Wars Typically Bring Opportunity

- Another high-quality stock for your watchlist

- Why the Fed should stay the course irrespective of Russia

- I"ll take a recession over out-of-control inflation

A lot has happened since I last penned a missive.

Tensions with Russia seemed to have escalated…

Bonds and gold caught a bid as investors seek shelter… sending yields lower.

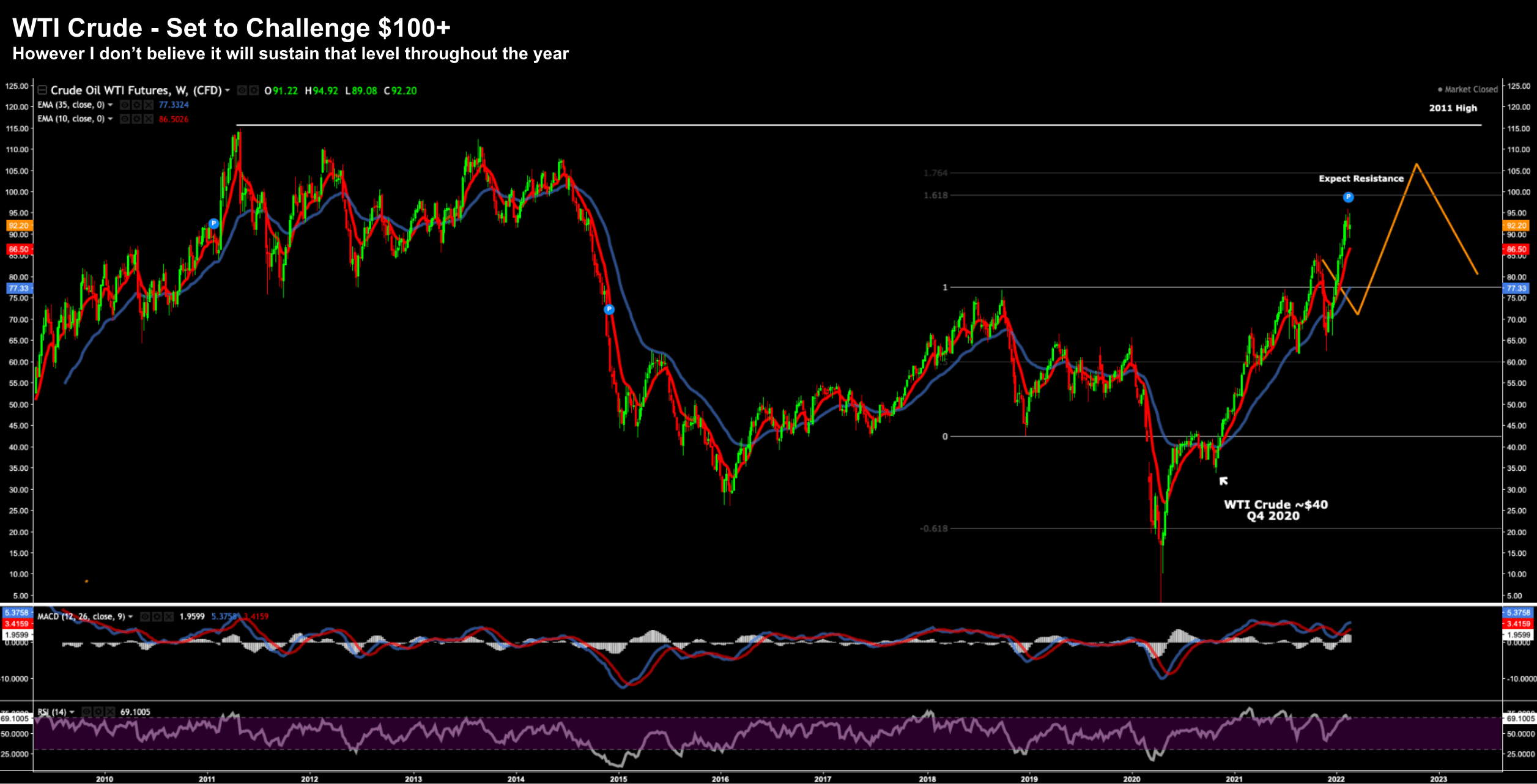

Oil looks to be on course to challenge $100… which will do little to appease growing inflation fears.

