Words: 1,065 Time: 5 Minutes

- Be careful what you wish for

- The sharply weaker trend in jobs raises concerns

- Despite the risks – fund managers see the Fed as a panacea

History has shown that stock markets generally perform well when centrals banks start an easing cycle.

And with the Federal Reserve Bank almost certain to cut rates later this month (more on this below) – it should bode well for asset speculators.

However, the more important question is not whether the Fed will cut rates…

It’s why they’re likely to cut.

Typically a rate cut cycle comes with a slowing economy; i.e., one in need of (monetary) assistance.

And whilst cheaper money is welcomed by borrowers (less so savers) – investors don’t want growth to slow too much.

Slower growth means weaker employment, reduced consumer spending, lower inflation (as demand falls) and overall lower corporate earnings.

That’s a negative for stock prices.

Put together, it may be “good news” that monetary policy is about to become less restrictive.

But on the whole – we need to balance this with how much the economy is weakening.

Be Careful What You Wish For

Last week brought us a slew of macro-economic data.

Unfortunately none of it was good. From manufacturing to hiring, it’s been grim tidings.

But Friday’s monthly jobs report was the worst of all:

- Labor market deterioration: Just 22,000 jobs were added in August, dramatically lower than economists’ expectations for 76,500 new roles.

- Negative job growth: For the first time in nearly four years, the economy lost jobs, with a decline of 13,000 positions in June.

- Rising unemployment: The jobless rate rose to 4.3%, the highest levelsince 2021

- Stagnation:The data underscores the extent to which consumers and businesses are struggling to accommodate the weight of tariffs, stubborn inflation, the decline in America’s immigrant workforce and overall economic uncertainty

It was not too long ago (7 months before Trump was re-elected – March 2023) — US unemployment hovered at half-century lows – a rate of below 4.0%.

