Relief Rally Likely to be Temporary

Words: 1,377 Time: 6 Minutes

- Market catches an expected bid

- Turns out Trump is clearly influenced by the market"s reaction

- Stocks need far more certainty to materially advance

My apologies for being off-line recently – I"ve been on holidays.

Market commentary was traded for traveling and playing more golf 🙂 All going well – I will resume writing two to three times per week in May.

To kick things off – I thought it would be good to scroll back about 4 weeks.

Did things trade the way we expected?

Approximately one month ago – stocks plunged on Trump"s draconian tariffs – resulting in the VIX spiking above 45x (not something we see often).

Generally when we see panic (i.e., the VIX above 45) – this results in a great opportunity for investors to increase (not decrease) their exposure to higher quality names.

For example, I nominated the zone of 4600 to 5000 as a potential (initial) buy zone for those who had reserve capital available (see "Trump Dump Offers Opportunity")

Below is the weekly chart (and annotations) I shared March 31:

March 31 2025

Approx four weeks ago I was looking for the S&P 500 to test the zone around the 200-week EMA. This was where I sensed we could find support.

I nominated this area to be a good "initial" buy zone — especially in stocks which were higher quality (e.g., Google, Apple, Meta, Amazon, Microsoft, Nvidia etc).

Alternatively, indexed based investors could consider adding either the SPY or QQQ.

Let"s update the weekly chart:

April 24th 2025

So far things have traded largely per the script.

And whilst I don"t pretend to predict bottoms (or tops) – just below 5,000 (i.e. the 200-week EMA) – felt like a good 3-year risk/reward area.

From here, I think we could see the Index rally to the zone of ~5700.

From a technical lens – this is the 35-week EMA – which may act as resistance.

This is often what we see during bearish markets (where the 10-week EMA trades below the 35-week EMA).

It"s also the top of our distribution – established from the high of July last year.

However, I give far more weight (e.g., 80%+) to what we see with the fundamentals.

Over the long term – it"s fundamentals which will determine prices.

However, in the very short term – markets are often influenced by momentum and emotion (and why opportunity is created).

