Words: 1,309 Time: 6 Minutes

- Three large firms warn of near-term downside

- A look at the “bull steepening” of the 10-yr / 3-mth yield curve

- Keep a close eye on BBB credit spreads

Over the weekend – I warned investors to brace for a possible 10% to 15% pullback over the coming 2-3 months.

In this post – “S&P 500 Faces a Litmus Test” – I talked to stretched valuations (e.g., ~22x forward earnings); and the vulnerable technicals.

However, predicting the timing of a sharp decline is very difficult.

What’s more important is not trying to squeeze the last “5-8%” from an epic run… it’s to ensure you are not overly exposed in the face of excessive valuations.

Today we have heard similar (correction) warnings from the likes of Morgan Stanley, Deutsche Bank AG and Evercore ISI.

Bloomberg reported a chorus of stock market prognosticators are warning clients to prepare for a pullback as “sky-high equity valuations” slam into souring economic data.

Does this sound familiar? It should.

Wall St Warns…

Let’s start with Morgan Stanley’s Mike Wilson…

Wilson sees a correction of up to 10% this quarter as tariffs hit consumers and corporate balance sheets.

- Consumers may struggle to absorb the higher prices (evidenced by the slow down in Real PCE); and

- Corporate profit margins are likely to decline (as many are forced to partially absorb the cost increase)

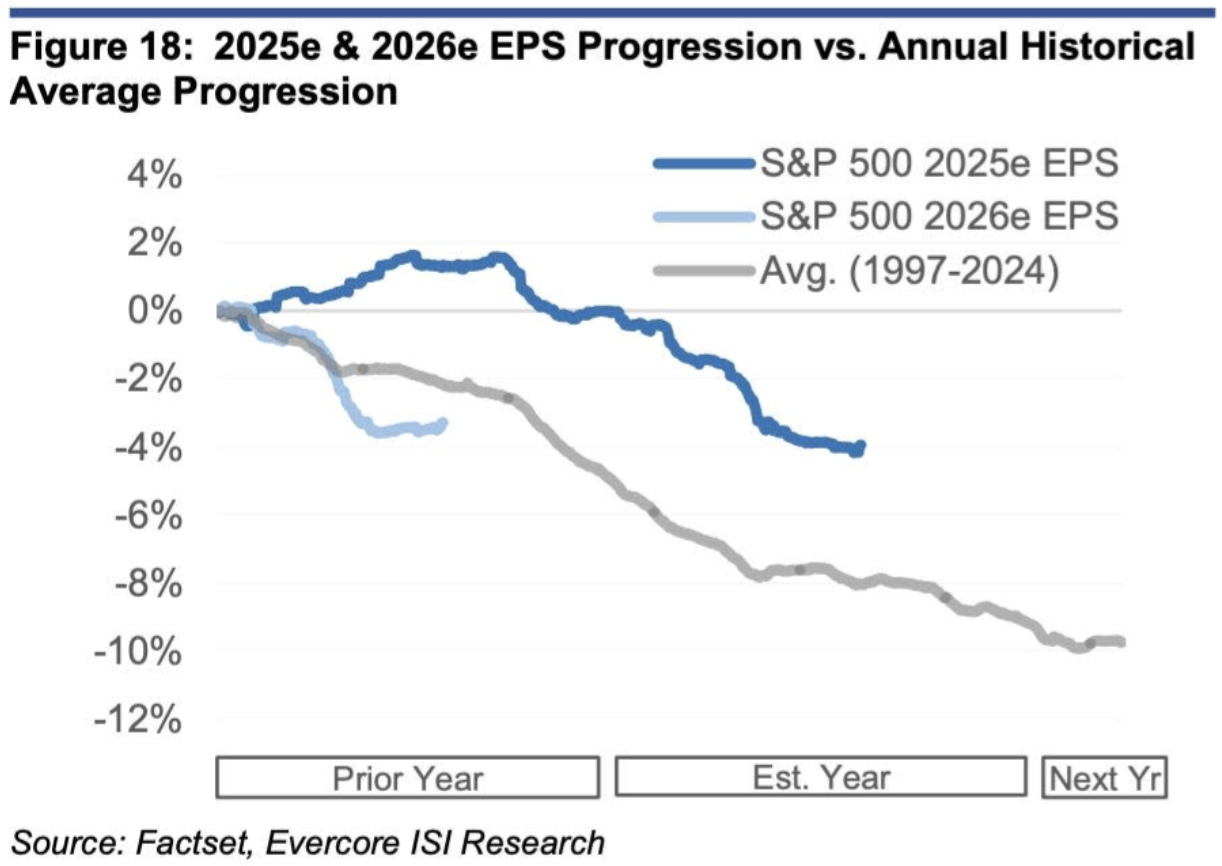

Evercore’s Julian Emanuel is expecting a more substantial decline of as much as 15% – sharing this:

