- Expect another leg lower

- Big tech sells off on sharply higher bond yields

- Have we priced in all the risks?

Yesterday I explained why a recession in 2022 is unlikely.

It’s possible. But not plausible.

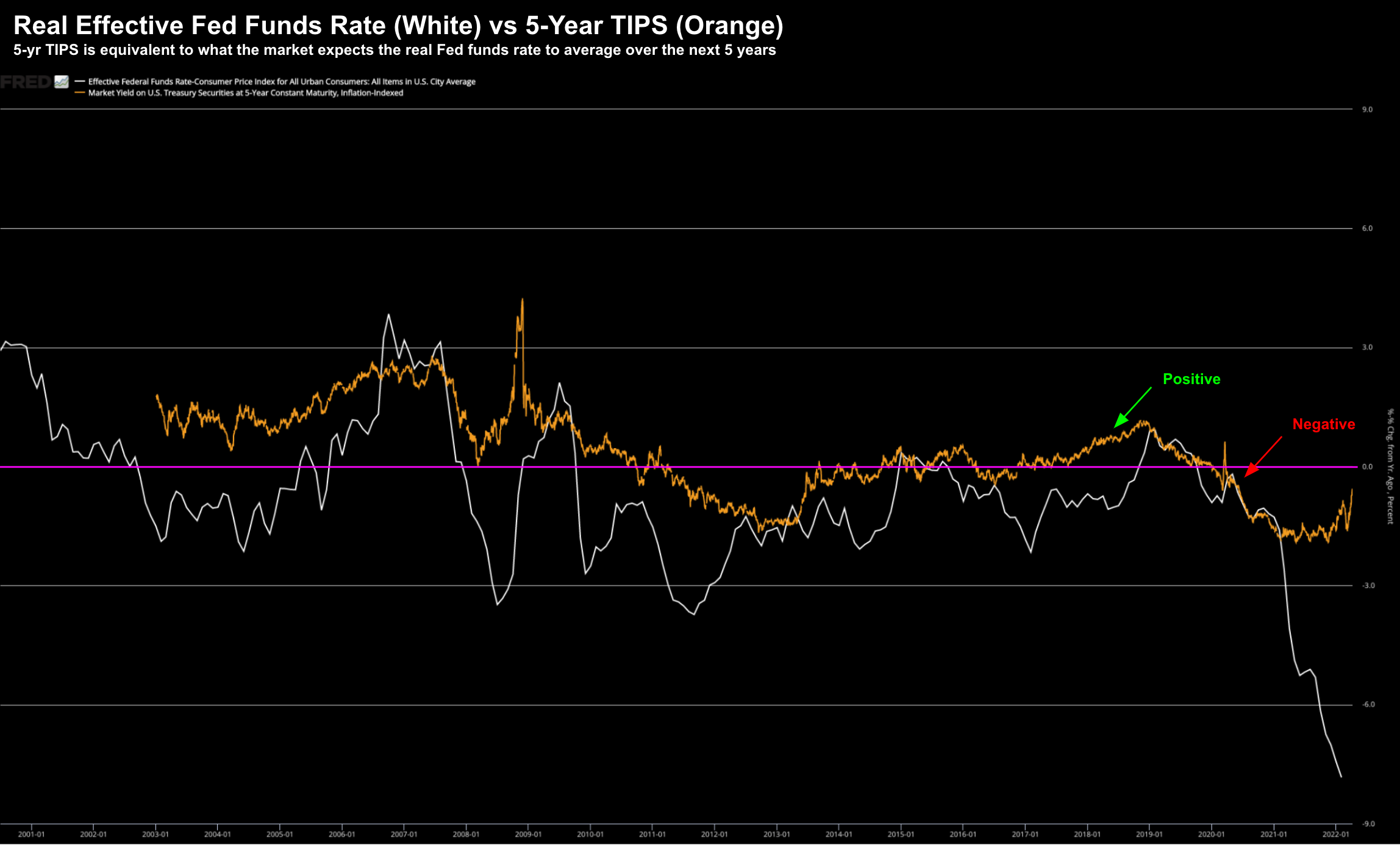

In summary, I was looking a real yield curves (not nominal curves)

From mine, when the real effective fed funds rate (white line on the chart below) rises back above the orange line (5-year TIPS) – we should start our recession clocks.

April 11 2022

Why I favour this chart is these are both real yields (i.e., adjusted for consumer price inflation).

This is what drives real-world consumer behaviour.

And today, your cash is trash.

The Fed hope to change that equation – but it’s going to take time.

But cast your eye back to late 2006…

16 years ago, the effective real Fed funds rate (white line) shot back above the 5-Year TIPS (orange line) which told us the market felt the Fed was too tight.

