Turbulent Times Ahead

- Volatility to equal opportunity

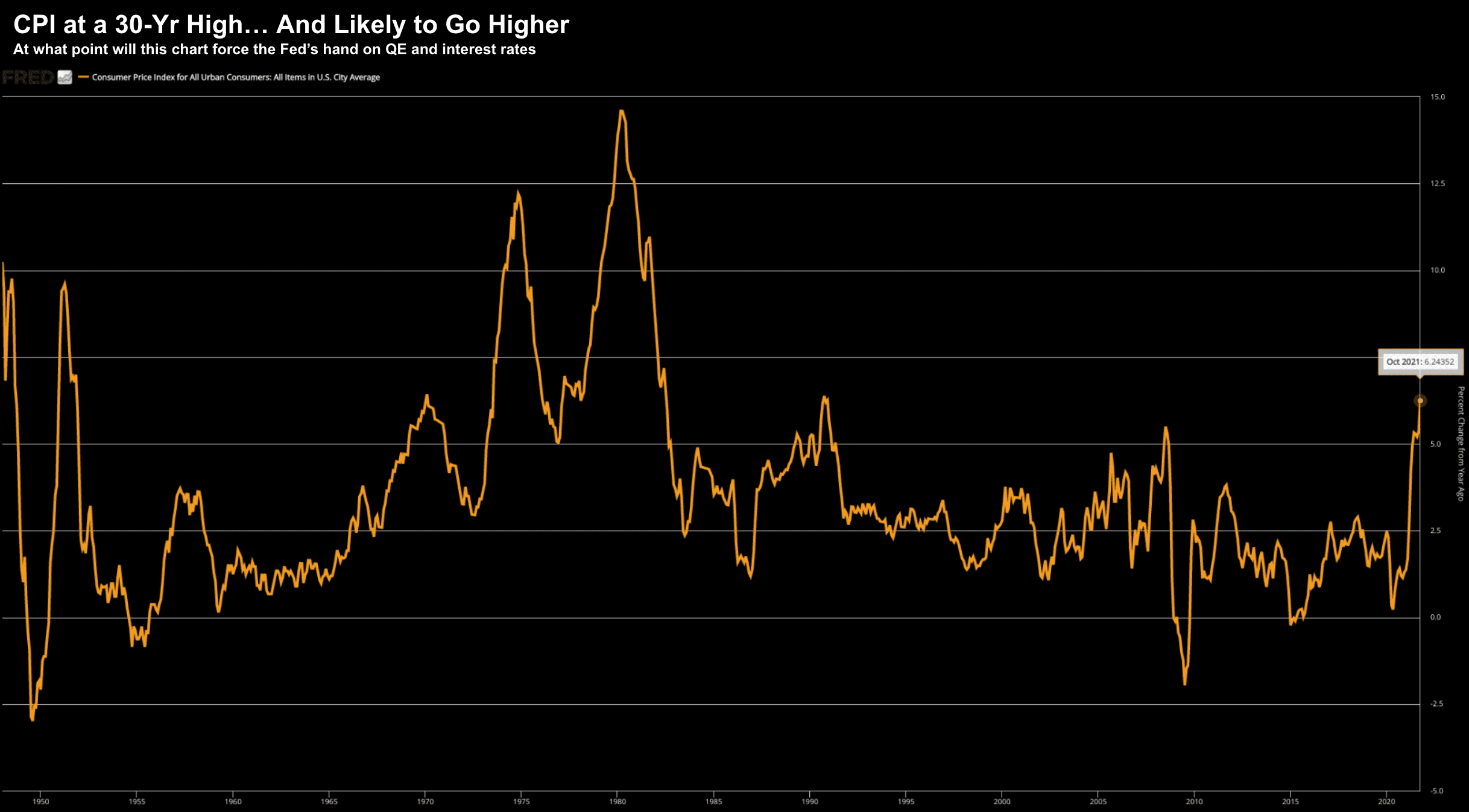

- CPI expected to hit 6.7% annualized for November

- Looking for more selling in tech names

