What Do Q1 Earnings Tell Us?

Words: 1,092 Time: 6 Minutes

- Q1 "25 earnings ok – but a long way short of Q1 "24

- If earnings are to be revised lower – stocks have room to fall

- The Mag 7 vs the broader S&P 500

Over the long term – its earnings growth which drives stock prices.

However, in the short-term, we will experience large divergences based on investor emotions (such as fear, greed and bias).

It"s these divergences which create opportunity for patient (and astute) investors.

At the time of writing, we"re now past the midpoint of companies reporting earnings for Q1 2025.

What follows is a summary of the trend.

That said, it"s important to note that stocks are always looking forward between 6-9 months.

This is why they will generally react from more to guidance than any earnings surprise or disappointment.

For example, if they believe earnings are likely to slow (or possibly contract) – stock prices will fall sharply.

What"s Driving Earnings Growth?

Before I begin, if you want to better understand what is driving earnings growth and any trend – look no further than Factset.

Led by John Butters – he does an excellent job in breaking down the earnings by sector and what trends they"re seeing.

This summary draws for their latest update with a few comments of my own.

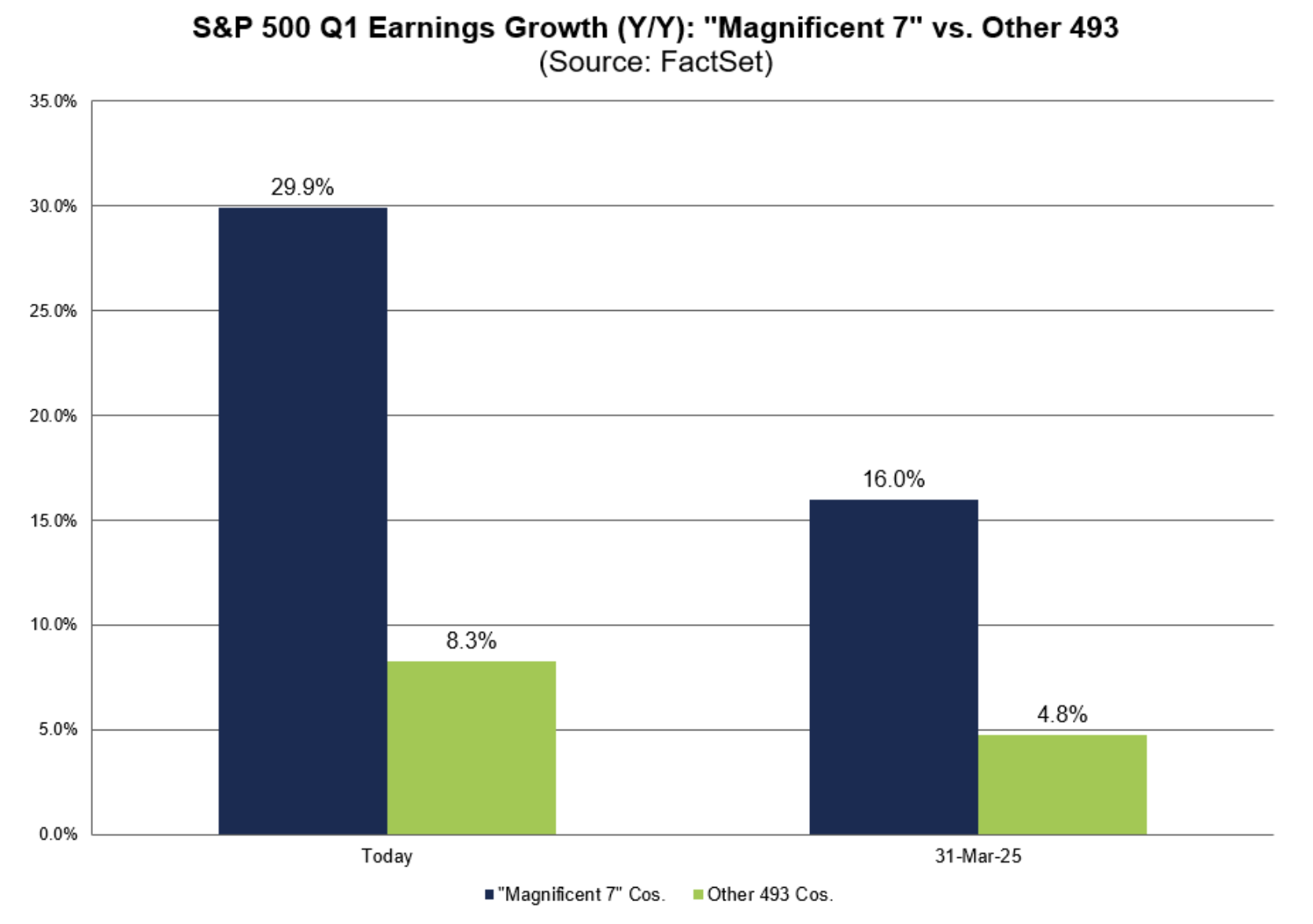

First, below is the contribution which is being made by the Mag 7 vs the balance of the market (ie the other 493 companies) in terms of earnings growth:

For comparison – in the first quarter of 2024 – the Mag 7 grew earnings by 52% from the prior year, while the gain for rest of the S&P 500 was just 1.3%

During the year – this saw the Mag 7 accelerate to comprise ~35% of the total S&P 500 market weight (i.e., an unhealthy balance)

Fast forward 12 months to Q1 2025 – the group"s earnings are up 29.9% against 8.3% for the rest of the index.

And whilst 29.9% is a very healthy level of YoY earnings growth – it"s a long way below the 52% from last year.