“Every structural bull market since the late 1990’s has seen a late stage surge in capital markets activity and a period of intense investor FOMO. FOMO is already here. Stocks have over-discounted the potential for continued good news.”

He warns of a 7%-15% correction in the coming months with a year-end target of 5,600

With a trailing price-to-earnings ratio of 24.7x – the S&P 500 is trading at the top decile of valuations since 1960.

Emanuel doesn’t see a market crash in the cards, as valuations haven’t reached the dot-com bubble’s 28x price-to-earnings ratio.

He said that “old-school” fund managers who lived through the dot-com bubble are now asking him the four most dangerous words in investing:

Is it different this time?

My answer – very rarely is it ever different.

For example, metrics such as valuations, balance sheet, cash flow and profitability ratios are what they are (e.g., they are either strong or weak, consistent or lumpy; overvalued or undervalued etc).

All that’s different is the business you’re evaluating.

Three decades ago it was the internet; five decades ago it was the PC; and today’s shift is AI.

What’s different is the “widget”. We are working through another technology shift – one which will transform and accelerate human ingenuity (as each of the other evolutions did)

But the rigorous discipline of evaluating a business’ quality and its relative valuation does not change.

Finally, the team at Deutsche Bank led by Parag Thatte notes that a small drawdown in equities is overdue considering they’ve been on a tear for over three months.

Beware the “Bull Steepener”

The three banks above echo the points I’ve made on the blog over the past 3+ months.

In short, with the S&P 500 now above 6,000, the greater risk is to the downside.

But it won’t stop some investors chasing those final few points; and/or trying to keep pace with the S&P 500.

