S&P 500 Hits Stall Speed

Words: 1,563 Time: 7 Minutes

- Market reluctant to push above 6,000 – almost 22x fwd PE

- Some Fed members are at odds with Powell"s hawkish tone

- A sharply weaker labor market will be a force majeure for the Fed

Another week comes to close – as we draw near the end of the second quarter.

For the past two weeks or so – investors are reluctant to push prices much higher.

From mine, the index is not only expensive – trading near a forward price-to-earnings (PE) ratio of 22x – the downside risks don"t handily offset the (possible) upside reward.

For example, it would not surprise me to see the S&P 500 trade up to a zone of 6,200 (adding another 5% or so).

However, equally I see a possibility for a 10% to 20% move lower given the risks to earnings growth, inflation (from tariffs), employment and geopolitical tensions.

I will look at both the technical and fundamental setup for the S&P 500 shortly. Beforehand, a follow up on my previous missive "Powell"s Limited Options"

Post Powell"s public address on monetary policy – other Fed Governors were free to share their thoughts on where they see short-term interest rates in the month"s ahead (i.e., what they can control).

And it would seem the Fed is divided…

For example, Friday Fed Governor"s Chris Waller and Mary Daly spoke with CNBC.

Both lean dovish – somewhat at odds with Powell.

Starting with Waller – he"s of the view "the Fed could cut rates in July" – going earlier to avoid a potential slowdown in the labor market (which I would argue is already here).

"I think we"re in the position that we could do this as early as July. That would be my view, whether the committee would go along with it or not"

In his remarks, Waller said he thinks the Fed should cut to avoid a potential slowdown in the labor market.

"If you"re starting to worry about the downside risk [to the] labor market, move now, don"t wait," he said.

"Why do we want to wait until we actually see a crash before we start cutting rates?

So I"m all in favor of saying maybe we should start thinking about cutting the policy rate at the next meeting, because we don"t want to wait till the job market tanks before we start cutting the policy rate."

Daly was mostly supportive of Waller"s view – however feels more time is warranted – leaning towards Sept before they act to cut rates. From Reuters:

The fundamentals of the U.S. economy are moving to where an interest rate cut may be necessary, San Francisco Federal Reserve Bank President Mary Daly said on Friday, though she signaled a July rate cut would probably be too early.

"Unless we saw a faltering in the labor market that was meaningful and we thought it would be persistent then I would say the fall looks more appropriate to me"

Waller and Daly"s comments make sense.

The economy is clearly slowing – supported by their downgrade to GDP growth and forecast uptick in unemployment to 4.50% by year"s end.

It would appear the debate is when (not if) – and the risks to reigniting inflation.

But there is something which could force their hand…

Economy is Clearly Slowing

Recently I"ve argued that if it were not for Trump"s draconian tariff war – the Fed would be cutting rates now.

I think that"s a clear cut case…

Echoing Chris Wallers" comment – the Fed would be getting in front of the existing weakness vs waiting for a potential recession to happen.

But Trump has effectively put "handcuffs" on the world"s largest central bank – driving massive uncertainty with price stability.

Now the Fed has a dual mandate:

- Price stability (i.e. target inflation at ~2.0%); and

- Full employment (i.e., 4.0% to 4.5% unemployment)

Their focus over the past 3+ years has been mostly inflation; i.e., getting prices for goods and services to rise only ~2.0% YoY.

And for the most part – inflation is trending lower.

For example, prices for goods (exclusive shelter) have slowed to not much more than 1.5% year over year.

Inclusive of shelter prices – which comprise 30% of the index – they sit near 2.4% YoY

