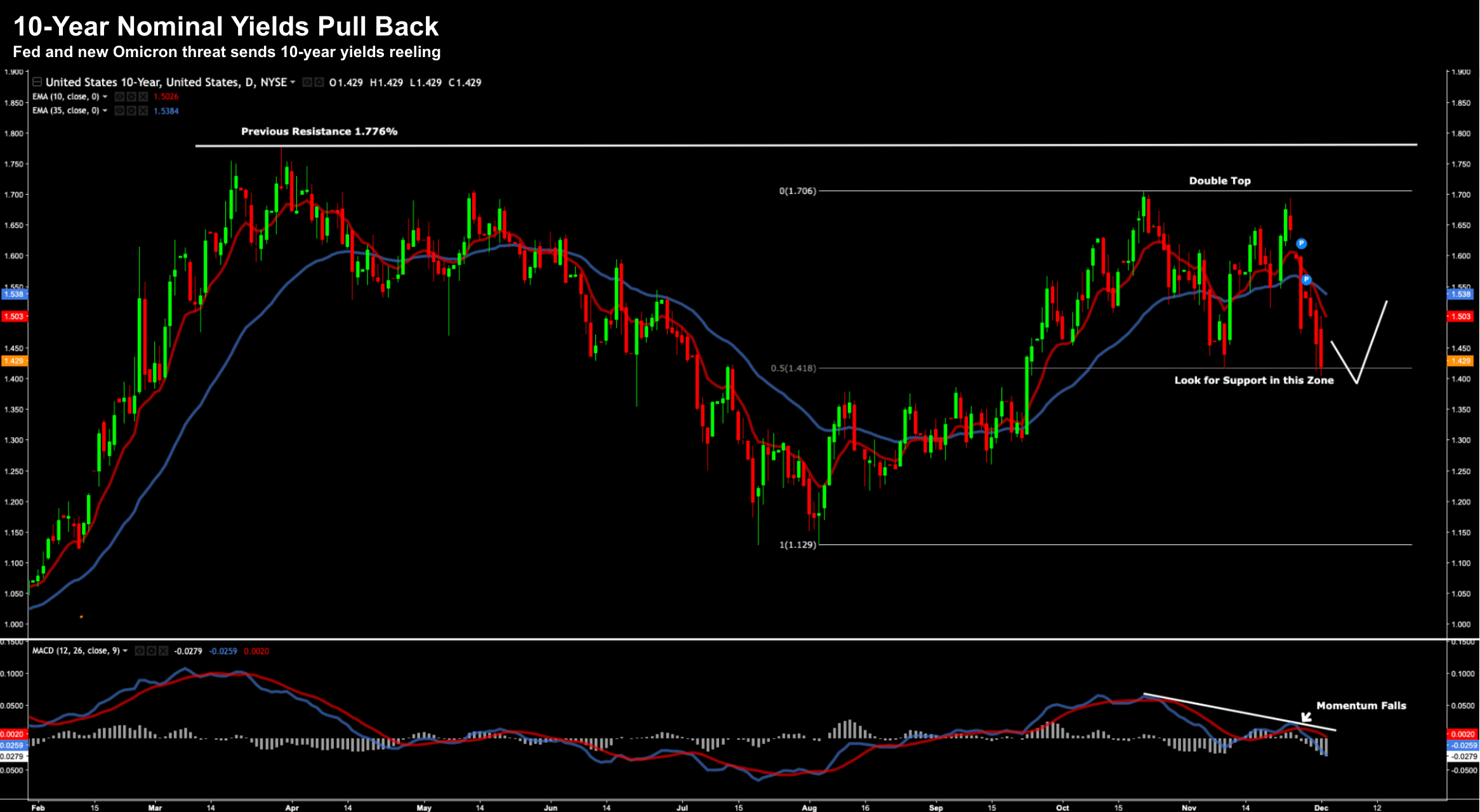

Consider the retreat we"ve seen with US 10-year yields:

Dec 1st 2021

These yields have plunged ~16% in just weeks (i.e. investors seek shelter in bonds)

This is problematic.

Put another way, you could interpret this as the bond market not being optimistic about what growth it sees ahead.

For example, they could be thinking the Fed is about to make (another) policy mistake.