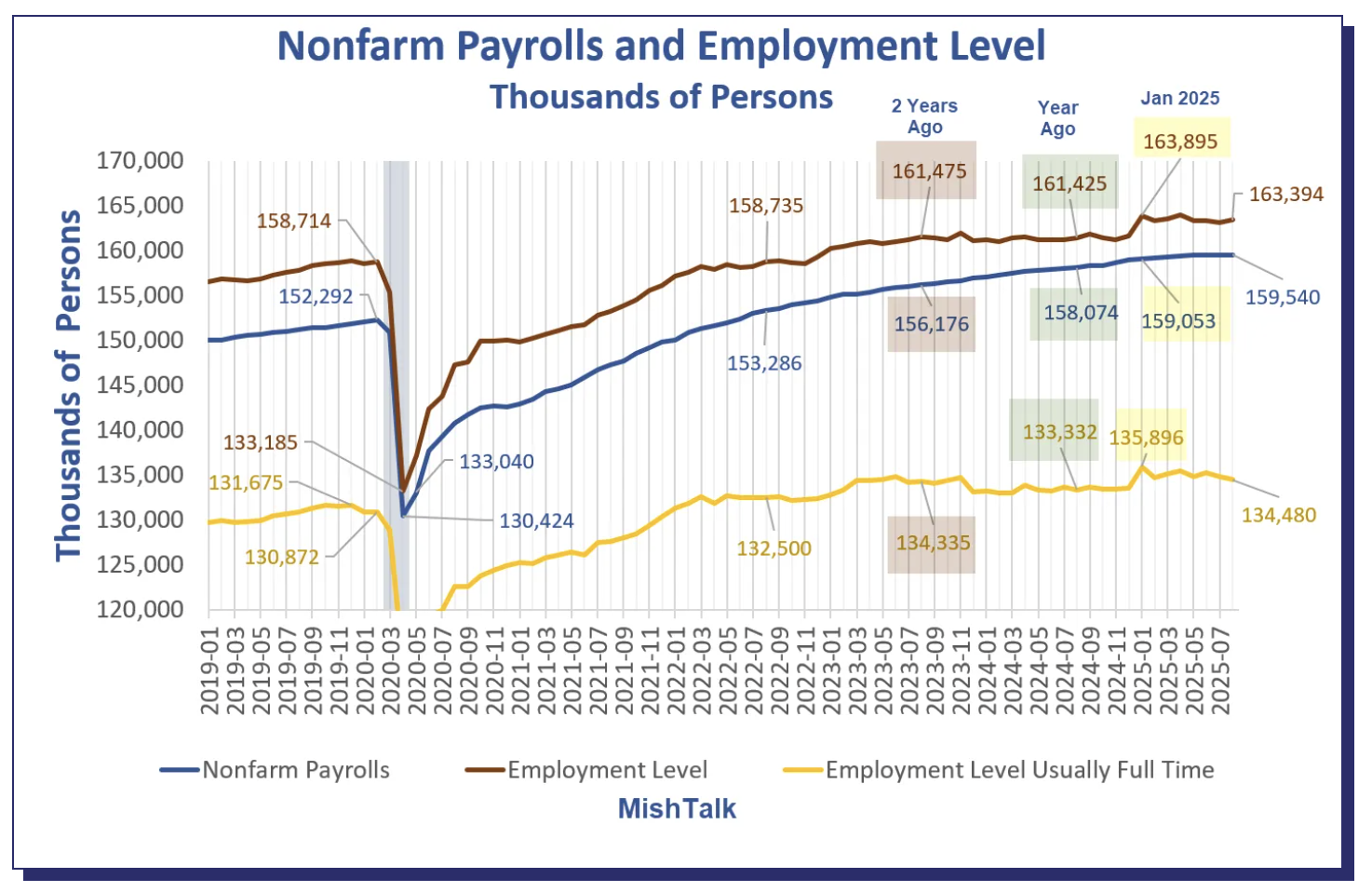

But since Trump returned – jobs have been disappearing at scale:

The trend in these two charts is fanning concerns that the economy is entering a period of high uncertainty and stagnation.

Here’s Mike Shedlock’s take:

- While the payroll survey showed a modest gain, the household survey revealed significant drops in key areas, including a loss of over 1.4 million full-time jobs since the beginning of 2025. Shedlock suggests the payroll survey over samples large employers, masking a decline in small business jobs.

- He points out a weakening in 9 of 14 sectors showing job losses in August. Manufacturing, construction, wholesale trade, and professional services were cited as particularly weak, while only health services and leisure/hospitality saw growth. The author also points out a decline in average weekly hours for manufacturers.

- Finally, he suggests the official unemployment rate of 4.3% is misleading. By using the broader U-6 unemployment measure (which includes discouraged and underemployed workers), the rate jumps to 8.1%.

Echoing the last point – Shedlock feels the true state of employment is much weaker than official reports suggest due to flawed survey methodologies and people dropping out of the labor force.

Irrespective, both mainstream (and Shedlock’s) figures add weight to the prior month’s jobs report, which showed a shockingly cooler hiring picture than previously thought.

Job growth has moderated materially in recent months, openings have declined and wage gains have eased—all of which weigh on broader economic activity.

The Growth Slowdown

I doubt the Fed was ‘blind’ to what was coming down the pike (given the widespread uncertainty)

I’ve always felt that if Jay Powell had the flexibility to cut – he would have if it were not for the inflationary risks caused by Trump’s tariffs (which are yet to hit at scale).

Various Fed members have also been vocal about the rapidly deteriorating jobs picture – arguing for rate cuts sooner than later (see “Powell in No Hurry to Cut Rates“)

Following Friday’s report – we can confidently assume rate cuts are now imminent.

The Fed will not want to disappoint. It’s perhaps a question of whether it will be 25 bps or 50?

I suspect 25 bps – as 50 could show panic.

