Why I Added to Shopify Today

- Shopify (SHOP) is a good 5-year bet

- Global eCommerce set grow at 21% CAGR

- How you get a flywheel working – align your incentives

Markets are plumb bobbing to find a bottom.

It"s a process… maybe they will find it.

Hard to know.

2% daily moves were obsolete last year… not now.

With a VIX above 30… that"s what you should expect.

TL;DR is the market is unable to price (or handicap) the risk(s) around the cocktail of:

- unwanted sustained inflation;

- subsequent monetary policy;

- Russia"s invasion of Ukraine; and

- the outlook for global growth.

But what I can say is an awful lot of bad news is now priced in.

How much is difficult to say…

But I do think it will only take a couple of "good news" days (and they will come) which will see the market roar as much as 5% or more.

A Closer Look at Shopify

One of the better quality disruptive stocks to be crucified over the past 12 months is eCommerce platform provider Shopify.

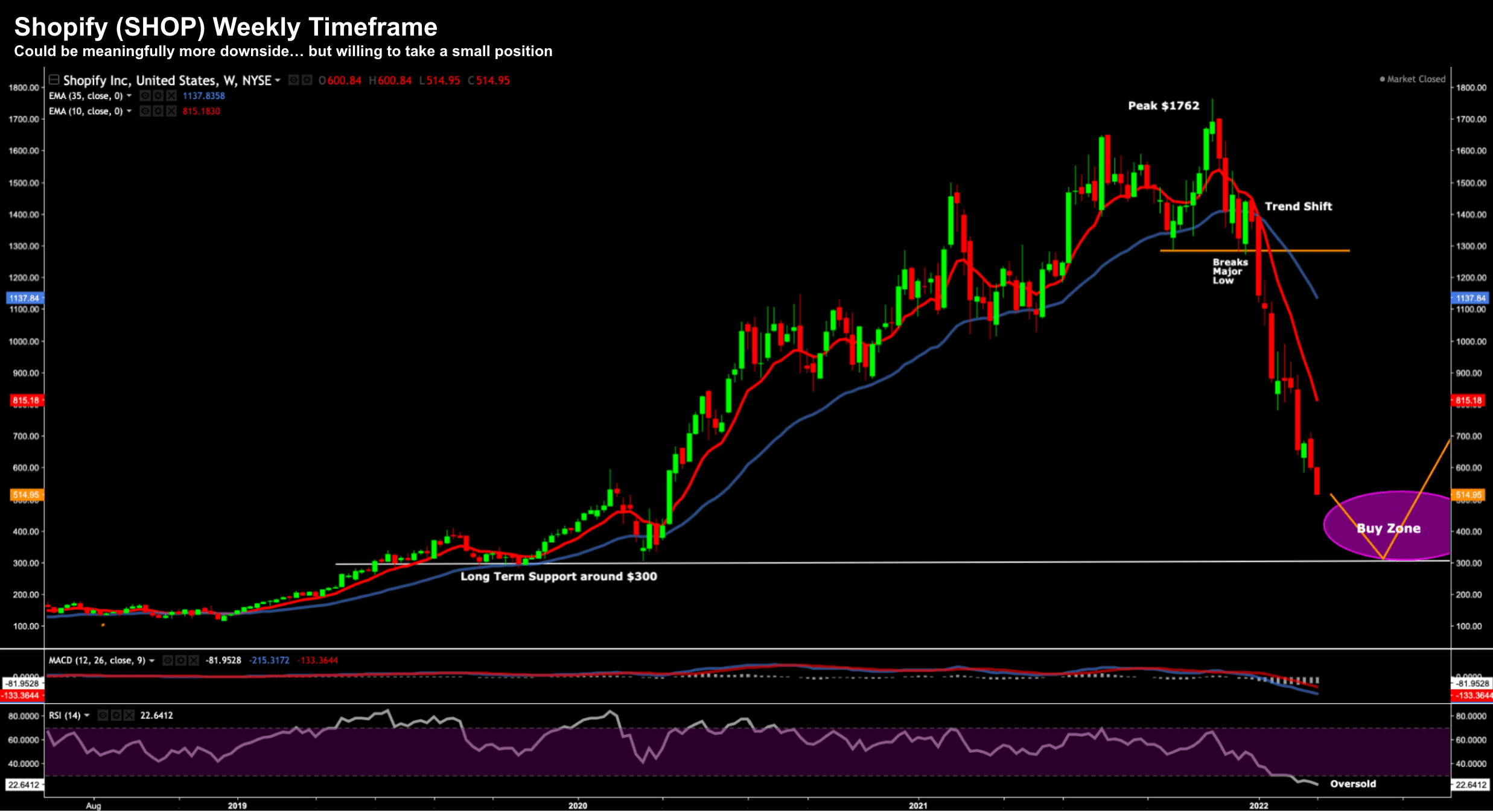

Take a look at the weekly chart… with the stock~71% off the high.

When a business like Shopify is trading lower by ~71%… it gets my attention.

As an aside, $1,800 was a bullshit number… so "71%" is perhaps arbitrary.

That said, some poor fool paid that price.

But the stock was never worth that much on any metric.

However, today I nibbled at the stock… with around 1% of my total portfolio.

It"s a small stake – but it"s also high risk.

Capital allocation matters.

It"s a lot less risky than buying it at say $1,800… yes… but there"s still risk.

For example, in this climate what"s to say the stock is not $300 tomorrow?

That"s where it traded in March of 2020.

And many of these stocks are now below their pre-pandemic levels.

But here"s the thing:

Shopify is a quality cash flow positive business where they command the lion"s share of the market (I will share the numbers shortly)