And all that against the backdrop of the Fed set to hike rates at least 6 or 7 times this year.

So what to make of it all?

Run for the hills?

Or look to hunt opportunity?

I"m here to tell you why it"s the latter…

Revisiting Earlier Predictions…

At the start of the year I nominated 5 charts which I felt held the key to 2022.

They were:

- WTI Crude

- 10-Year Treasury Yields

- 2-10 Year Yield Curve

- Core PCE Inflation; and

- The US Dollar Index

There are other charts I keep a close eye on (e.g. credit spreads, TIPS, gold and M2 money supply to name a few) – but I felt these five in particular could have a major bearing on how the year was to transpire.

And so far, things appear to be trading per the script.

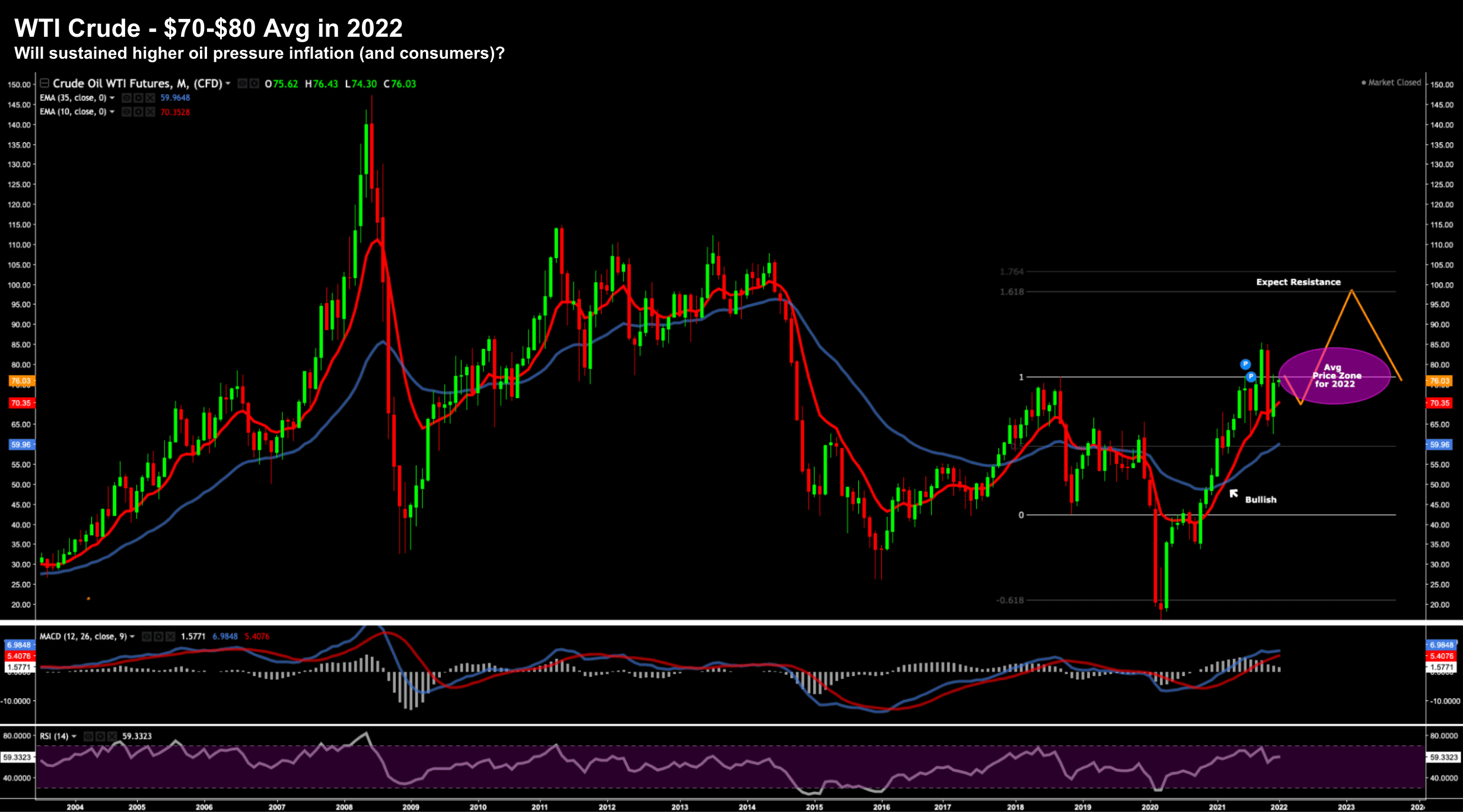

Let me start with WTI Crude…

Below was my forecast at the beginning of the year – looking for the tape to challenge $100.

Crude was trading ~$76 at the time but looked like it was set to run higher.

As I will show below – it"s more than likely that the price of crude will easily exceed $100.

In fact, it"s more likely to retest the ~$115 high of 2011.

However, despite the tensions we see with Russia, I believe any push above $100 will be short-lived.

And prices will most likely drop back to between $70 and $80 for the balance of the year

