A Very Complacent Market…

Words: 1,523 Time: 7 Minutes

- Tariffs are here to stay… it"s a question of who pays?

- Further dollar depreciation could result in another inflation spike

- Stock market overly complacent opposite the risks

I"ve been off the air the past two weeks…

With not much happening in terms of price action (i.e., attractive buying opportunities) – I"ve been catching up on overdue reading – making time to do some quality fundamental analysis.

I"ve been pouring over company filings – sharpening my focus for when stocks go on sale.

However, patience is needed.

That said, I"ve observed the market trickle up to the 6200 zone (not unexpected) in the face of what feels like increased uncertainty.

Let"s take a look….

Tariffs Not Going Away

From mine, the recent developments in Trump"s draconian trade policies — marked by steep tariffs, fluctuating commodity markets and geopolitical maneuvers — present a highly complex and uncertain landscape.

Despite dramatic announcements and headline-grabbing tariff threats, markets have remained oddly resilient, while underlying forces quietly shift (more on this further on)

For example, Trump"s imposition of steep tariffs—such as 200% on pharmaceuticals and 50% on copper—has less to do with traditional economic rationale and more with political leverage.

Initially justified by trade deficits and national security claims, tariffs have evolved into a tool to exert pressure on key trading partners like Brazil, Japan, South Korea, and China, regardless of trade balances.

From mine, Trump"s terrible tariffs are increasingly decoupled from economic fundamentals and are used as instruments of geopolitical strategy.

Consider Brazil – they now face sharply higher tariffs despite the US enjoying a trade surplus with it, highlighting how trade policy is wielded as a form of political punishment rather than economic adjustment.

This makes me wonder how sustainable this is when policy is based on nothing more than presidential discretion and opaque decision-making?

But the 50% tariff on copper is particularly noteworthy for investors…

As soon as Trump announced the price hike – it precipitated an immediate and historic surge in copper futures prices..

Jul 13 2025

This is important for a number of reasons.

Copper"s critical role in manufacturing and infrastructure, combined with limited substitution options, makes it particularly vulnerable.

For example, Trump"s policies are now triggering stockpiling behaviors, notably in China, straining global inventories and supply chains.

And it"s not just China – many countries will be trying to get their hands on it ahead of tariffs.

Countries heavily reliant on copper exports, like Chile and Peru, face heightened risks amid tariff uncertainty, while US manufacturers grapple with higher input costs and insufficient domestic refining capacity.

Here"s my question:

How will supply chain disruptions and rising commodity prices affect global manufacturing competitiveness and inflationary pressures?

I say this because these commodity price rises (whether it"s copper, silver or platinum) will all pollute through the supply chain.

However, markets are ignoring this (for now).

Now on this subject – next week we get the all-important import prices.

Import prices were slightly higher the past two months which tell me inflation is already here. However, the only question that isn"t clear is just who eats it?

As Warren Buffett told us "the tooth fairy isn"t paying for them"

The answer entirely depends on who has pricing power.

For example, if a company has strong pricing power (like say Apple) – then the consumer will eat it.

However, if a company doesn"t enjoy pricing power – they will eat it.

Case in point:

Consider the company Helen of Troy – they told us last week they are raising prices 7-10%

"Q: Can you provide more details on your pricing strategy and how you are considering elasticity in the current environment?

A: Brian Grass, Interim CEO: We are implementing average price increases across our portfolio ranging from 7% to 10%, with individual product increases varying from 0% to 15%. We are making conservative elasticity assumptions due to the challenging environment. Tracy Scheuerman, Interim CFO, added that pricing is selective by brand, considering the category"s nature and country of origin."

Compare that with a company like Conagra.

They don"t have pricing power and are citing rising commodity, labor and steel costs – up more than 7%.

"Consumer sentiment remains under pressure. The cumulative impact of inflation and economic uncertainty has led to value-seeking behaviors becoming even more pronounced," CEO Sean Connolly said.

The company plans to mitigate the tariff hit through an accelerated cost-savings plan, alternative sourcing and selective price hikes.