That"s good news…

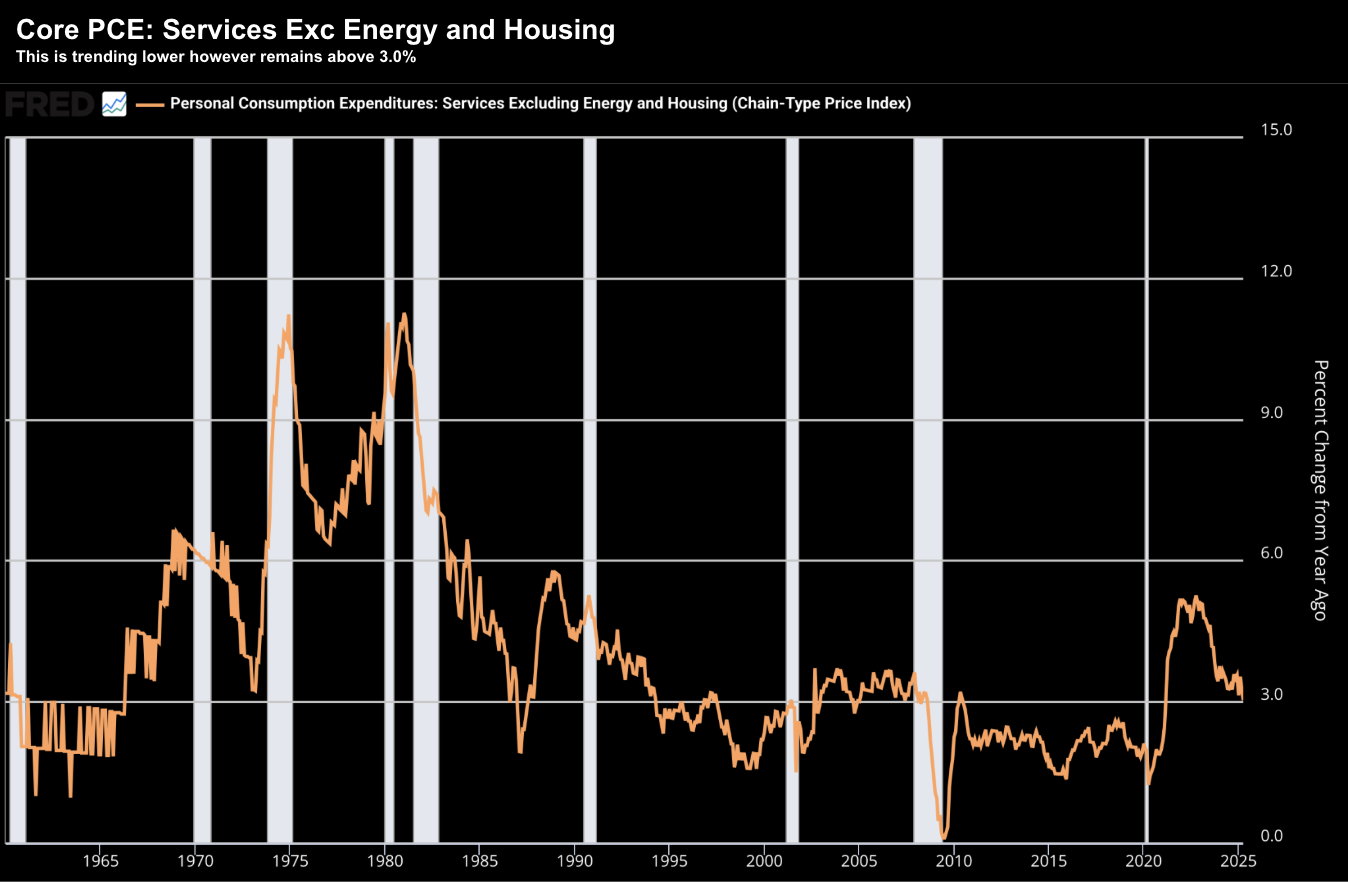

However, the Fed"s preferred measure of Core PCE Services – which excludes housing and energy – remains above 3.0% – indicating they still have plenty of work to do.

Assuming inflation continues to trend lower (an assumption we cannot make given the tariff increases) — we could see the Fed shift its gaze from (mostly) inflation to what we see in the labor market.

For now are very close to full employment – with unemployment at just 4.20%

However this is expected to increase… with the Fed forecasting 4.50% at year"s end.