Up until two weeks ago traders were not asking many questions…

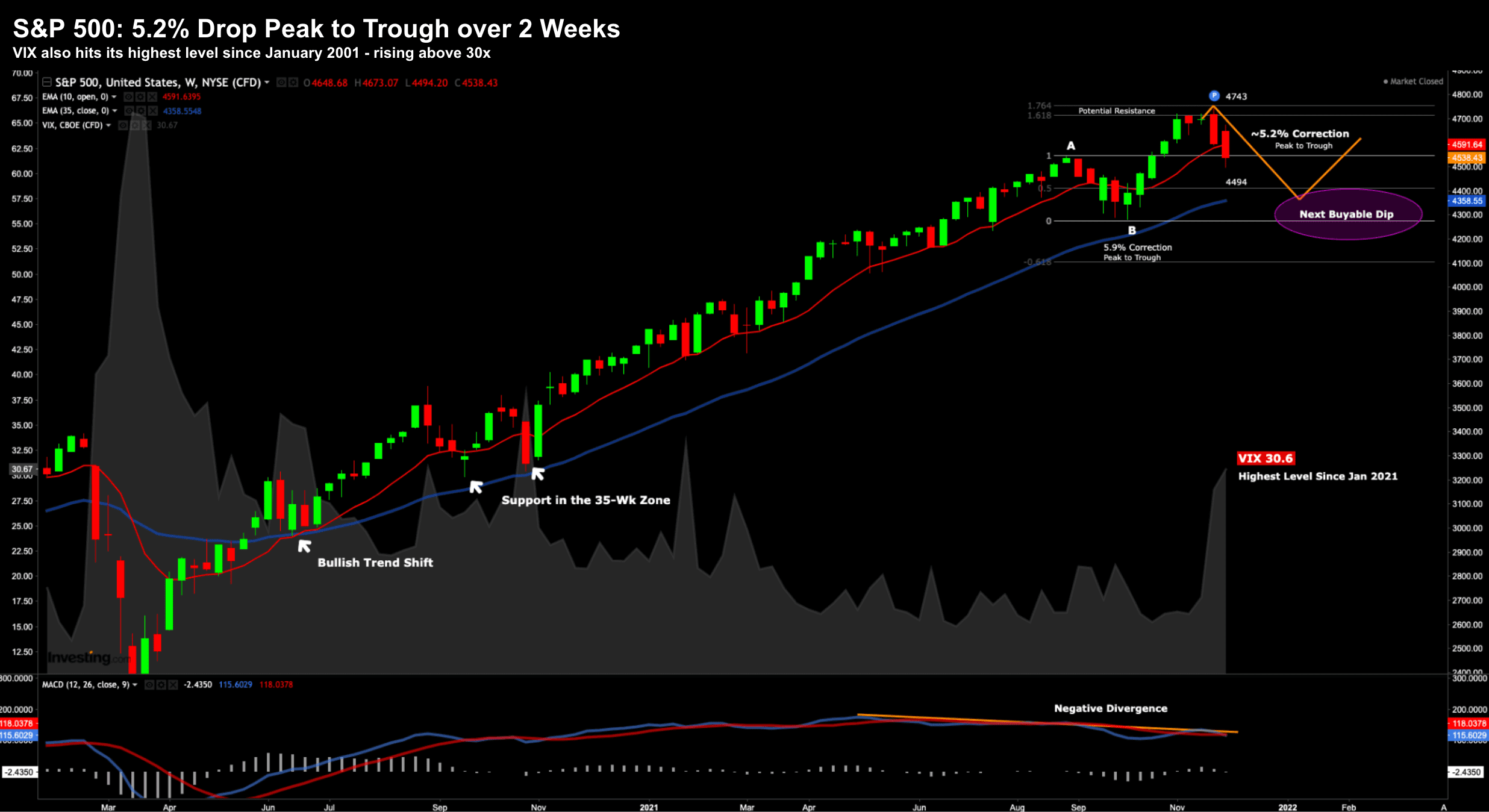

The S&P 500 hit a new high of 4743… which had some commentators calling for highs of 4800 before the end of the year.