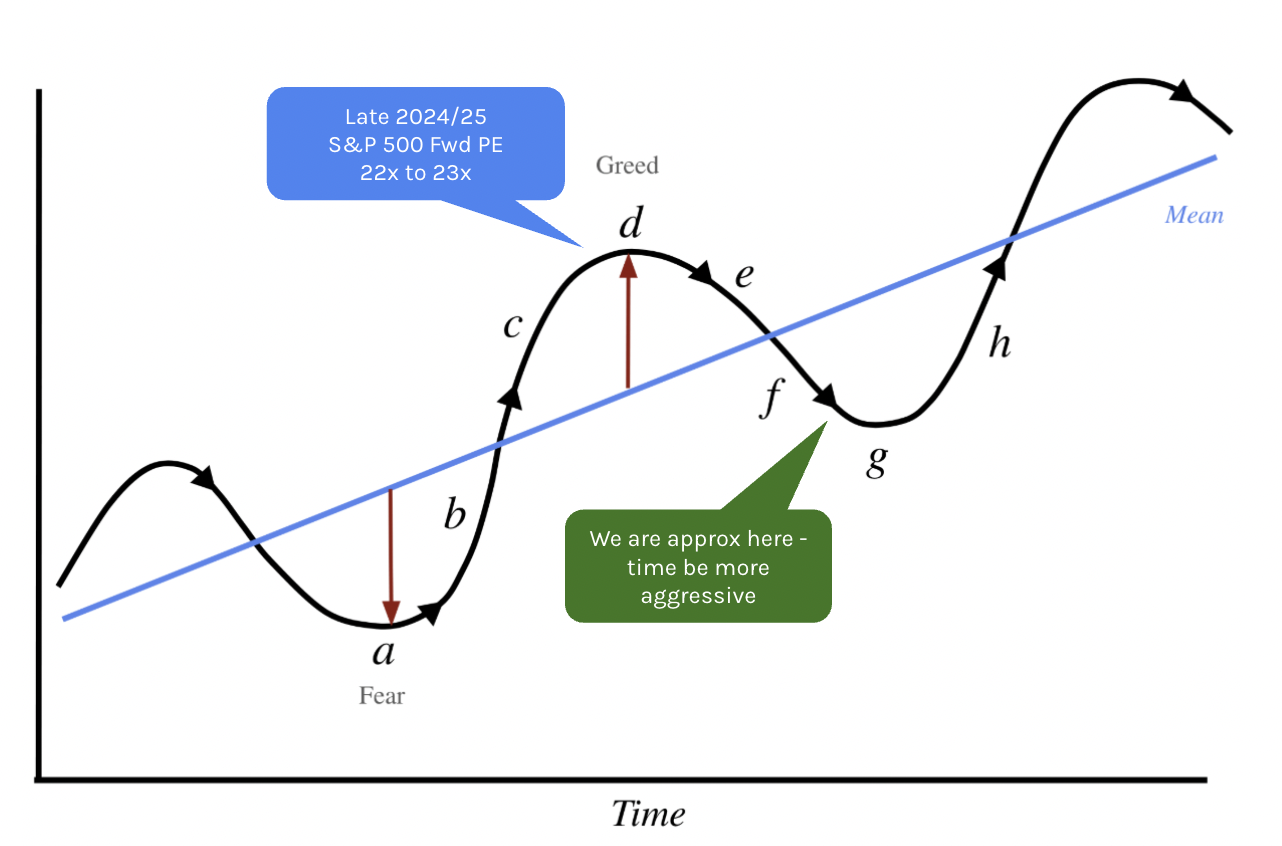

Longer-term readers will recall this (investor) model – where self-defeating emotions such as fear and greed will take prices well above and below their longer-term average (blue line) – creating opportunity to either buy (where there is panic) or sell (where there is greed)

Bringing this back to the market – if we assume the S&P 500 will earn $275 per share this year (which remains consensus) – 5700 offers a forward PE ratio of ~21x

21x is a high multiple to command in any environment.

However, it"s especially high given the uncertainty regarding interest rates, tariffs and economic growth (more on this further below).

My expectation is analyst targets will be revised lower after earnings season – closer to the range of $250 to $260 per share.

In other words, single digit EPS growth on last year.

Therefore, if we apply a multiple of 19x to $260 – we get a figure closer to 5,000

Put another way – I think it will be very difficult for stocks to reclaim their earlier all-time highs in this climate.

The damage Trump has caused to investor (and business) confidence cannot be undone anytime soon – even if we gain clarity on tariffs.

Which is a nice segue to the "Trump Put"

The "Trump Put"

This week we learned Trump has no intention of firing Fed Chair Jerome Powell (not that he has the ability to anyway) – and that he intends to be "very nice" to China on trade.

But we"re talking about Donald Trump; i.e., what does "very nice" mean?

10% tariffs or 50%?

Irrespective, from the market"s lens, Trump is clearly watching markets. I think there is a clear limit to how much pain he"s willing to bear.

And this applies not only to equities – but specifically bond prices (which determine interest rates)

This is otherwise known as the Trump Put – an option that allows investors to limit their losses if shares fall.

From mine, the put strike price is in the zone I nominated (i.e., 4600 to 5000).

I say this because this is clearly the zone where Trump blinks. And we have seen this twice:

- 90-day pause on tariffs – which saw the market bottom; and second

- He has no intention of firing Powell

Both saw the market plunge on his initial threat – only to bounce sharply after Trump pivoted.

This is noteworthy. It tells us Trump is a market watcher (despite his words to suggest the market must take its medicine or words to that effect)

That said, the market is not saying everything is clear.

You only need to look at what is rallying.