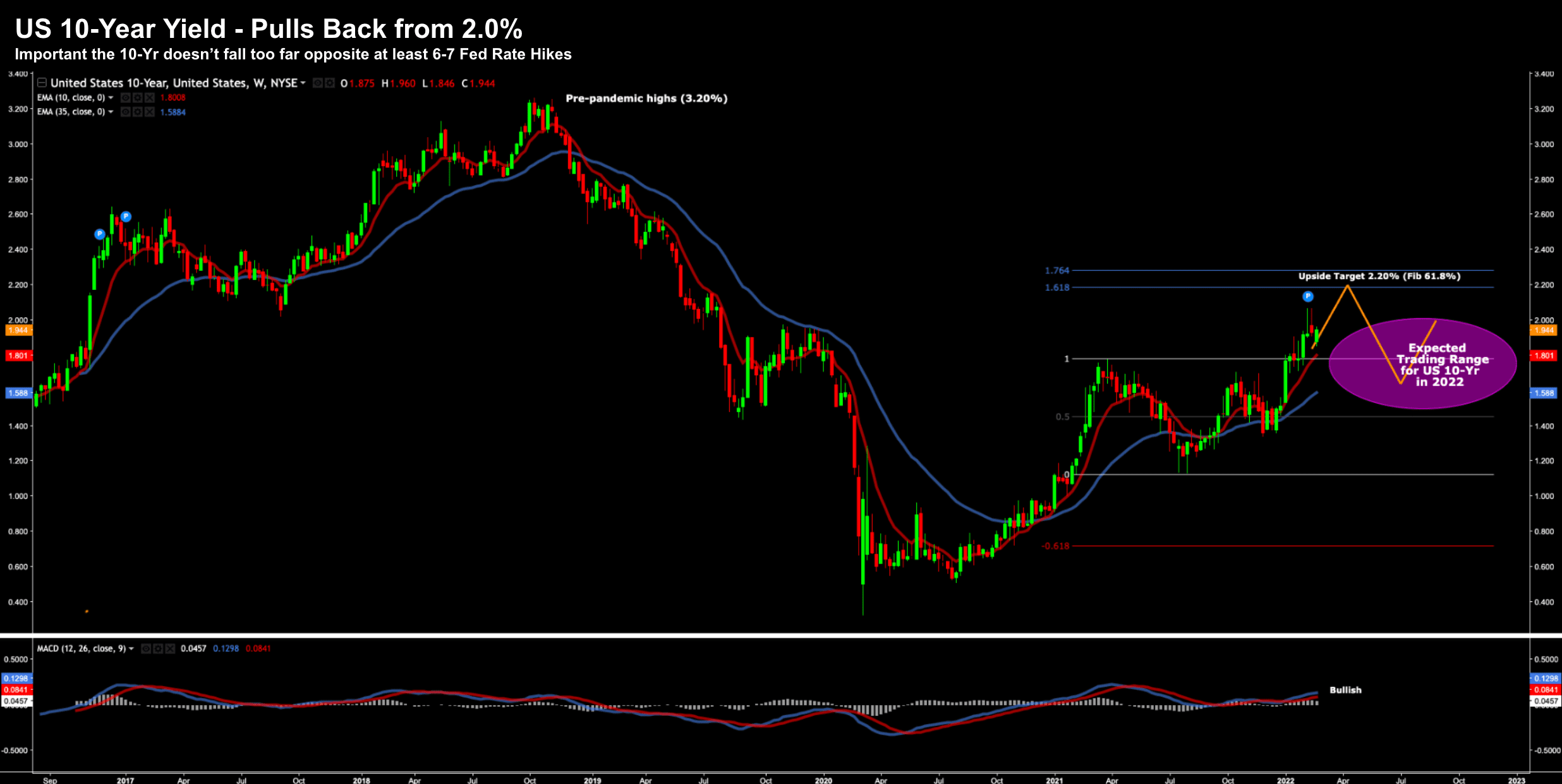

Yields Fall as Investors Seek Shelter

Last week the 10-year surged above 2.00% on surprisingly hot PPI data…

However, since then bonds have caught a bid.

The threat of war will often see investors buy bonds… in turn sending yields lower.

Now at the start of the year I was looking for these yields to challenge 2.0% – perhaps as high as 2.20%

However, I also felt there would be strong resistance in that zone…

I think the market is comfortable with the 10-year trading around these levels (if not higher)

In fact, I think there would be panic in the market if the 10-year was to fall below 1.50%

The market knows the Fed is likely to hike at least 6 times this year (maybe seven) – and this has been priced in.

That"s not new news.