What"s more they are posting record revenue growth, customer retention and growth and have a flywheel which works.

Let"s start with a quick "back-of-the-envelope" assessment of the total addressable market for eCommerce.

This space is white-hot… and set to only get bigger.

Global eCommerce

When one thinks of global eCommerce – perhaps Amazon (AMZN) is the first stock which comes to mind.

And it should – it"s the dominant player.

It"s also my third largest holding (behind Google and Microsoft).

But the eCommerce platform Shopify is taking a good chunk out of Amazon"s market… particularly when it comes to empowering business.

First, let"s look at what eCommerce is compelling:

- Total Addressable Market

- In 2014, the global eCommerce market was worth around $1.3 trillion.

- In 2021, global eCommerce hit $4.89 trillion – that"s a CAGR of 21% (i.e. 400% over 7 years)

- Headroom

- In 2019, just 13.6% of sales were made from online purchases.

- In 2021, that number was almost 20% and is estimated to be ~22% by 2024.

- In 2022, it"s estimated that there will be over 2.14 billion people worldwide buying goods and services online (up from 1.66B in 2016)

- Market Sales

- 2021 U.S. eCommerce total sales were estimated at $870B

- In China, that market is $2.8 trillion (where 52.1% of all sales are online)

- See this link for eCommerce sales by country

- Mobile eCommerce

- Insider Intelligence forecasts m-eCommerce will grow at a 25.5% CAGR through 2024.

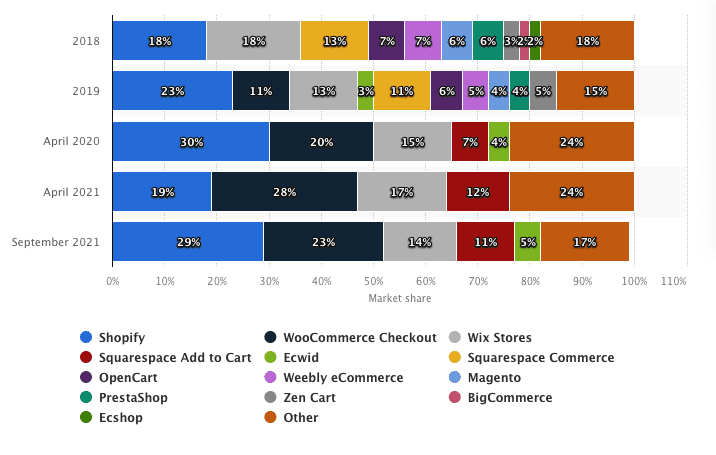

Which begs the question – what market share is Shopify enjoying in this exploding market?

Market Share and Growth

Chances are you have used Shopify"s platform without even knowing it…

There are now ~2M online stores powered by their platform… where they have 29% share of all eCommerce platforms.