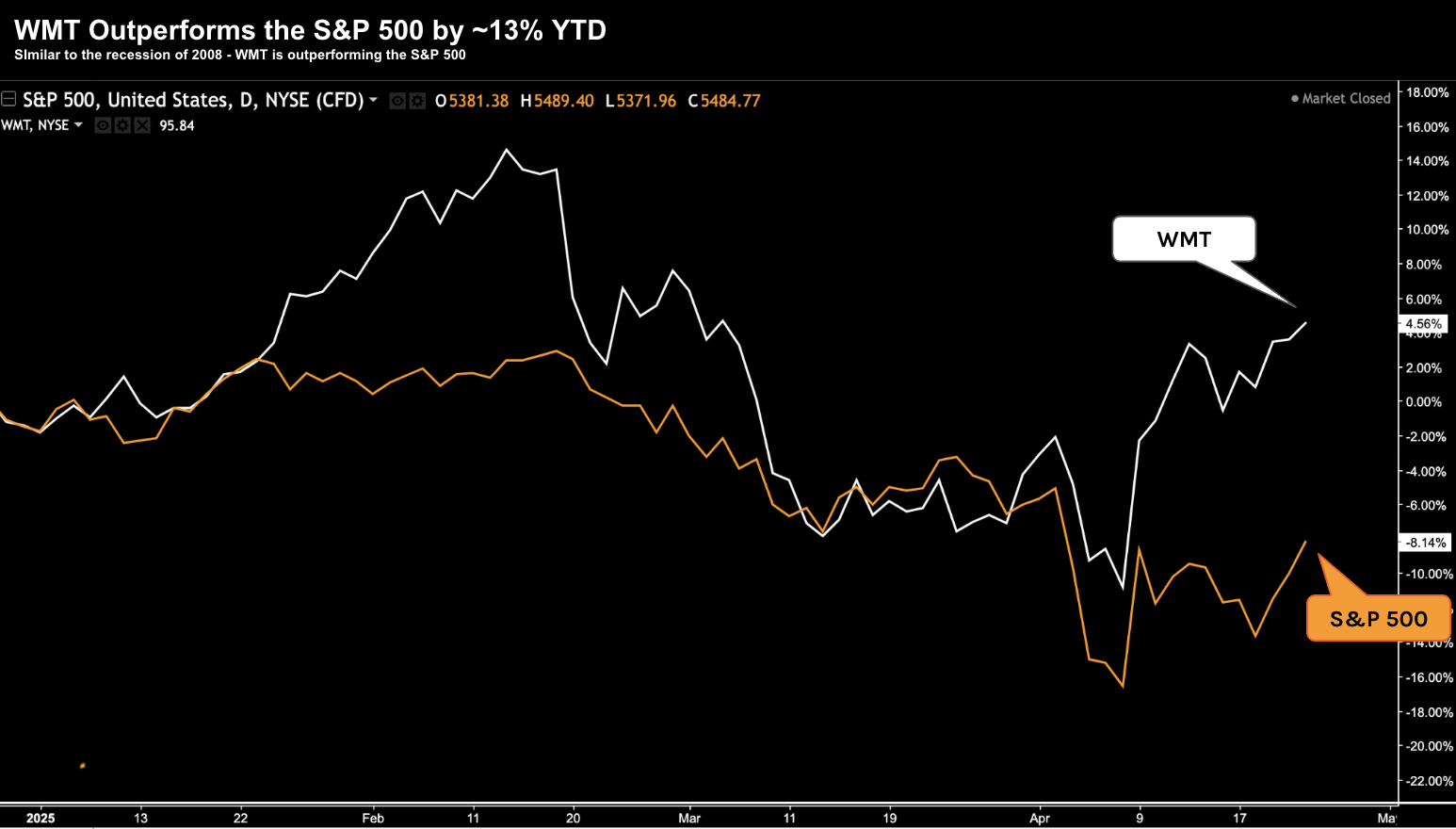

For example, Walmart (WMT) was the only stock in the S&P 500 that rose between the market peak in 2007 and the low in 2009 (given how defensive the stock is)

So far this year – WMT has outperformed the S&P 500 by almost 13%

April 24th 2025

From mine, this is a sign that investors are losing confidence in the economy; and/or pricing in a greater possibility of recession.

