S&P 500 Down ~9% in 3 Weeks… That’s a Good Thing

- S&P 500 trading largely "per the script"

- Quality companies start to look more attractive

- NFLX and MSFT in focus…

Greetings from a cold and snowy Tahoe…

I"m up here for a few days with friends before I head to Palm Springs.

Snow one week… warm sun the next.

Last night I was re-reading my missives over December and January… and so far things appear to be "trading per the script"

Here"s a few links in case you missed them:

- Thoughts on 2022 with 5 Charts

- Value Over Growth

- Massive Bond Exodus to Start "22

- Earnings: Will Value Outperform Tech?

- Tech Sell Off Not Finished Yet

- Fasten Your Seatbelts

There was a consistent theme with each of these posts:

- Remain patient as quality opportunities are coming

- Bond yields are rising and likely to rise further

- Higher bond yields will pressure tech stocks over growth; and

- The Fed is playing catchup and the market (bonds and equities) are yet to fully understand this

In terms of equities – I was looking for a 10% type correction (possibly) more in the first half of the year.

And if we were lucky enough to see that – it would be a great opportunity to pick up share in quality companies which are profitable

Today you had this opportunity and it"s exactly what I did.

By way of example, I put ~25% of my cash to work today against companies I really like.

For example, Microsoft, Netflix and Amazon offered attractive levels today. Other companies like Nvidia were worth a nibble (certainly not an "all-in" bet).

And whilst I have every expectation there could be more downside over the next few weeks (or months) – that"s more than fine.

Readers will know I am not in the business of trying to pick bottoms. I almost never do. Liars always pick bottoms.

But what I can say is I never buy at all-time highs…. that part is easy.

Let"s start this missive with how the S&P 500 closed the week… because it was painful for some.

S&P 500: Looking a Lot Better

Mainstream headlines might read a "bloodbath" on Wall Street… but it"s selling fear.

And I get it – fear sells – and they are in the business of monetizing your eyeballs.

Reality of course is this market is now looking a lot healthier than it did before Christmas.

What"s more, financial conditions are robust (as I showed the other day).

For me, December was the time to be fearful… not after an ~8% correction.

As a preface, the Nasdaq just posted its worst week since 2020, after dropping nearly 7.6% in the holiday-shortened week. The index is even deeper in correction territory, off 14.25% from its November record close.

Makes sense to me… the Nasdaq was incredibly expensive going into December.

And with FMAGA comprising almost 25% of the S&P 500 – it"s easier to see how this is dragging the broader market lower.

Remember I was saying recently "wait for selling in names like Apple and Microsoft"… well today we got it.

