Trading the Pullback

- A Buyable Opportunity

- This correction is likely technical in nature

- All about how fast bond yields rise

Earlier this month (Sept 6) I made a meaningful shift to my portfolio…

Going into September I held 35% cash…

I was mindful of a pullback but wanted some exposure (e.g. 65%) on the likely event stocks drifted higher.

And they did…

However, I lightened my exposure and raised my cash level to 50% earlier this month – the most defensive position I"ve had in more than 12 months.

Don"t get me wrong…

I want to be long this market.

In fact, I think we will end the year higher than where we are trading today…

What"s more, pending what we see from the Fed (and inflation), 2022 feels like it could be a good year.

But I also think we are in the middle of a constructive (healthy) pullback.

Tonight"s post will be brief – as I have explained my thinking in recent weeks.

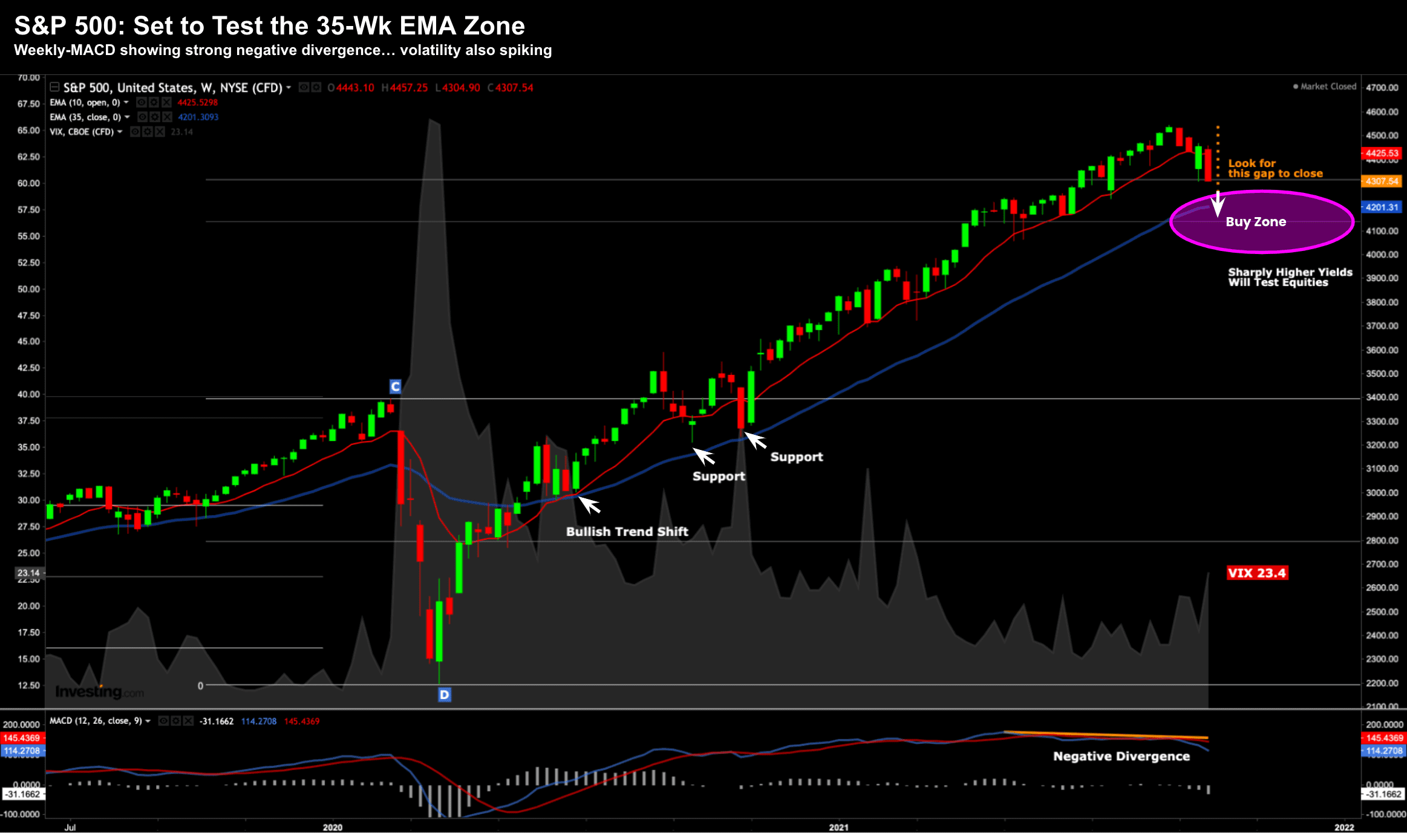

But let"s start with the weekly chart for the S&P 500.