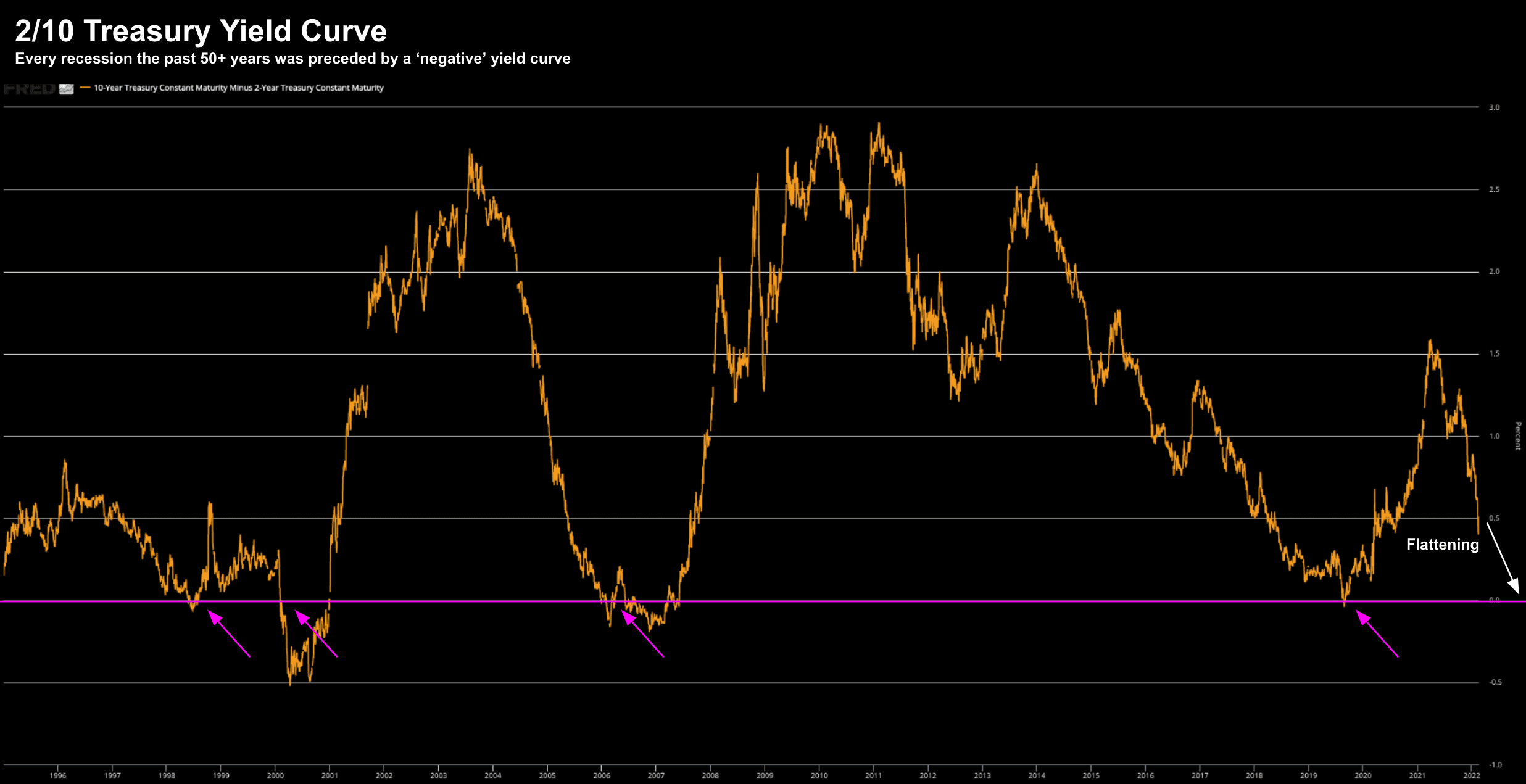

However, what it may not be comfortable with is the yield curve.

It has been crushed in recent weeks – and is now trading at around 35 basis points.

To me this has the potential to become problematic….

For example, should this fall meaningfully below zero, then you can dial in a recession within 12-18 months.

As an aside, I was listening to Bank of America"s CEO Brian Moynihan over the weekend, and how his bank is now running stress tests against their book in the event of a recession.

And whilst he is not saying a recession is a near-term event (I don"t think it is) – it"s not beyond the realms of possibility for 2023 or early 2024.

And it will be the Fed who hike rates straight into it (which is almost always the case).

Bank of America is concerned enough about inflation to stress test its portfolio for the possibility that Fed policymakers are unable to control it and prevent the country going into recession, Chief Executive Brian Moynihan said.

"We have to run those scenarios," he said. "What will hurt the industry generally will be if they have to create a recession. And that"s not their goal for sure. They"ll hopefully do a great job handling it. We stress test that and we"re fine."

Goldman Sachs" Chief Executive David Solomon warned that rampant inflation could be a headwind to growth.

"We"re moving from an environment of very easy money and below trend inflation to an environment of tighter money and above trend inflation. The economic environment is different and there will be consequences to that," he said.

Yes… and we are seeing this with the yield curve.