Fast forward 8 trading sessions and index is down 5.2% from peak-to-trough.

It"s only the second pullback of more than 5% all year (the other being ~5.9% over September)

From mine, traders and investors are weighing two primary risks:

- What policy measures central planners may take against the spread of the new Omicron COVID variant; and

- How aggressive any Fed taper will be as they tackle unwanted inflation.

Naturally, the riskiest names were hit hardest – the Nasdaq down ~2.6% – with high-multiple growth stocks feeling the brunt (more on this in a moment).

Higher-risk small caps also felt some pain – losing some 4%

However, between now and Christmas – all eyes will (once again) be on Fed Chairman Jerome Powell.

The FOMC meets December 14th.

Will they reveal any plans to raise interest rates sooner than anticipated because of persistent inflationary pressure?

And are they going to accelerate their tapering of bond purchases beyond what was previously communicated … effectively slowing new liquidity?

Maybe the answer will depend on what we get with the consumer price index (CPI) Friday.

CPI is expected to jump above the annual pace of 6.2%… the hottest in 30 years.

CPI this Friday

From mine, the market is far more concerned about the risks posed by the Fed than it is the Omicron variant.

That is not to undermine the seriousness of its spread… however so far zero deaths have been reported for fully vaccinated people.

But that hasn"t stopped many in the mainstream hitting the "outright panic" button.

I digress….

What really shook the market (for me) was Jay Powell admitting he was wrong on inflation.

Reluctantly he said that the Fed may soon have its hand forced… also adding the word "transitory" was no longer appropriate.

Hmm mmm.

Amazing what adding $4.4T to the balance sheet will do in just over 18 months.

Last month we received the hottest CPI print in 30 years… 6.2% annualized.

But looking ahead – economists polled by Dow Jones predict it rose 0.6% on a monthly basis last month – or 6.7% year over year

Annualized CPI October 2021

Question is: why would Powell do this opposite a new COVID risk?

I guess we will find out more in ten days…

But I do think the Fed have boxed themselves into an increasingly tight corner.

As I said months ago – they had a solid "window" to start winding down QE and paving the way for rate hikes at least 6 months ago.

For example, economic growth was heading in the right direction… consumers were confident… COVID risks were diminishing… stocks were at record highs etc.

Why not then?

Powell"s justification was more work was needed on the employment front… so the "bar tab" remained open.

With that, stocks took another leg higher.

But I wondered how further liquidity going to incentivize people coming back to work (especially with many States still paying people to stay home?)

I could see how it would turbo-charge risk assets – but what would it specifically do for employment?

Not much.

Now this week… we learned more about employment progress.

November monthly job additions missed expectations by some ~300,000 jobs.

That"s a bad result.

However, the positive is the overall unemployment rate is now down to around 4.2%

That"s not a lot higher than the pre-pandemic level of ~3.5%.

Put another way, an unemployment rate of just 4.2% is not what I would consider an economic emergency.

People are returning to the workforce…. and employers are aggressively looking to hire (raising wages and incentives).

Nonetheless – the market was not too thrilled about the Fed potentially reducing its support in this uncertain environment.

Market Pullback in Progress

If you put together the Fed and Omicron risks… the market appears to be taking a few (well earned) chips off the table.

Dec 04 2021

The S&P 500 has pulled back 5.2% from its all-time high (peak to trough).

But when you consider the market is still up ~20% year to date — it"s modest.

Further to recent posts – I think a move to the 4400 zone would be a healthy development.

We may not see that over the next three weeks (and the lows could already be in)?

However, I think it"s likely.

And if we do – I would be a buyer of the Index in this zone.

Be Patient and Selective

I"ve selectively added to a couple of names – as I think the risk/reward level is more attractive for the long term.

