Value over Growth

- Hawkish Fed catch some off-guard

- S&P falls slightly… as "value" trumps "growth"

- Market sensitive to possible Fed balance sheet reduction

Earlier this week I shared my high-level thoughts for 2022.

Key themes were:

- More Fed will equal greater volatility (e.g., as they move to combat unwanted inflation)

- A market correction is more likely in H1 due to a hawkish Fed

- Any meaningful dip will represent an opportunity in value and quality stocks (vs "hyper-growth"); and

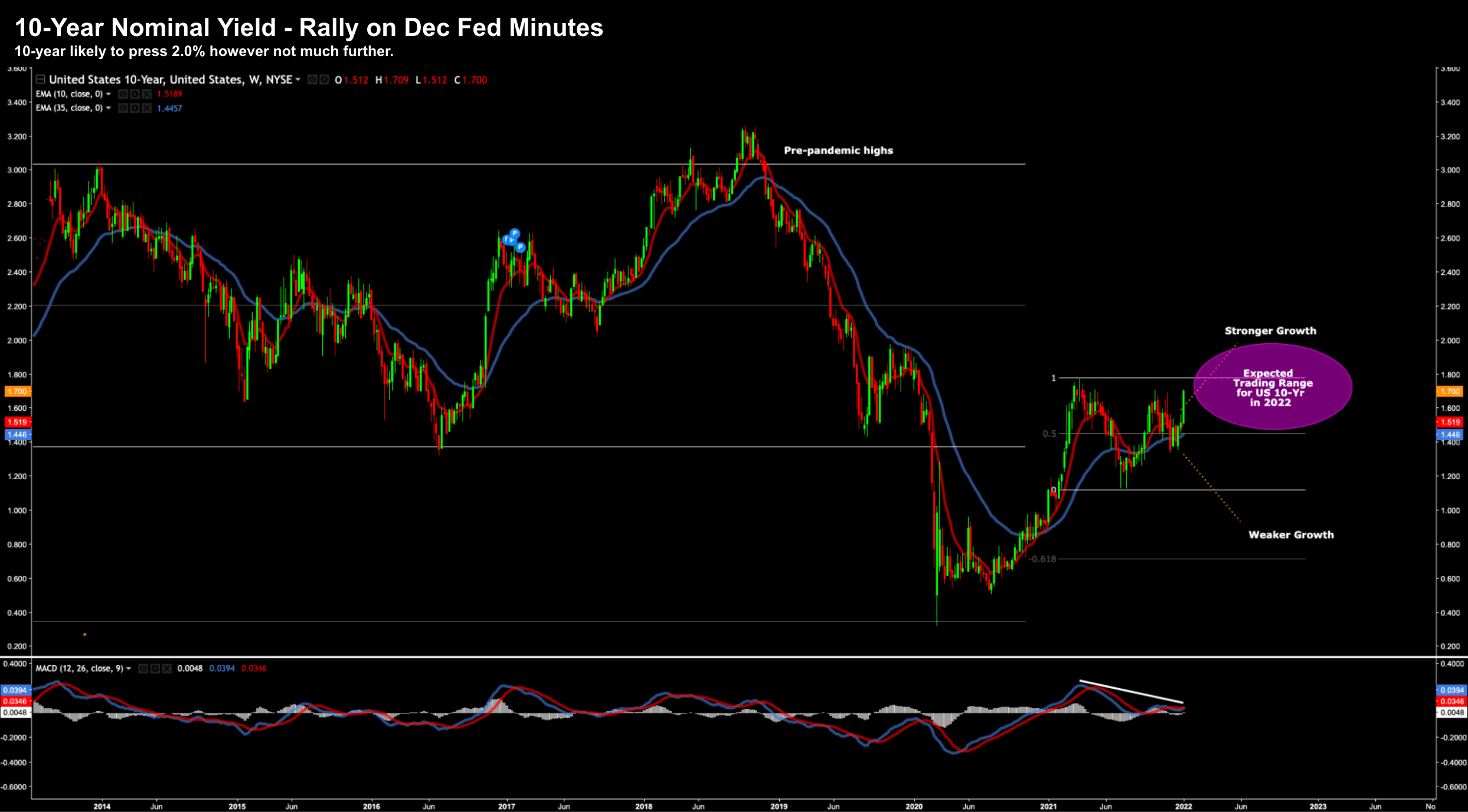

- The 10-year yield is likely to challenge 2.0%

We are merely three trading days into the year… and we have been given a small taste.

For example, the Fed released its minutes today from their December 14-15 meeting.