Pullback in Play

Regular readers will know I was looking for the gap between the all-time high of 4544 to close against the 35-week EMA

From mine, if we saw that gap reduce – it would represent a better risk/reward entry point.

And whilst it"s too early to call a coup – things appear to be headed in the right direction:

Sept 30 2021

At the time of writing, the S&P 500 closed 4307.

That is 5.2% off the all-time high.

The good news is we are now only around 2.5% off my target zone (e.g. between 4100 and 4200)

And whilst I could be wrong – there"s a very good chance we see that tested in the next 1-2 weeks.

Here"s something else:

Take a look at the lower window – the weekly-MACD.

Notice how this was forming a series of lower peaks… and is now falling quite sharply.

Now as those "lower peaks" formed, the market was making higher highs. We call this "negative divergence".

From mine, we started to see this between May and July (which was when I first started increasing my cash position)

And quite often – it"s a sign of lower prices to come.

Let"s see how things go over the coming weeks… and whether my more conservative position the past few weeks was the right call.

Again, I"m not calling this a "victory" yet…. as the market will often make me look like a fool!

It"s All About Bond Yields

As I wrote a few weeks ago – there were any number of catalysts to spark a correction.

We had China slowing, concerns of Evergrande default, Washington DC antics, concerns about the spread of Delta… you name it.

For me, the three primary catalysts were:

- Language from the Fed

- The pace of any rise in bond yields; and

- Q3 earnings / Q4 guidance

Some might argue the language from the Fed was hawkish last meeting.

And I get why they would say that…

My counter-argument is they are still extremely accommodative anyway you look at it… despite any plans to taper later this year.

For example, look at where real rates are. They are deeply negative.

That said, Powell"s tone has shifted since then…

For example, the word transitory is used less…

Powell has since described inflation as frustrating… and expects we will see it for longer.

We have also seen bond yields react… moving sharply higher perhaps on the basis the Fed will be forced to act sooner than what the market is pricing in.

