Software: Disruption or Destruction?

- Markets weigh Agentic AI"s threat to traditional application layers.

- Will AI enhance existing workflows or structurally impair legacy SaaS business models?

- From blanket euphoria to strategic redistribution

On the surface, you could be forgiven for thinking the S&P 500 looks composed.

It"s largely flat for the year — maybe slightly negative when you read this — however underneath there is extraordinary volatility.

Nowhere is this more evident than in the software sector.

The speed of the (AI) transformational shift is taking no prisoners on Wall Street.

And whilst it"s true such tectonic shifts will create opportunity, they also create disruption.

The question is whether it"s disruption or destruction?

With declines of more than 50% in some names, the repricing is reminiscent of the early cracks that appeared during the 2000 dot-com unwind.

For example, earlier last year, during the DeepSeek episode, investors briefly questioned whether large language models (LLMs) truly required massive compute spending.

Markets recovered from that panic (for the most part), however now money is asking a different set of questions; i.e.,

What role does agentic AI play in the future of existing software businesses?

Whilst no one can answer that accurately (I will share some expert views shortly), the market generally likes to "shoot first and ask questions later".

Needless to say, software has been shot with both barrels.

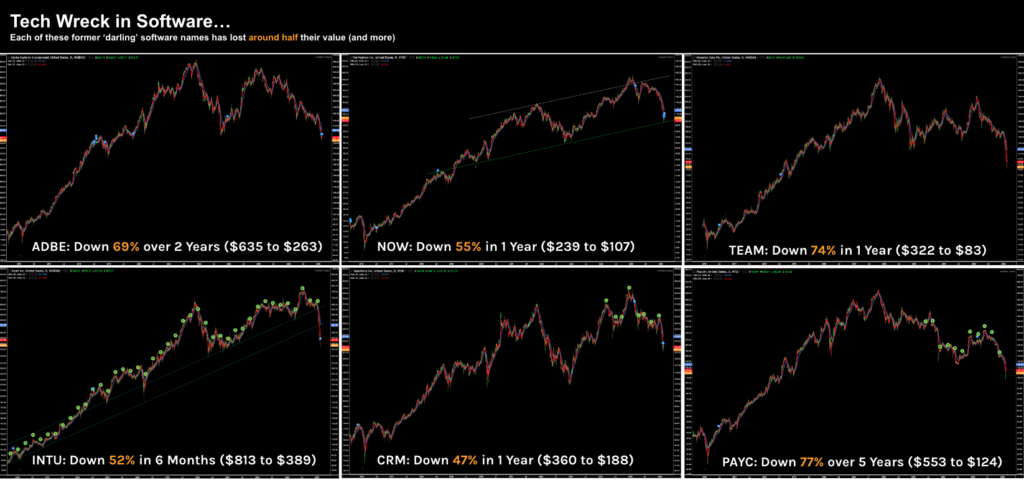

Carnage in Software Land

To appreciate the scale of the drawdown, I will share six weekly charts:

- Adobe (ADBE)

- ServiceNow (NOW)

- Atlassian (TEAM)

- Intuit (INTU)

- Salesforce (CRM)

- Paycom (PAYC)

I chose these names as they are not speculative, loss-making startups.

They are category leaders — all highly profitable and arguably dominant within their respective niches.

What"s more, they compounded wealth for investors for more than a decade. And yet — in recent months — they have been decisively repriced.

Note: this list is not meant to be exhaustive. Names such as LegalZoom.com (LZ), PayPal (PYPL), Expedia Group (EXPE) and Equifax (EFX) are also being repriced.

The point isn"t to catalogue every casualty — it"s to frame one question:

How deep — and how lasting — will AI-driven disruption actually be?

And whilst we can all share our own theories, the market is not waiting around to find out.

What the "Experts" Say…

You will have your own opinion on what disruptive changes AI are likely to bring.

Below I will share both the bearish and bullish case.

Let"s start with the "Godfather" of AI — Jensen Huang, CEO of Nvidia, and his outright dismissal of the bear case:

"There"s this notion that the tool in the software industry is in decline, and will be replaced by AI … It is the most illogical thing in the world, and time will prove itself.

"If you were a human or robot — artificial, general robotics — would you use tools or reinvent tools? The answer, obviously, is to use tools … That"s why the latest breakthroughs in AI are about tool use, because the tools are designed to be explicit."

