‘Trump Dump’ Offers Opportunity

Words: 1,165 Time: 6 Minutes

- VIX hits 45…. Buying "Peak Fear"

- Valuations more attractive – but more to go

- Why we could see 4700 on the Index

It"s official….

The stock market is now "on sale".

For those who resisted chasing extreme valuations the past 12 months – your patience has been rewarded.

Valuations have come down.

In turn, the longer-term risk reward is now more attractive than what it was only a couple of months ago.

But these are rare times…

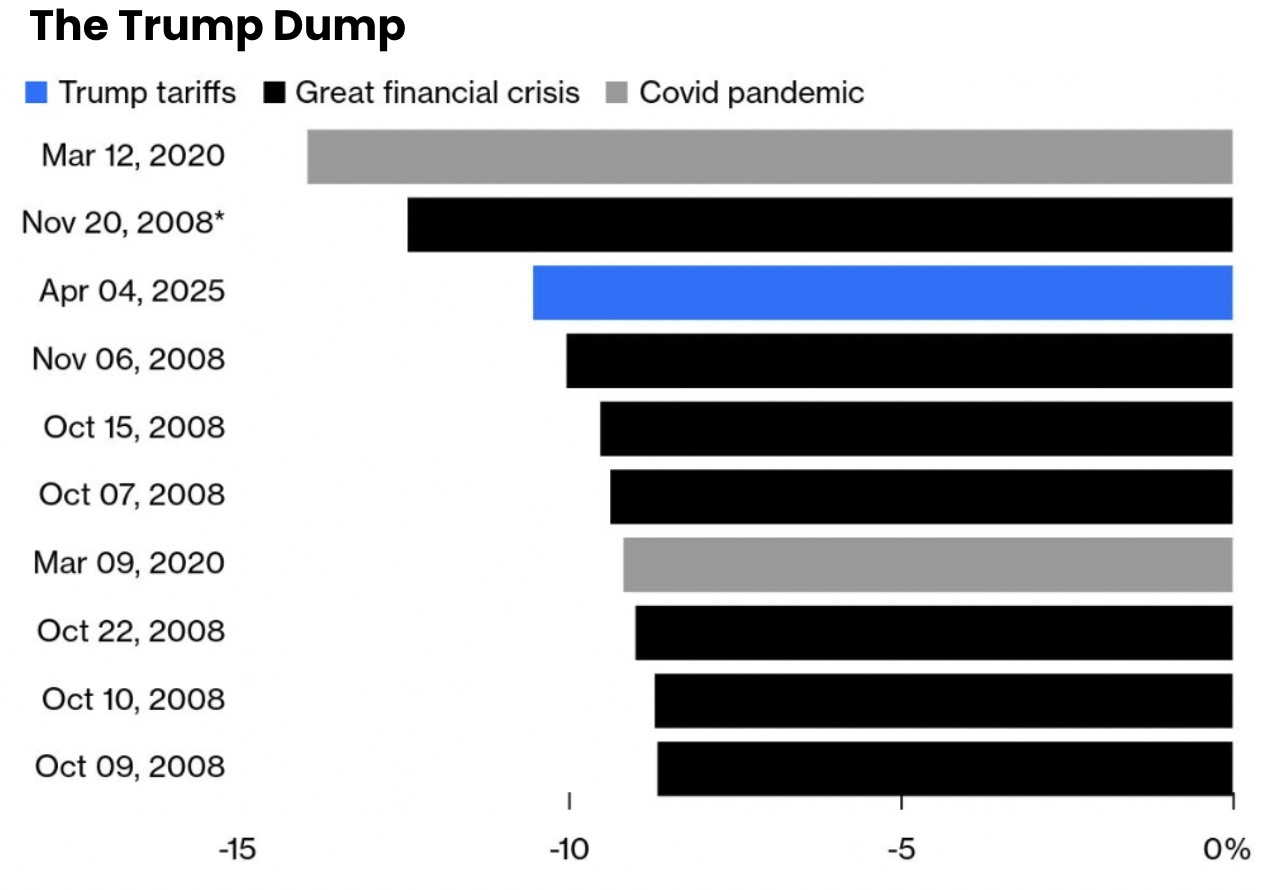

For example, it was the only third time this decade that the S&P 500 shed more than 10% in two days.