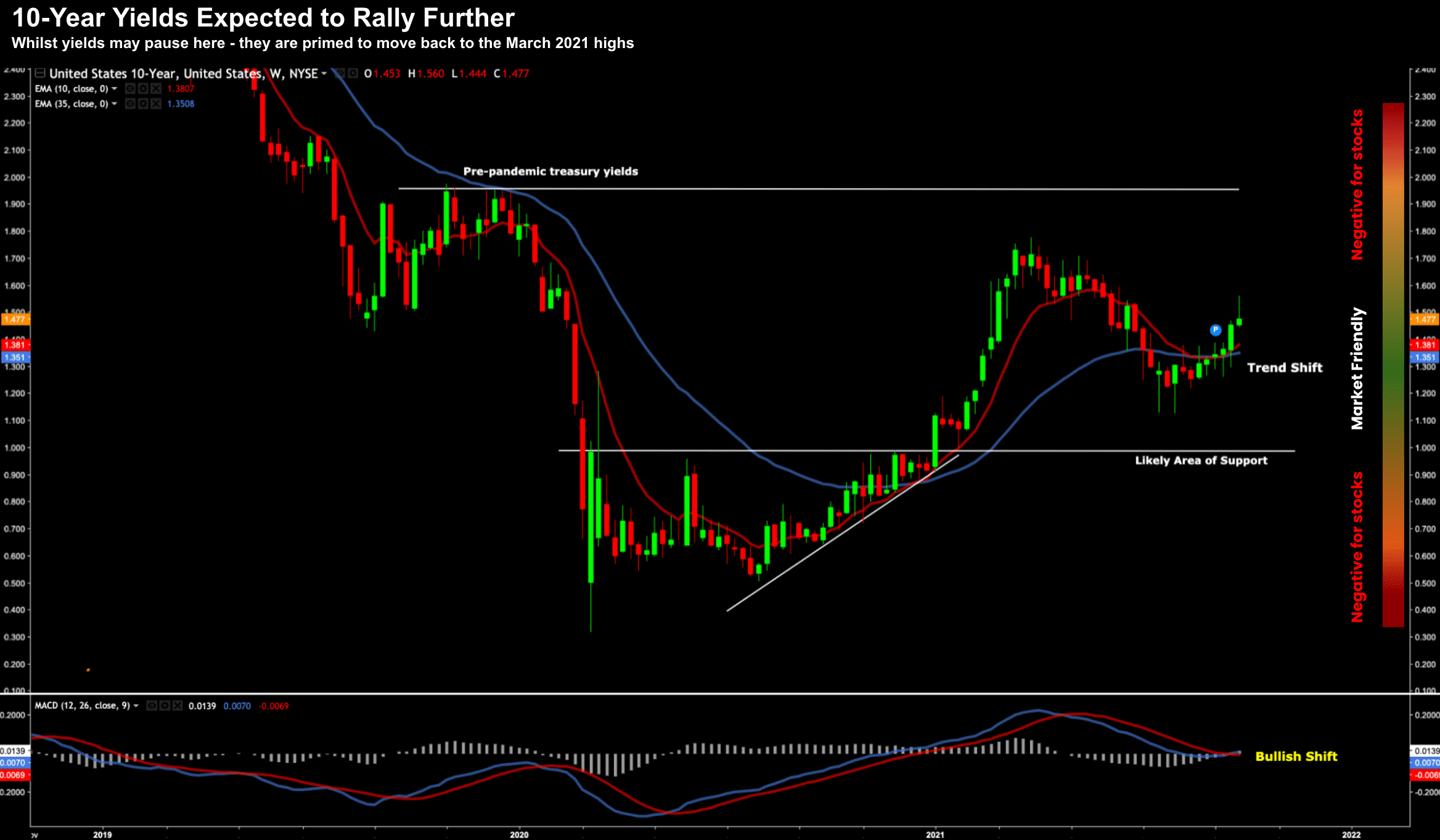

Here"s the weekly chart – with my "market friendliness" barometer on the right:

Sept 30 2021

Now the 10-year has moved a lot in a few short weeks.

As such, in the very near-term I would expect some consolidation – which might appease the market.

But I think yields will simply catch their breath…

For example, my view is they"re now going to re-test the March 2021 highs of 1.75% at some point this year.

In fact, I would not rule out 2.00%

And if we do – we are moving into the "red zone" for equities on my barometer.

That said, it"s far less about the nominal level – it"s all about how quickly we get there.

The move in bonds (for example) is starting to send shudders through the tech… as expensive (quality) names like Google, Apple, Microsoft and Amazon are sold.

And that"s not a bad thing… especially if you are looking to get into these names at (much) better prices.

That"s precisely what I see ahead…

That is, rare opportunities to get into quality companies at a far more attractive levels.

And whilst you might wear a little more pain (e.g. 10-15% more on the downside) – that"s fine.

These are quality long-term plays which deserve a solid place in your portfolio.

Putting it All Together…

September has a reputation of being a bad one for investors.

This month didn"t disappoint!

It was the worst month since March 2020.

Now you can pick your poison as to why… but I honestly think this is the case of the market getting ahead of itself.

Some people will say concerns over China… or a taper tantrum… or Congress failing to raise the debt ceiling.

Who knows? There are probably "ten" other good reasons I have missed.

For me this is technical.

Remember – the S&P 500 is having an incredible year.

We started the year at 3756… which puts the market some 14.7% higher at the time of writing.

If you offered me 14.7% at the start of the year – I would take it.

Right?!

Now my guess for this year was 4200 – good enough for 12%

That guess may prove to be accurate or way off (probably the latter!)

Let me leave you with this regarding the current pullback:

There have been 34 corrections of greater than 5% since 1993.

Now for 31 of those 34 corrections – we were back at the highs within three months.

I think this will be 32 of 35… as I believe this is purely technical and will represent a buyable opportunity.