Ready for a ‘Growth Scare’?

Words: 1,251; Time: 7 Minutes

- Why I think growth could stall in the month"s ahead

- Trump"s "anti-growth" policies offsetting tax cuts and deregulation

- Real PCE quarterly change (YoY) will warn of a slowdown

Earlier this week I talked about the levels of growing uncertainty facing the market.

For example, whether it"s tariffs, tighter monetary policy or fiscal policy – investors are finding it challenging to price the risks.

It"s becoming increasingly more difficult to factor what policy makers will do.

For example, let"s start with the Fed…

After two hotter-than-expected inflation prints this week – markets are now pricing in zero rate cuts for this year.

Some are saying that should inflation continue to remain stubborn (or hot) – it"s possible we see a rate hike.

That"s not currently priced in.

And when it comes to policy from Washington D.C. who knows what will happen?

Consider what"s in effect today with tariffs:

- 25% tariff on steel and aluminium (all countries) effective March 12

- 10% tariff on China from Feb 4

- 25% tariff on Mexico – paused for one month

- 25% tariff on Canada – paused for one month; and

- Retaliatory tariffs due to go into effect April 1 (following due diligence)

All or none of these things could happen.

Ford"s CEO said if these tariffs are to go into effect, they will "blow a hole in the industry"

Popular restaurant chain Chipotle said tariffs will increase the cost of their meals by 6 basis points.

And when it came to the latest round of earnings reports – approx 60% of all companies said they are closely watching the situation – however it"s still too early to quantify the impact.

Readers will know I think all tariffs are a bad idea (see "Zero Sum Game")

My view (or hope) is Trump is using the threat of tariffs as a negotiating tactic to get some better deal for the US. For example:

- Better security at the border;

- Reducing the amount of drugs coming into the country;

- Trading partners to buy more of U.S. made goods; or

- Encouraging foreign companies to build their products in the U.S. (which Trump said will see them avoid tariffs).

But we can"t be sure…

Tonight I want to talk about why I think market"s have stalled since Trump won the election.

And from mine, it"s the increased risk of a growth scare.

Why Growth Could Stall

When Trump won the election – he was viewed as a pro-growth President.

And that is mostly true….

For example, two of his growth policies included:

- Lowering taxes (corporate and individual); and

- Removing layers of government regulation

In short, he wanted to remove the "shackles from business" – get big government out of the way – where business could invest and have an incentive to grow.

The market was very happy with this approach.

However, three of his policies are not pro-growth:

- Eliminating (or reducing) illegal immigration (which is reduce the overall labor force);

- Tariffs – which will likely drive up costs; and

- Sweeping cuts to government spending

And whilst the current debt and deficits are not sustainable – emotions are flaring with respect to the "how" (vs the what – e.g., cutting wasteful spending).

However, from an investor"s lens, when the government spends less – generally the economy contracts.

The three policies outlined above are arguably anti-growth. And based on this lens – you can see why equities are failing to push ahead.

They"re now worried about a potential "growth scare".

Market Yet to Recognize Tightening

There are a lot of things which push the price of equities higher.

For example, monetary policy, fiscal policy, inflation, investor sentiment, tech innovation, earnings growth, cheaper money – you name it.

But at the end of the day – a lot of the price action is driven by the availability of money.

More money translates into higher asset prices.

For example, if liquidity is flowing – either from the Fed or the government (or both) – equities will most likely rise.

However, if either tap is turned off, equities start to worry (especially if growth falters)

And I think that"s heading our way.

Let me explain:

If we look back over the 12 months – we had extremely accommodative financial conditions. We had:

- The government spending at levels not seen since WWII (where deficit-to-GDP hit 7%); and

- The Fed was signaling rate cuts.

Both are very bullish signals (and market friendly).

However, we should be mindful that the economic data lags financial conditions by 6 to 9 months

This is mostly why commentators are quick to say "things are very strong".

They are looking through the rear-view mirror.

Since September last year – financial conditions have tightened considerably (despite Fed rate cuts).

Look at what we"ve seen with the US 10-year yield (which determines the rate on your mortgage, car loan, credit card etc)

It has surged from a low of 3.59% to over 4.50% today (and I suspect going higher)

US 10-Year Yield – Feb 13 2025

This alone has made borrowing more expensive for businesses and households.

This has led to tightening of credit availability and higher debt servicing costs (for both business and government).

This is a significant factor impacting economic growth – but again – is yet to show up.

