Stunning Intraday Reversal… What Does It Mean?

- Short covering rally? Or genuine buyers?

- Why aren"t bonds catching a bid on Ukraine?

- Real 10-Yr Yields highlight the inflation problem

Before trade opened today – Dow Futures were down some 800 points.

The unprovoked attack on Ukraine from Russia sent shockwaves through global markets.

The Nasdaq was lower by ~3%… European indices cratered.

However, by the end of the US trading day, the Dow had swung to the tune of 900 points.

It was a stunning reversal.

But market"s really accelerated post Biden"s speech on the next wave of sanctions against Russia.

However it was perhaps what he didn"t say…

In this instance, the President said there will be no sanctions on any Russian oil or gas (Putin"s primary income source).

Why not?

Putin is probably making more money on oil trading above $90 than what he might be "losing" with so-called "tough" sanctions.

This sent markets soaring… with oil losing $10 p/barrel (after trading over $100 overnight)

The Nasdaq staged an incredible ~7% reversal – led by big tech.

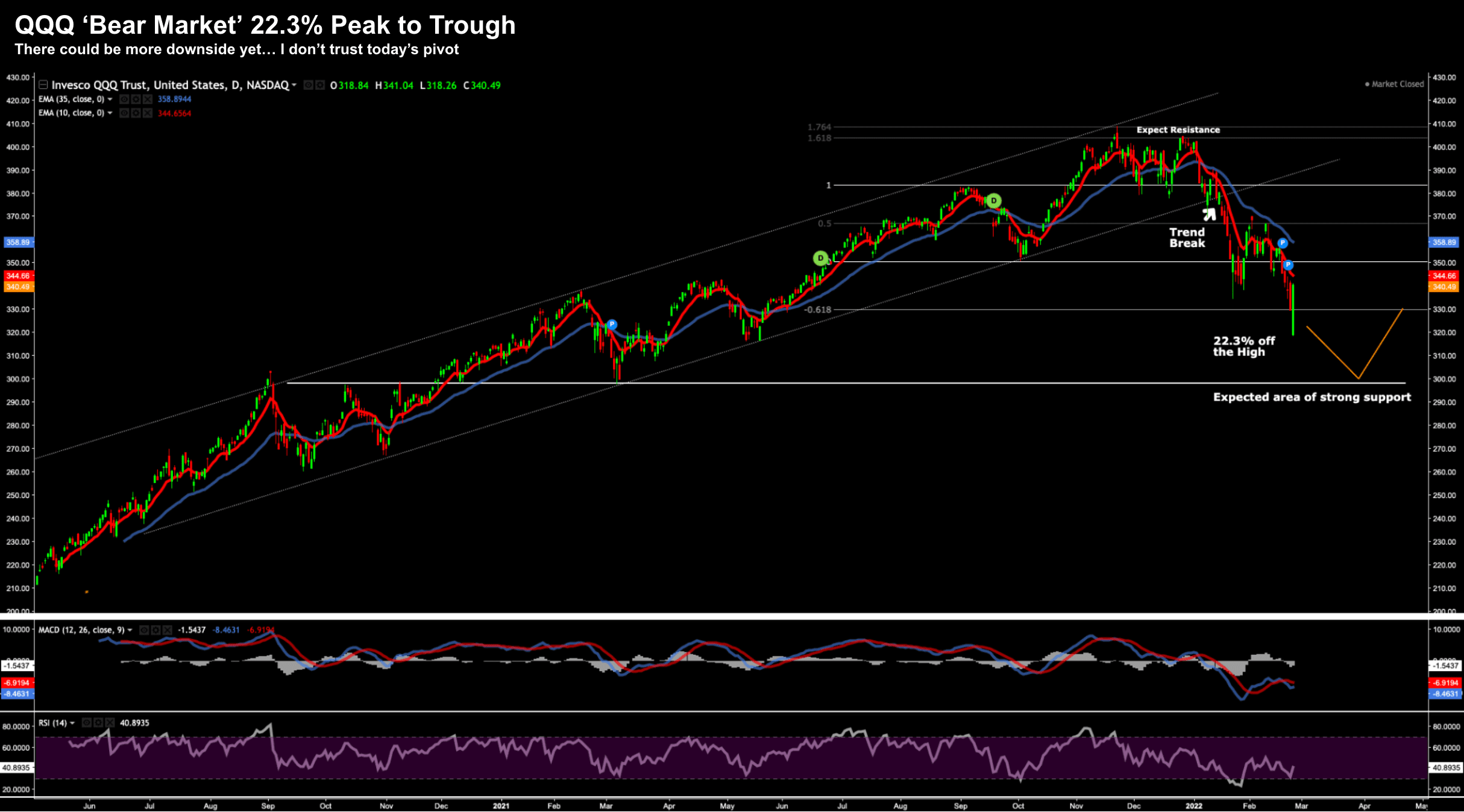

Below is the daily chart of the ETF QQQ – note the most recent large green candle.

A couple of important things to highlight:

- The near perfect trend channel for the QQQ ETF over the past 2+ years.

- That channel broke in January – forming a new bearish daily trend

- The ETF is now 22.3% off its all-time high – now a "bear market"

The ETF opened at 318 (a level not seen since May 2021) to close at 340.

But here"s the thing:

Days like today are not necessarily indicative of a bottom.

They tell me there"s a ton of uncertainty.

And if anything – we saw a lot of short covering in names that have been beaten down.

It"s still premature to call a market bottom.

One hot night doesn"t make a summer.

We are closer – but there"s nothing to say tomorrow may not see markets give back some ground.

I also don"t think now is the time to run for the exits.

If nothing else, the US economy remains on solid footing.

For example, there are 1.6 open jobs for every person. That"s hardly recessionary.

Consumer balance sheets are very strong (as banks reported); and there is ample liquidity in the system.

The economy may be slowing… but it"s far from receding.