"These are small price changes, on a penny basis. They"re not huge price changes, but it will be specifically targeted to the products that are costing us more due to the tariff-based inflation"

And finally, Levi"s said they see prices raising around 3%.

From mine, it will be pricing power aspect which will ultimately determine whether tariffs result in margin impact (e.g., Conagra) or the consumer"s pocketbook (e.g., Levis, Apple, Helen of Troy etc)

With Levi"s saying to expect maybe a 3% increase – they can absorb most of the cost – but someone in Levi"s supply chain will be feeling it.

Given their dominance in jeans apparel – they can push any cost increases onto someone else. But not all company"s enjoy this luxury.

Bottom line is price increases are here… it just depends on where along the supply chain they are showing up.

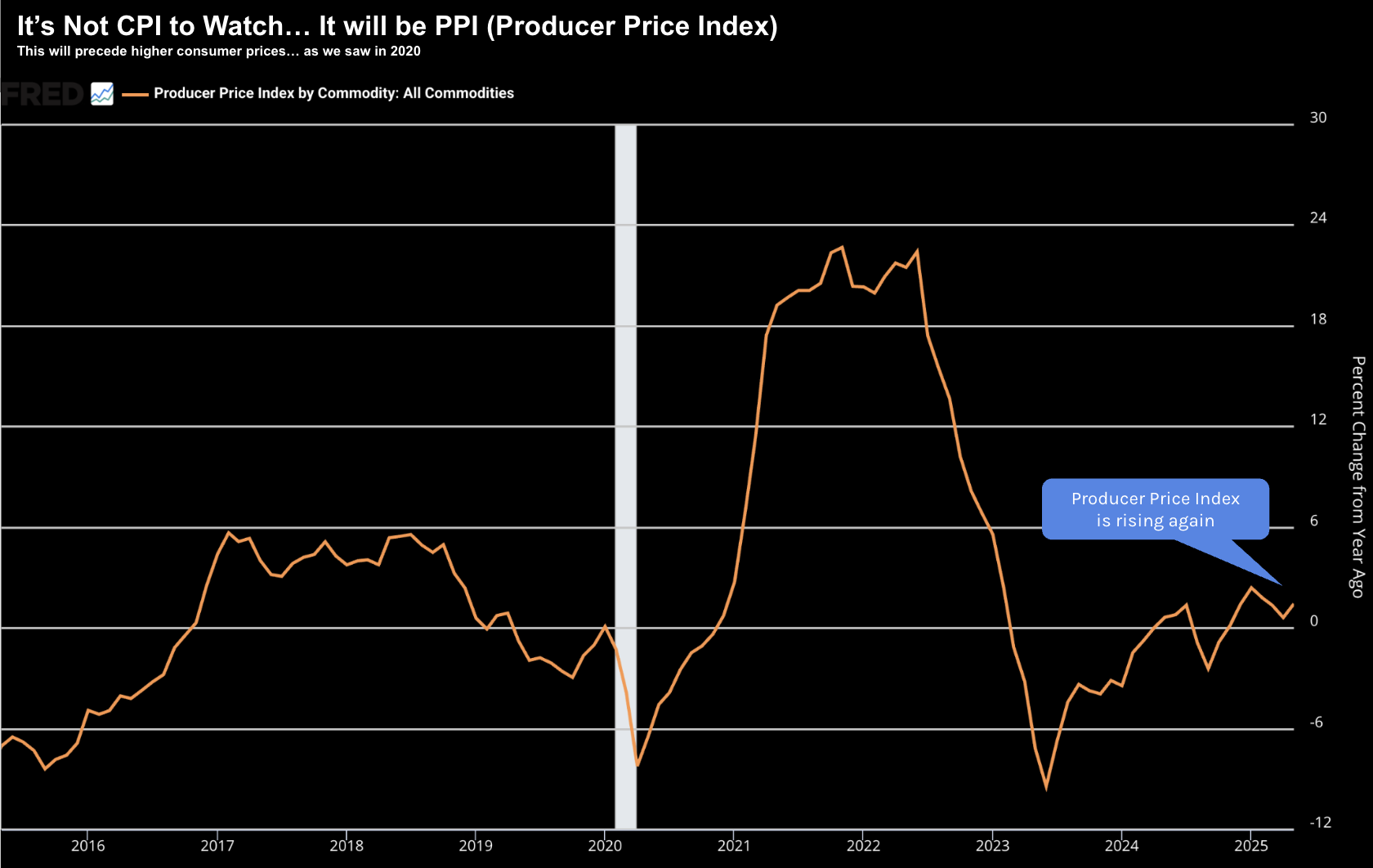

For example, take a look at the Producer Price Index (PPI)

I personally don"t think the Fed"s preferred measure – PCE – is going to be that meaningful.