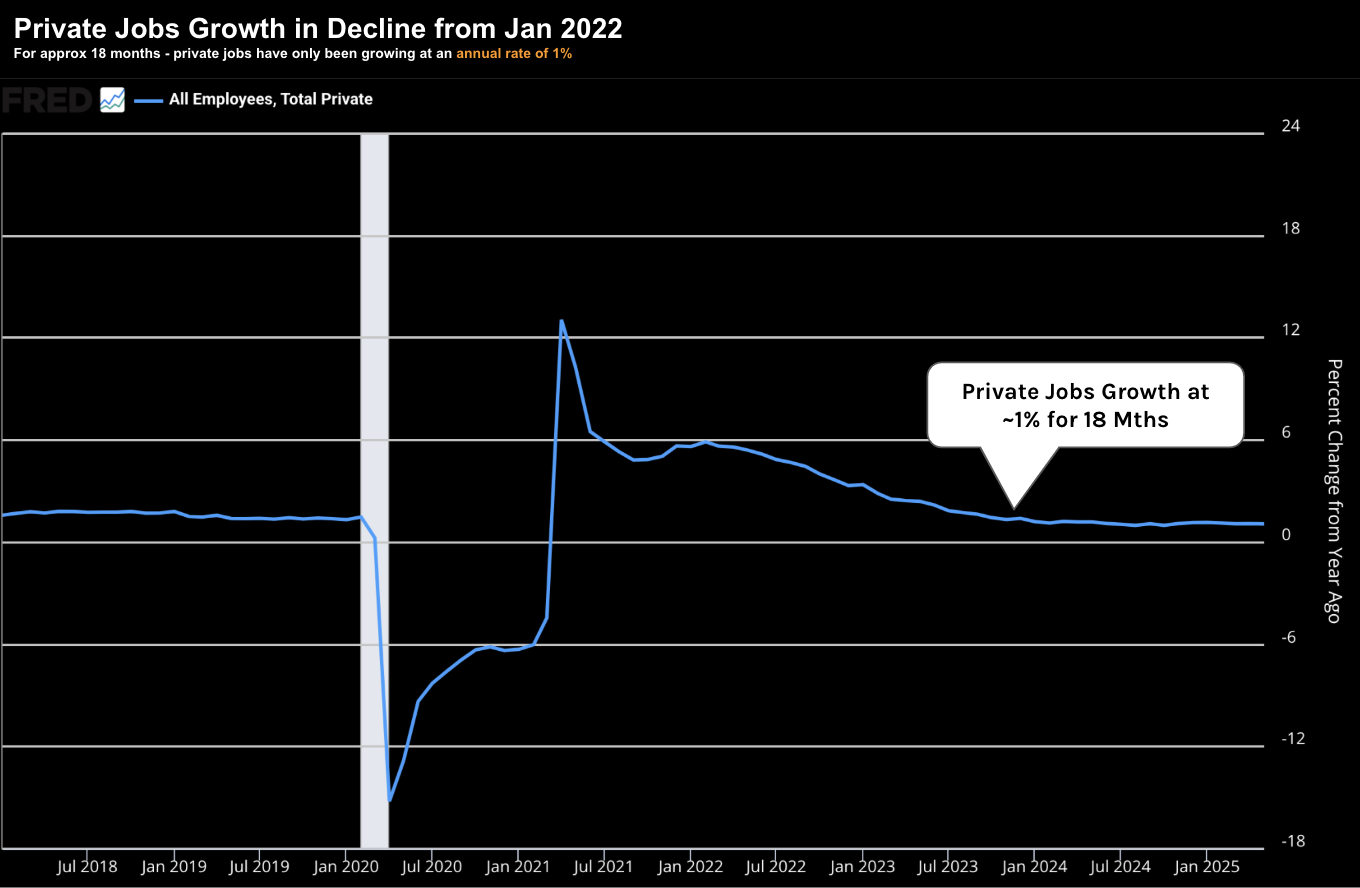

For example, below we can see the relative weakness in the labor market – evidenced by the lack of private sector job growth:

This chart (from the Fed) shows the long-term with private sector job growth and the percentage change year-over-year.

Now I use this lens as the month-to-month jobs numbers are extremely noisy – subject to significant revisions from time to time.

Therefore, the best way to look at this is to zoom out and look at any long-term trends – separate the signal from the noise.

As we can see – private job creation (i.e. those jobs which produce tax income) – has been growing at an annual rate of ~1% for the past 18 months

By comparison – over the past decade – private sector jobs have grown at an annualized rate of 1.3%, while real GDP growth has been about 2.3% per year.

The notable difference this year is the number of immigrants (legal and illegal) entering the labor market is slowing dramatically. That"s going to have an impact…

Based on this – I think we could see job growth fall below 1% by the end of this year.

If my thesis is true (and it may not be) – then it"s most unlikely you will see the economy growing at ~2.0%+ per year (and hence my reservation for sharply higher stock prices mentioned in my opening remarks)

Why does this matter?

From mine, if employment is substantially weaker (e.g. where job growth falls below 1% and/or unemployment starts pushing levels of 4.5%) – that could be a force majeure for the Fed to cut.

On the flip side, if inflation is substantially higher (e.g., due to Trump"s price increases) – well that"s a more difficult decision.

S&P 500 Hits Stall Speed

With the Fed taking the summer off – markets will be left to their own devices to figure things out.

As I said earlier – participants appear reluctant to push prices meaningfully higher.

After the pop we saw in early May, the S&P 500 has effectively hit stall speed.

As the weekly chart shows — the Relative Strength Index (RSI) continues to lose momentum.

Technically I don't like the setup here:

- Strong negative divergence with the RSI (lower window); and

- Expected resistance in the 61.8% to 76.4% zone outside our distribution (established from the pullback in mid 2024)

The market saw resistance in the 61.8% Fibonacci retracement zone earlier in the year – which could be rejected again.

If I were to guess – prices are likely to pull back towards the 5400 zone over the coming months.

Now from a fundamental perspective (which I always give more weight) – the S&P 500 remains very expensive around 5,900

Investors are paying a lot of earnings growth (which may not arrive)

For example, with earnings coming in ~$240 per share for 2024 – expected to grow ~12% to ~$270 this year (questionable given the coming slowdown) – that"s a forward PE of 21.8x

If we express this as an earnings yield to compare to risk free returns — we take the inverse of 21.8.