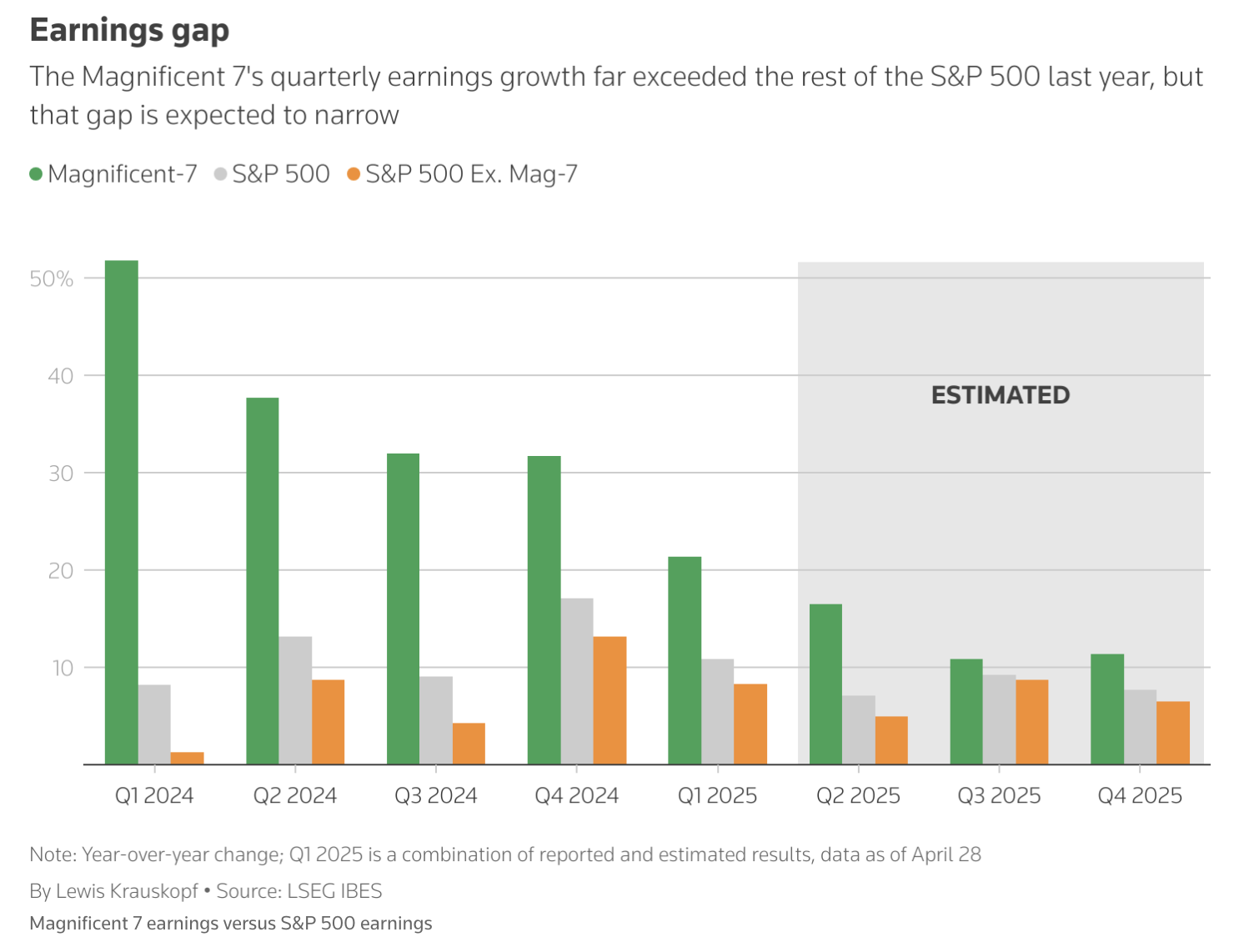

Here"s another representation showing the (narrowing) "earnings gap" from the Mag 7 vs the broader market.