Specifically, Shopify have seen:

- 1.75 million merchants sell on their platform

- This equals ~11% of the total eCommerce market; where

- 17,683 domains currently run ShopifyPlus

And this makes for some compelling revenue and cash flow numbers…

A Good Long-Term Bet

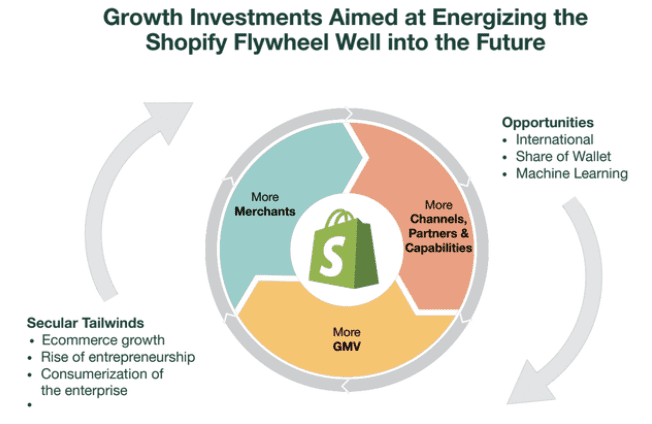

Perhaps the secret to Shopify"s success is the power behind their merchant flywheel.

What"s great about this model (and it"s not unique to them) is their product offerings enable growth in its users" businesses – and if successful – Shopify shares in this growth.

In other words, the incentives for success are very much aligned (a problem many business don"t have)

The way this works is Shopify charges (business) customers $29+ per month to launch an e-commerce website.

However, once on the platform, a business will typically add essential eCommerce capability such as payment processing, lending, a higher subscription tier, and/or point-of-sale solutions (and that list of services is growing).

ARPU (Average Revenue Per User) obviously increases the more the platform is leveraged.

But what Shopify are laser focused on is growing their merchants" businesses (in turn their own revenue)

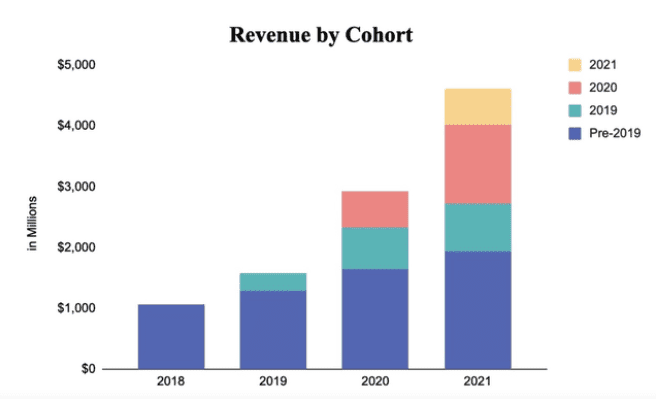

Here we see how existing merchant revenue earned from pre-2019 has almost doubled between 2018 and 2021.

That"s how sticky the platform is…

Now in their most recent report – Shopify grew the number of merchants by 31%.

Total revenue increased by 57% year over year to $4.6 billion, while operating income nearly tripled year over year to $268.6 million.

What"s more, gross merchandise value (GMV) climbed by 47% year over year to $175.4 billion.

And over at Shopify"s payment portal, gross payments volume increased by 45% year over year to $27.7 billion with a 51% GMV penetration, up from 46% a year ago.

An incredible set of numbers (in my view)

And yet – despite the beat – the stock has lost some 71% from its high.

Two reasons (that I can see):

(a) the company guided lower with revenue growth; and

(b) they reinvest free cash flow back into the growth of their business (not unlike Amazon in its early years)

From mine, the slower revenue growth is due to their revenue sharing agreement with third party developers and needing time to ramp new initiatives.

However, these are very short-term headwinds. They are not structural problems. My view is the eCommerce CAGR of 21% is a long-term trend which is only set to grow.

With respect to profitability – this is not a concern for me in the near-term.

What I am more focused on is free cash flow or FCF (i.e. operating cash flow less any cap-ex).

This is the only metric you need to assess the health of a business.