Today, real yields remain deeply negative largely due to excessively high levels of inflation (we will get the latest read for March tomorrow).

Now as the Fed tightens and sells bonds – real yields will gradually improve.

And hopefully, inflation also begins to moderate in the second half of the year.

But the chart tells me the Fed has a long way to go.

Okay… let’s turn our attention to equities.

They might be falling out of bed.

The last couple of weeks have seen growing selling pressure – particularly in market leaders.

And we might be seeing the pivot I’ve been warning of…

Market Meets Stiff Resistance

Forecasting the direction of the stock market day-to-day / week-to-week is very hard to do.

In fact, it’s near impossible.

That said, over the past 6 months or so I feel things have traded largely ‘per the script’.

For example, the chart below highlights 4 distinct ‘phases’ I nominated:

- Phase 1: Q4 targeting a rally to a zone of 4800 and potential resistance.

- Phase 2: Expecting a 10-15% pullback during Q1/Q2 (and then support)

- Phase 3: Technical bounce from the zone of ~4100 and resistance around point “A” (~4550)

- Phase 4: Possible re-test of the March lows…

‘Phase 4’ may have just commenced… but it’s still too early to say with conviction.

However, technically things are lining up…

Here’s what it looks like in chart form (with the 4 phases labelled):

April 11 2022

The price action of the past three to four weeks has not filled me with confidence.

And whilst the exceptionally sharp rally off the February lows was welcomed…. I was concerned when I saw “Cathie Wood” stocks leading the charge.

In short, market froth was back.

My advice was to use the opportunity to get out of more speculative positions; and/or reposition your portfolio.

For example, consider some of the health care names like LLY and UNH (which I also own)

But of late, the more disturbing sign is we are seeing some weakness in the market leaders.

For example, Apple, Google, Microsoft and Amazon.

Consider the ETF QQQs (a great proxy for big tech)

April 11 2022

First thing to note is the QQQ remains in a weekly bearish trend (i.e., the 10-week EMA is below the 35-week EMA)

The ETF rallied to the 35-week EMA (after being down ~22% off its high) before finding selling pressure.

We are now looking at strong rejection from this zone… where probabilities suggest there’s more downside.

My best guess is we retest the lows of March 2021 – which could be in the realm of 12% lower.

If true, this will be a heavy drag on the broader market – especially if the likes of Apple, Amazon, Microsoft and Google roll over.

That said, if we do see a level of around 300 for this tech-heavy ETF (i.e. 26% off the high) – I would be a buyer for the long-term.

And the Culprit?

It’s not hard to see why there is mounting pressure on high growth / tech names.

Look no further than 10-year bond yields….

They are ripping higher on expectations of aggressive quantitative tightening (i.e. where the Fed pivots to becoming a bond seller – in turn – driving up rates)

April 11 2022

The move in the 10-year has been something else….

In just 6 weeks this has gone from 1.66% to 2.82% – an incredible move.

And anyone with a variable home loan is already paying more than 150 basis points more than just 12 months ago.

If you ask me, this move looks overdone in the near-term.

And here I’m looking at the lower window or the RSI (Relative Strength Index).

Very rarely do we see the chart this overbought before some kind of correction lower.

For example, I’ve highlighted the past 6 times we saw the 10-year this extended…

Not long after, bonds entered a corrective cycle.

I think we will see something similar before too long.

Putting it All Together

Tomorrow we get the latest reading on inflation for March.

Expect a CPI number inching towards 9%.

Producer price inflation is likely to be higher.

Cleveland Fed President Loretta Mester told CBS’ “Face the Nation” on Sunday that she still believes the Fed can get inflation under control without causing major damage to the economy.

Really?

We wish the Fed luck landing the plane softly opposite 200+ basis rate hikes in combination with trillions in QT.

However, Mester added that the COVID lockdowns in China will “exacerbate” the supply chain issues that are contributing to inflation in the U.S

Hmm mmm.

And what about the long-lasting war in Ukraine – what impact will that have on oil prices, specific commodities and food inflation?

For example, I read today one analyst (Baird) downgraded Nvidia (NVDA) on these concerns.

The research firm said the macro field is complicated for stocks like Nvidia…

“For one, recent Covid-related shutdowns in China could create further logistical problems for the company’s supply chain. Second, Russia “likely represents a larger percentage of consumer GPU than the consensus view, driven by both gamers and mining”

The recent embargo on trade with Russia in the wake of the invasion of Ukraine could weaken sales.

And I suspect NVDA are not alone with these types of macro headwinds.

There is a long list of unknowns at present – nearly impossible to calibrate in parallel.

But the tape tells me markets are not comfortable… and the VIX is slowly waking up from being overly complacent the past two weeks.

Expect more selling pressure…