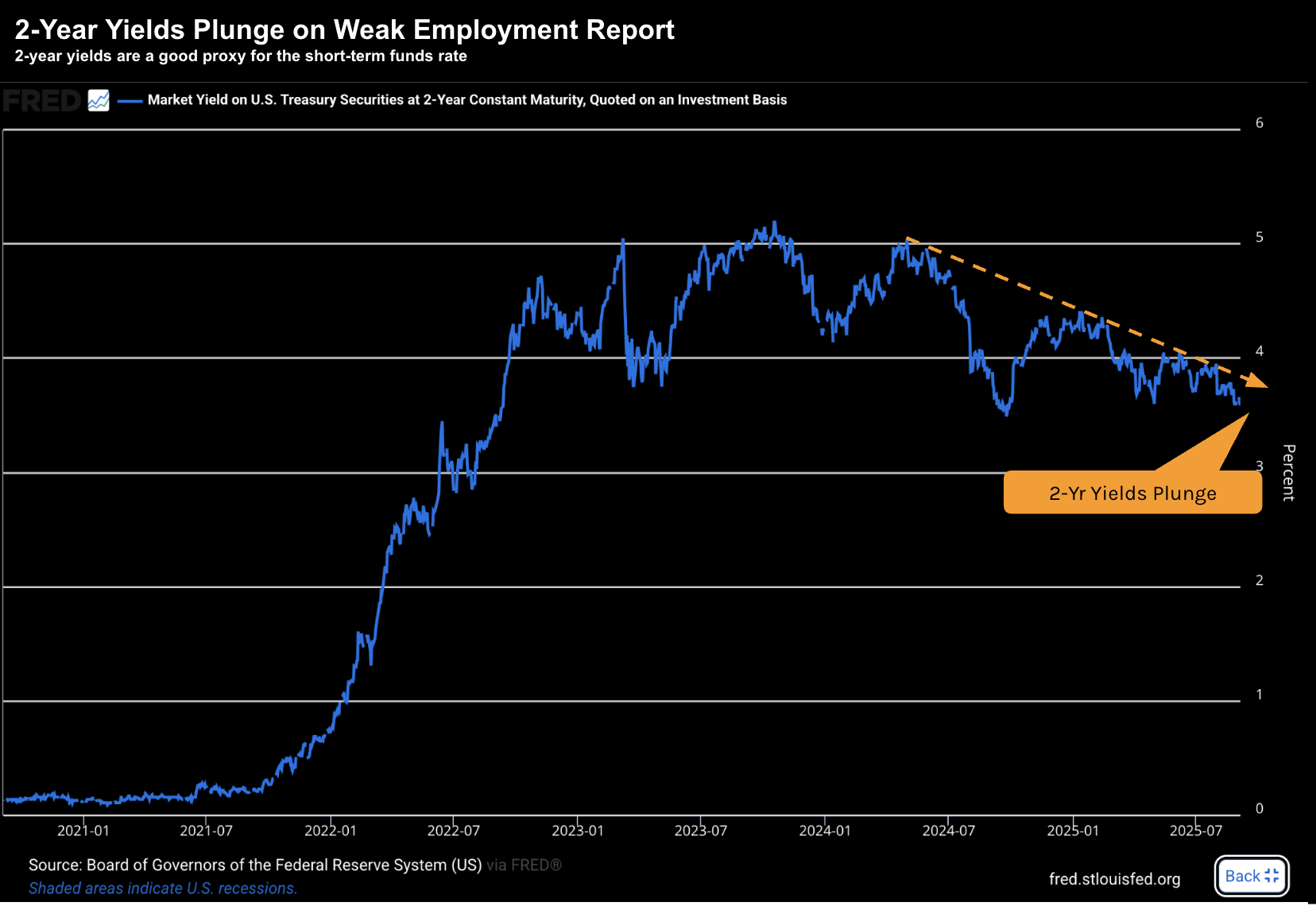

What’s more, we only need to look at the sharp drop in both the 2-year and 10-year yields.

The cooling in bond yields sparked a flight to safety – with 2-year yields hovering near the lowest since 2022.