Not only did the minutes confirm up to three hikes are on the table – there was talk of reducing their ~$9 Trillion balance sheet.

Below is a summary from CNBC:

Officials indicated that they foresee up to three quarter-percentage-point increases in 2022, as well as another three hikes in 2023 and two more than the year after that.

In addition, the committee announced it would speed up the tapering pace of its monthly bond-buying program. Under the new plan, the program would now end around March, after which it would free up the committee to start hiking rates.

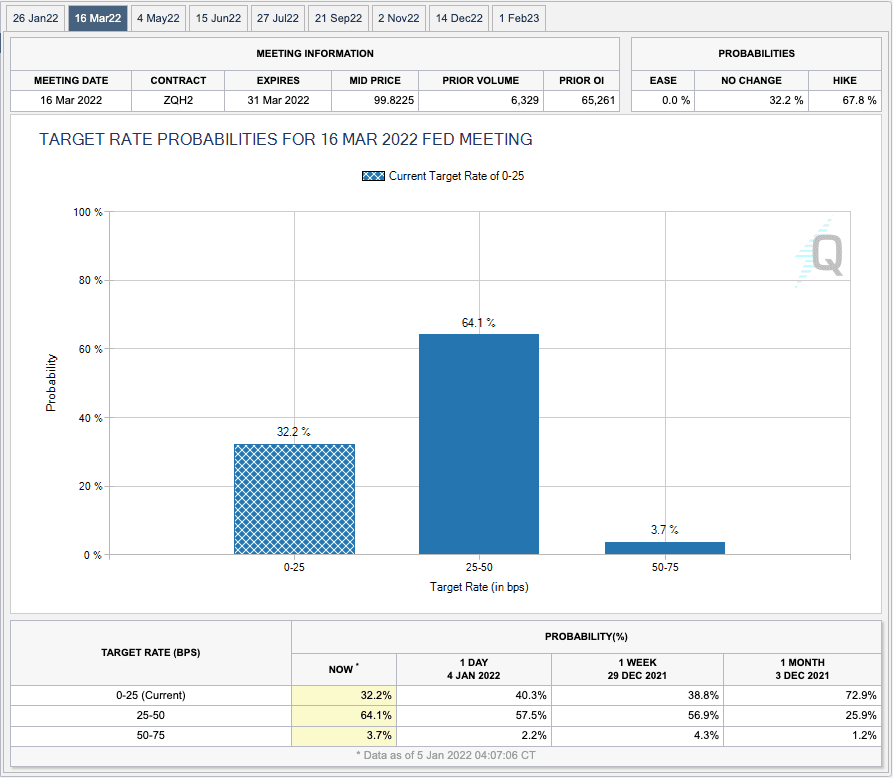

Current fed fund futures market pricing is indicating about a 2-to-1 chance of the first hike coming in March, according to the CME"s FedWatch Tool. Traders figure the next increase would come in June or July, followed by a third move in November or December.

Fed officials indicated that the reasoning behind the moves was in response to inflation that is higher and more persistent than they had figured. Consumer prices are rising at their fastest pace in nearly 40 years.

Policymakers also discussed when they might start reducing the Fed"s $8.8 trillion balance sheet, which has more than doubled since the beginning of the Covid pandemic.

None of this should come as a surprise.

But equity markets moved sharply lower on the news.

My assumption over the past two months (or so) was equities were not fully pricing in this scenario (e.g.,evidenced by the (overly complacent) VIX trading around 16)

Today the VIX jumped to almost 20x on the Fed"s hawkish news…

However I suspect there"s more to come as the Fed declares its hand.