I outlined a few of these on the blog.

To be clear, I am not all-in – but I have increased my exposure.

What"s more, I expect these names to be volatile in the weeks / months ahead.

That"s okay…

I may not be buying them at the bottom (I don"t try to pick bottoms)… but I do know I"m buying some higher quality businesses at least 20-30%+ below their recent (expensive) highs.

By way of example, one measure of risk appetite is Cathie Woods"s popular ARK Innovation ETF.

It was thumped 12.7% for the week – where all but two names in ARKK are now in bear markets (i.e. down at least 20%).

Tesla (TSLA) is one name not in a bear market – but is still down 19.5%. As an aside, TSLA boasts a forward PE of 131x and a price-to-sales of 21x. I say it goes much lower.

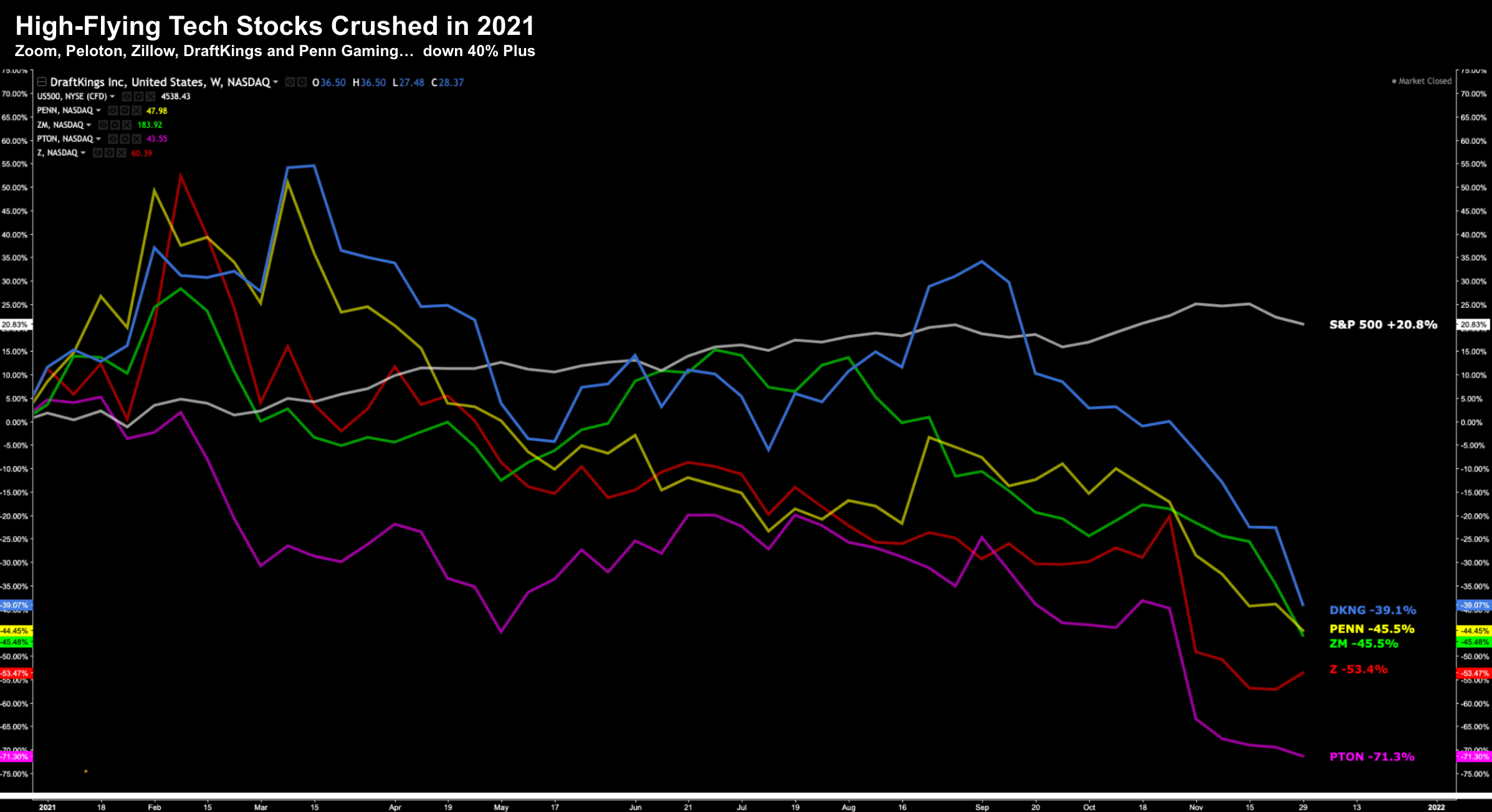

But in terms of the more widely-held high-multiple names (e.g., Zoom (ZM), Peloton (PTON), Penn Gaming (PENN), Zillow (Z) and DraftKings (DKNG)) – take a look at the carnage we"ve seen this year (specifically from September):

Dec 04 2021

These names are down anywhere from 40% to 70% (in PTON"s case) – given the outlook for higher rates / shift into more "value" based names.

That said, the broader market has held up.