10-Year Treasury Tell the Story

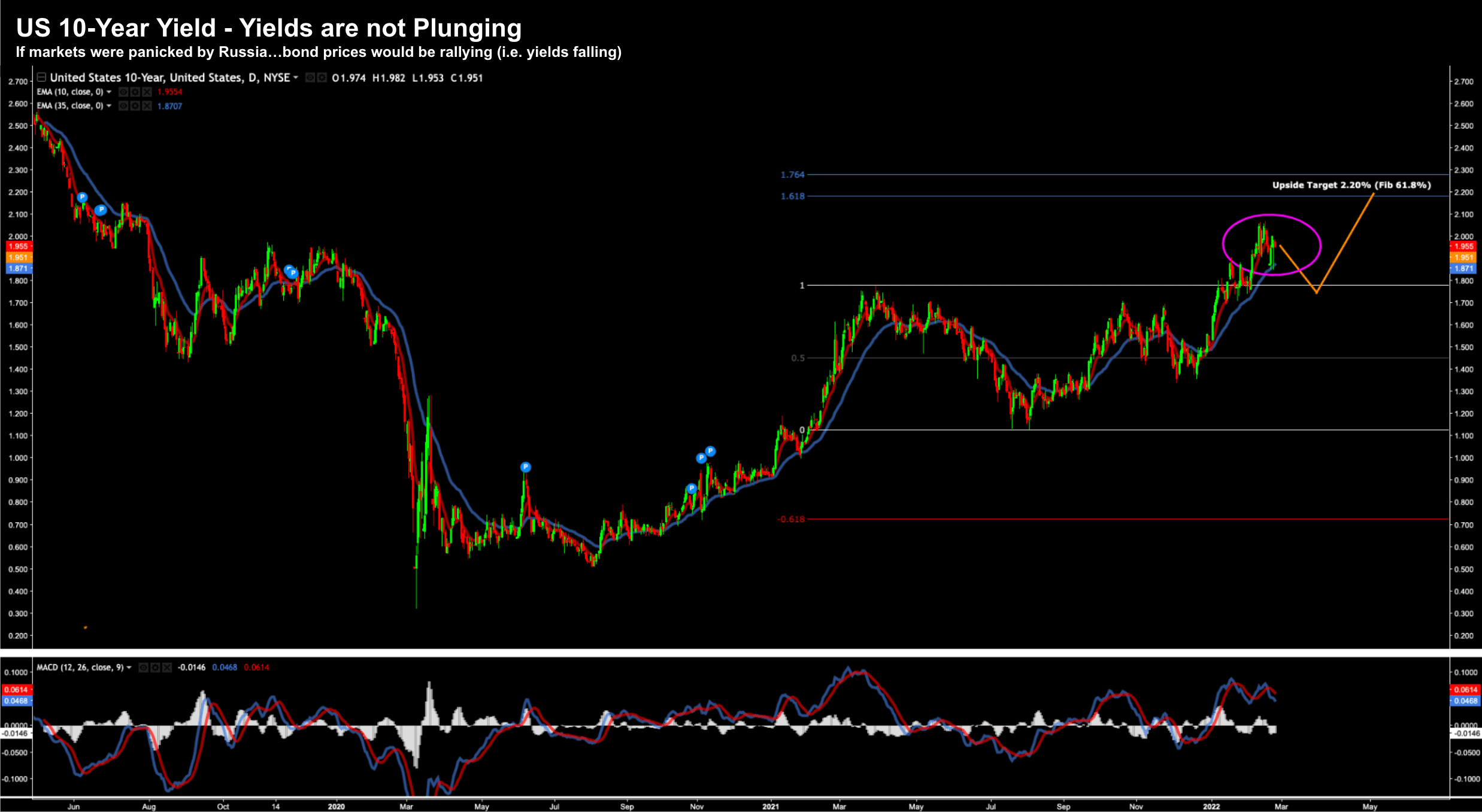

Whilst mainstream headlines will talk about the price action in equities – treasury yields tell the story.

For example, below is the US 10-year yield daily chart:

What the daily chart shows is how these yields have barely moved post Russian"s aggressive invasion.

Gold caught a bid (although pulled back sharply today) – however 10-year bond yields are holding above 1.95%

Why?

Typically in times of heightened geopolitical uncertainty and risk – investors will rush to the safety of US treasuries.

This is typical of what we see.

Not this time.

For those less familiar, in times of panic bonds are bought and their yields fall.

This hasn"t happened.

