The Punishing Price of Missed Expectations

- Why things inevitably revert to the mean

- Facebook and PayPal punished on weak guidance

- Google reports a record year… the stock surges

My last post suggested the selling probably isn"t over yet…

And to that end, patient investors will likely get another "bite of the cherry".

It was well timed – as many tech stocks saw a fresh wave of anxiety today.

And I think we see more tomorrow with Facebook"s news (more on that in a moment).

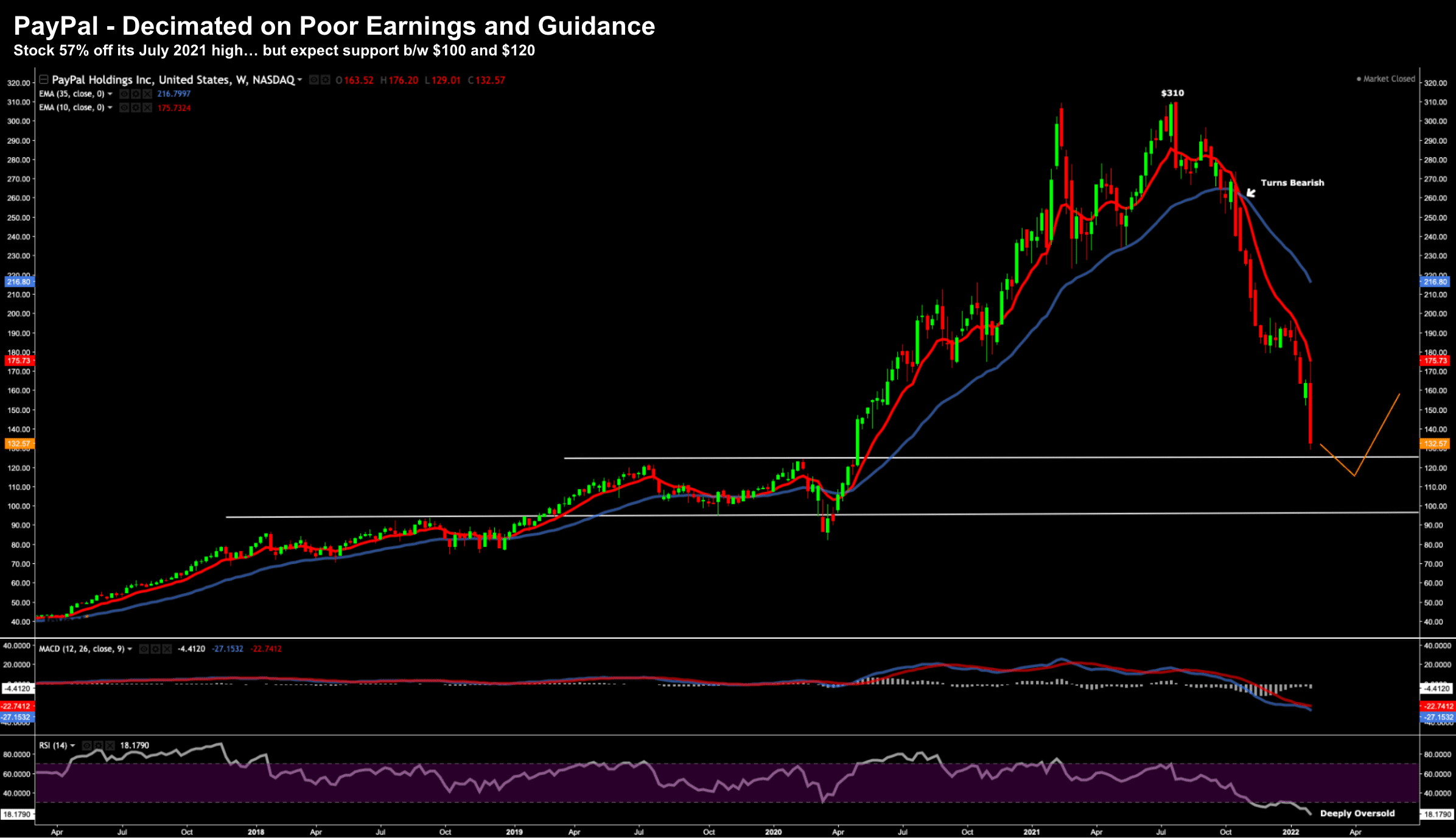

But let"s start with payments leader Paypal.

