What ‘Shock’ Will 2022 Deliver?

- Three shocks to come in 2022

- Money flows into defensive names

- What"s the last domino to drop before a recession?

It was a mixed week for major indices – as investors weighed the implications of aggressive quantitative tightening (bond selling) from the Fed

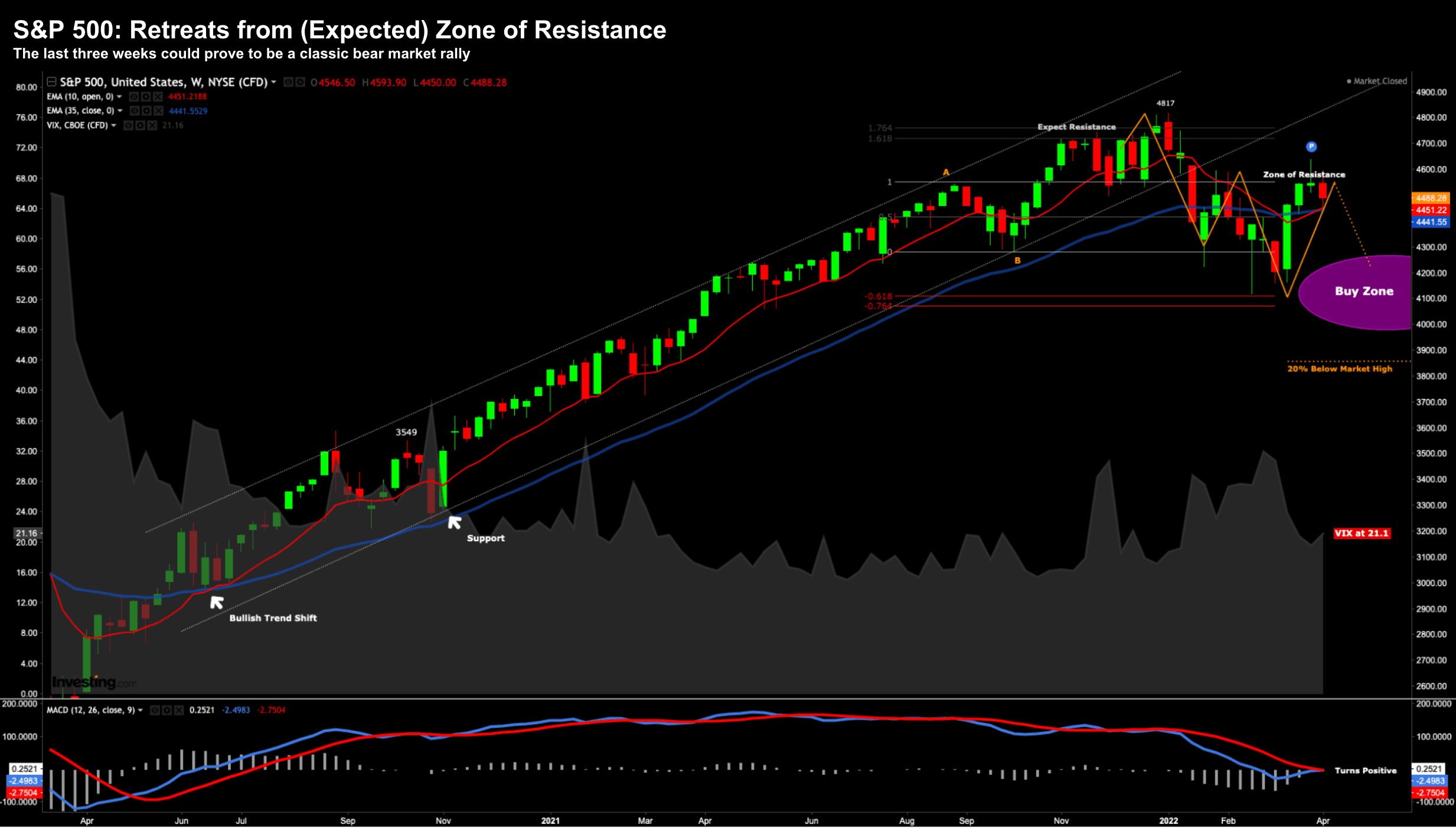

But let"s begin with how the S&P 500 closed Friday (and what"s next):

April 8 2022

Over the past few weeks, I flagged the zone of 4500 to 4600 as a potential area of selling pressure.

So far this appears to be playing out.

We raced to a level of 4543 the week ending March 21 – however have lost ground since.