And with the Fed now behind the curve on inflation – they will be forced to act (irrespective of what"s happening with Russia)

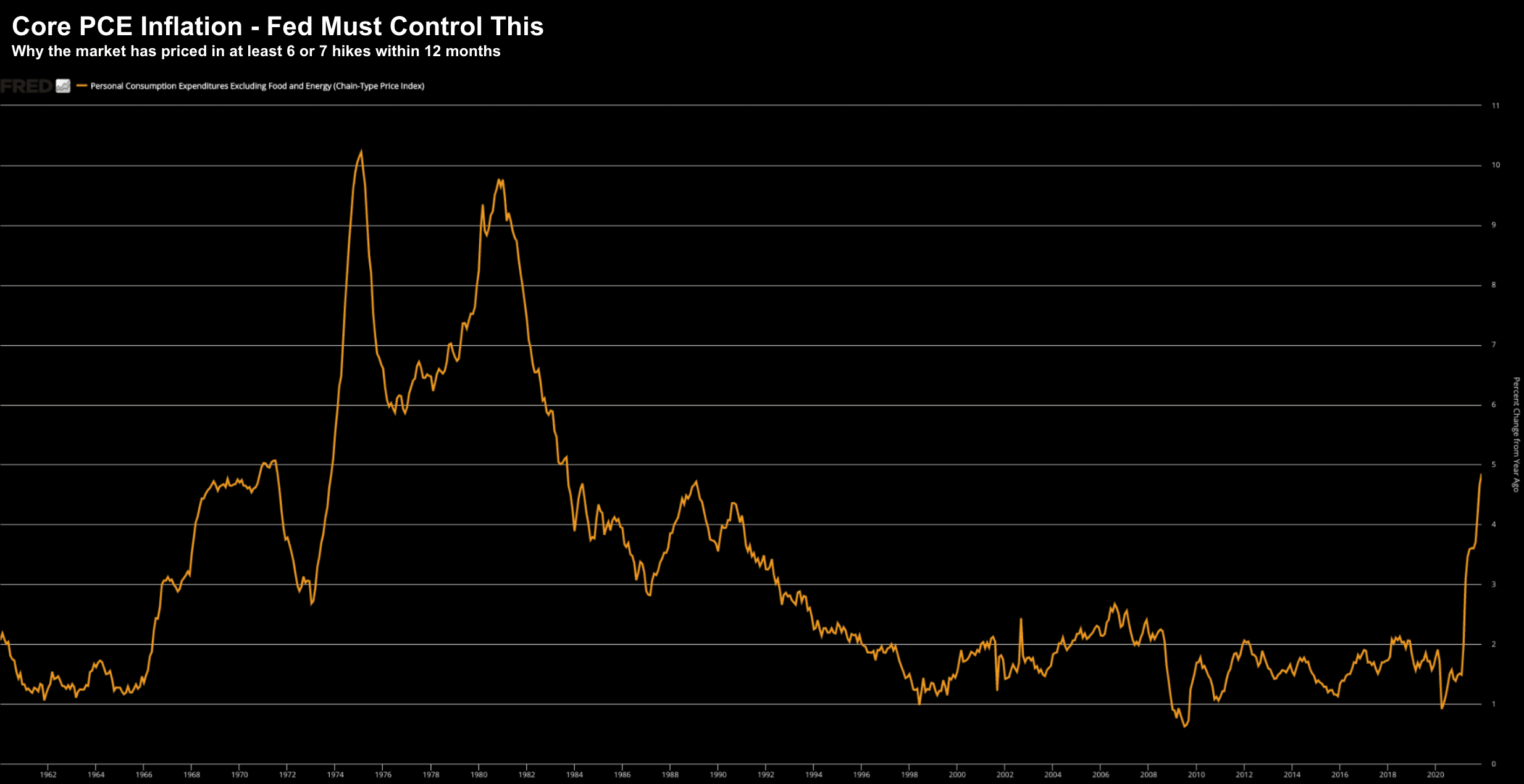

Core PCE Inflation

If you were to ask me what concerns the market more:

- Russian invasion of Ukraine; or

- The Fed failing to control inflation….