And who knows – all going well – we might see 15% over 3 trading days.

That would feel like 1987"s Black Monday.

Very rarely do investors hit the sell button this fast.

Bloomberg summarized the 10 greatest two-day selloffs in this century; and the "Trump Dump" ranks among the best.

Welcome Back Vol – We"ve Missed You!

For several months markets have been extremely complacent about the potential risks (tariffs just one).

For example, as part of this post, I highlighted some of the growth headwinds which were not being adequately priced.

At the time, the post was not widely read:

From mine, there are a host of (growing) risks which jeopardize aggressive earnings growth this year ("Ready for a Growth Scare?"). For example, we have (certainly not limited to):

- Reduced fiscal spend from the government;

- Stubbornly high bond yields (e.g., around 4.50% on the 10-year);

- Risk of higher inflation due to potential tariffs;

- A weary consumer – where discretionary spend is falling; and

- Various growing geopolitical risks

Fast forward a couple of months – and these risks are being reflected in the tape (which I will demonstrate in a moment)

But first – let"s look at how traders hit the panic button.

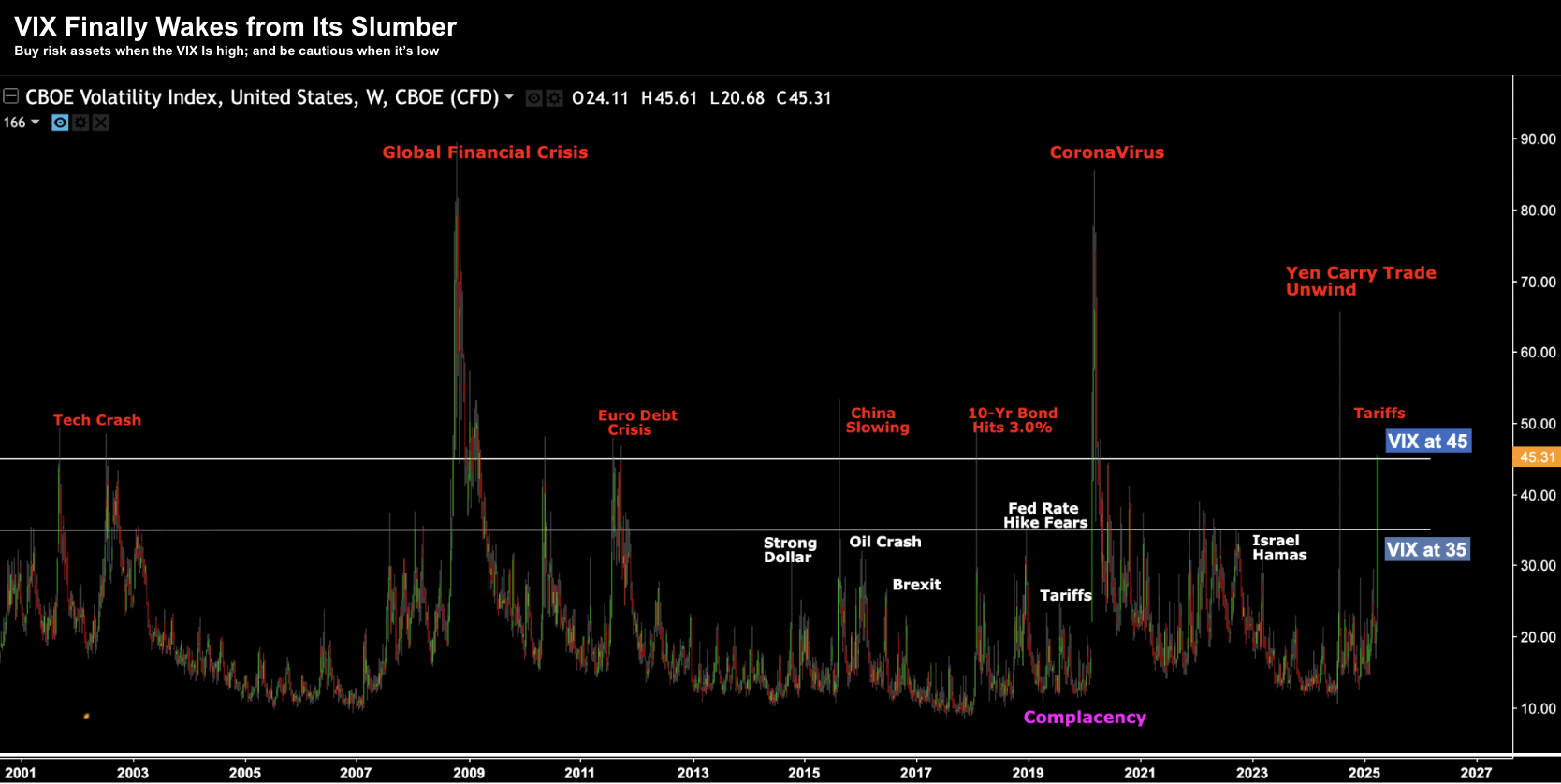

Derived from options prices — the VIX surged to its highest since the worst of the COVID lockdowns – moving past a value of 45x.

Again, this is not something you see too often.

The VIX has traded above 45 only seven times the past 25 years.

However, as this post demonstrates, when the VIX trades at a level of 45 or more (irrespective of the cause) – stocks are generally on sale.

But for clarity:

- This does not mean that stocks will not keep falling (they most likely will); and

- We cannot pick the bottom (and nor does it matter)

I say this because if your timeframe is at least 3 years, buying quality stocks (or the Index itself) generally proves to be a good risk reward bet when buying peak fear (a VIX at 45 or above)