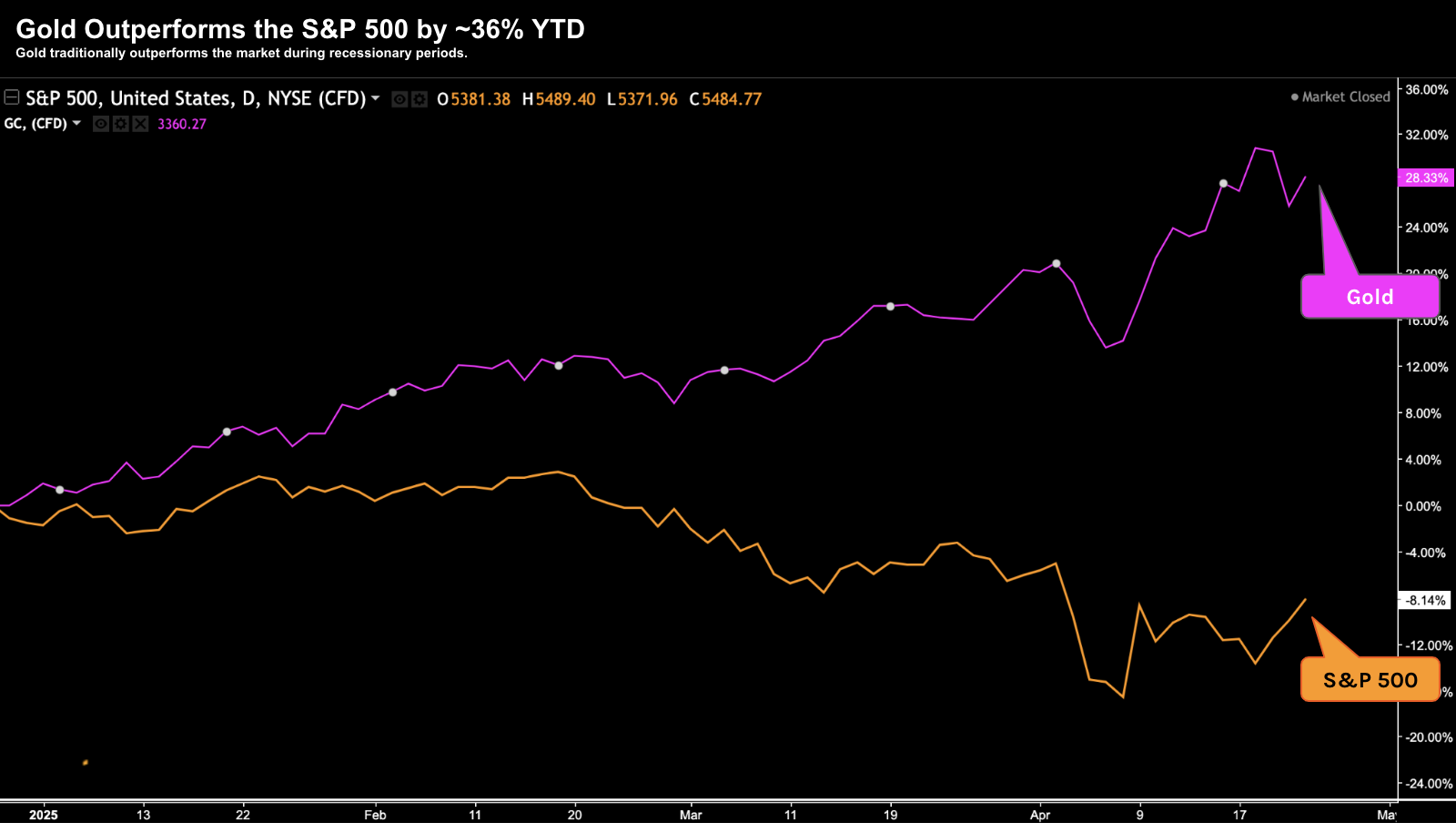

The other example is what we see with gold vs the S&P 500. Gold generally outperforms equities during times of high uncertainty and recessions.

The shiny yellow metal has "thumped" equities this year – outperforming the S&P 500 by around 36% YTD.

Both the outperformance of both gold and Walmart simply adds weight to my thesis that anything above 5,700 to 6,000 for the S&P 500 might be very challenging this year.

Stocks Need Certainty

A couple of months ago I said the market needs certainty to advance.

I cannot overemphasize this point enough.

Put another way, it"s very hard for markets to invest with conviction if the ground rules constantly change.

Now, Trump has told us he wants tariffs against China to be "substantially lower" than 145%

Good news. I"ve said 145% are not tariffs – they are an embargo.

In addition, Treasury Secretary Scott Bessent tried to assure investors that tariff reductions will not be unilateral.

But it"s the shift in their rhetoric which is important. This is why markets have caught a (temporary) bid. Some common sense appears to be kicking in.

And whilst we know Trump"s opening gambit on tariffs was completely unrealistic – we don"t have certainty.

This is key.

If we have continued uncertainty – it will continue to thwart investment.