It"s the latter.

Inflation and monetary policy.

Whilst geopolitical tensions are always present… generally they are not sustained market events.

In the short-term they bring volatility and uncertainty… as there are a lot of moving parts.

But in the long term – wars prove to be buying opportunities (in my experience).

However, what Bank CEOs are concerned with is the measures the Fed takes to control 40-year high inflation:

Core PCE is the Fed"s preferred measure of inflation. This removes food and energy prices.

It"s target is for a level of around 2%

Today it"s closer to 5% and likely headed higher.

As part of my post last week I explained the only two pathways the Fed must take to get in-front of the curve.

In short, they must change the supply demand equation for money.

That is, improve demand by making it more attractive. And reduce supply via its balance sheet.

Inflation won"t meaningfully change course unless they take action on both these fronts.

Now some people are saying the Fed might "pause" here (e.g. only raising rates 25 basis points in March – and not 50) given what we see with Russia.

From mine, that would be a mistake.

The Fed needs to move aggressively and with speed.

And if that means potentially hiking into a recession (which is what Bank of America and Goldman are suggesting) – from mine that is a far better outcome than runaway inflation.

As they say, once the "inflation genie is out of the bottle", he"s very hard to get back in.

He"s now out. Well out.

And the Fed is going to have to work very hard to get him back in.