Awful.

In full disclosure, I own Paypal and it represents about ~2% of my portfolio.

It"s not a big position… but a position nonetheless.

It was smoked to the tune of ~25% on poor quarterly earnings and weak forward guidance.

The stock is now 57% off its July 2021 high (and trading back to a price I originally paid)

PYPL – Feb 2 2022

For what it"s worth – if you don"t have a position in this stock – it"s now starting to look reasonable.

But it could easily trade lower (don"t try and pick bottoms)…

What I can guarantee you is you are not buying at the high (unlike some poor investors)

But if your view is long-term, then I think you can start wading into this stock.

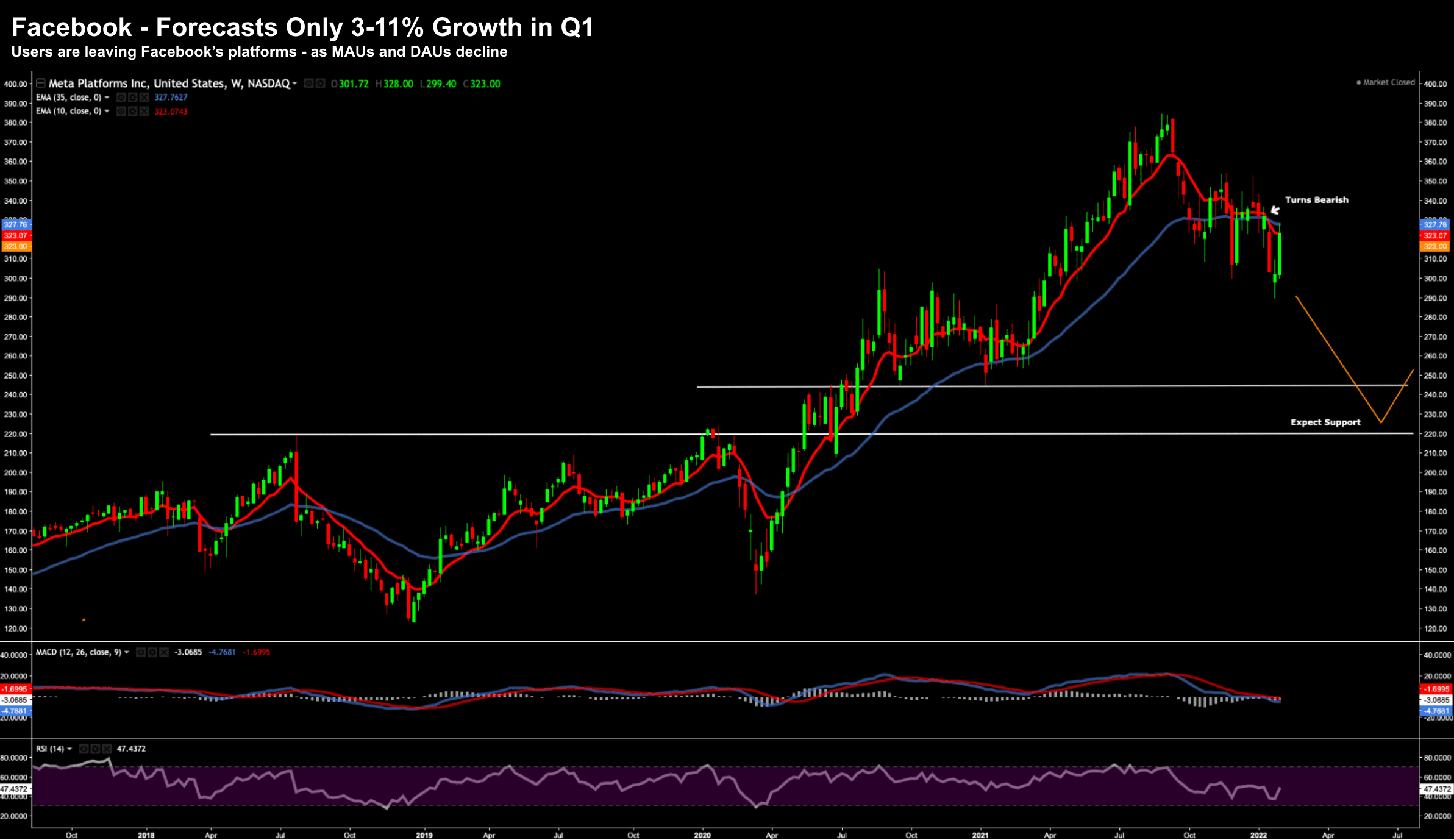

Now let"s turn our attention to the other train wreck… Facebook (or Meta Platforms)

It announced Q4 earnings after the bell and it wasn"t pretty.

The stock is down over 20% (hence why we will see a softer market tomorrow)

Q4 earnings missed expectations ($3.67 EPS vs $3.84 expected) – whilst only offering 3% to 11% revenue growth for the Q1 2022.

It was a disaster on every level…

They also reported a decline in their Monthly Active and Daily Active Users (MAU"s and DAU"s) — not something a "growth" stock should ever report.

Facebook traded as high as $328 today… but is expected to open tomorrow around $250 (a drop of ~24%)

FB – Feb 2 2022

Here"s the key metrics:

- Q4 Revenue: $33.7B vs $33.4B expected

- Q4 EPS: $3.67 vs $3.84 expected

- MAUs 2.91B vs 2.95B expected

- DAUs – lost 1M DAUs in North America

- Operating Margins: 45.5% last year vs 37.5% this year

The company talked to headwinds such as iOS privacy; inflation and supply chain impacting ad-spend; and foreign exchange impacts (i.e. a stronger dollar)

There is very little to like about these numbers… horrible!

However what PayPal and Facebook suggest is you simply cannot miss and/or guide weak in this climate.

If you do – your stock will be crucified.

Put another way (and repeating what I said heading into earnings) – stocks were priced to perfection.

And in the case of growth stocks… it was beyond perfection… it was irrational exuberance in many instances.

And whilst I think both these stocks are excellent businesses (e.g., strong operating margins, leading market positions and the size of their respective user base) – they are navigating through some difficult times.

And both deserve a market premium…

However, investors were simply chasing these (and other stocks) at any price.

Wrong move.

They were beyond extended.

But now with the stocks correcting anywhere between 30% and 60% – it could pay to start taking a look if you don"t already have a position.

Just take into consideration they could easily trade lower in the near-term – as the next 6-12 months will likely be tough going.

Google Delivers in Spades

As regular readers know, the largest position in my portfolio (~17% of my total) is Google.

In full disclosure, I work for Google.