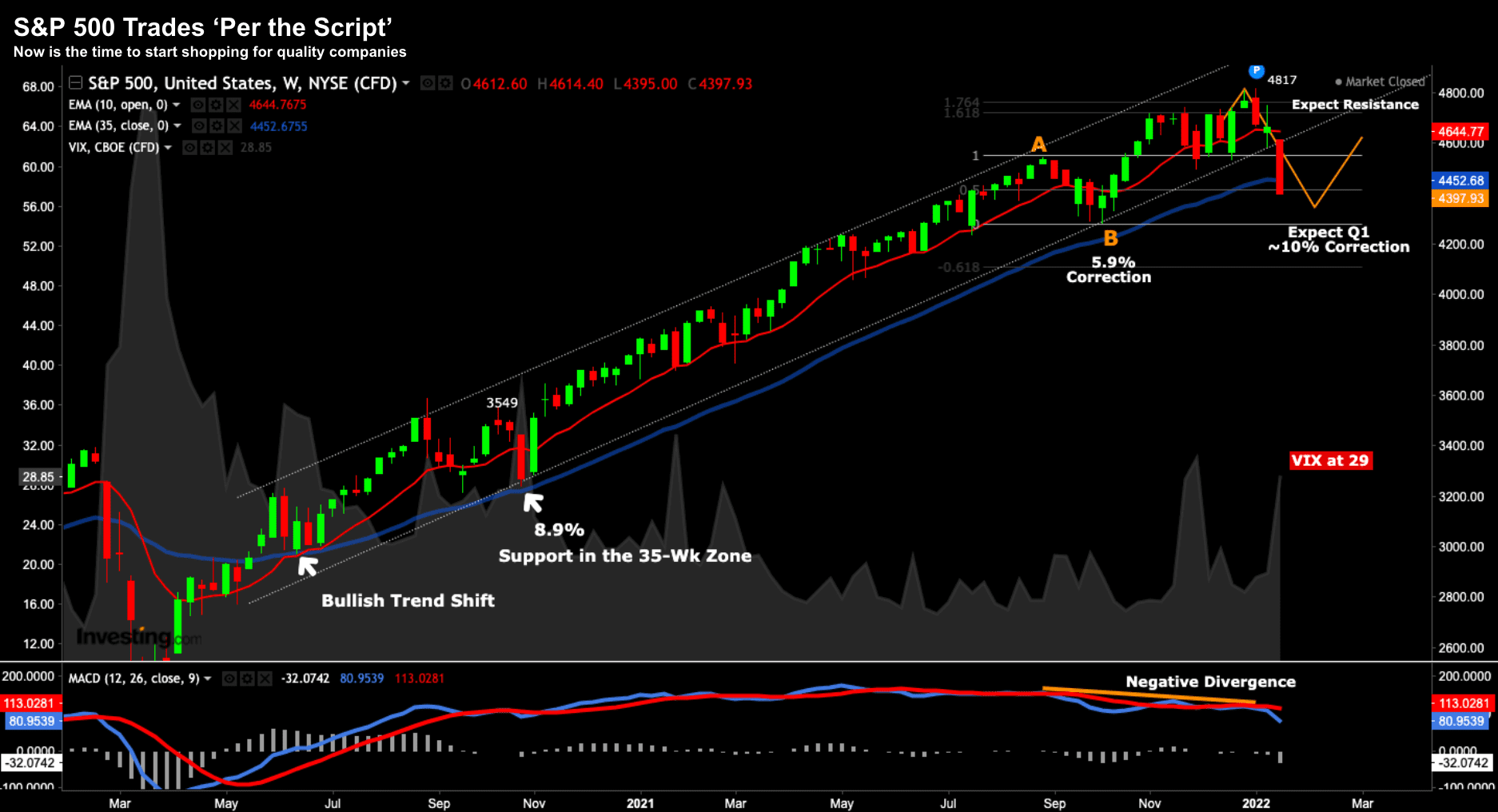

S&P 500 – Jan 21 2022

With the S&P 500 now trading below the 35-week EMA (blue-line) whilst in a weekly bullish trend – that"s a time you want to start shopping.

For example, note the last previous pullbacks.

When things trade around this zone (or slightly below) — markets "generally" catch a bid.

Now it doesn"t always happen that way (I wish!)

Sometimes the previous major low will break (e.g., Point "B" on this chart) and we go much lower.

That"s fine also… as long as you have a solid capital management plan.

But what I see happening is a corrective move of maybe 10-15% before we catch a bid.

After this week"s close – we are down around 8.6%

And whilst that"s a reasonable correction… you need to position this opposite the staggering gains of the past three consecutive years (i.e. 27%, 16% and 28%). This is a healthy development… and once we should expect.

Other observations on this chart are two-fold:

- VIX almost touching 30; and

- Strong negative divergence with the weekly-MACD

My expectation was for a large volatility spike this quarter… guess what… we got it.

This is a great indicator of the panic we saw today.

And this can also be mapped to the number of companies hitting new 52-week lows this week.

But in terms of the MACD – it"s been telling us that momentum was fading.

And whilst I don"t use this as a sell signal in isolation – it"s often a good warning that there is selling pressure ahead.

Time to look at some of the stocks I"ve been watching closely…

Netflix: More Realistic Valuation

There were a couple of notable stocks to call out this week.

