Just How ‘Strong’ was the Sept. Jobs Report?

Just How ‘Strong’ was the Sept. Jobs Report?

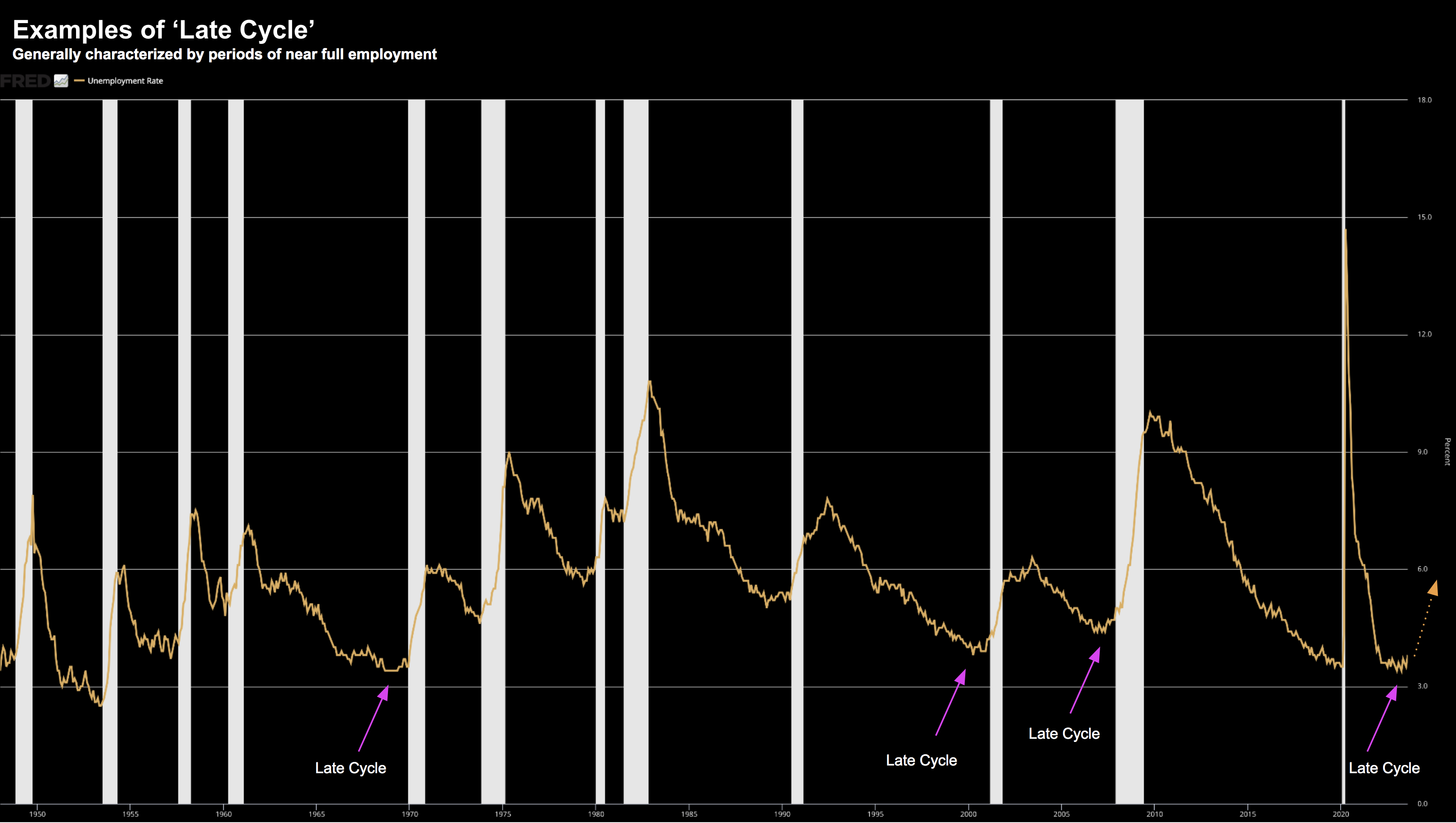

Never take a headline print at face value. There's always more to the story - where it pays to dive into the details. Digging below the surface takes some work - however it's worth doing. Last week was a great example. The BLS told us 336,000 jobs were added vs expectations of 160,000. Sounds strong? But was it? Not really. For example, since June 2023, full-time employment is lower by some 696,000 jobs