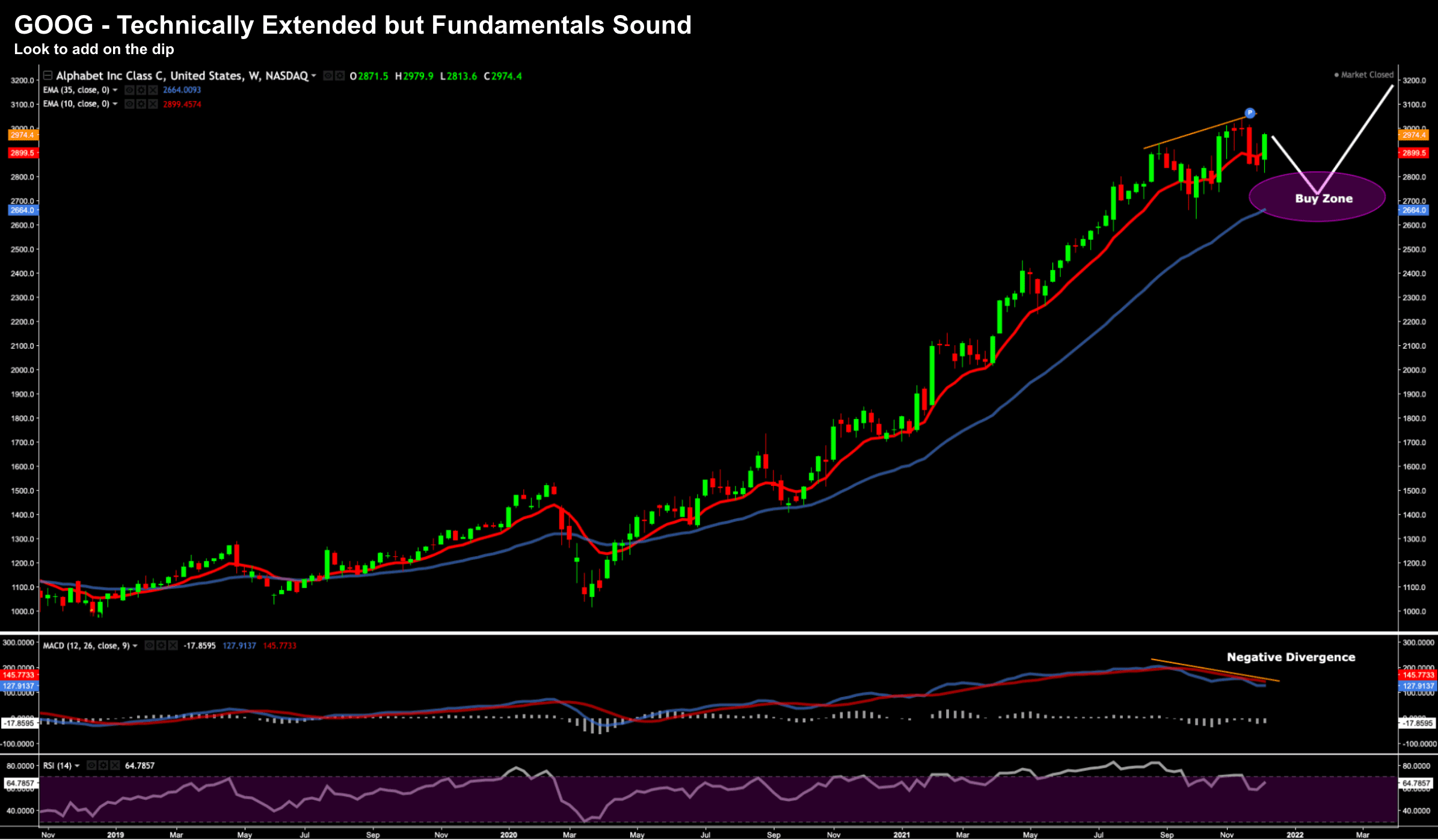

December 8 I said the stock was trading at close to a 25% discount based on discounted cash flow analysis (you can read my analysis here)

Recently Google was caught up in the tech sell-off which saw its shares below $2,600.

From mine, that was a steep discount to its intrinsic value.

Now at the time (Dec 8th) – I said the stock was extended technically – suggesting a likely dip which would represent opportunity:

GOOG -Dec 8 2022

I was looking for a price of around $2600 to $2800

We got it!