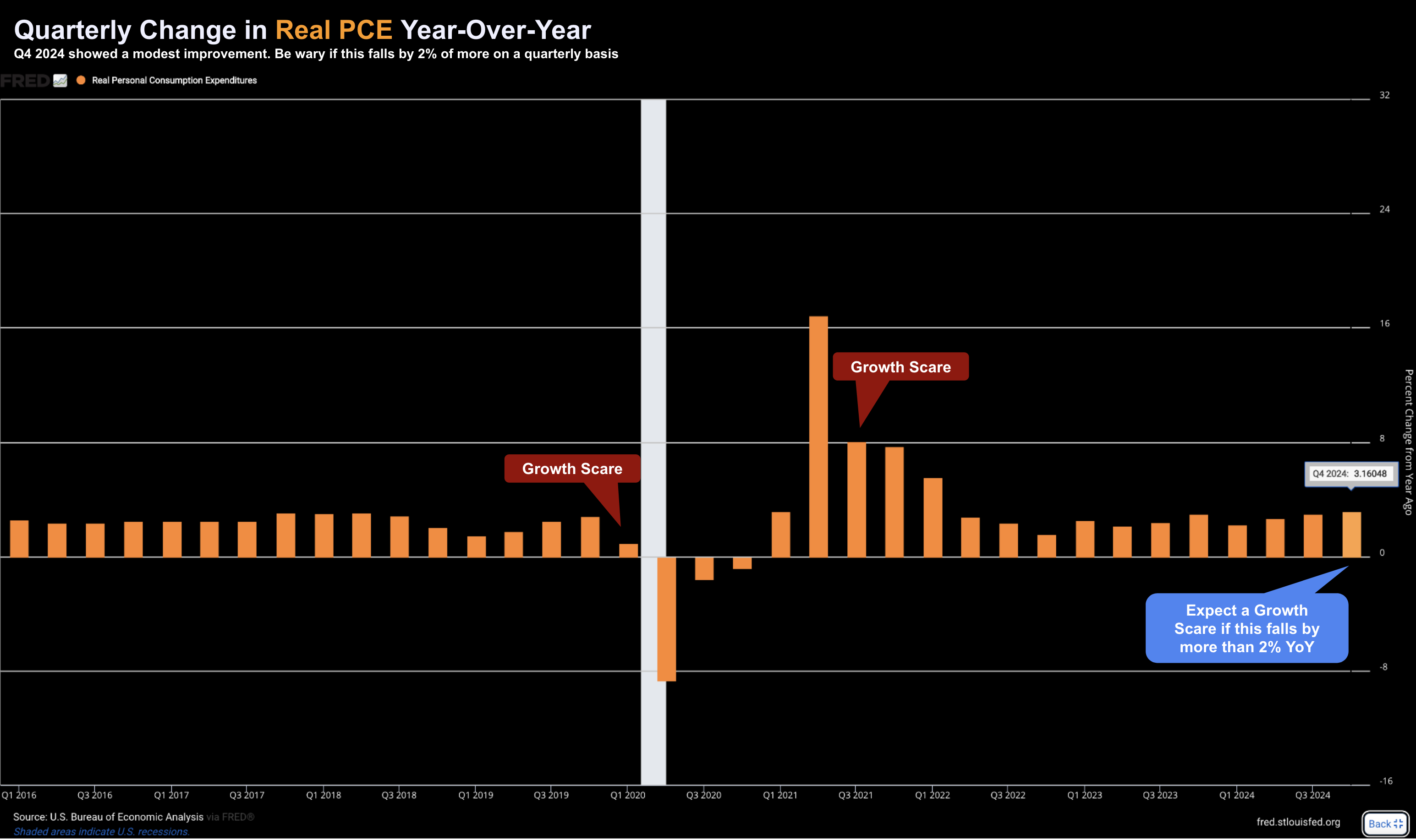

I will demonstrate this shortly looking at the change in quarterly Real PCE on a year-over-year basis.

But this is Econ 101:

When you make something cost more (in this case, money) — expect less of it.

Again, coming back to the Fed….

After expressing a desire to cut rates – they are now stuck.

After two hot (sticky) inflation prints this week – CPI and PPI — the Fed is now on hold for a while. And it could be a lot longer than just 2025.

For example, the all-important yield curve is entirely flat for three or four years.

That means very few (if any cuts) are expected into 2026 and 2027.

So let"s connect a few dots:

- Tightening financial conditions with higher bond yields (potentially going higher);

- Government policies such as less immigration, increased tariffs and reduced government spending; where

- We should expect overall demand to fall, prices to rise and growth to slow

Remaining Agile

An aggressive tariff war (if it were to eventuate) is only one factor which could invite a growth scare.

However, if we look more broadly, there are other things to be mindful of.