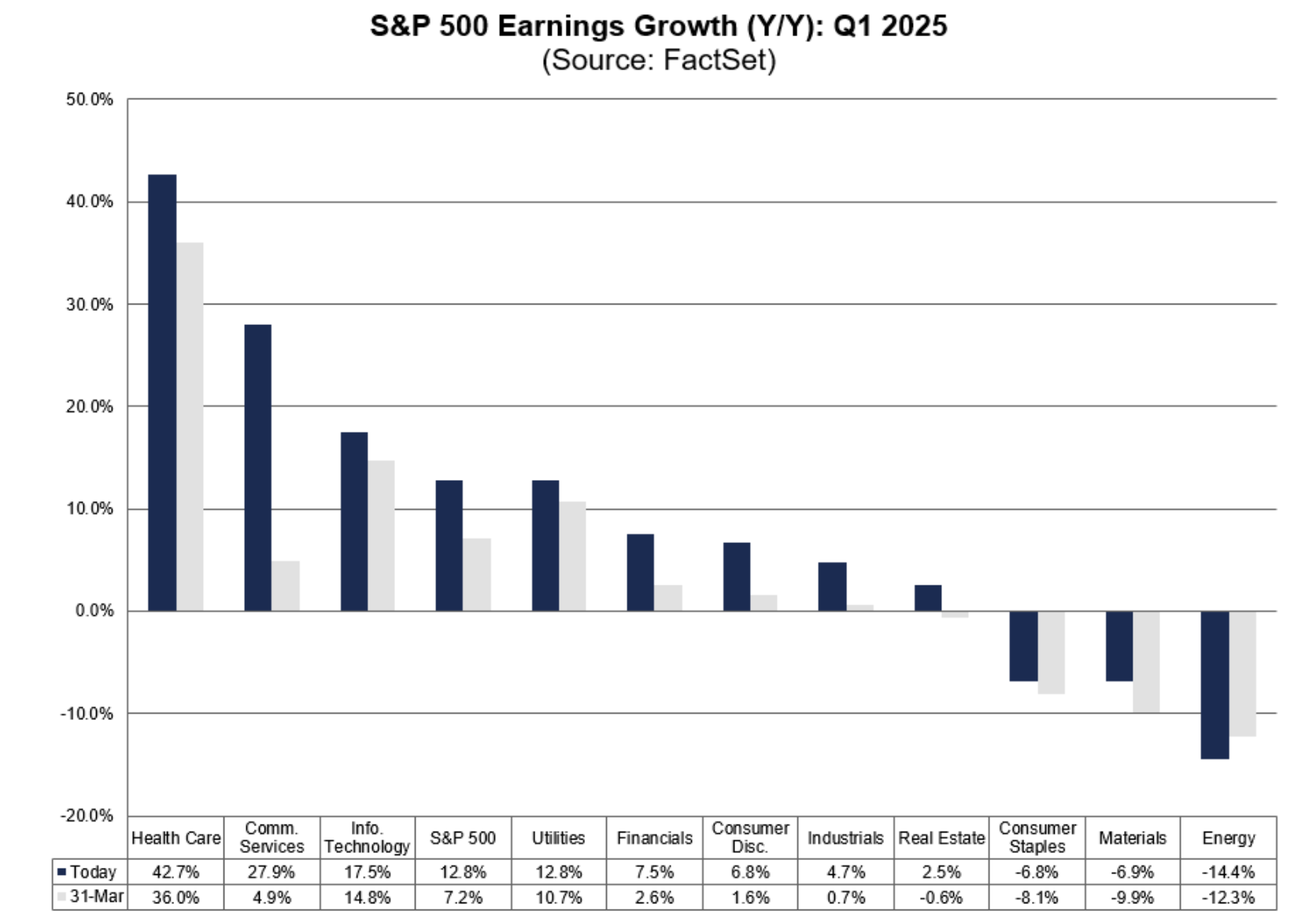

Looking more broadly – here"s what we see with respect to earnings growth at the sector level:

Health Care (42.7%) is the clear standout followed by Communication Services (27.9%) – where the category is led by Google and Meta.

Information Technology (17.5%) – which captures the likes of Apple and Microsoft – came in third.

Energy (-14.4%) and Materials (-9.9%) is the laggards – but also may represent the best value for investors (as many fear lower demand opposite a potential recession)