It"s a compelling argument.

But it"s also worth acknowledging the obvious: Huang has an enormous vested interest in AI proliferating — and in the narrative that AI augments, rather than cannibalises, existing software ecosystems.

A more nuanced perspective is emerging from strategists and sector analysts. Jim Reid of Deutsche Bank observes:

"While the question over the end-winners from AI is unlikely to be answered in 2026, recent months have seen a clear shift in markets from AI euphoria towards more differentiation between companies, and growing concern about its disruption to existing business models."

Put another way — Reid is saying we"ve moved from blanket enthusiasm to selective scrutiny.

Kirk Materne of Evercore shares this balanced view:

"Software is contending with a steadily more bearish narrative, amplified by each new AI release that investors perceive as disrupting software.

The common thread across nearly every software downturn is that the sector tends to outperform the S&P once it finds a bottom.

The harder question is how much pain remains before getting there."

And that"s the tension.

For example, some software products remain deeply embedded in mission-critical workflows.

I personally think ServiceNow (NOW) is a good example.

Yes, there is a sophisticated software layer to what NOW does.

However, the workflows will be much harder to simply replace with a code writing tool.

For the most part, strong competitive moats (such as ServiceNow and possibly Adobe) are unlikely to vanish overnight.

I would feel comfortable nibbling at these names (as I have done with Microsoft and Amazon recently).

Which is why some investors argue the selloff has become indiscriminate.

One portfolio manager puts it bluntly:

"There are (some) babies being thrown out with the bathwater."

That said, we can never try and predict how much further things will fall (hence why I use the term "nibble").

Even market structure specialists see familiar behaviour.

Steven Sosnick — who writes for Interactive Brokers — notes that large secular moves often overshoot — in both directions.

For example, investors may have been overly optimistic about AI"s upside for certain companies. Equally, they may now be overly pessimistic about its downside.

And from a fundamentals perspective, the base case hasn"t collapsed.

Dan Romanoff of Morningstar argues that software fundamentals remain intact:

"We acknowledge the risks, but we believe the fears are overblown."

Again, there are two sides to every coin. Which brings us back to the central issue:

This is not a binary debate about whether AI matters or the impact it will have. The debate is around how value accrues — and which incumbents adapt — versus which ones are structurally impaired.

And the market, right now, is repricing that uncertainty in real time.

Disruption or Destruction?

Three questions come to mind:

- Is the market correctly distinguishing between disruption and destruction?

- Are we witnessing a rational repricing of business models that face genuine existential threat, or…

- Is this another episode where a technological breakthrough triggers indiscriminate de-risking across an entire ecosystem — from incumbents to enablers — before the economic winners are even clear?

Or maybe it"s a bit of each? I don"t pretend to know with any precision.

However, I can offer observations…

Let"s take Anthropic…

The OpenAI competitor (see this clip) has released new models and tools that materially expand what AI agents can do.

I"ve been experimenting with these models and they are truly powerful.

The latest iterations allow users to interact with their computers in natural language — generating code, manipulating files, aggregating data, formatting reports, even handling workflows like expense tracking.

Now these tasks have traditionally sat at the heart of software-as-a-service platforms. Therefore, I can understand why some investors reacted.

For example, if an AI layer can sit on top of existing systems and execute workflows autonomously, what happens to the application layer itself? Is it redundant?

- Do SaaS products become mere data repositories?

- Does the interface — historically the source of stickiness and pricing power — get abstracted away?

That fear explains some of the repricing.