This week the S&P 500 gave back 1.3%… taking its total retreat for 2022 to just under 6%

Now when you consider the S&P 500 started 2019 at 2431 – the index is up a whopping 84.6% in just over 3 years.

In other words, a 6% pullback is nothing.

Trillions in monetary and fiscal stimulus made the 85% 3-year rally happen – with nominal rates pinned to zero.

Investors had no other choice.

However, yesterday I asked what percentage might be "given back" now that the easy-money is now in reverse?

My view: 20% is plausible.

Outside the chart, the other thing screams "risk off" is what we see by sector. In other words, where is money flowing?

In short, money is getting extremely defensive.

For example, below is a percentage of Russell 2000 stocks trading below the Feb 24 market low:

- Discretionary 50.4%

- Financials 37.9%

- Industrials 30.1%

- Telecom 29.4%

- Technology 24.9%

- Materials 23.2%

- Staples 20.4%

- Health Care 10.6%

- Real Estate 8.8%

- Utilities 0%

- Energy 0%

The names holding up (in bold) are sectors which are all low growth / higher yield / defensive.

Some might call them "value" – where they typically trade at a very low PE (e.g. below 12x).

But what this table illustrates is how divided the market is… as money chases names which typically perform better during times of recession.

So What "Shock" will we see for 2022?

So what might take the market 20% lower?

Well there are any number of catalysts. For example, take your pick from:

- Lower earnings revisions / weaker forward guidance;

- Inflationary pressures lasting longer than anticipated;

- Aggressive rate hikes beyond what"s priced in;

- Short-end of the yield curve flattening or inverting;

- Quantitative tightening – how much and how fast;

- Oil sustaining a level above $90 – driving further inflationary pressure;

- A stronger US dollar – acting as a headwind for global earnings;

- A deep European recession; and

- A slowing China…

This week I read a research note from Bank of America"s top strategist Michael Hartnett.

Here"s a line from the report:

"Inflation shock is worsening; rate shock is beginning; and recession shock is coming"

Harnett echoed the sector overview I provided above – commenting on weekly fund flows.

He said that fund managers continue to increase exposure to defensive assets with healthcare attracting $1.7 billion – the largest inflow in five months.

Yesterday I called out my own exposure to both LLY and UNH (two solid healthcare picks).

DHR is another one I like.

Elsewhere, Hartnett also notes the largest inflow to bank loans since Feb17 ($2.2 billion) and the largest inflow to EM equities in 10 weeks ($5.3 billion).

He also cited money flowing into big tech..

For what it"s worth, I think big tech trades lower here but it will be a strong defensive asset when times get tough.

The "MAGA" complex trades at modest forward PEs (e.g. below 30x) given their exceptional growth rates; consistent strong free cash flow; and bullet proof balance sheets.

What"s more they have extremely defensive moats.

Now Hartnett reiterated his bearish view on the S&P 500 for 2022 with the risk of three shocks.

- "Inflation shock" worsening

- "Rates shock" just beginning

- "Recession shock" coming

For example, we know that inflation always precedes recessions. Consider:

- Late-60s recession was preceded by consumer price inflation;

- 1973/4 with oil and food shocks;

- 1980 recession due to an oil shock;

- 1990/91 by high CPI;

- 2001 by inflation tech prices; and

- 2008 by the housing bubble.

I often like to say that the Fed will exaggerate the boom bust cycle via monetary policy.

They like to "think" they are smoothing out the business cycle – and they might in the very near-term.

But longer-term – they always make the bust worse than it needed to be.

It"s essentially a giant misallocation of capital.

Businesses that attract capital shouldn"t.

For example, artificially low money will push asset prices far beyond fundamental value (e.g., the past three years) – and as they begin to tighten to tame inflation – the air quickly comes out of the bubble.

Rinse and repeat.

Every time consumers are left holding the bag.

This will not be any different.

But perhaps what"s most important is the last "domino to drop" (in terms of recession expectations) are far higher yields and a resulting steeper yield curve.