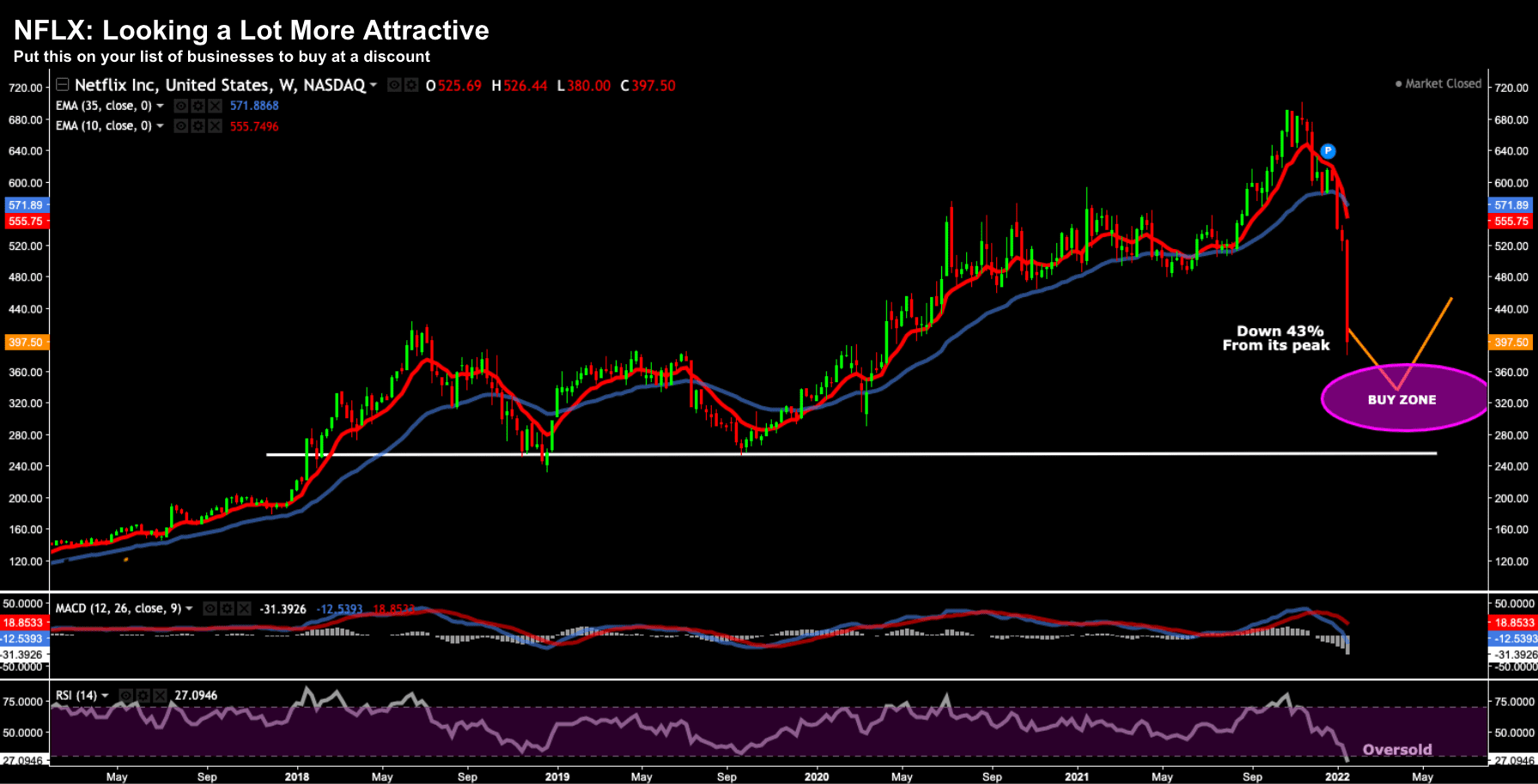

For me, the first of these was Netflix (NFLX).