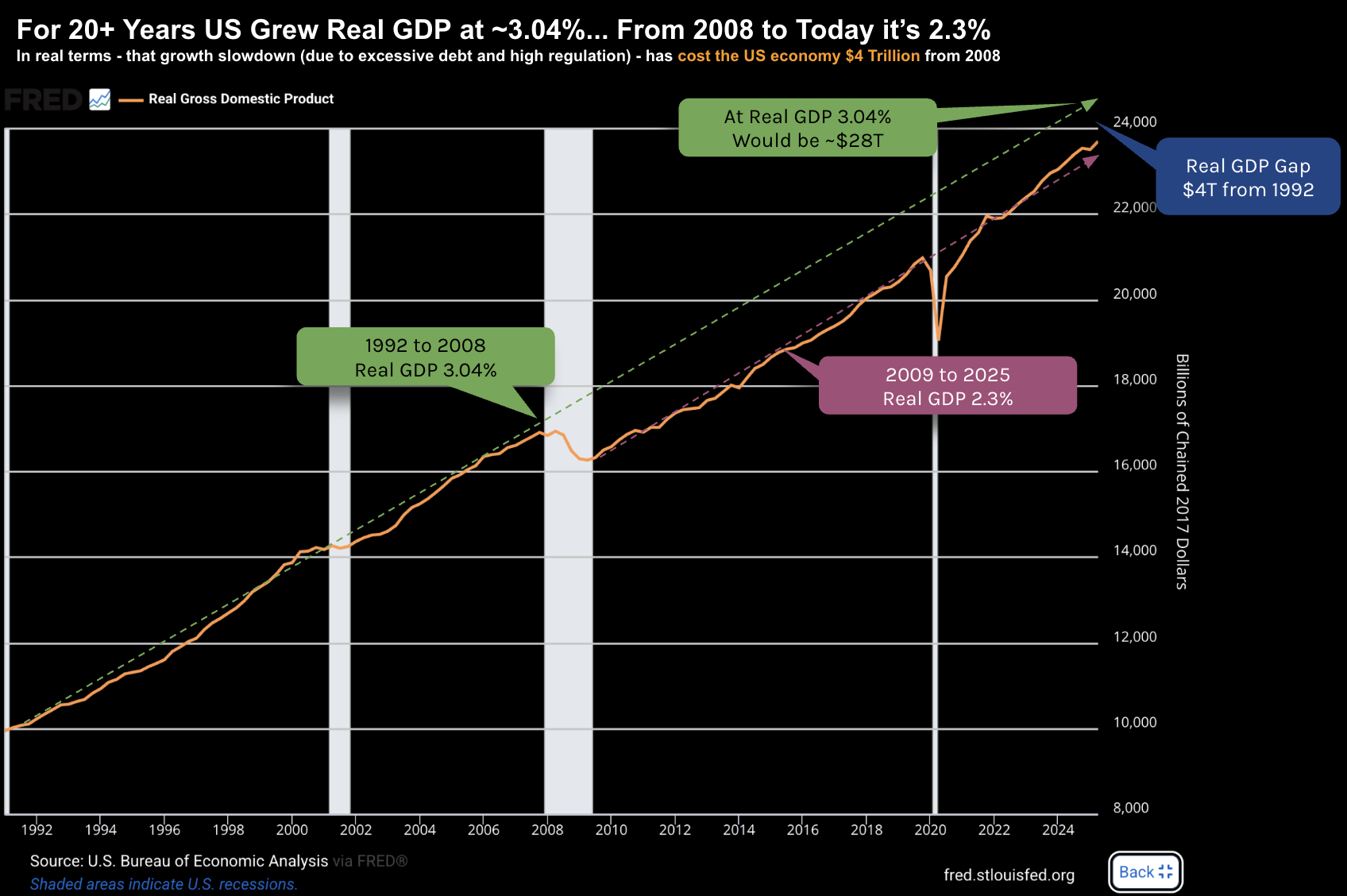

And if we zoom out – the longer term growth picture remains troubling.

For example, earlier today I was looking the trend in the Real US GDP growth from 1992.

The inflation adjusted rate of growth for US output used to be around 3.04%.

However, the events of 2008 knocked the US off its ‘growth axis’ – largely due to the enormous debt load which was saddled against the economy.

Since then, the economy has grown at a paltry rate of just over 2.0%.

- If average 3.04% CAGR from 1992 to today – Real US GDP would be around $28 Trillion.

- Today’s Real GDP Is ~$24 Trillion; i.e., ~$4 Trillion short of where it should be.

- Excessive debt (and deficits); and

- Excessive regulation / bureaucracy

It’s very hard to accelerate when you’re impeded by excessive debt.

This applies equally to individuals, families, businesses and governments.

Excessive debt (and the interest payable) absorbs precious capital which could be deployed in more productive areas.

And in the case of the government – areas which could be tax generating (vs tax consuming).

Is that likely to change?

Well that answer will largely depend on your own ideological lens.

My personal feeling is Trump’s (terrible) tariffs will do nothing to improve US (or global) growth. It will only impede it (see ‘Zero Sum Game’)

Tariffs destroy competition, slow innovation and investment, restrict trade and drive up prices for consumers.

But I would be very happy to be proven wrong in two or three years.