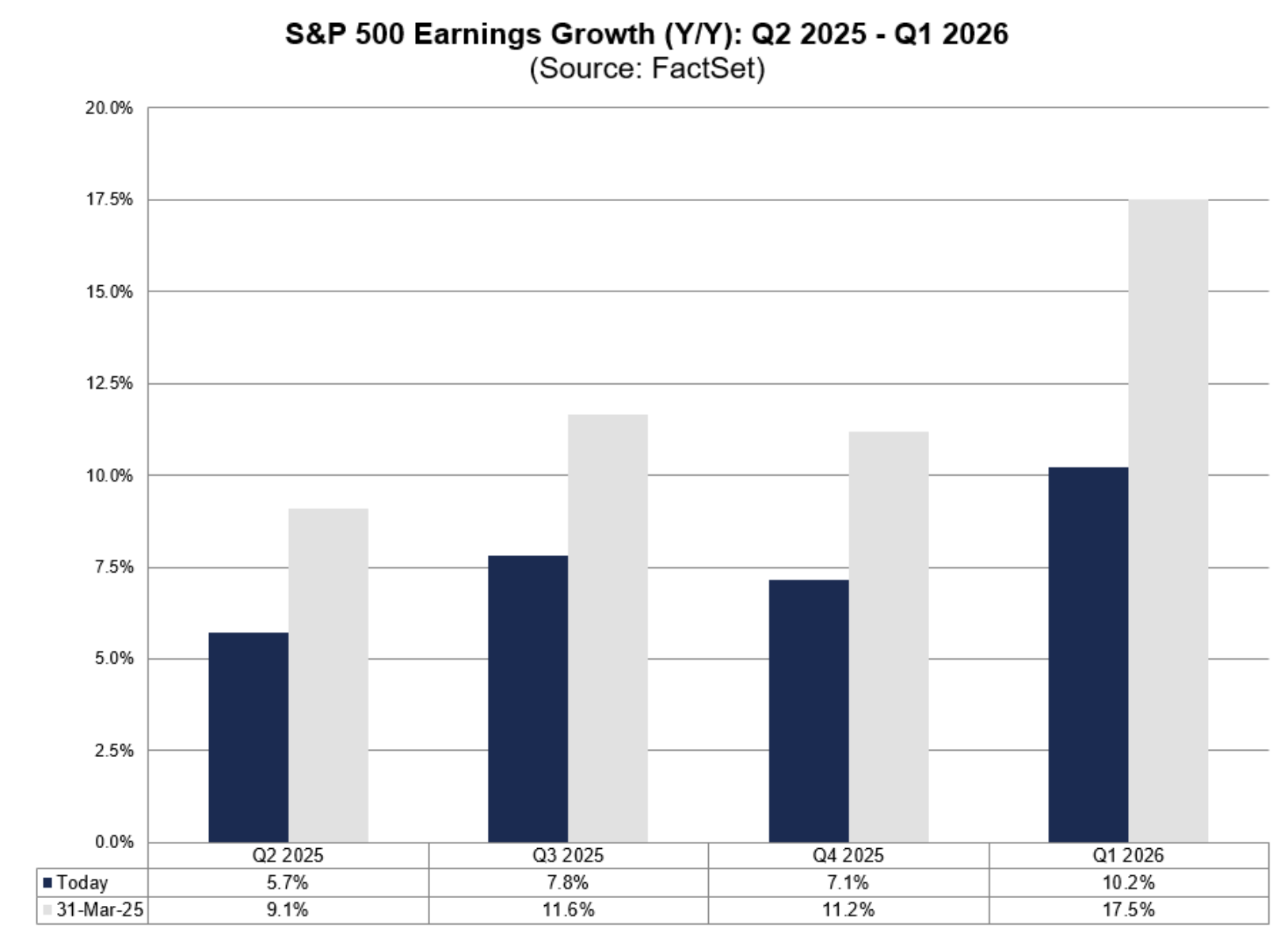

Overall, the blended average for the S&P 500 is 12.8% – however is likely to decline to single digit – as this chart shows.

For example, should the end of year earnings growth come in between 7% to 8% — this would be consistent with the long-term average.