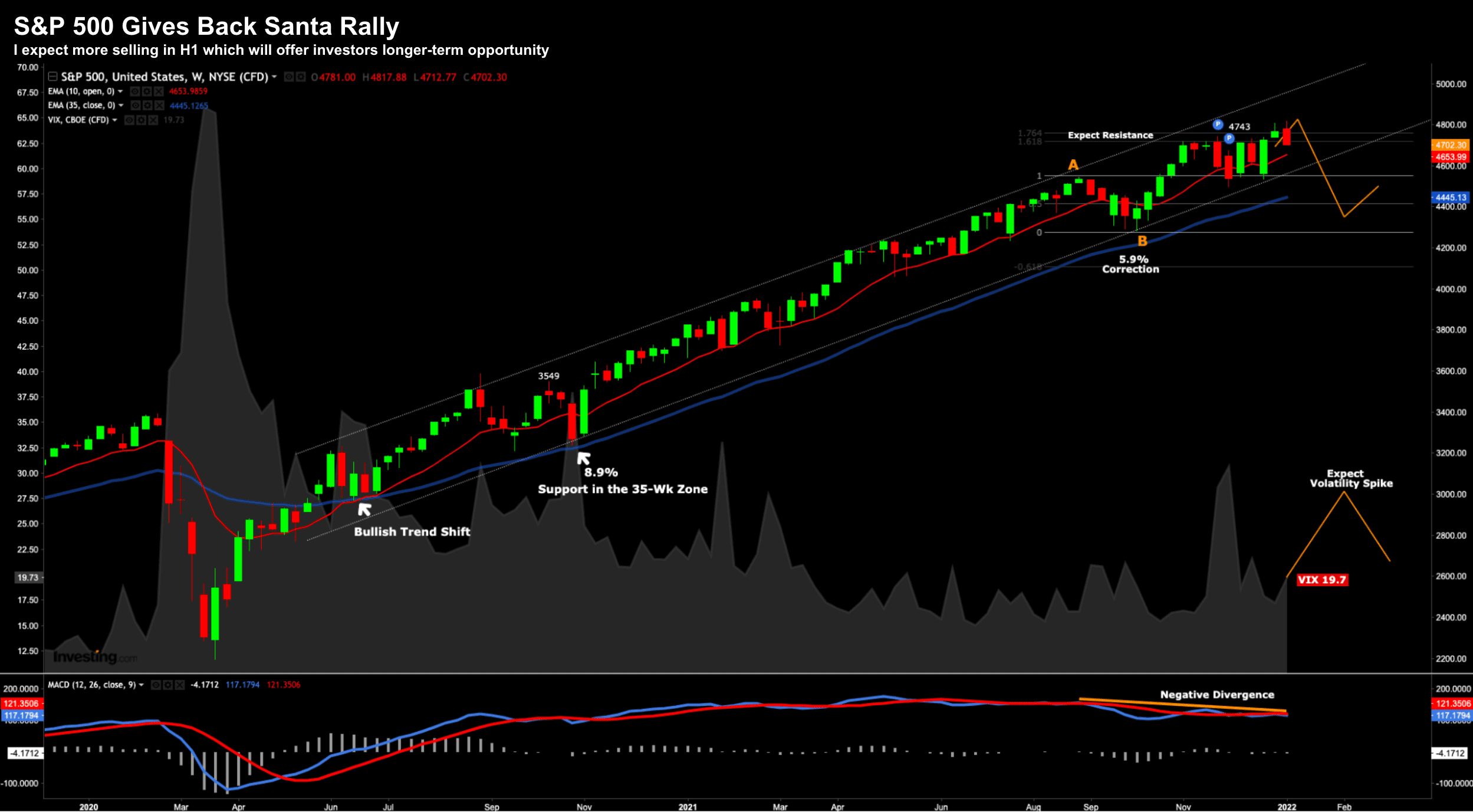

S&P 500 – Yet to Meaningfully Pullback

Whilst mainstream might lead with "massive market sell-off"… it"s misleading.

Now, if you"re overly exposed to higher multiple (growth) names – yes – it was probably another rough day.

Previously inflated names like (but not limited to) PTON, PINS, ZM, TDOC, DKNG, SE, SQ, SHOP and HOOD are at least 30% to 50%+ from their highs.

Again, this list isn"t meant to be exhaustive… as there are "hundreds" of names like this.

And it"s not hard to explain…

Investors paid exceptionally high multiples for future cash flows which may or may not materialize several years in the future.

In a sense, it is not unlike what we saw with the dot.com era over the late 1990s.

But the prospect of higher interest rates means these cash flows will be discounted.

Multiples will (and deserve to) come in substantially.

However, on the flip-side, quality growth (e.g., FMAGA) and value names are yet to correct.

Let"s look consider the S&P 500 in the weekly timeframe:

Jan 5 2022

The S&P 500 moved lower by 93 points (or ~1.9%)

That"s not a huge move… especially when you consider the staggering ~27% gain last year.

However, the tech-heavy (growth orientated) Nasdaq fell 3.5%

But this is a rotation we are seeing… and I think we will continue to see well into the year.

The shift from growth to value is now gaining momentum… but started in earnest last year.

On the other hand, quality companies trading at forward earnings multiples like "15-20x" are holding up.

They are not losing "30-50%" of their former value… perhaps 5-10% off their highs at most.

And in some cases, setting new record highs.

In summary, I would like to see the broader S&P 500 move closer to the 4400 zone.