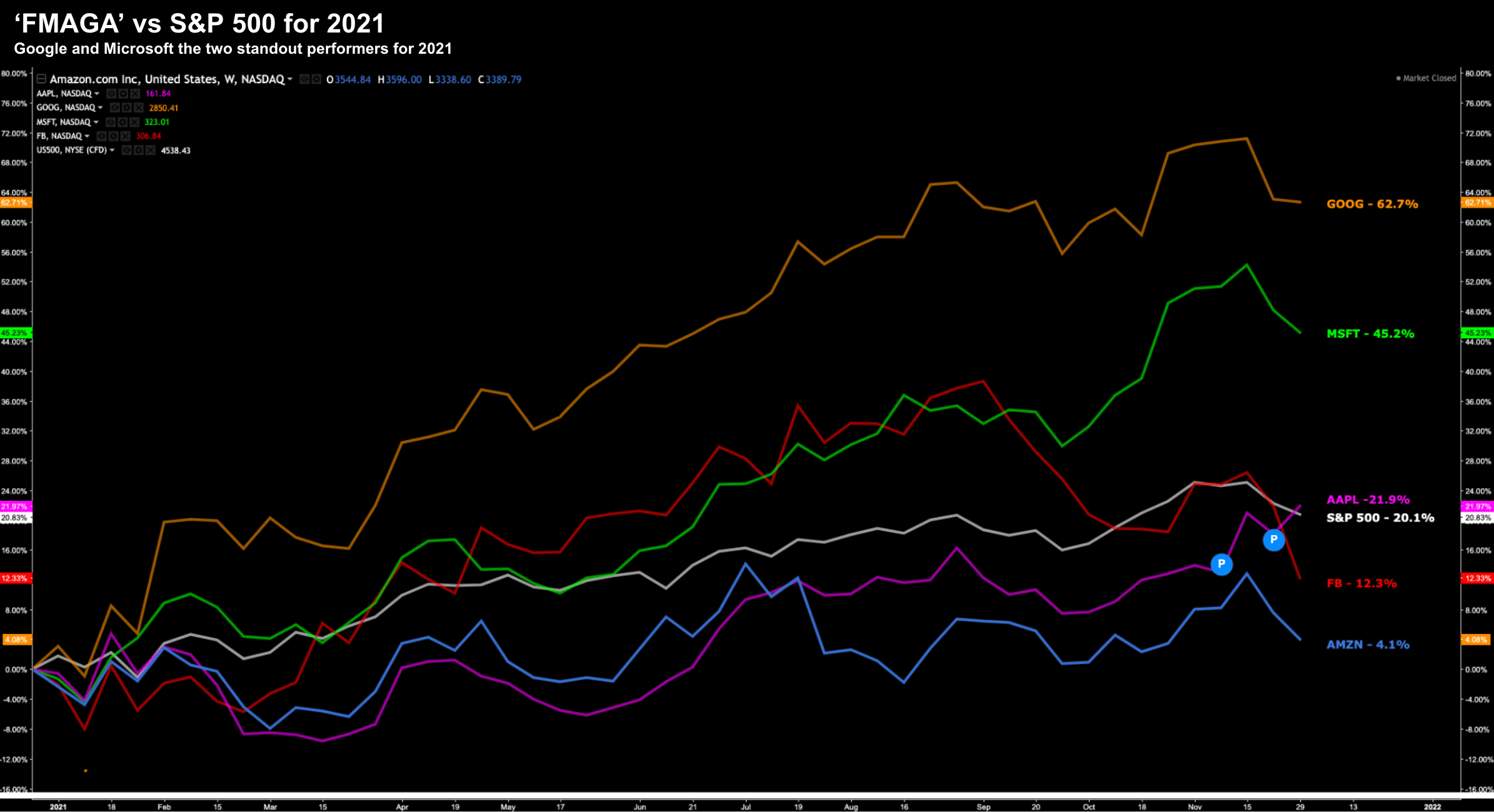

To that end, I think the S&P 500 is more likely to fall should the "FMAGA complex" give back ground.

We saw a little of this on Friday…. with Apple, Microsoft, Facebook, Amazon and Google all lower. For example, there was almost $200B wiped off big-tech alone Friday.

- Microsoft – $48.7B

- Apple – $31.5B

- Amazon – $24.1B

- Google – $12.7B

- Tesla – $69.9B

Below is how FMAGA has performed against the Index so far this year:

Google and Microsoft the clear standouts returning 63% and 45% respectively.

On the other hand, AMZN and FB have lagged the market.