Putting It All Together

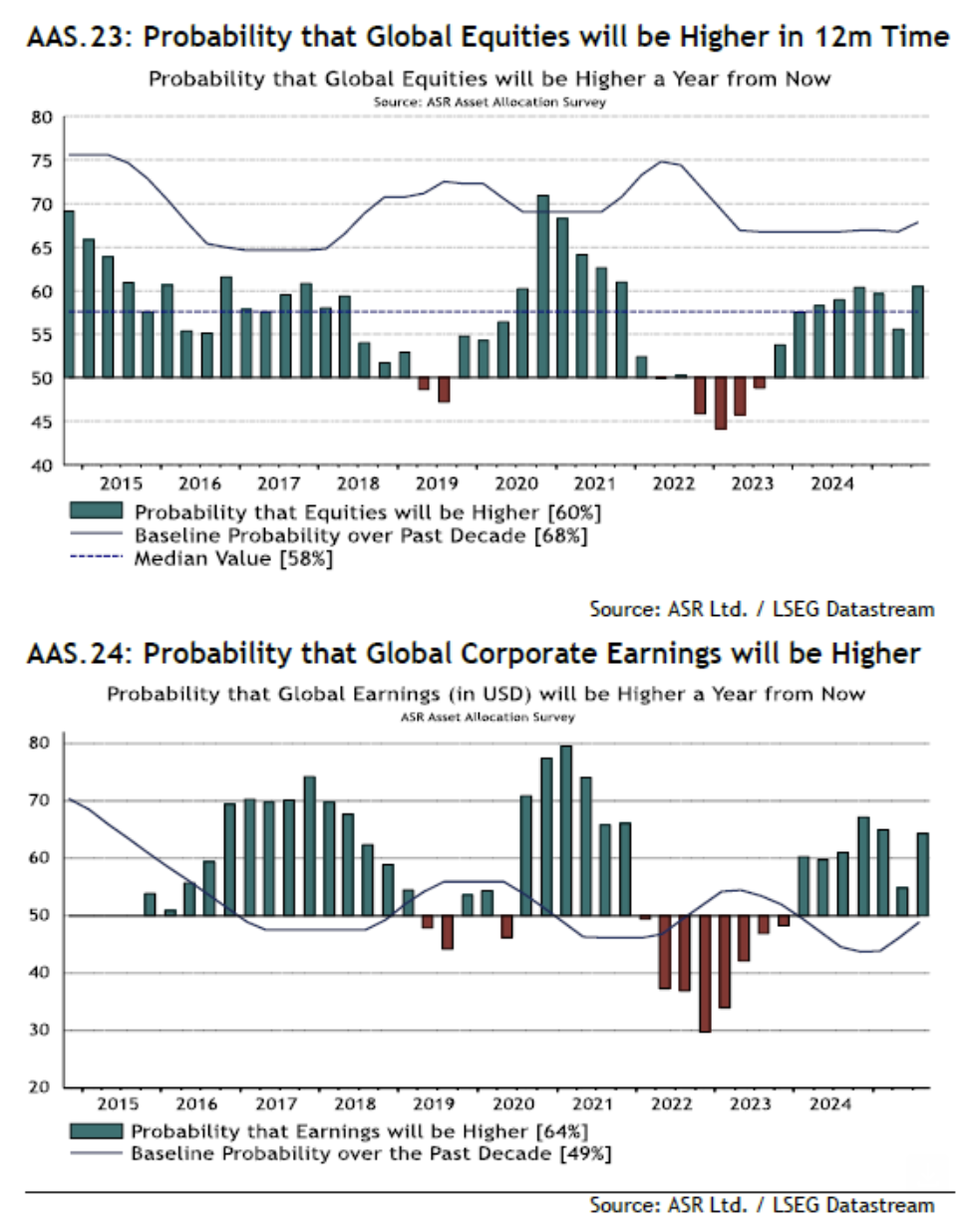

Despite the obvious slowdown – global fund managers remain very bullish on stocks and earnings.

According to Bloomberg – the latest global survey of asset allocators by Absolute Strategy Research, conducted just before the last weeks woeful jobs numbers – big money managers expect share prices to climb over the next year, on the back of rising earnings:

But for this to happen – it assumes that a recession is not a “12+ month” risk.

Robust earnings growth requires a robust (spending) consumer. The consumer is 70% of GDP.

Two reasons I remain skeptical:

- The re-inversion of the 10-2 yield curve (a steeping curve is negative for stocks); and

- The (negative) impact of Trump’s tariffs (which are yet to hit at any scale)

It’s highly presumptuous to think “three or four” Fed rate cuts will act as a panacea to these (and other) risks.

From mine, I would not be comfortable paying 22x to 23x forward earnings to own stocks.