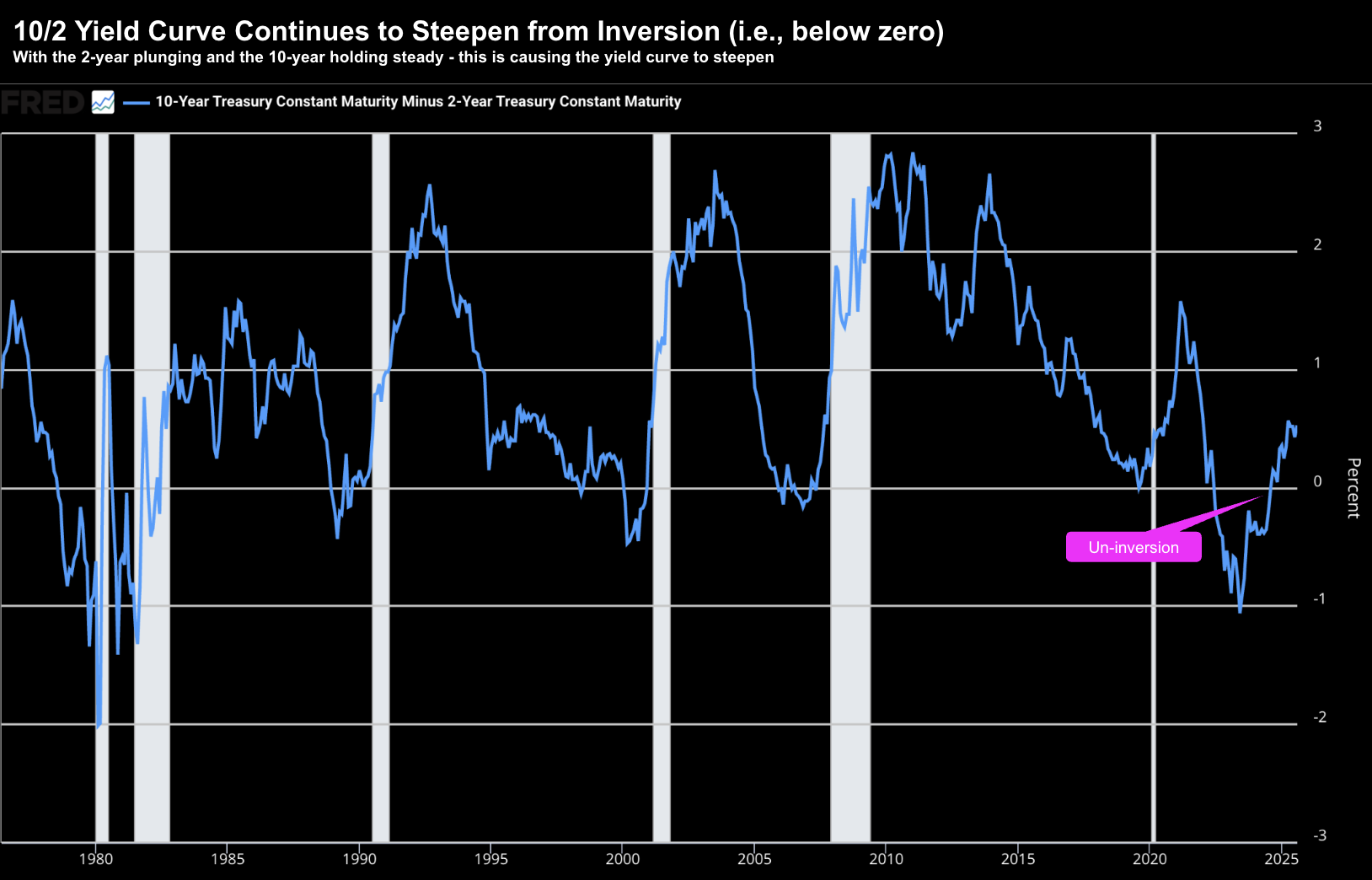

Something else investors should be mindful of is what we see with the re-steepening of the yield curve from inversion.