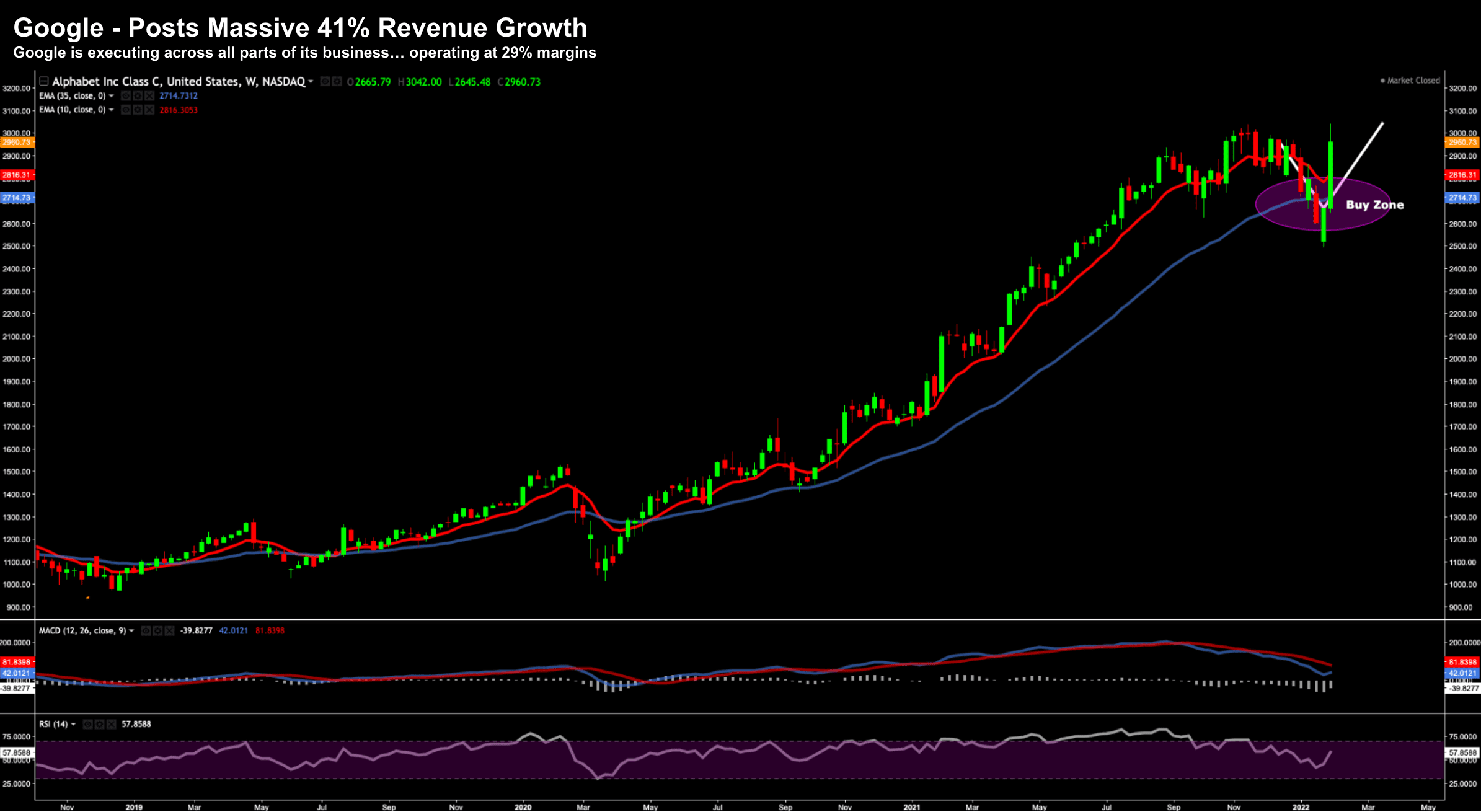

Let"s now update the chart following Google"s latest blockbuster quarter:

GOOG -Feb 2 2022

Here we see the stock traded just below the 35-week EMA zone and screamed higher post the earnings result.

Here are the key numbers:

- Earnings per share (EPS): $30.69 vs $27.34 expected

- Revenue: $75.33 billion vs $72.17 billion expected,

- YouTube advertising revenue: $8.63 billion vs. $8.87 billion expected

- Google Cloud revenue: $5.54 billion vs $5.47 billion expected

- Traffic acquisition costs (TAC): $13.43 billion vs. $12.84 billion expected

- $50B stock buyback over 2021

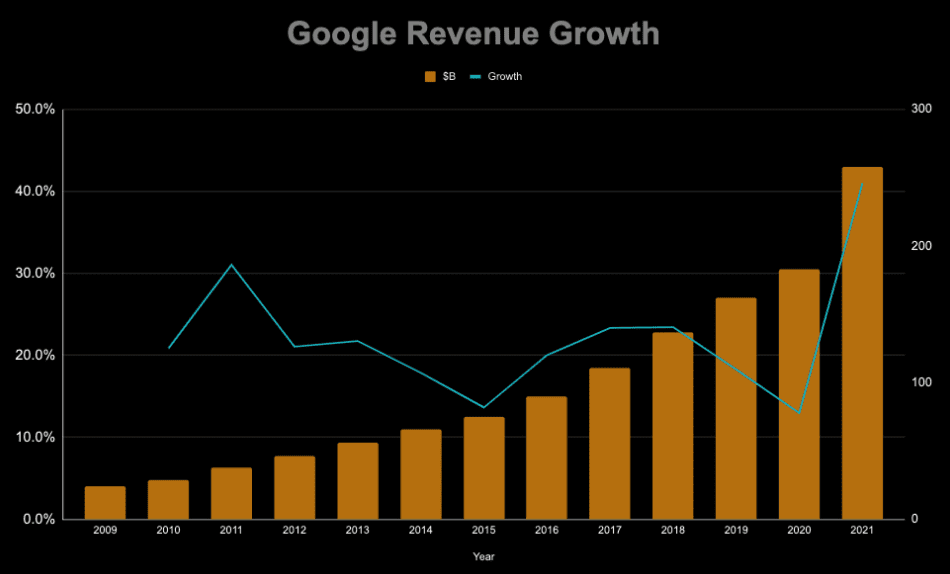

Now take a look at this chart I produced showing year-on-year revenue growth in absolute (RHS) and percentage (LHS) terms from 2009:

2009 to 2021

Here we see the 41% top-line revenue growth – surging past $250B for the year.

Now that"s not 41% revenue growth on say just "$100M"… that is last year"s number of $183 Billion

But you know what I like most?

The $67B in free cash flow – which has now bolstered the balance sheet to a whopping $145B (exclusive of expected cash generated for 2022)

Yes, I work for Google and don"t want to sound biased.

But even if I wasn"t an employee – I think it warrants a strong position in any portfolio (as does Microsoft, Apple and Amazon)

And credit to you if you bought the stock at a "discount" the past week or so.

Stocks vs Earnings

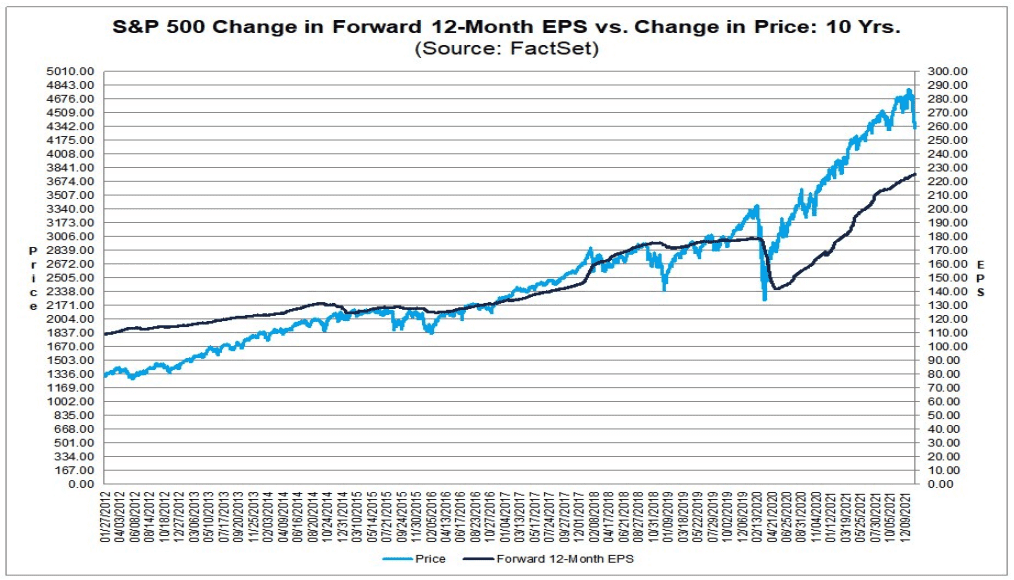

The other day I shared this chart from Factset….