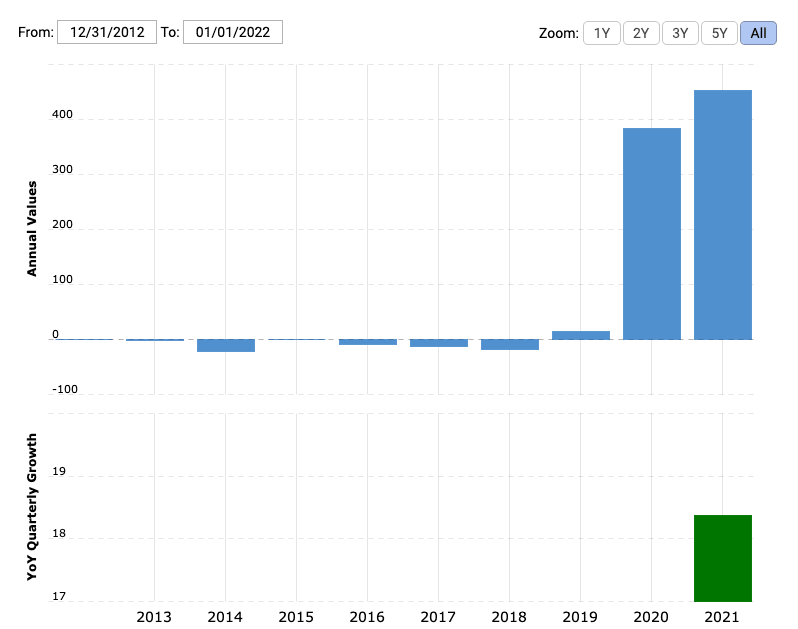

Take a look at this trend for FCF:

This came in at $453.64M year-over-year for the quarter ending December 31, 2021 – up 18.4% year on year

This FCF will be reinvested into initiatives like their fulfilment network (i.e..2 day delivery matching AMZN to 90% of the US) and allowing merchants to sell NFTs.

The problem is the market is obsessed with profitability today.

That"s fine… but what they should be obsessed with is free cash flow… especially for a business like Shopify which is scaling at an incredible rate.

Again, I see traces of Amazon here in its early days before everyone understood what Bezos was doing.

What"s more – Shopify is a very good allocator of capital.

For example, they boast 64% revenue CAGR over the last five years; 28% Return on Equity.

Not bad.

Now if Shopify decided to focus on earnings / profits – you might argue the stock would probably be higher.

They chose not to.

This has given investors a great long-term entry (in my view) around $500 to $530

Putting it all Together

This was a stock I was happy adding a small portion of my portfolio today based purely on the quality of the business (and the discounted price).

For the past two years I have been watching Shopify climb from "$600 to $1,000 to $1,800" as I scratched my head in disbelief.

I knew their business was doing well… I could see the merchant and GMV growth…. their flywheel was second to none for eCommerce.

But I could not wrap my head around the multiples investors were willing to pay for that growth.

Now we are given a solid long-term (e.g. 5-year) opportunity.

The 71% sell off was largely due to three things:

- Negative sentiment towards all (hyper) growth stocks given the expected Fed tightening / quantitative tightening;

- Expectations of maintained growth momentum (despite very tough COVID based comps and reinvestment cycle); and

- A focus on companies showing profit (vs strong free cash flow which is reinvested)

But it should be highlighted that Shopify still expects to record year-over-year growth, albeit at a slower pace.

I love the fact they are continuing with their plan to invest in its platform to make it easier for merchants to scale their businesses and sell products to other regions.

The merchant"s success is also Shopify"s success.

Incentives are aligned.

Over 2022 you"re going to see more plans around:

- Opening up greater channels for merchants to connect with more buyers; and

- Simplifying the fulfilment process to allow for faster and more efficient deliveries.

One last thing… this is not a trade I expect to "double" in 6-12 months.

In fact, I have every expectation I might be underwater by "20%" over the next 12 months.

That"s fine…. the market is skittish given all the headwinds.

As a result, there will be some "babies" thrown out with the bathwater (as they say)

I"m willing to bet SHOP"s share price will be a lot higher in 5+ years based on what I see with:

(a) eCommerce growth more broadly;

(b) the free cash flow they are generating;

(c) their customer acquisition growth and retention; and

(d) the incredible flywheel they have built with merchants.

The proof (as always) is in the numbers.