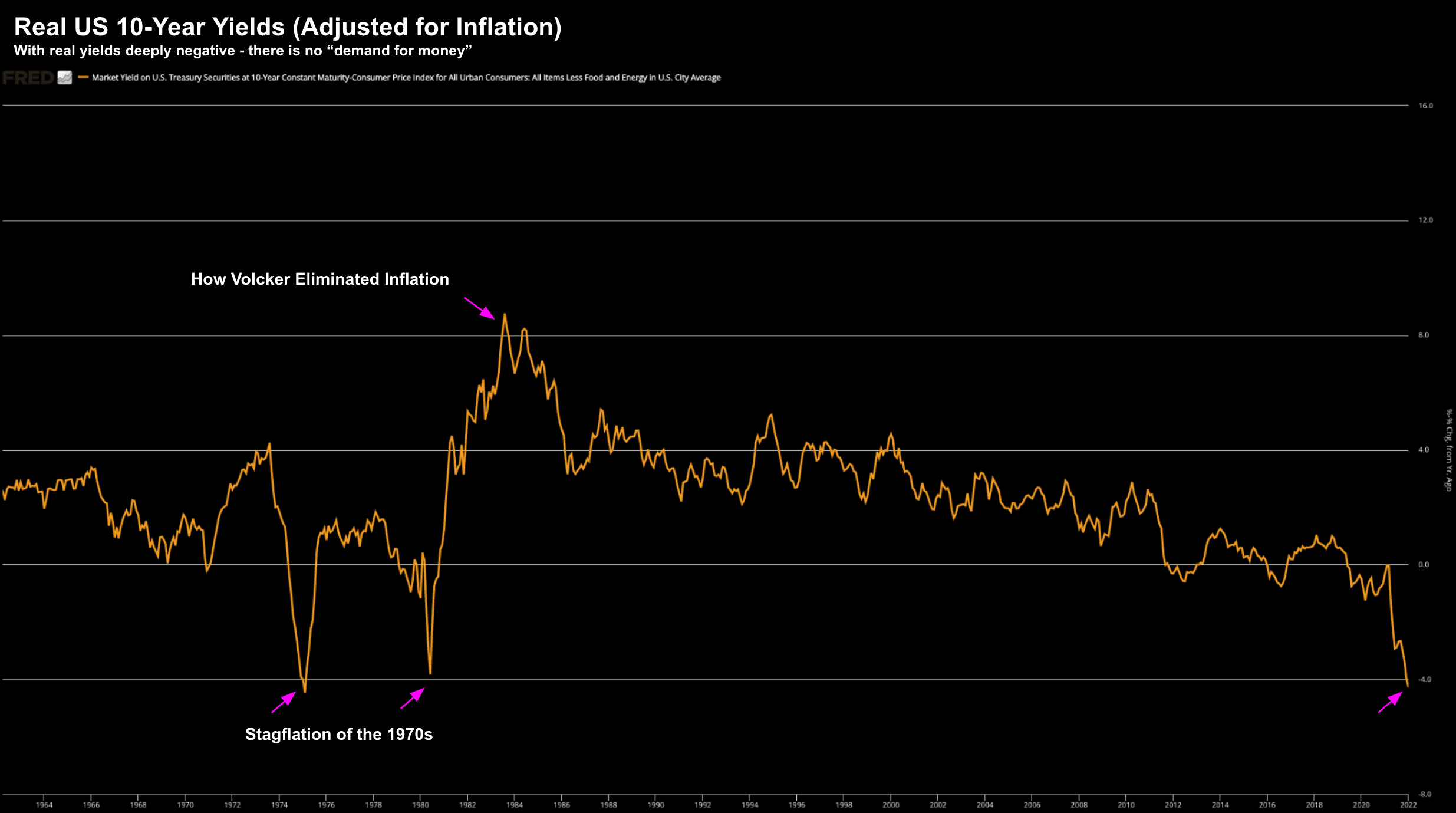

Real 10-Year Yields Deeply Negative

What"s also worth noting is how deeply negative real yields are (i.e., nominal yield adjusted for inflation).

This is what provides the "gasoline" for the inflation fire.

I talked to this the other week…

In short, when the return on cash (and/or cash equivalents) is deeply negative – it destroys any incentive to hold cash.

That is, you eliminate demand.

Take a look at this chart…

From mine, until we see real yields trading above that of inflation… the Fed will continue to have a problem.

But here"s the rub:

With the added Russian / Ukraine uncertainty – Powell will most likely pander to the market and raise rates only 25 basis points in March (and not 50).

This will do nothing to curb inflation.

And neither will the next 4 or 5 rate hikes.

The Fed have a choice:

- appease markets and the economy by taking a "tepid" approach to rates and the balance sheet; or

- fight inflation head-on by meaningfully addressing the supply / demand equation for money.

My guess – it will be the former.

And it will be a mistake… with CPI to exceed 8% in the months ahead.

Putting it All Together…

Today"s reversal didn"t convinced me the bottom is in.

It could be… but I need more.

If anything, I saw short covering in deeply oversold (higher multiple) names.

Take the ARKK ETF – it surged 8% (after being down 6% at the open).

ARKK owned stocks such as Tesla, Teladoc Health and Roku all ripped more than 10% intra-day.

But there"s more work to do before we repair the technical damage on the chart.

That doesn"t happen with one "positive" session…

The good news (and it is good news) is we are closer to the bottom.

The longer-term upside is now looking more attractive against downside risks in quality (cash producing) names.

For example, the QQQ fell to 22.3% off its all-time high.

This is a meaningful correction (and overdue).

Stocks like Apple, Google, Microsoft and Amazon were all on sale. I would recommend picking some up if you don"t have any.

I added some Shopify today at ~$590. It was a small portion of my portfolio (1%) – but worth adding to.

Keep your pencils sharp… there"s opportunity in quality names.