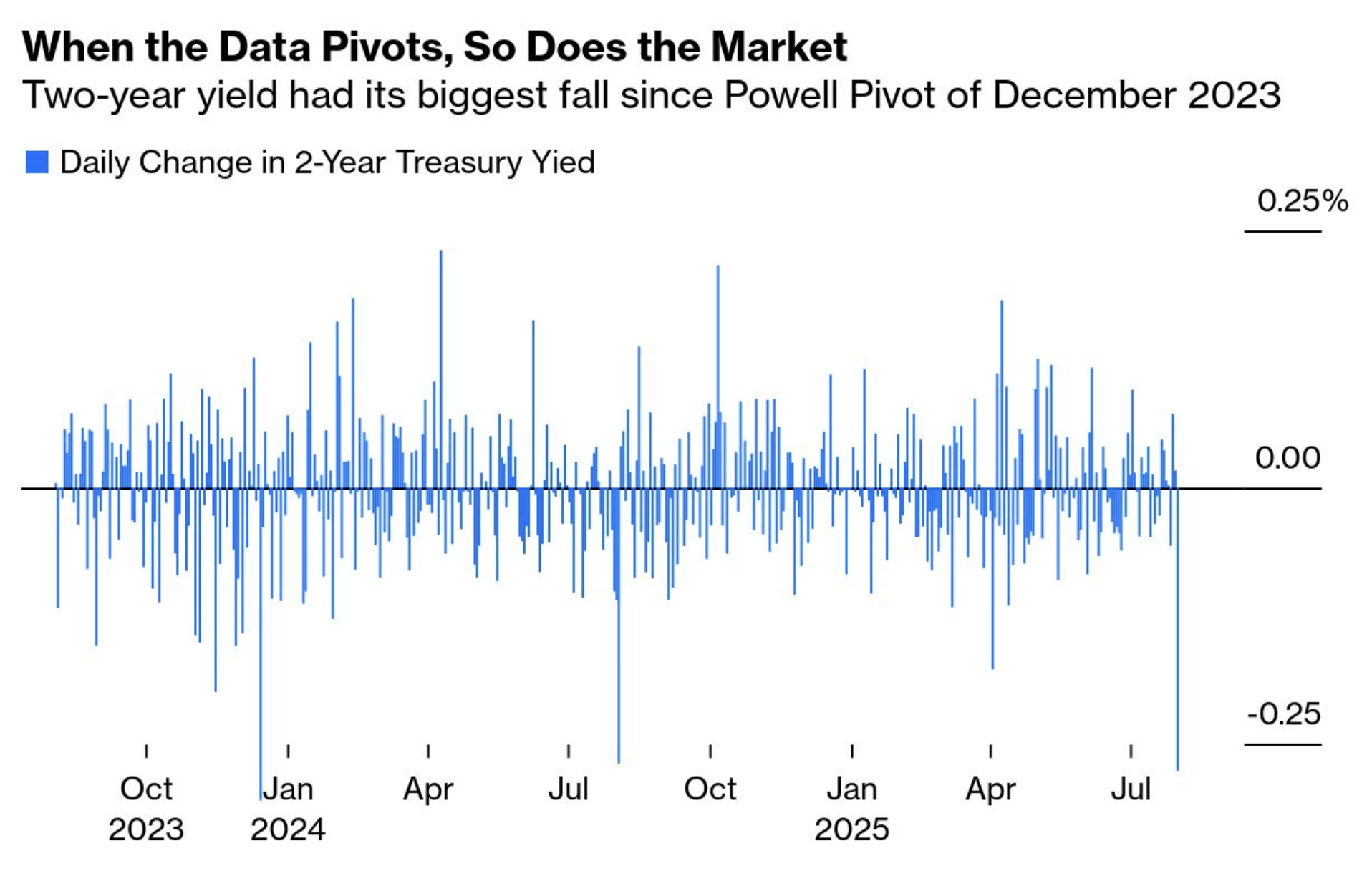

For example, with respect to the shorter-end of the curve – yields sank following news of last week’s disastrous jobs data

The 2-year yield is a proxy for short-term interest rate moves.