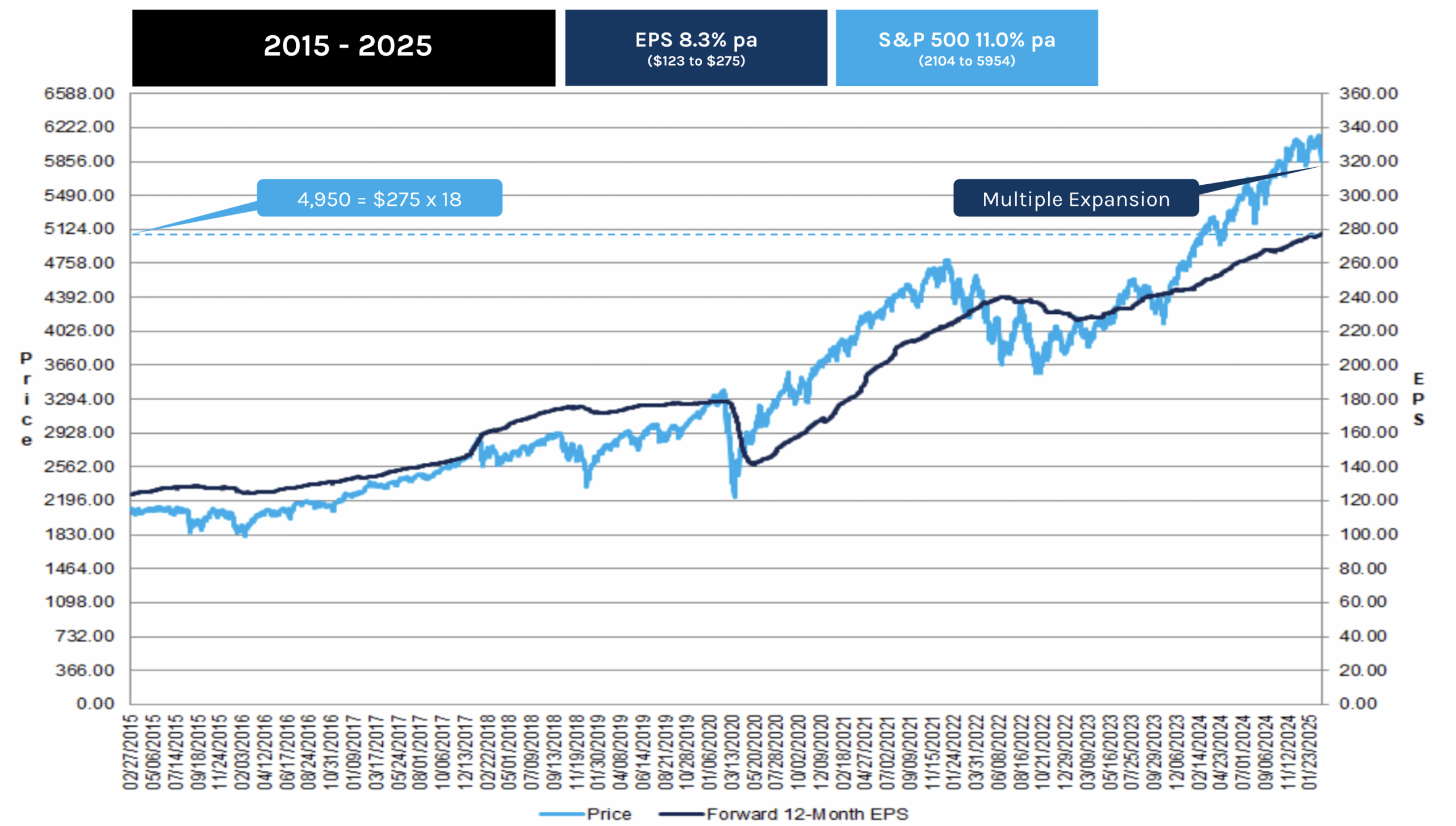

If we refer to the chart below (EPS vs S&P 500) – the EPS for the market was roughly $120 per share in 2015.

At the time the market traded just below 2200 – i.e., a multiple of 18x (consistent with the 10-year average multiple but above the 100-year average of around 15.5x)

Fast forward to today – expectations are for $260 to $270 per share this year.

Based on a 10-year period – this would represent CAGR of between 8.0% and 8.4% (you can test outcomes here with my CAGR calculator)

However, as I"ve warned over the past few months, the asking multiple is much higher.

For example, if we assume earnings of say $260 (the lower end of the range) – at a price of 5600 on the S&P 500 – that"s a multiple of 21.5x (almost 4 "turns" higher than the average ask of the past 10 years of 18x)

That"s the risk some investors are taking if choosing to pay the excess premium asked.

As an aside, you can now see why at the start of the year I challenged most "expert" S&P 500 price forecasts for a level of 7,000+ this year… the valuation was far too stretched.

Putting it All Together

If you are adding exposure here thinking we are through the "worst of it" with respect to tariffs (or other risks) – I would think twice.

For example, v-shaped rallies in bear markets are typically associated with some kind of large monetary policy response.

However, we don"t have that from the Fed. They are effectively adopting a "wait and see" approach – given the uncertainty around tariffs.

Therefore, in the absence of any Fed response, I question the sustainability of this (expected) bounce.

For example, over the past few weeks my feeling was we were likely to rally to around the 5700 zone (potentially a little higher) before striking resistance.

There were two reasons (the first carrying far more weight):

- First – the market is not cheap at 5700. If we assume $260 in earnings – you"re paying almost 22x in a slow growth environment; and

- Second – technically the market was likely to rally to an area around the 35-week EMA (i.e., 5700). Typically in risk-off markets – any strength will find some resistance in this zone.

My advice for patient (long-term investors) is to consider adding closer to a multiple closer to 18x (or below).