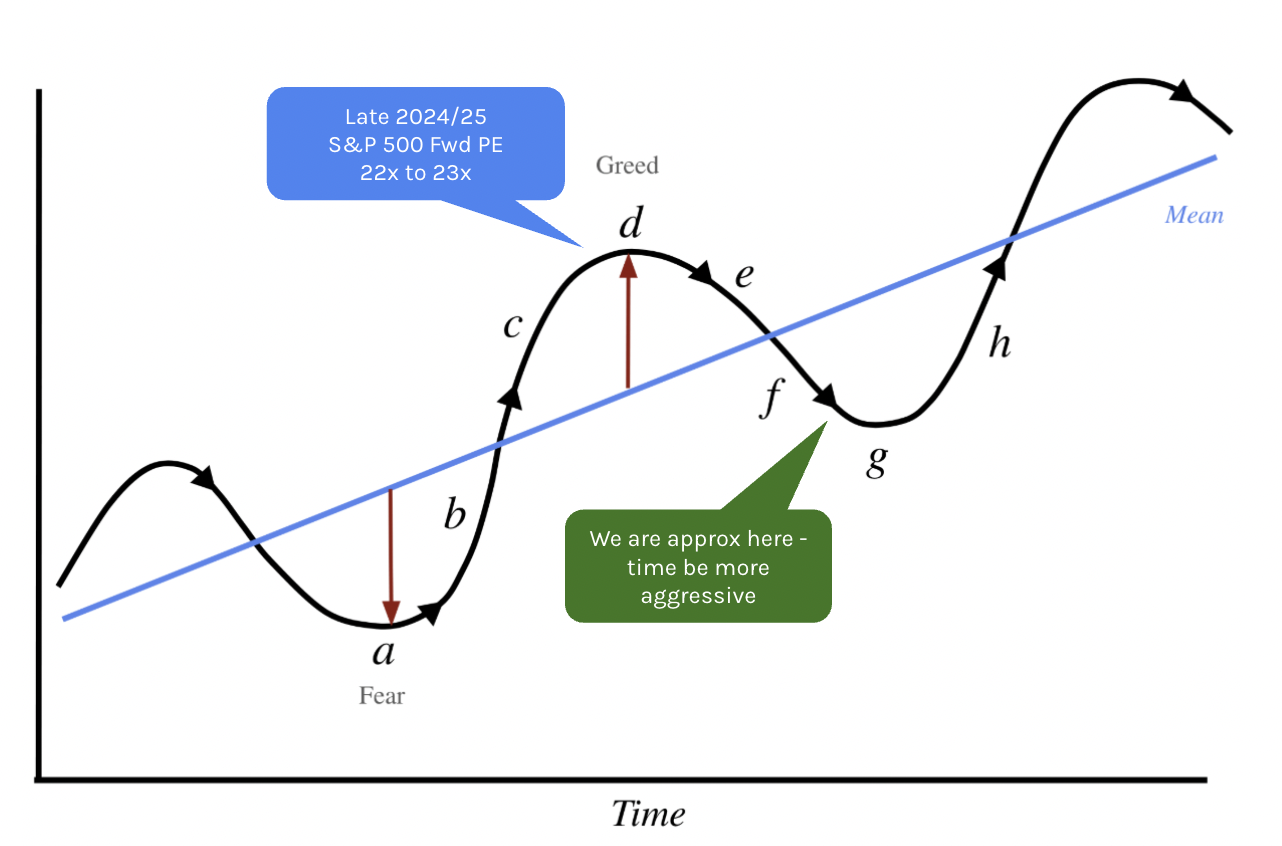

Here"s another way to think about it (a chart I refer to often).

The idea is to buy stocks when we are at points "a" or "g" (i.e., fear and panic)

And similarly, the best time to sell is when everyone believes "trees will grow to the sky" (e.g., which was the case a few months ago – where forward PE ratios exceeded 22x)

This brings us to valuations…

Valuations More Attractive

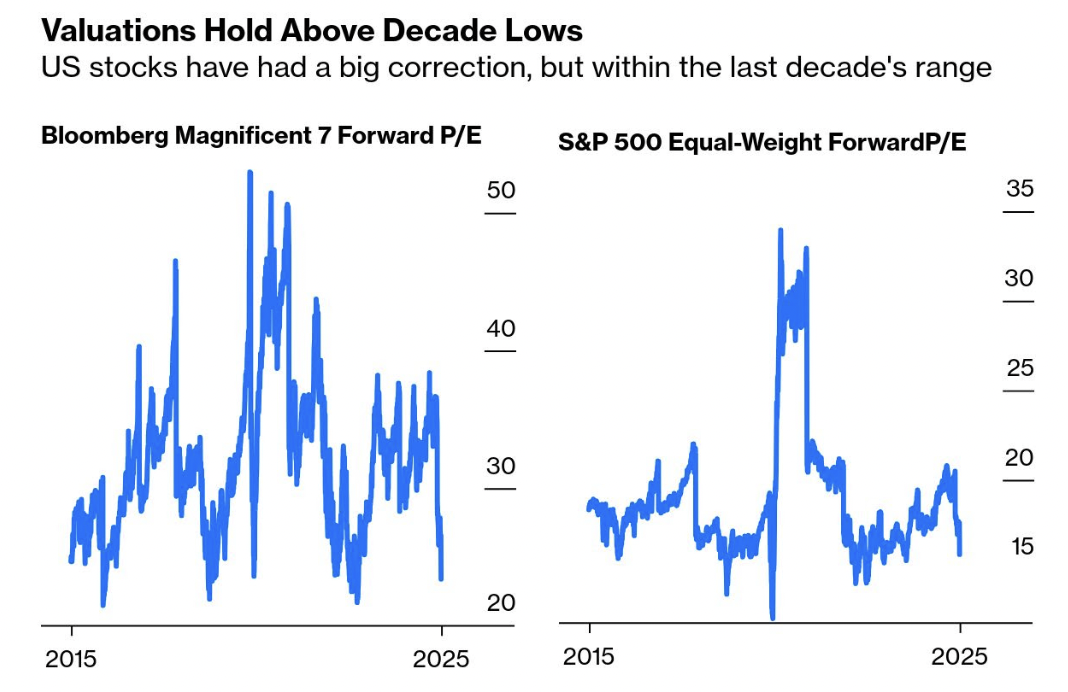

Valuations have come down a long way (good news) — but they have further to go.

As I will show shortly – they remain above their lows for the last decade.