Feb 2 2022

Over the long run – stocks tend to have a strong relationship with earnings.

But at times – they tend to overshoot in either direction.

During 2021 – thanks largely to the Fed with ultra-easy monetary policy – we overshot to the upside.

Too far!

That"s now correcting…

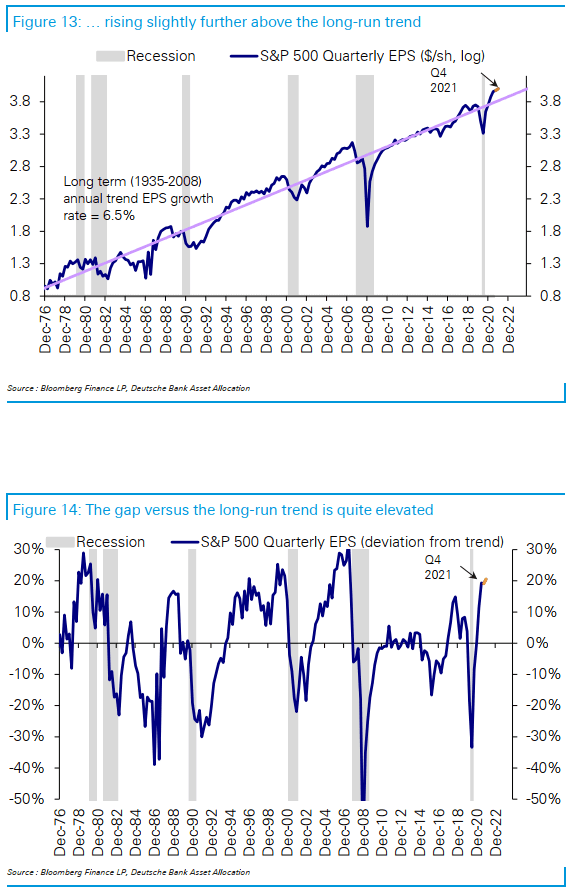

Now today I came across a compelling chart from Bloomberg which echoes this story:

Figure 14 shows the elevation in terms of deviation from the EPS trend (which averages around 6.5% long-term)

Now after a year where forecasts were being constantly upgraded (i.e. rocket fuel for higher prices) — markets are no longer needing to make up lost ground.

Put another way – that trade is over.

Evidenced by what we saw with PayPal and Facebook today – the market is now very quick to punish "misses".

Here"s Bankim Chadha, asset allocation strategist at Deutsche Bank:

Companies that beat earnings estimates have outperformed the headline index by 0.2pp (vs 0.5pp historically, -1d to +1d), while companies that missed have underperformed by a record -4pp (-1.6pp historically).

Similarly, companies that beat on sales have just performed in line with the market (vs 0.7pp outperformance historically) and those that missed have underperformed by a record -2.3pp (vs -0.8pp historically).

My takeaway:

This is a new narrative for the market… where you need to be very careful if you are deciding to pay an excessive premium.

Certain stocks were extremely extended… and many are reverting to the mean.

Putting it All Together…

Any miss in earnings and/or weak guidance in this climate is seeing stocks punished.

Names like PayPal and Facebook have not seen "20% down" days in years.

It just doesn"t happen.

Heck, I can"t even remember when Facebook guided for only 3-11% revenue growth?!

On the other hand, investors will happily pay a premium for a company who is delivering.

Apple, Microsoft and Google are three great examples.

We will hear from Amazon tomorrow…

But if we zoom out – we can now see how things got well ahead of longer-term trends.

I have illustrated this several times using the monthly chart for the S&P 500.

Now if we consider earnings growth… it has averaged 6.5% per year for decades.

And it"s why stocks do well over the long-term.

But when things extend themselves too far above trend (which we saw last year) – mean reversion is inevitable.

And that"s never a bad thing.