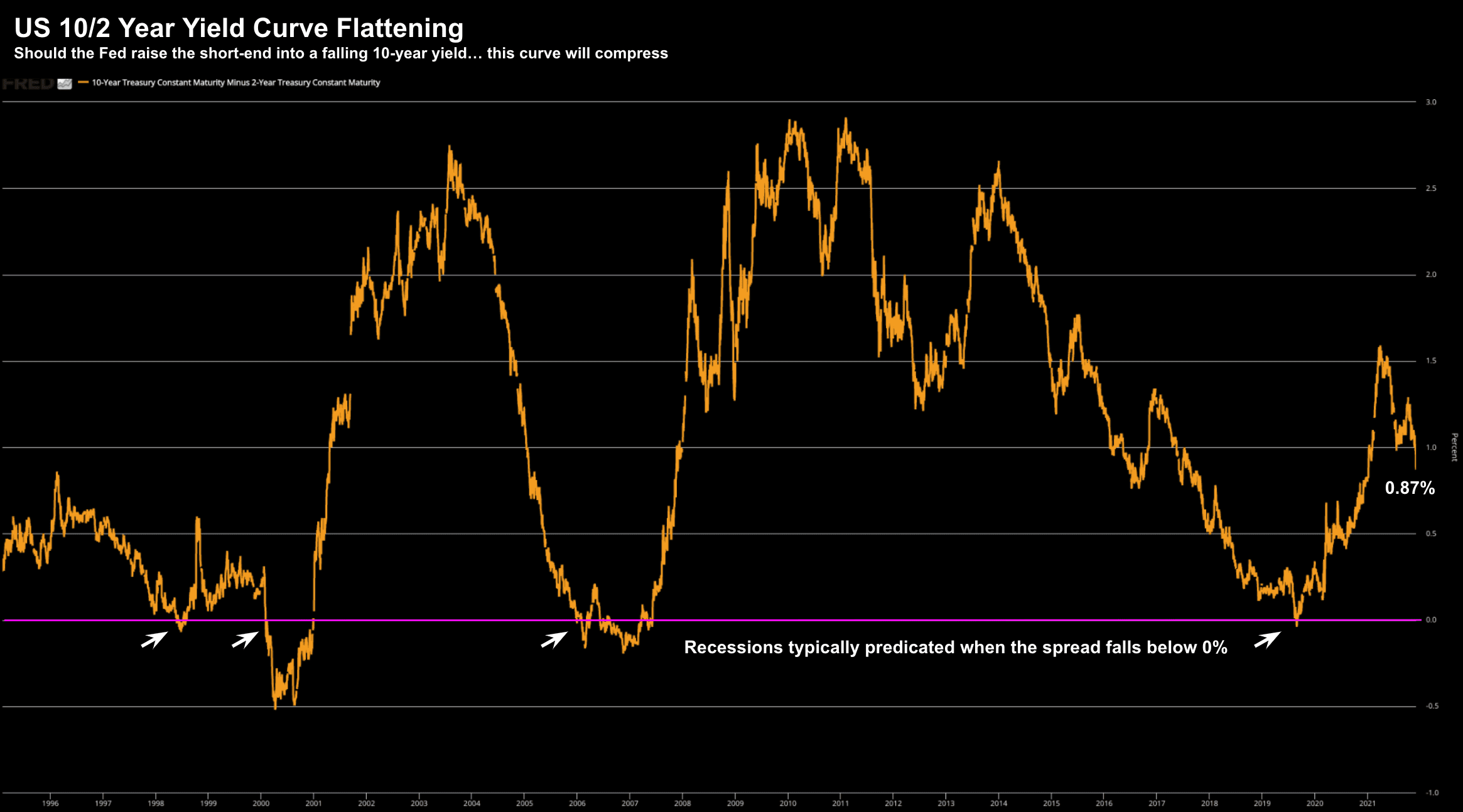

And that is showing up on the 10/2 Year Spread:

US 10-Yr / 2-Yr Yield Spread Continues to Fall

As we know, whenever this spread falls below zero, a recession typically results within 12-18 months.

The good news is we are still 87 basis points above zero (pink line).

The bad news – it"s flattening at velocity – as the 10-year yield falls.

What the market fears is this could compress further if the Fed are to raise short-term rates to fight inflation; and the 10-year fails to rally in unison.

Remember: it"s the Fed who controls the short-end (and 2-year by proxy); but the market (not the Fed) determines the long-end (e.g. 10-year).

Putting it All Together

My gut feel is this sell-off will represent opportunity.

Now stocks were extended.

From there, I suggested probabilities favoured a near-term technical sell off.

As I like to say, sometimes we need to go down to go up.

That"s how the market works.

Pullbacks in bull markets are welcomed (and expected) developments.

Again, we"re a mere 4.8% off the all-time highs.

That"s nothing when you consider we are still up 20% for the year.

But if you bought near the top on "FOMO" – your portfolio might be feeling it.

Or if you bought extremely high multiple names over the past 12 months – that trade is probably hurting too.

However, some of these (higher quality) names are offering attractive levels.

For example, cloud business Snowflake (SNOW) closed at $311 today.

That"s very much in my nominated buy zone. Consider adding some here.

I will give you another high-multiple name which has crept onto my radar… Doordash (DASH).

It closed $161 today (down 37% from its record high)… and is approaching a zone I like (b/w $130 and $140).

It traded as high as $257 three weeks ago.

That"s the kind of brutal selling we"ve seen in these (and other) names.

But you need to be selective with stock selection.

For example, names like "SNOW" and "DASH" could go a lot lower the next few weeks… I don"t know… I don"t try and pick bottoms.

And that"s fine…

What I can say is you are picking up quality stocks which are well off their highs.

These two are potentially worth a look.

Let"s see how things go… but so far I like what I see.