The challenge we now have is dimensioning what the "E" (earnings) will be in "PE" (price-to-earnings)

For example, at the start of the year, experts were forecasting earnings per share of $275 for the index.

| Institution | 2025 | EPS | Fwd P/E |

|---|---|---|---|

| Oppenheimer | 7100 | 275 | 25.8 |

| Wells Fargo | 7007 | 274 | 25.6 |

| Deutsche Bank | 7000 | 282 | 24.8 |

| Soc. Gen | 6750 | 272 | 24.8 |

| BMO | 6700 | 275 | 24.4 |

| HSBC | 6700 | 268 | 25.0 |

| Bank of America | 6666 | 275 | 24.2 |

| ScotiaBank | 6650 | 255 | 26.1 |

| Barclays | 6600 | 271 | 24.4 |

| Evercore ISI | 6600 | 257 | 25.7 |

| Fundstrat | 6600 | 275 | 24.0 |

| Ned Davis Research | 6600 | 254 | 25.9 |

| RBC Capital Markets | 6600 | 271 | 24.3 |

| Citigroup | 6500 | 270 | 24.1 |

| Goldman Sachs | 6500 | 268 | 24.3 |

| JP Morgan | 6500 | 270 | 24.1 |

| Morgan Stanley | 6500 | 271 | 23.9 |

| UBS | 6400 | 257 | 24.9 |

| BNP Paribas | 6300 | 270 | 23.3 |

| Cantor Fitzgerald | 6000 | 267 | 22.5 |

| AVERAGE | 6617 | 268.0 | 24.6 |

At the time, I said expect these (earnings forecast) to come down — perhaps as low as $260 per share (or lower)

If $260 turns out to be accurate (and it may not) – and we apply an average PE multiple of 18x – that puts the Index around 4680

This suggests there could be more downside to come.

For now, the sell-off appears more consistent with a typical 15% to 20% correction.

Could We See 4700 for the S&P 500?

If you"ve been following this blog – the sharp move to the downside will not be overly surprising.

It"s speed might be… however in absolute terms it should not.