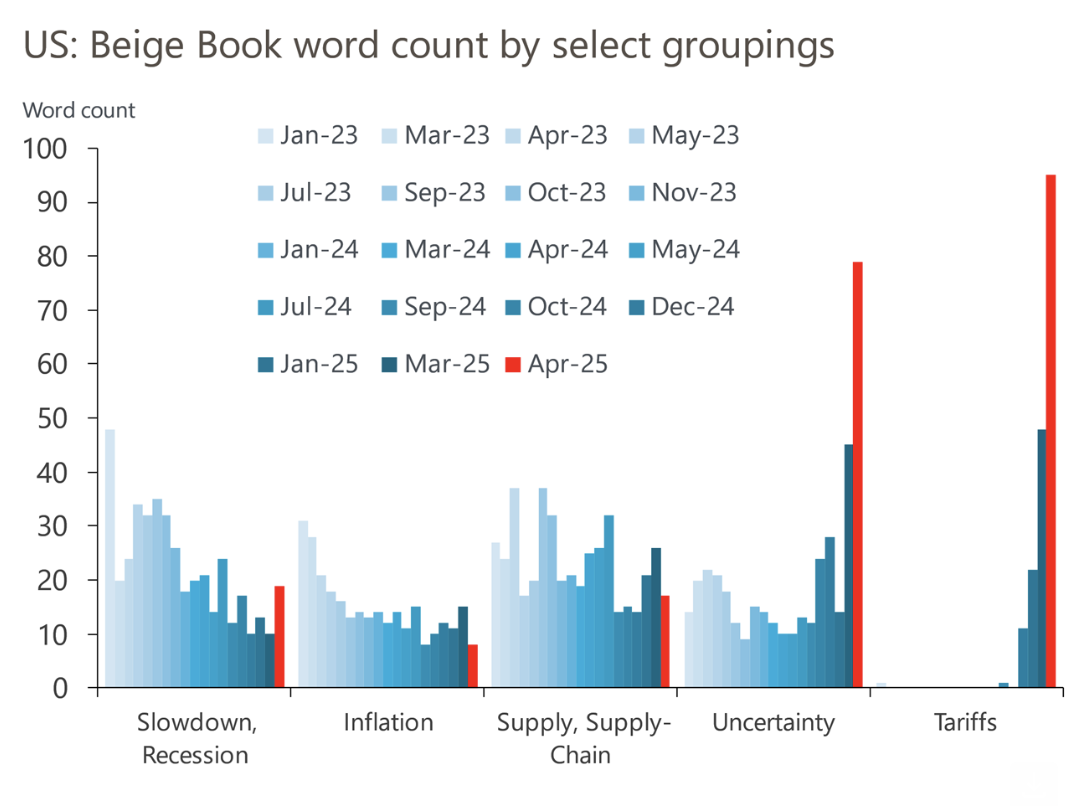

For example, the Federal Reserve"s Beige Book captures this.

Published during the week – it was dominated by the uncertainty created by tariffs. And if we compare that to inflation – it"s no longer a major concern.

Bloomberg Opinion cited Oxford Economics – who offers a breakdown of the themes that dominate each Beige Book edition

Source: Bloomberg Opinion

I raise this because whilst uncertainty remains for the next 90 days (minimum) – then we will see reduced investment.

In turn, this will have an impact on future earnings and consumption.

Putting it All Together

Despite the welcome relief rally – stocks are not out of the woods.

The uncertainty introduced from Trump has inflicted a lot of damage.

Not only on the market and its earnings – but on investor, consumer and business confidence.

However, the full extent of the damage will only be felt in the months (years) ahead.

For example, Bankim Chadha of Deutsche Bank has reduced his target for the S&P 500 for the year, citing doubts over whether tariff policies will be abandoned before they have already driven the economy into a recession.

This echoes what I said recently when we could already be in recession. Repeating some of my language from April 17:

Pending on whether Trump continues to "double down on dumb" with his trade policy – this will heavily influence whether we enter a recession.

That said, I think the damage is now done. In other words, we could already be in recession.

As J.P. Morgan states – even the universal 10% tariff will have material consequences to growth and inflation

Chadha"s base case remains "a significant rally on a credible relent on trade policies, with a target of 6,150 by year-end"

My concern is we"re now too late for this to materialize… especially given we"re unlikely to have absolute clarity on trade rules within the next ~2 months.

The longer these negotiations go – the worse it will be.

And if we"re already in recession — then a year end target of 6,150 is highly unlikely.