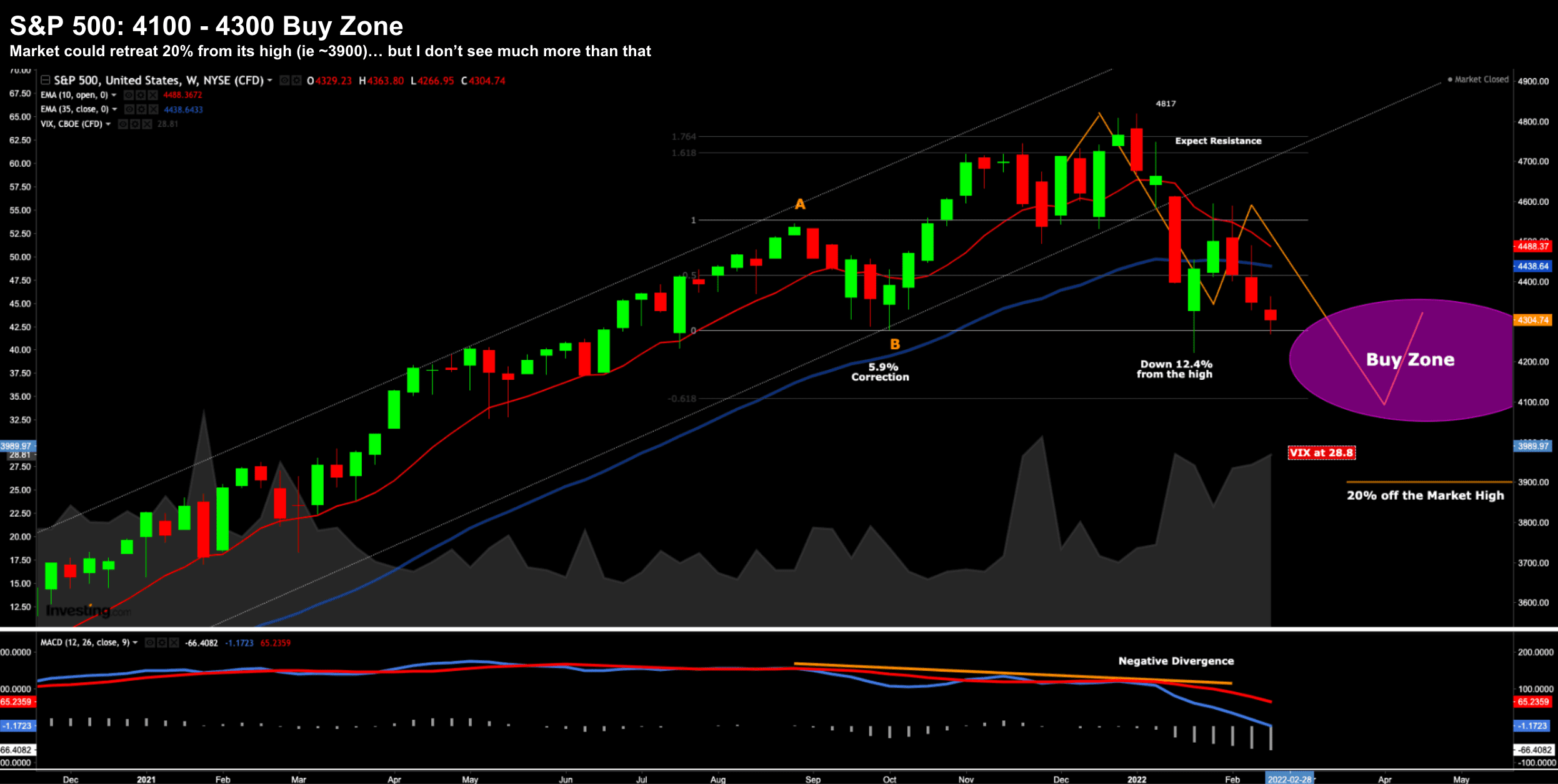

S&P 500 – Buying Opportunity

After the first dip of 2022 the week of Jan 24th – I suggested to traders to be patient.

My feeling was you were likely to get another "bite at the cherry".

Turns out, the S&P 500 managed to do just that.

The market is back near its January low and is offering traders (and investors) another opportunity in quality names.

However, you need to be selective.

From mine (and repeating myself from earlier this year) – I felt the zone of 4100 to 4300 offered good risk/reward.

But let me be clear…

That"s not to say I don"t think the market could fall ~20% from its all time high (i.e. to a level of around 3900).

That"s highly possible.

However, if we are presented with that zone, I think the upside outweighs the downside risks.

On the flip-side, readers will recall me saying earlier in the year that at a level of 4800 – I felt the downside risk of around 15% outweighed the possible 5-8% gain.

That is now playing out.

If you are buying the market here – expect further volatility.

The market is likely to move at least 10% in either direction.

And that"s okay…

What we are focused on are quality names for the longer-term.

Many of these are now offering traders the cheapest valuations I have seen in a long time.

That equals opportunity if you have the stomach.

Putting it All Together…

At the risk of repeating myself… you can be patient here.

You don"t need to be aggressive.