We are not quite there yet but we are heading in that direction…

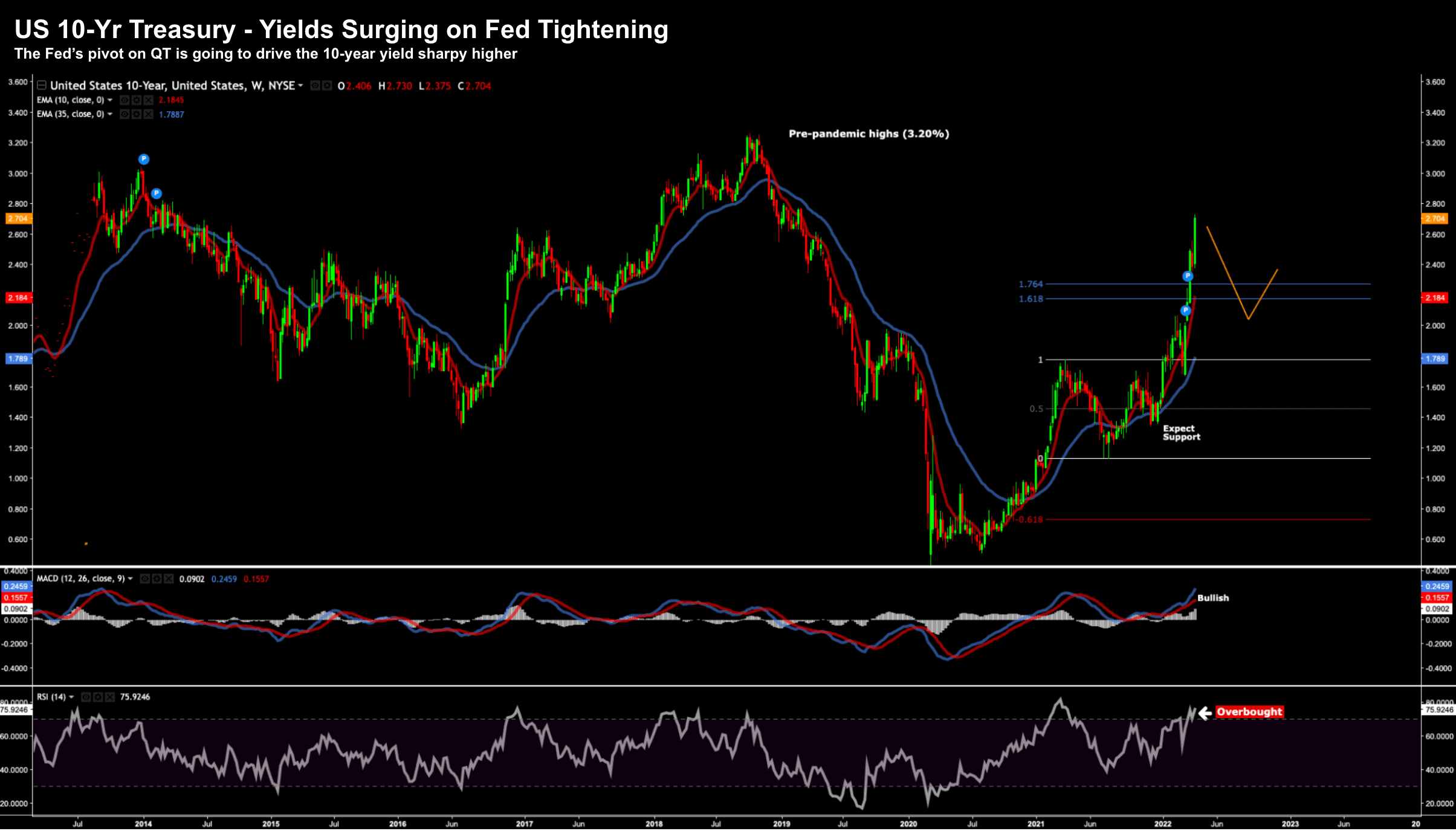

10-Yr Yield Surges as Yield Curve Steepens

Before I close, it"s worth noting the 10-year yield hit a fresh three year high today.

It"s not hard to explain – the market is now pricing in quantitative tightening (i.e. Fed bond selling) to the tune of $95B per month.

This is great news for the yield curve – but bad news for consumers.

In short, all forms of debt are about to become a lot more expensive (as we are seeing).

As an aside, look at the price action in home builders – they are getting decimated.

Let"s take a look at the 10-year yield:

April 8 2022

This is essentially Michael Harnett"s "rates shock" – which is just beginning.

The inflation shock is already here… and it will likely press 10% year on year before long. We get the latest monthly read next Tuesday – expect a number close to 9%

The recession shock is yet to arrive…. as the last domino is yet to fall.

Putting it All Together

It"s always worth noting fund flows.

There"s nothing about today which screams "risk on".

Today, value stocks were bid higher (i.e., dividend paying, low PEs, defensives) and growth was out.

The Dow Jones rallied and the Nasdaq dropped.

Now I hope you used the ~10% rally in more speculative tech names to reposition the last couple of weeks.

It was a gift.

And if we see another steep market decline (and I think we will) – and you don"t already have exposure to the likes of Microsoft, Apple, Amazon and Google – I would use that opportunity to buy for the long-term.