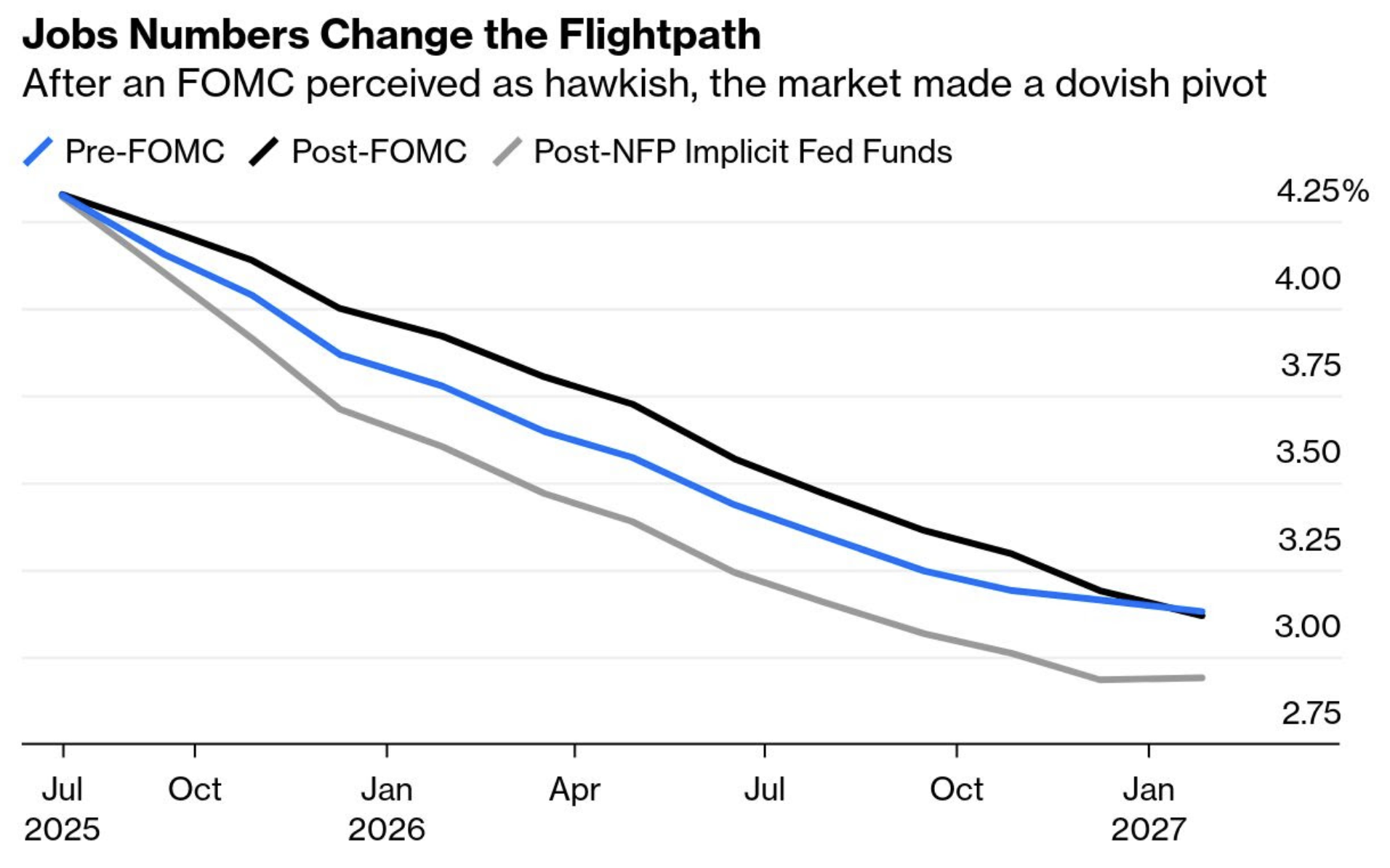

Futures now show a 95% chance the Fed will cut rates at its September meeting.

The Bloomberg World Interest Rate Probabilities shows that implicit expected fed funds rates were cut sharply to below 3% by the end of next year

However we did not see the equivalent move in the (more important) 10-year yield.

Jim Bianco, president and macro strategist at Bianco Research, notes the average time to recession from the 3-month / 10-year curve first inverting is 334 days.

For what it’s worth – this curve first inverted some 1,104 days ago (Oct 26 2022) – blowing out the average of 334 days.

In other words, it’s a very poor timing tool (more on betting ‘timing tools’ when I talk to the change in Real PCE in my conclusion)

But with respect to when the curve un-inverts – Bianco says this window shrinks to an average of only 66 days.

Again, this is merely an average.

But directionally it’s accurate as the 10-year / 3-month yield curve shows below (with the white vertical bars showing recessions)

Bianco says that in each of the past eight recessions that “uninversion” of the curve has been the result of a “bull steepening” where short-dated yields have tumbled as the Federal Reserve has cut rates in the face of very obvious economic or market stress.

Once the U.S. central bank starts cutting rates and the curve “bull steepens” recession is much closer at hand.

For those less familiar regarding the differences between a “bull” and “bear” yield steepening – below is a quick summary:

| Basis | Bear Steepening | Bull Steepening |

|---|---|---|

| Impact | It has a negative impact on markets due to inflation and increasing interest rates, particularly growth stocks. | It has a positive impact on markets due to the anticipated economic growth. |

| Occurrence | It occurs when long-term rates increase by more than short-term rates. | It occurs when short-term rates decline by more than long-term rates. |

| Central Bank Stance | It occurs when the Central Bank plans to tighten monetary policy. | It occurs when the Central Bank plans to ease monetary policy. |

| Outlook | For bond and stock markets, the outlook could be bearish. | For the economy and equity markets, the outlook could be bullish. |

| Investor preference | It makes long-term bonds less attractive. Hence, investors do not prioritize long-term bonds in this situation. | It makes long-term bond investment more attractive, leading to an increase in demand for such bonds. |

| Price-yield relationship | It leads to bond price falls and increases in yields. | It leads to higher bond prices, leading to lower yields for investors. |

For now, the market sees the bull steepening of the yield curve as largely positive (which is expected – given likely rate cuts).

However, Bianco reminds us it’s critical to observe where in the cycle this occurs.

In this case, we are coming from a point of deep inversion.

And as the long-term chart shows – typically this results in a recession in the subsequent months.