Given what we see with Russia, the Fed, inflation, oil prices, bond yields and supply-chain snarls… there are a lot of moving parts.

Some good news:

One "variable" which has been virtually eliminated from the financial lexicon is COVID… that"s now barely mentioned (apart from politicians)

Omicron has gone. Good riddance.

Before I close, it was interesting to watch trader"s surprise reaction to Home Depot"s earnings this afternoon.

Whilst they posted some great numbers – they are warning of slower growth for 2022.

This is a market tell.

It"s one of the few "barometer" stocks that I monitor (FedEx and American Express are others).

"Home Depot is being challenged by inflation and supply chain bottlenecks. The company topped Wall Street"s expectations and said it anticipates earnings per share will grow at a low single-digit pace while sales trends will be "slightly positive" in the coming fiscal year"

That saw the stock pummelled and is now ~25% of its highs.

However, the stock is now trading at a forward PE of ~20x (slightly below)

That"s not an outright bargain – but it"s getting far more attractive for a stock which dominates its category; and will always command a decent premium to the market.

I am not saying rush out and buy HD tomorrow… no… but it"s a high quality stock for your watchlist if/when the "baby is thrown out with the bathwater".

From mine, I will be happy to add some HD to my portfolio anywhere between $250 and $280.

Regards

Adrian Tout