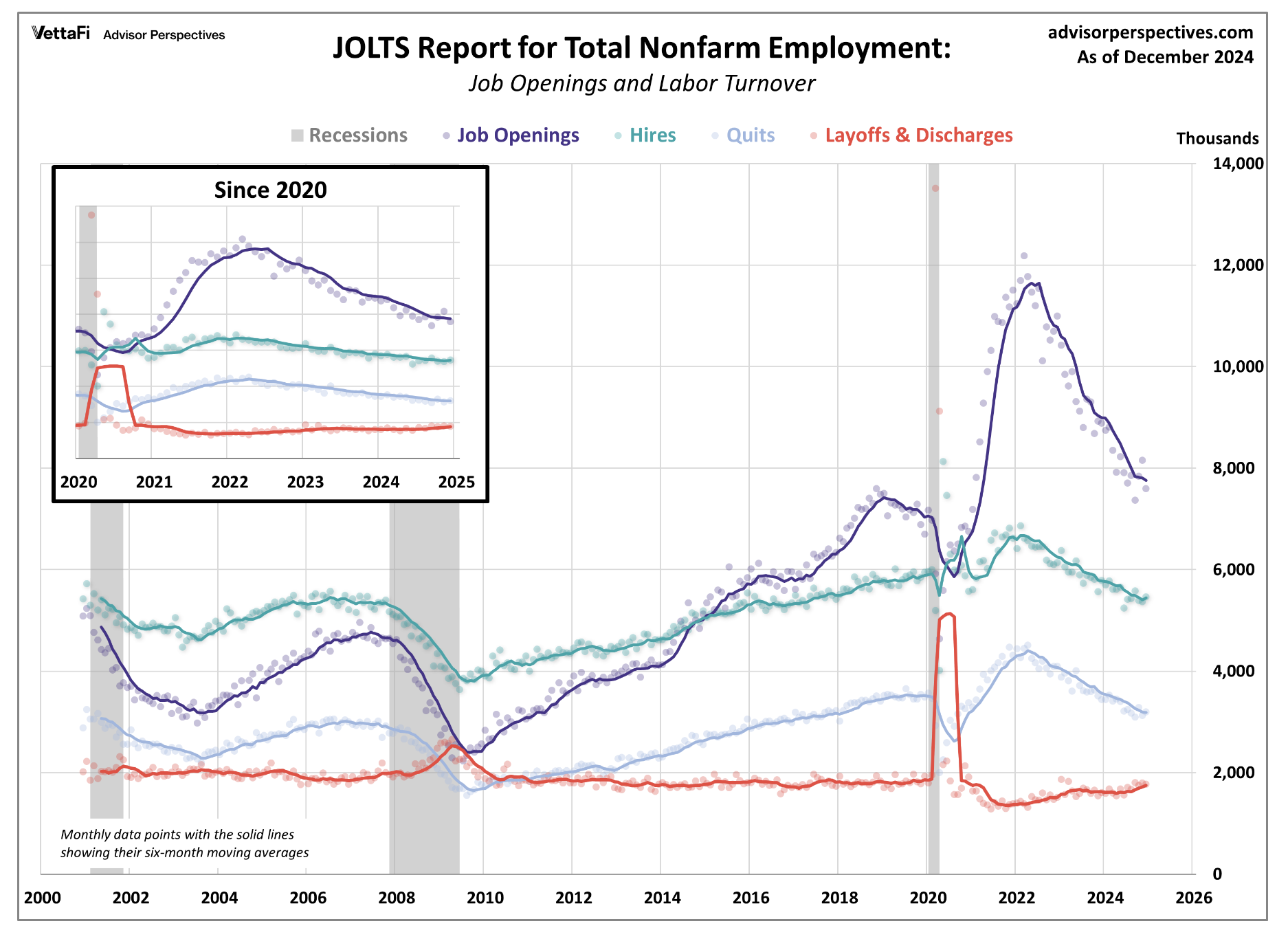

For example, last week we received a very sluggish hiring rate from the JOLTS survey – which suggests a low-velocity labor market.

Note the slowing of the purple line (JOLTS) – where layoffs (red line) are increasing.