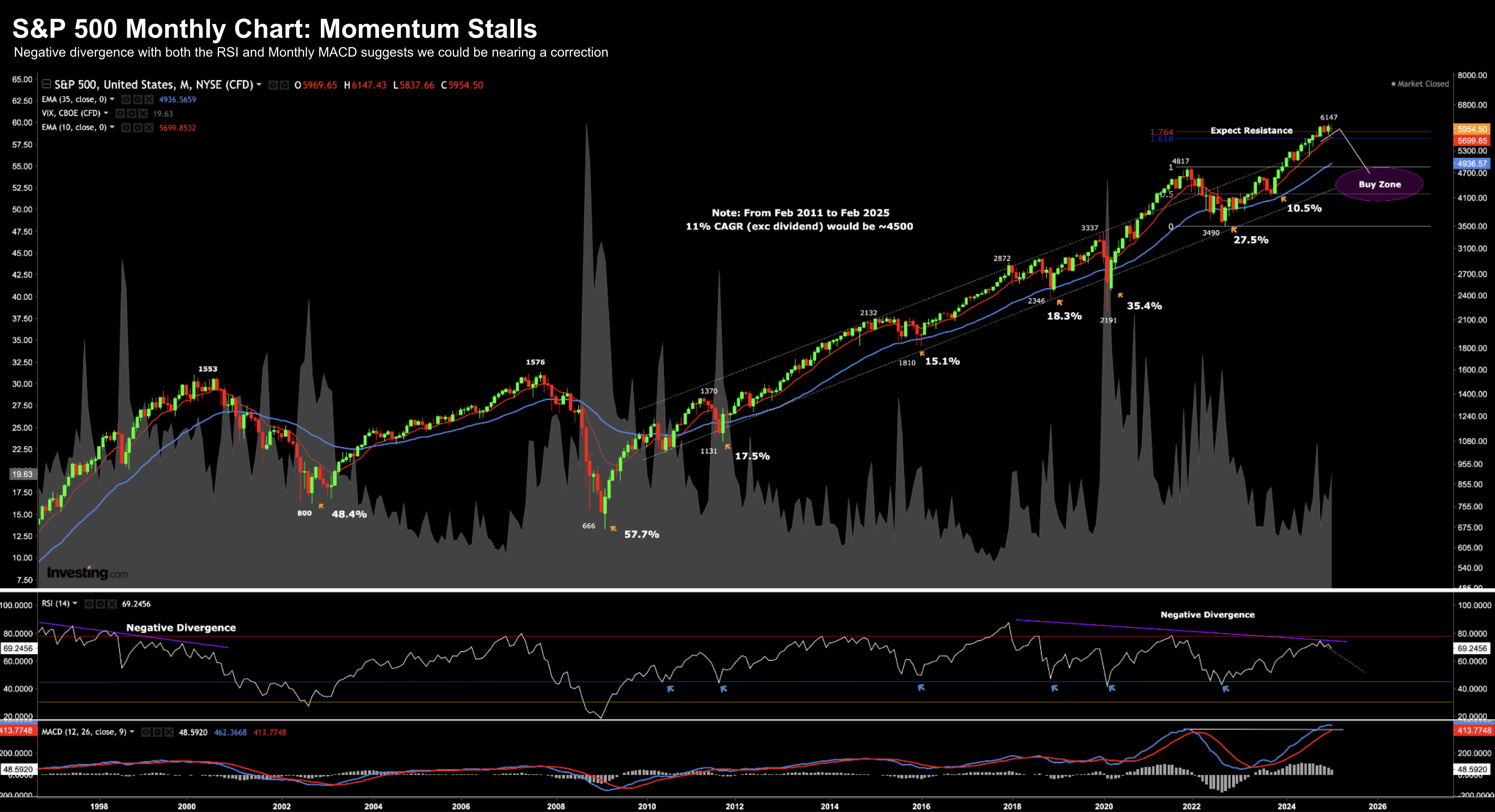

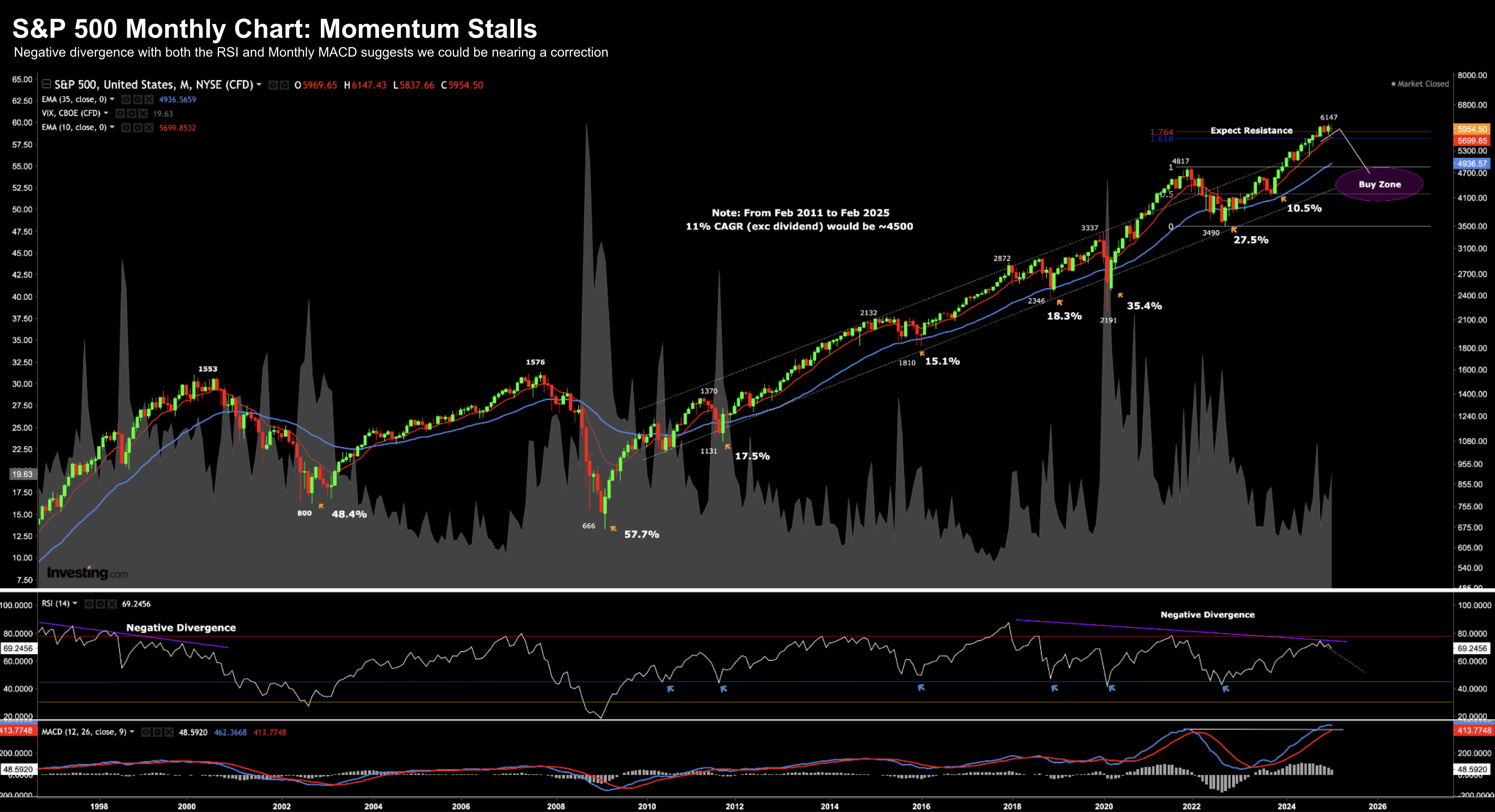

For example, scrolling back to this post from March 3 – I penciled in a possible move to around 4700 using the monthly chart.

Prices had moved a long way from the 35-month EMA (blue line) which tends to act like a "gravitational pull"

For example, think back to my cycle diagram where the upward sloping blue line is the "gravitational pull".

However, above and below that line is where the market works through period of both fear and greed.

March 3 2025

At the time, I felt the market was vulnerable to a move to the downside citing the falling momentum.

We observed the strong negative divergence with both the monthly-MACD and RSI (lower two windows)

Let"s now check in with the weekly timeframe following Friday"s extreme sell off:

April 6 2025

Four technical observations:

- The weekly RSI is trading at 27.6 – indicating an oversold market. And whilst markets can remain oversold for several weeks and do not indicate bottoms – typically they represent a better risk reward entry point over the longer-term