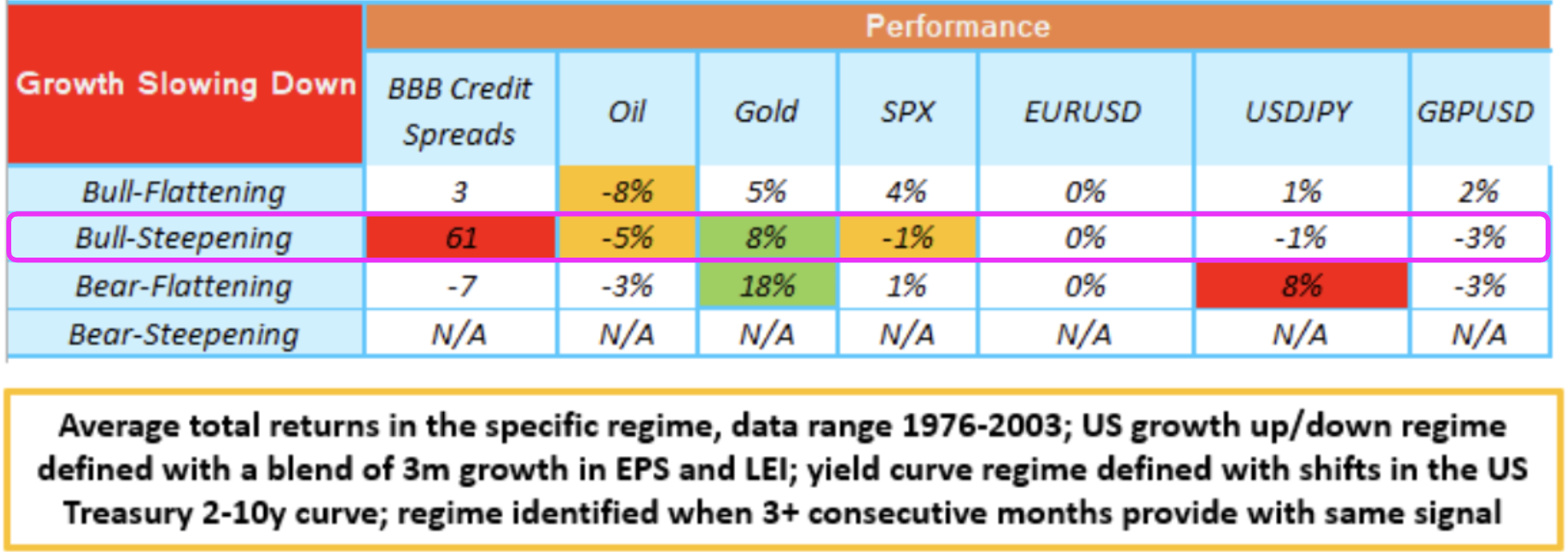

For what it’s worth, themacrocompass.com did some analysis covering the period 1976 to 2003 on the relative performance impact of bull and bear steepeners during periods of slower growth (using the 2-10 curve):

Of particular note – a bull-steepening curve during slower growth saw lower quality (BBB) credit spreads begin to blow-out; oil declines (and expected lower demand); and equities decline (SPX).

Gold however outperforms (which is what we’re seeing today).

The increase in BBB credit spreads is noteworthy.

When credit spreads widen – investors demand far more compensation for holding corporate bonds due to rising perceived credit risk (given the slowdown and increased default risks).

Putting It All Together

It would not be surprising to see the market give back around 10–15% over the coming weeks and months.

Valuations are very full and the economic data is weakening.

Trump’s tariffs are more likely to weaken consumer spending and compress corporate margins.

With respect to the bull steepening 10-yr / 3-mth yield curve—where short-term yields fall—historically this pattern precedes economic downturns when coming from inversion.

However, they’re generally a poor market timing tool.

My preference is to monitor what we see with the longer-term trend in changes to Real PCE (consumption).

When the consumer significantly slows its spending (e.g., more than 2% YoY change on a quarterly basis) – then brace for impact.

Typically, we will find the S&P 500 gives back meaningful (15%+) over the next 6-9 months.

Today the market appears comfortable with the risks (e.g., tariffs, consumer spending, corporate profits, interest rates, employment etc).

And the consumer is hanging in there (as we see with Real PCE showing soft declines each quarter this year) – where purchases year-to-date have mostly been tariff free (as tariff exempt inventories are drawn down)

However, when (not if) Trump’s ~15%+ tariffs work their way through various supply chains (which is just starting to happen) – we will see how the market reacts.