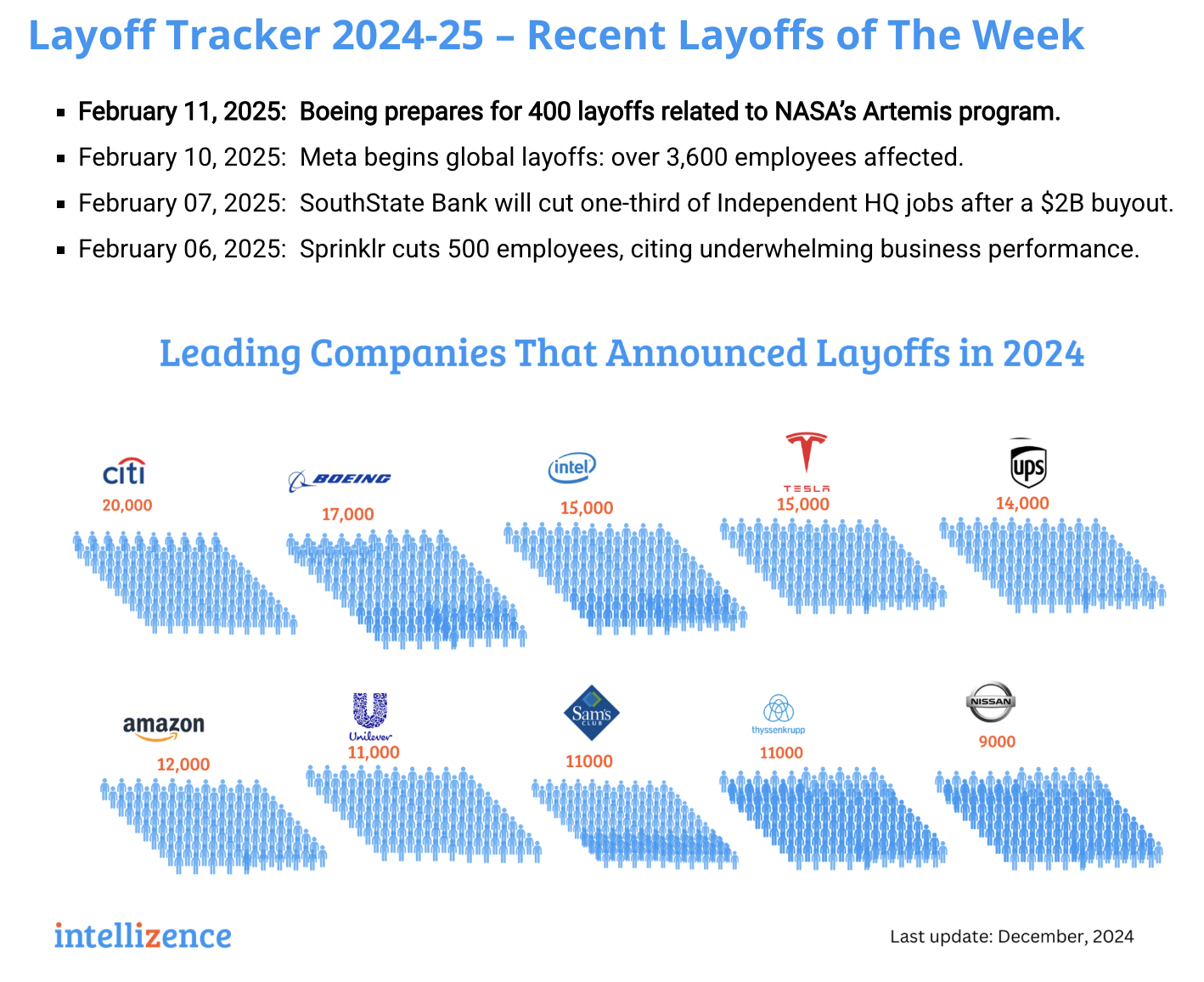

For example, we're seeing the number of corporate layoffs increase. Just this week:

- Chevron announced laying off 20% of its global workforce.

- Meta announced the layoff of 3,600 employees

- Google offered 25,000 voluntary redundancies to staff in its Platform & Devices business.

Here"s Intellizence with more:

This is something to watch…

For example, if interest-rate-constrained consumers are spending loss – facing reduced fiscal liquidity — then expect growth to slow.

As for me, I will be keeping a close eye on the quarterly year-on-year change in Real PCE.

That"s the engine of the US economy… the consumer.

For me, if I see Real PCE drop more than 2% year-over-year (on a quarterly basis) – yes – expect a growth scare

February 13 2025

Putting it All Together

We started this year with the market pricing in only "good things". For example, we had:

- A Fed ready to continue its easing cycle;

- A business friendly administration looking to cut taxes and lower regulation; and

- The promise "limitless" returns from AI

Investor expectations were very high – evidenced by the various valuation multiples they were willing to pay (whether it was P/E; P/FCF; EV/EBIT etc)

Traders were all leaning to one side of the boat.

However, shares prices have lost all momentum the past 12+ weeks. They have barely made any gains since Trump won office.

What"s changed?

From mine, this is due to the "anti-growth" policies and the uncertainty.

They are offsetting the two potential tailwinds (i.e., tax cuts and deregulation)

Uncertainty causes investors to pullback.

And should more data indicate consumers are slowing their spending (perhaps more fearful of losing their job) — a growth scare could be ahead.