That"s a further ~6% below today"s close… here"s hoping.

4 Rate Hikes and a Reduced Balance Sheet?

If nothing else, equities are starting to understand the Fed is serious about containing inflation.

This is no longer "let"s wait and see" (i.e., their tone throughout 2021)… this is now "we have a problem"

The language (and tone) of the minutes was very different to previous statements.

There was a real sense of urgency and action.

For example, there is now talk of up to four (not three) rate hikes this year… along with the possibility of the Fed reducing the size of their balance sheet.

They stated:

"Many participants judged that the appropriate pace of balance sheet runoff would likely be faster than it was during the previous normalization episode"

This is new information.

And whilst the up to three or four rate hikes is not necessarily problematic (i.e., real rates are still negative) – balance sheet reduction could be.

With respect to rates – the market has now increased the probability of a March hike to 64%.

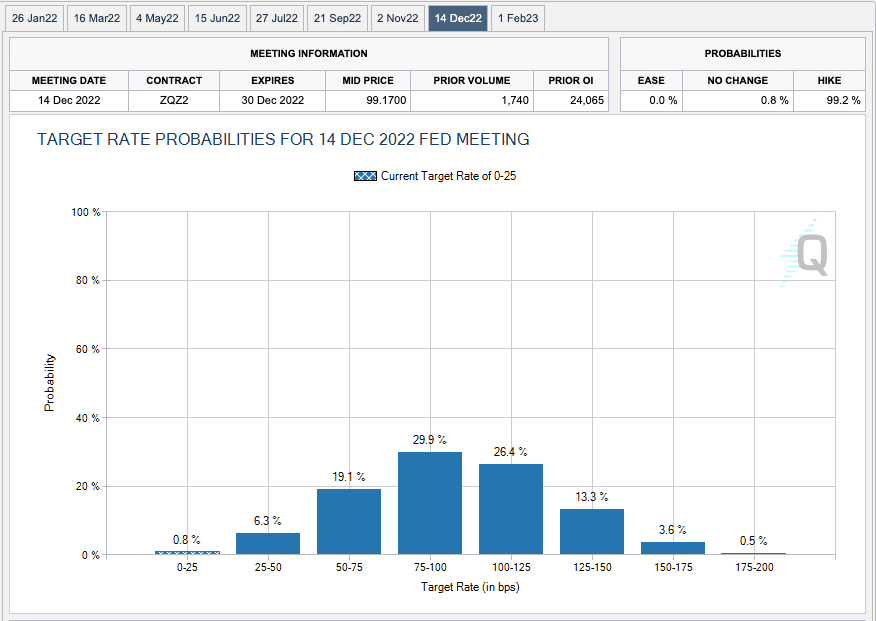

Looking further to December – the CME"s FedWatch Tool suggests a ~30% probability b/w 75-100 bps and 26% of 100-125 basis points.

And that renewed "fear" is clearly showing up in the 10-year yield – as it continues its march towards 2.0%