It lost 22% today on poor forward guidance – whilst beating expectations for the previous quarter.

However today was its worst day since 2012.

And this has every analyst quickly ratcheting their prices lower (which I always like!)

But from mine, the streaming giant commanded multiples which were simply too excessive in recent months.

Put another way, it has to be a damn good business to justify 60x plus type earnings.

Netflix is a very good business… but it"s not 60x good.

But capitulation like today is when I get interested…

Jan 21 2022

As we know, NFLX did exceptionally well during the pandemic… people stayed inside and streamed content 24×7.

But now we are out of the pandemic (more endemic) — these stocks are giving back their COVID gains (along with names like PTON, TDOC and ZM etc etc).

Technically the stock is now in a weekly bearish trend – so expect lower prices.

What"s more, typically after a capitulation day – you will often see it fall for the next 2 days.

But the sell-off now places NFLX at 35x next year"s earnings…

This is better.

Yes it"s still "pricey" at 35x… but it"s now on par with Disney (which I also own) and Costco… and as good as we have seen in a long time.

For me, it"s compelling in the zone of $300 to $350

Today I nibbled at the stock… taking a small amount of equity.

What"s more, I also sold out-of-the-money March $320 puts for ~11% annualized return (i.e. essentially getting paid for standing buy order at $320)

That"s a further 20% below today"s price (allowing for further selling).

We may not see that of course… and I will walk away with 11% on my capital. Not a bad deal.

In closing, I get the margin pressure NFLX reported… and the market is extremely competitive. Heavyweights like Disney, Amazon and Apple are all making big budget plays. That"s great for consumers.

However, NFLX is a clear category leader and the market for streaming content is only growing exponentially (as more folks "cut the chord").

Microsoft: Put this on Your Buy List

The other name I added to (and sold out-of-the-money-puts on) was MSFT.

Personally, this stock is one of the best stocks on the market.

In a word: it"s almost bulletproof.

The only challenge (of late) is it"s been expensive (like everything else!)