That will be a very slow burn as companies draw down their existing inventories (hence why inflation has been somewhat muted until now)

However, PPI is at the "front of the curve" and will be more meaningful – it"s a forward look on inflation.

And that"s what I will be watching…

And What About the Dollar?

If commodity price rises are not enough to raise an eyebrow – a major development is the behavior of the US dollar.

Contrary to typical expectations, the dollar has weakened significantly—even as positive economic data and rising interest rate differentials might suggest otherwise.

This depreciation boosts US export competitiveness but carries inflationary risks.

Now for investors – it"s important to note that a weaker US dollar aligns with administration goals to offset tariffs" impact by making American goods cheaper abroad.

However, further dollar depreciation could raise inflation by half a percentage point, complicating monetary policy and consumer price stability.

Question:

If the US dollar"s weakness persists amid ongoing tariff uncertainty – what will be broader macroeconomic implications?

The interaction between trade policy, currency markets, and inflation is a delicate balance with far-reaching consequences.

For example, according to Torsten Slok from Apollo Global Management – if we see another ~10% depreciation in the US dollar index (DXY) – that would likely see inflation jump a further 0.5%.

Stocks Just Shrug…

Further to my premise, US equity markets are simply shrugging all of this off.

As my chart shows below – the VIX (fear index) now languishes at levels not seen in months (i.e., a very high level of complacency)

The past few weeks – the S&P 500 showed little reaction to the announcement of severe tariffs, reflecting investor confidence that effective tariffs will be lower after negotiations and rollbacks.

And that may (or may not) be true….

My view is investors appear to price in a scenario of negotiation-driven tariff moderation, balancing risk with optimism about corporate earnings and macroeconomic fundamentals.

However, I don"t think markets can continue to ignore the escalating trade drama if tariffs begin to bite corporate profits or supply chains more significantly (which we will start to see over the coming weeks and month(s)

Let"s take a look at the weekly chart for the S&P 500

Jul 13 2025

It"s been a remarkable v-shaped rally from April.

Unlike the rally in 2020 – which was supported by unprecedented levels of monetary and fiscal stimulus – this rally is based on hope that:

- The Fed will be cutting rates at least twice before year"s end

- Inflation is no longer a risk (either from tariffs, higher commodity prices or a lower dollar); and

- Trump"s trade policies will have a positive impact on corporate profits and consumer"s wallets

Up until now – there is no monetary and fiscal backing.

Now there"s a chance we see the Fed cut should inflation come down – however it"s not a certainty.

In fact, I don"t think we can totally rule out the Fed raising rates again.

And I certainly don"t think 10%+ tariffs will be positive for either corporate profits and/or consumer spend.

Tariffs are here… it"s just a question of who is going to foot the bill.

Putting it All Together

If you are thinking about portfolio allocation – construct resilience through diversification, particularly into sectors less exposed to import tariffs or with strong pricing power.

For example, look at companies who average double-digit net income margins over the past ten years.

If they are single digit – they don"t have pricing power. Those companies will suffer margin impact.

In addition, continue to monitor commodity exposure – balancing opportunities from price spikes against risks of supply chain disruption (especially as companies continue to wind down their "tariff free" inventories).

As I say, I think it will be the Producer Price Index (PPI) that outweighs either CPI or PCE.

It"s a forward look at what inflation is potentially coming down the pike.

From mine, the interplay between draconian (aggressive) US trade policy, market resilience, commodity volatility, currency fluctuations, and political momentum creates a multifaceted, highly uncertain environment.

I would not be overly complacent…