US 10-Year Yield at 1.705%

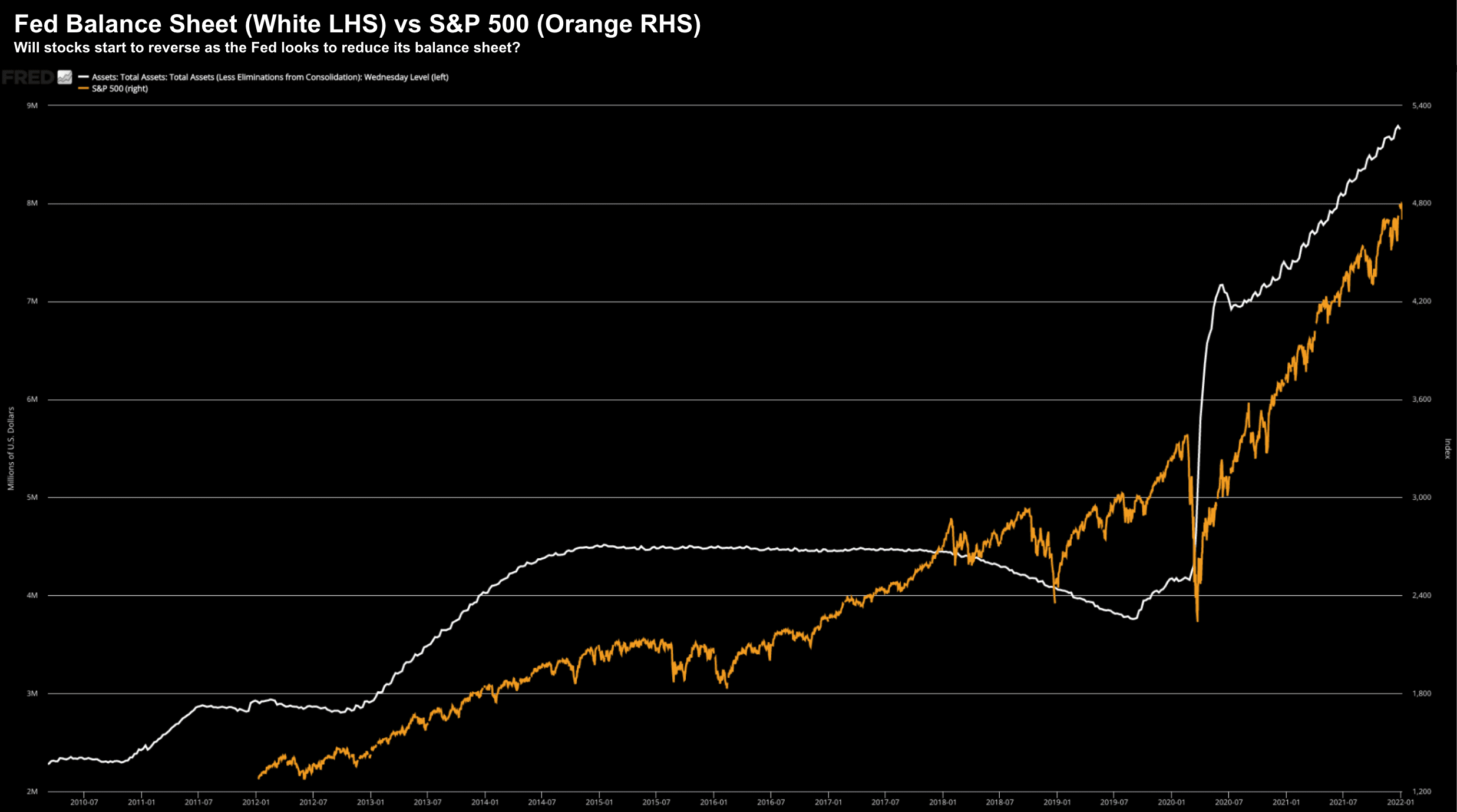

But it"s the (very close) relationship between equities and the Fed"s balance sheet that deserves attention:

Jan 5 2021

From April 2020 stocks have accelerated at the same velocity as the Fed"s printing press.

That is, straight up.

However, the "white line" is going to flatten from March 2022 and possibly go into decline later in the year.

Now the last time the Fed shrank its balance sheet amid interest-rate hikes, the stock market had a bear-market scare in late 2018.

That forced the Fed to call it off and resume balance sheet growth in 2019.

From there, stocks rallied.

Put another way – Powell pandered to the market.

But Powell is sensitive to what this course of action could do… suggesting:

"… it"s best to take a careful, methodical approach with respect to the balance sheet – as markets can be sensitive about it"

Do you think Jay?!

Their December minutes indicated that the strength of the economy, level of inflation and much-increased size of the balance sheet relative to the economy should make for a swifter wind-down.

But just what "swifter" means isn"t yet clear.

This year? Next?

However, the idea of the inevitable balance sheet reduction is now part of the lexicon.

This wasn"t the case last year.

Putting it All Together…

Personally, it was pleasing to hear the Fed taking steps to remove excessive (damaging) stimulus.

And whilst it"s a good 6-9 months too late (at a guess)… it"s time they quit pandering to the market.

Equities won"t like it (as Powell suggested) – but so what.

That"s how addicts typically behave when you take away the "drug".

In this case, the drug of choice is free money.

From mine, the economy has not needed "war-time" stimulus measures for almost a year… and yet we have ~$9 Trillion on the balance sheet with zero rates.

It made no sense.

The Fed were well behind the curve.

Is it any wonder we have excessive money chasing too few goods?

I think the Fed can start unwinding their balance sheet later this year whilst raising rates – causing little damage to the real economy.

That should be their focus… not stocks.

And whilst a "taper tantrum" will likely result (e.g., 10-15%) – that"s fine.

Many stocks carry excessive valuations and multiples deserve to come in.

And if businesses are strong (e.g., producing good cash flows and profits) – their share prices will do well over the long-term (irrespective of central bank policy).

You might say that 2022 and 2023 will give us a chance to see who was swimming naked.

And all going well, this could present a great opportunity to buy quality companies at far cheaper prices.