2. The 200-week EMA (purple line) is around 4700. My best guess is this zone (not level) will act as an area of support. We saw this during the 20% sell-off during 2022 – where the market traded briefly below this level for 3 weeks before catching a bid

3. The third observation is what we see with the VIX (shaded blue area). It"s now at 45 – a level not seen since the year 2020.

4. During 2022 and 2023 the market faced resistance around the 4600 zone. Quite often previous resistance will become new support

Put together, with the market trading around 5,000 at the time of writing, the downside risks are now starting to appear lower than the (longer-term) upside reward.

And whilst I think we will see further selling (with futures showing a move of ~3% lower at the open) – we are getting closer to finding support.

Therefore, you should consider adding long exposure here.

For example, let"s say you wanted to initiate a position in Apple, Google or Amazon.

I would buy one-third to one-half of your intended position size. From there, I would buy another third (or half) should it continue to drop another 10%.

This is my approach – as I know cannot pick the bottom. And if I do – it"s luck.

Therefore, if you find a particular (quality) stock is now more attractive (e.g., based on valuation measures such as P/E, P/FCF or EV/EBIT or other preferred metric) – start increasing your exposure.

And as it falls – continue to add – until you establish your full position size.

As a further risk mitigation strategy – avoid making any stock more than 20% of your total portfolio. Most of my positions are between 2% and 5%.

Putting it All Together

Last Friday I increased my exposure to US stocks.

I added long exposure to almost all of the Mag 7 names; the ETF QQQ and the Index.

And if we continue to see further downside (which I expect) – I will add more.

For example, should we see the S&P 500 trade around 4600 – I will establish a full position in the Index.

For context, a move to 4600 will represent a 25% correction from the high of around 6100.

Could it fall well below 4600?

Of course!

But that"s the risk I will happily take.

I"m not looking to trade my position in these new positions over the next month, or 6 months, year or even two years.

However, I"m willing to bet the S&P 500 will be at least 6,500 in three years if buying at 4,600 today.

That"s a CAGR of ~12% excluding dividends.

From my lens, the "Trump Dump" is likely to represent a great long-term opportunity for patient investors.