1 / 21.8 = 4.6%

By way of comparison – we can secure a risk free near ~4.50% from the US 10-year yield – which tells us there is very little (if any) risk premium buying stocks. That"s not attractive (see this detailed post from May)

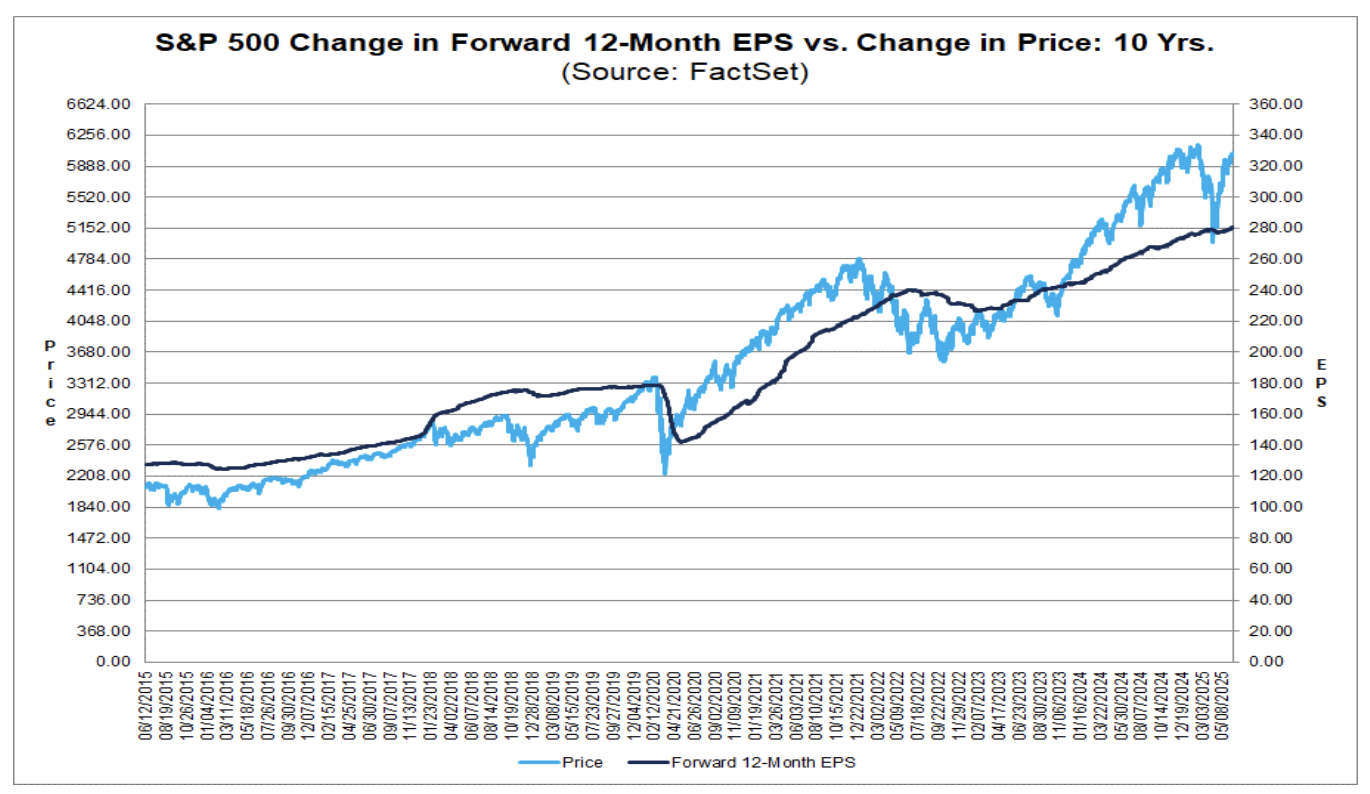

As a visual guide – below is Factset"s 12-month forward EPS vs the S&P 500.

Here we see the widening divergence between what investors are paying for earnings (i.e. the distance between the light-blue line (price) vs dark-blue line (fwd EPS)

Again, if I were to guess, prices will revert to the mean.

Putting it All Together

Coming back to the (dovish) comments today from Governor"s Waller and Daly…

What you will find is the Fed will try and guide the 2-year lower with verbiage.

Today the US 2-year trades for around 3.91%

However, we know the effective fed funds rate is between 4.25% and 4.50%.

This suggests the (bond) market expects the Fed to cut around 50 basis points between now and year"s end.

But here"s the thing:

What matters more is what we see with the US 10-year.

That"s what determines the price of money (e.g. your mortgage, car and student loan etc).

The Fed can try and "talk down" the 2-year yield with dovish language — but whether the 10-year comes along for the ride is another story.

So far that"s not the case…