But here"s where the logic starts to fracture…

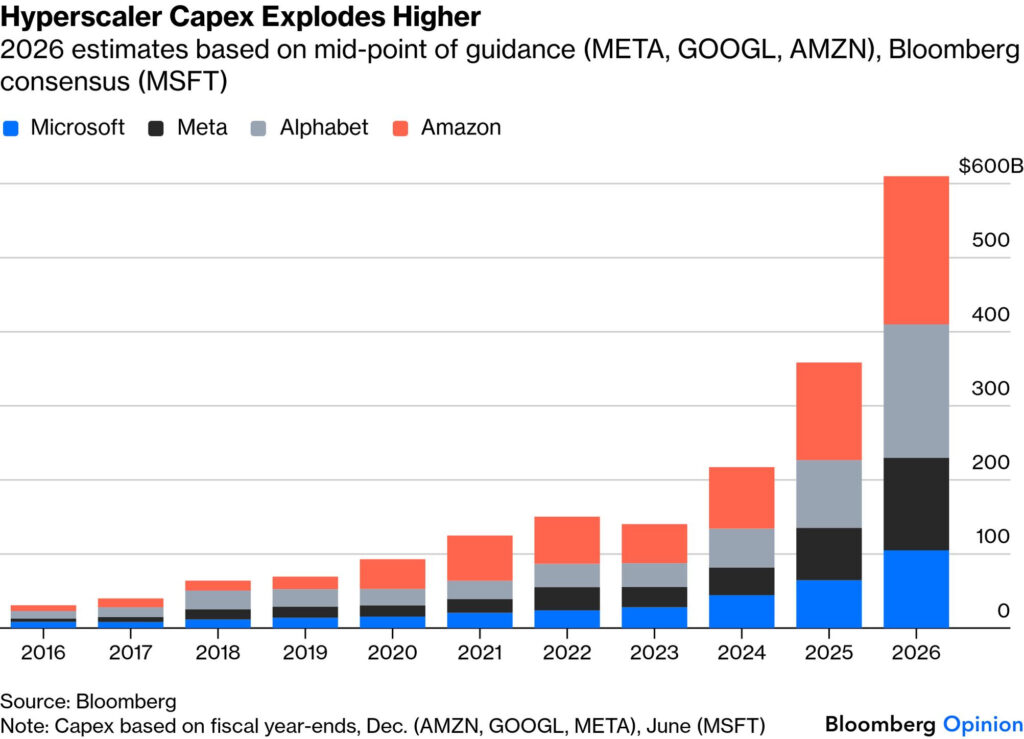

If AI-native companies are about to cannibalise the entire software stack, why are the perceived beneficiaries of that disruption also being repriced?

For example, when hyperscalers reaffirmed enormous AI-related capex plans (generally a sign of explosive growth and demand), the market recoiled.

Is it a fear of over-capitalization?

And does this make investors question the "20%" plus returns on capital in years to come?

Disruption narratives typically create clear winners and losers.

For example, railroads crushed canal operators — but steel demand surged. The internet disrupted physical retail — but logistics, payments, and cloud computing flourished.

It would appear that investors are simultaneously worried that AI will:

(a) destroy the application layer; however are

(b) skeptical that the infrastructure build will generate acceptable returns.

Or maybe this is as simple as indiscriminate (AI) de-risking?

Putting it All Together

Markets rarely move with perfect logic in real time.

Because the threat of "Agentic AI" is the newest (scariest) narrative, it is being overweighted in the price of every software asset, regardless of the strength of that company"s moat or returns on capital.

When uncertainty spikes, correlation rises. When narratives break, investors de-risk first and discriminate later.

Today I see three forces colliding:

- Technological acceleration — AI capabilities are improving faster than expected.

- Valuation compression — software multiples are adjusting to a new risk premium.

- Index concentration risk — technology"s weight inside the S&P 500 means thematic selling cascades quickly.

That does not automatically mean software is obsolete (that"s very unlikely).

And nor does it mean every sell-off is irrational.

The more important question is whether AI is eliminating value — or redistributing it?

History suggests technological revolutions do not destroy entire ecosystems overnight. They compress margins in some areas, expand them in others, and shift the locus of power.

The internet did not eliminate enterprise software. Cloud did not eliminate software vendors. Mobile did not eliminate desktop productivity.

But each transition changed who captured economics.

For example:

- If AI becomes a workflow layer that enhances existing platforms, incumbents adapt and survive.

- If AI abstracts the application layer entirely, then business models compress and valuation frameworks must adjust.

The market today is pricing in uncertainty around that outcome. And uncertainty, by definition, is volatile.

Before I close:

When the top ten stocks in the S&P 500 exhibit 99th percentile correlation, portfolios are more fragile than they appear.

Concentration risk amplifies narrative risk.

Which means this is not just a software debate. It is a portfolio construction debate. AI will reshape productivity.

It will create enormous value. It will likely destroy some value too.

But history tells us that when fear becomes indiscriminate, opportunity eventually emerges.

The harder question — and the one investors must answer for themselves — is whether this is the beginning of structural impairment… or simply the messy middle of transformation.