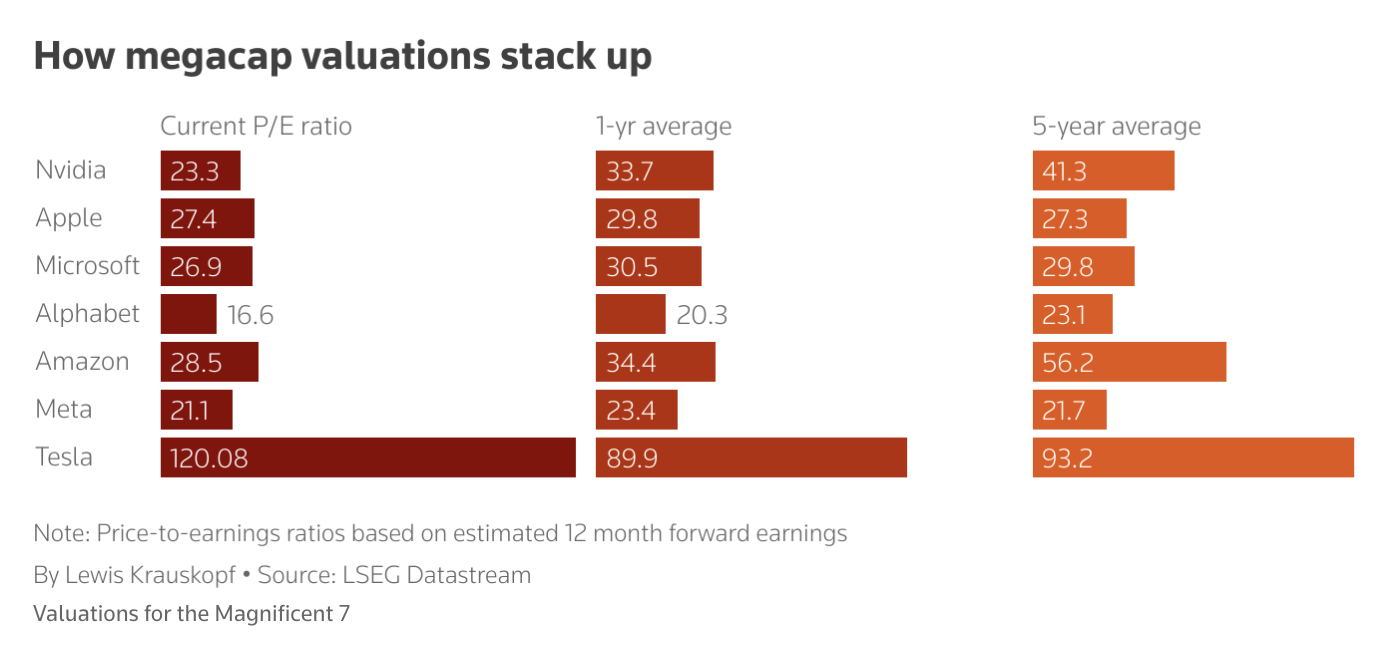

With respect to the Mag 7 and the multiple – most are now below their (pricey) 5-year averages excluding Apple and Tesla

However, with the exception of one name, most are still not cheap.

The exception is Google.

And it has nothing to do with the fact I work at Google.

From mine, the search leader is offering long-term value at 16.6x forward earnings – given its superior quality (specifically high levels of free cash flow, net income margins and return on invested capital above 20%)

For example, at 16.6x forward earnings – that"s almost 5x cheaper than the broader market at around 21x.

However, you are getting a far superior company to the "average" S&P 500 name (especially in terms of the quality metrics outlined above)

This is why I added back exposure around $155 to $157 per share (where the forward multiple was closer to 15x) – after reducing my exposure closer to $200 per share.

Meta is also reasonably priced at its current valuation – roughly 21x forward.

That said, I personally choose to value stocks on either a P/FCF or EV/EBIT basis (paying very little attention to earnings as they are reported)

In closing, whether it"s the S&P 500 or the Mag 7 – if earnings are to come in lower than expected – this will pressure stock prices.

Remember – over the long-run – stock prices will gravitate to the mean (e.g., ~18x or below)

In terms of the broader index – earnings could easily trade at or below 4800 should 2025 finish in the realm of $260 per share.

Always start any investment decision by first looking down (not just up).