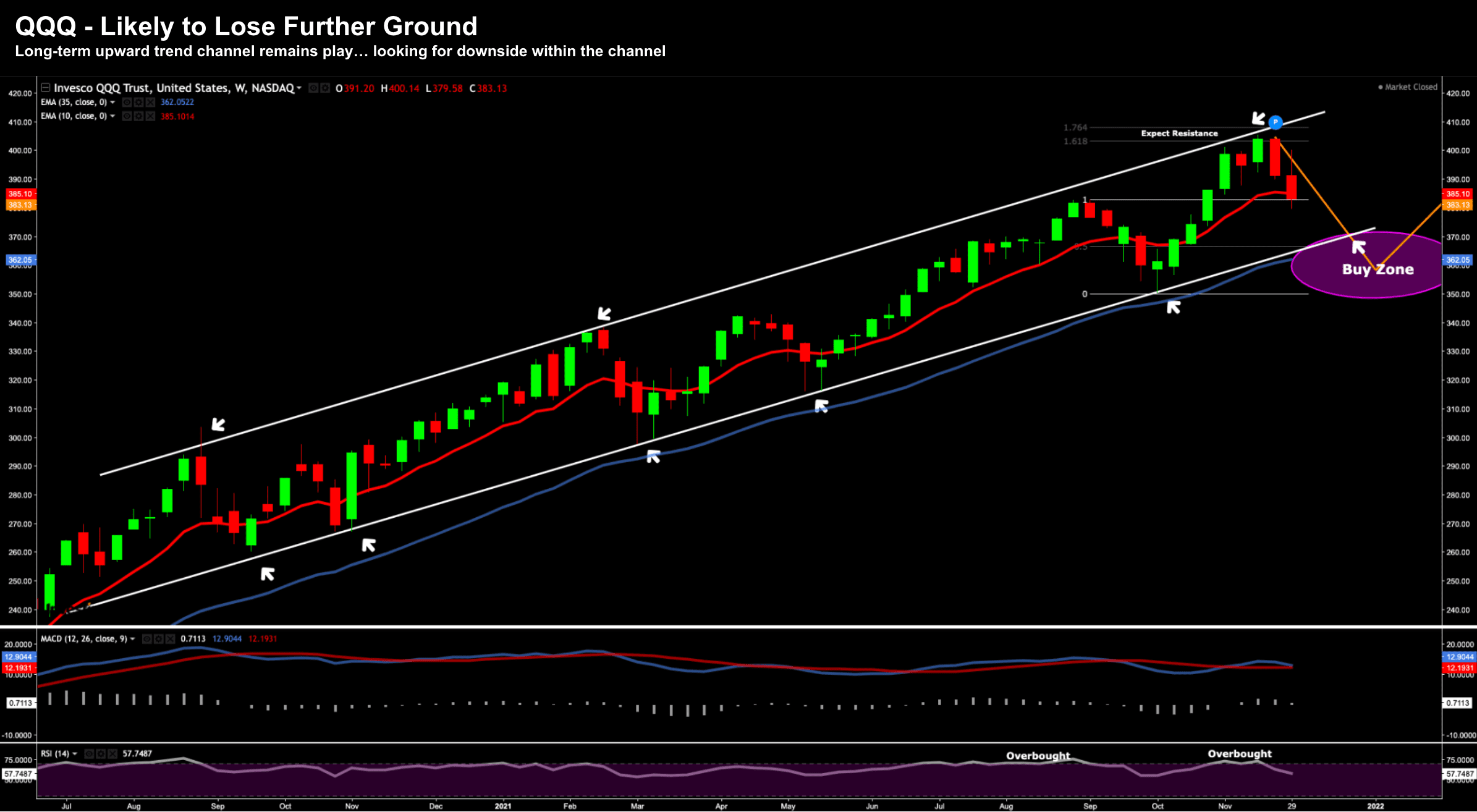

If I now look at the popular QQQ ETF – this offers some clues as to what we might expect:

Dec 04 2021

Some technical observations (and why I think there"s more to come)

- We saw resistance at the upper limits of a well-defined trend channel;

- There was resistance 61.8% outside the September retracement (i.e. where I added to AMZN and APPL);

- Overbought nature with the weekly RSI (i.e., often an area of profit taking);

- The weekly-MACD has not been making higher-highs of late – suggesting momentum is fading; and

- Look for a retest of the 35-week EMA (blue line) zone – also the lower limit of our trend channel (~5.5% lower than Friday"s close)

As I say, my thesis is it"s been FMAGA which took the Index higher.

Therefore, it"s also likely the same complex will take it lower on any correction.

And this is the issue when market leadership is so incredibly narrow (i.e., it lacks breadth)

Again, I am not bearish.

I will be buying this pullback… not selling.

Putting it All Together…

One final note before I close this Saturday afternoon….

The 10-year yield traded down to 1.35% this week.

Nervous investors are buying bonds (at negative real yields) for safety.

Put another way, these investors are looking for a return of capital… not a return on their capital.

To them, stocks look far too risky.

Now 1.35% on the 10-year is a long way below the 1.69% we saw just a few weeks ago.

It"s important to note that 1.35% is not a high-risk zone for the market.

However, if we see these longer-term rates fall below say "1.20%" (the August lows) – that could be problematic.

At that point, the yield curve will flatten further… which suggests some caution ahead.

In summary, there"s nothing (yet) that really scares me about the charts (or market).

Again, that"s a function of your own lens.

I"ve been waiting for a decent pullback to add to select names (and the index itself). And a 5% move lower isn"t much given how far we have come the past 12+ months.

Now if we see more selling in the weeks ahead (due to heightened Fed fears or Omicron"s spread) – I think the market finds support.

For example, consider the following:

- real rates are not yet anywhere near tight (look for that around 2.5%)

- there isn"t a shortage of liquidity despite the threat of a faster taper (the Fed are not reducing their balance sheet);

- corporate profits (in quality names) remain very strong (look for a strong Q4); and

- credit spreads remain very low and do not suggest there is a chance of near-term default risk.

That"s not to say credit and monetary conditions will not change in the months ahead (they will)… but today those risks are not there.