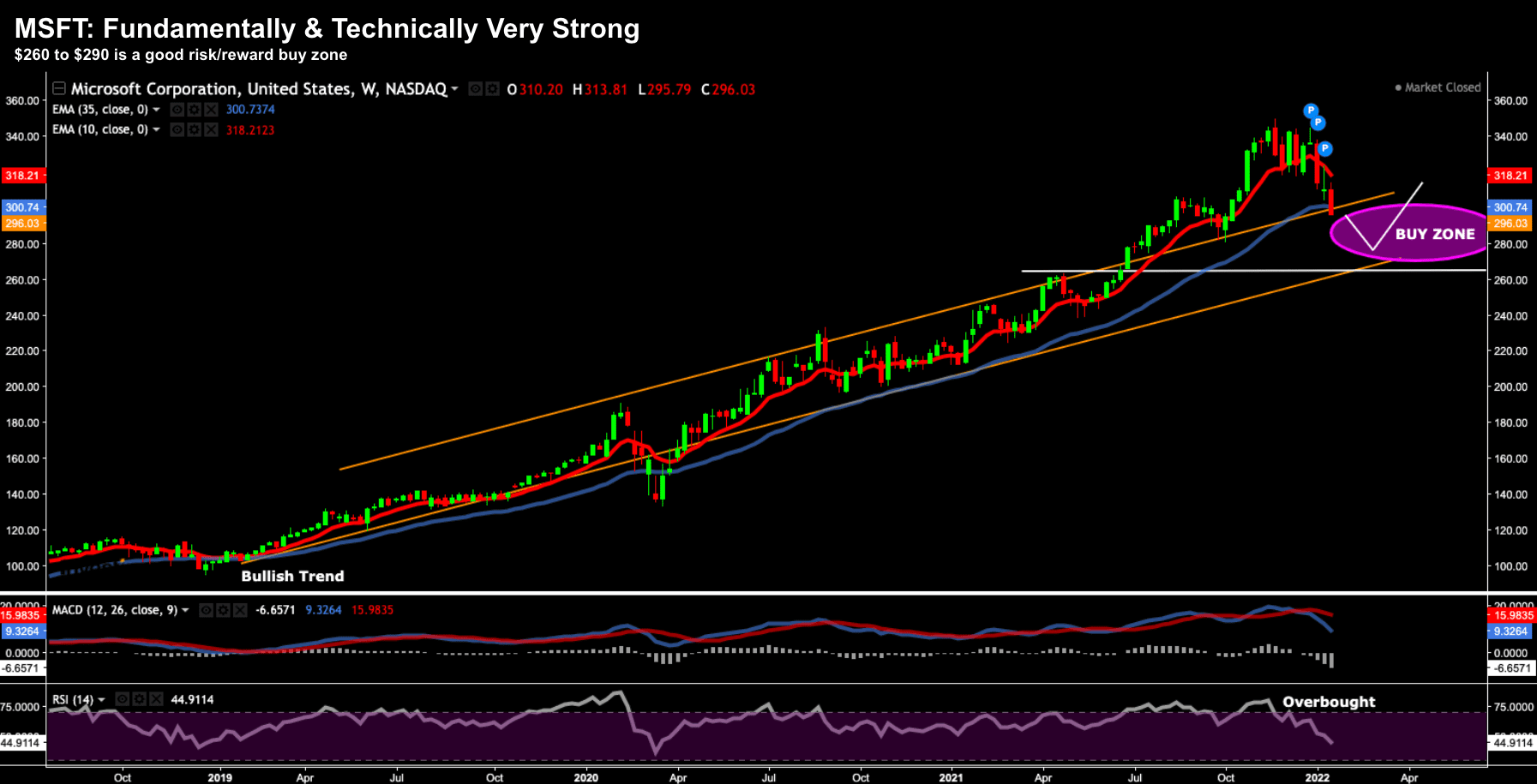

Let"s take a look at the weekly chart:

Jan 21 2022

To be clear, this is already one of my top four key long-term holdings.

It"s very hard to find a better business.

But I own it from much lower levels than today.

Technically I see MSFT pulling back to a zone of $260 to $290…. which is well off its recent $350 high (e.g., ~25% lower if we see $260).

It"s also trading back around its 35-week EMA – which is typically a good risk/reward long-term zone.

Also note the clear trend channel we have seen the stock the past few years…

It broke higher recently (thanks to the Fed"s policies and traders willing to pay "anything" – evidenced by the overbought RSI) – but is looking to come back inside that channel.

Now next week it announces Q4 earnings.

If I were to bet – earnings will be strong. For example:

- Two-thirds of its revenue is now from the incredibly profitable cloud (Azure) business – growing around 40%.

- We are likely to see overall 17-18% revenue growth for the foreseeable future; and

- At ~25x forward earnings… this is not a bad deal in the $260 to $290 zone.

Just to be clear, it might fall on earnings pending guidance or a slight miss on growth expectations.

That"s been the theme so far this reporting season.

But I think over the long-term – if presented with a ~20% decline – it"s generally a good time to add to the stock – not sell it.

Putting it All Together…

Things are trading per the script from my lens.

I appreciate this week might have been rough pending how you are positioned.

Personally I had some losers but I also had some winners.

But what made me really smile was getting into some quality names (and also selling some out-of-the-money puts) on names that I like.

Call it patience being rewarded.

I still believe there is every chance the market moves lower next week.

And who knows, perhaps the Fed delivers another surprise and the market takes another (big) leg down?

In my experience, big down days like today are followed up with more selling.

Just on this, a good rule of thumb for capitulation days is the "3 day rule".

Always wait 3-days after the first day of capitulation. That generally sees things shake out a little.

For example, you might get names like NFLX and MSFT cheaper again Monday.

It would not surprise me.

But I do think we are getting closer to some attractive levels in quality tech…

However, for companies that I call "low-or-no earnings" (those which trade on revenue multiples) — they are in for a long rough ride.

Have a great weekend all…