Have Jobs Slowed Enough for the Fed to Pause?

Have Jobs Slowed Enough for the Fed to Pause?

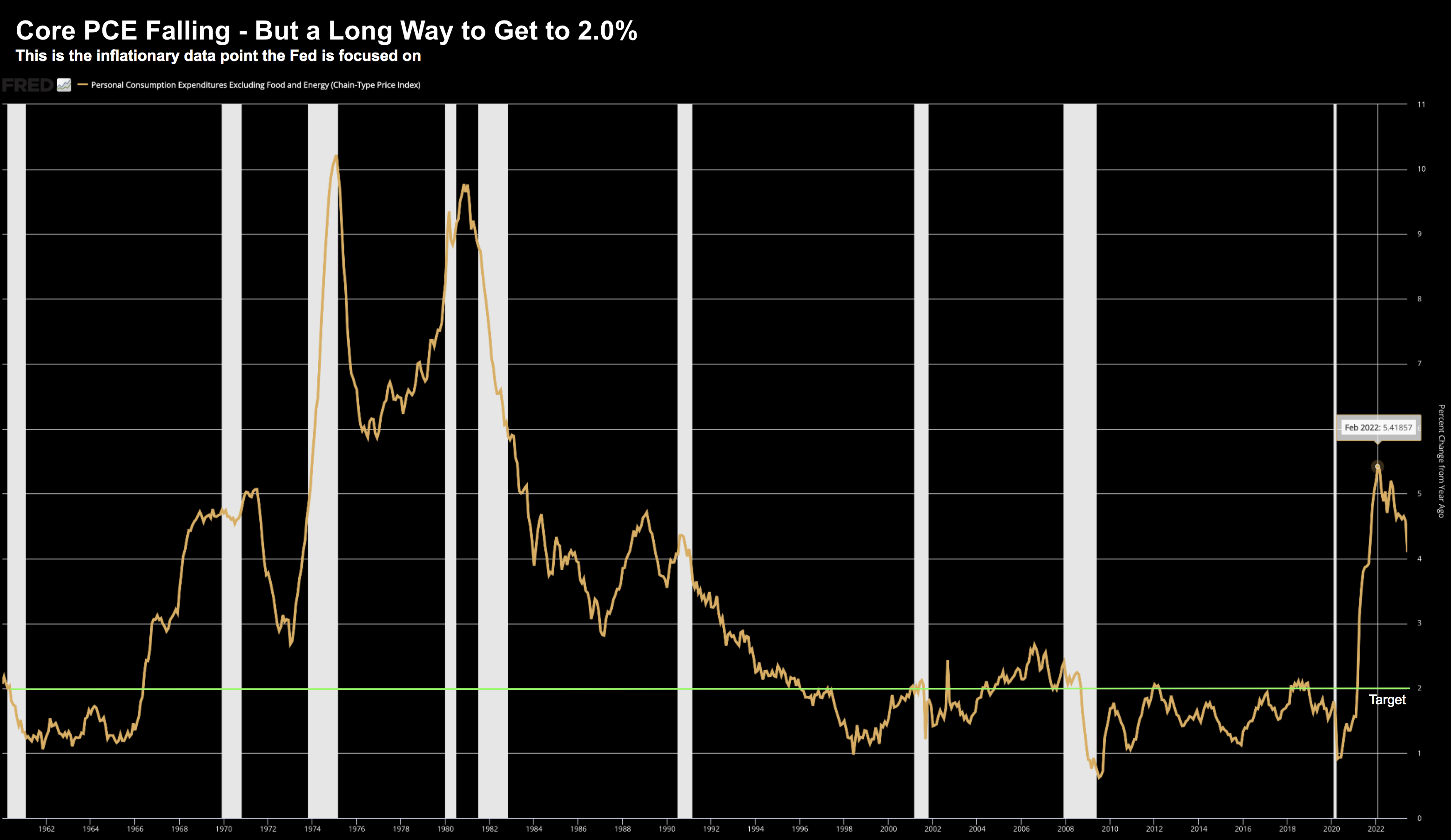

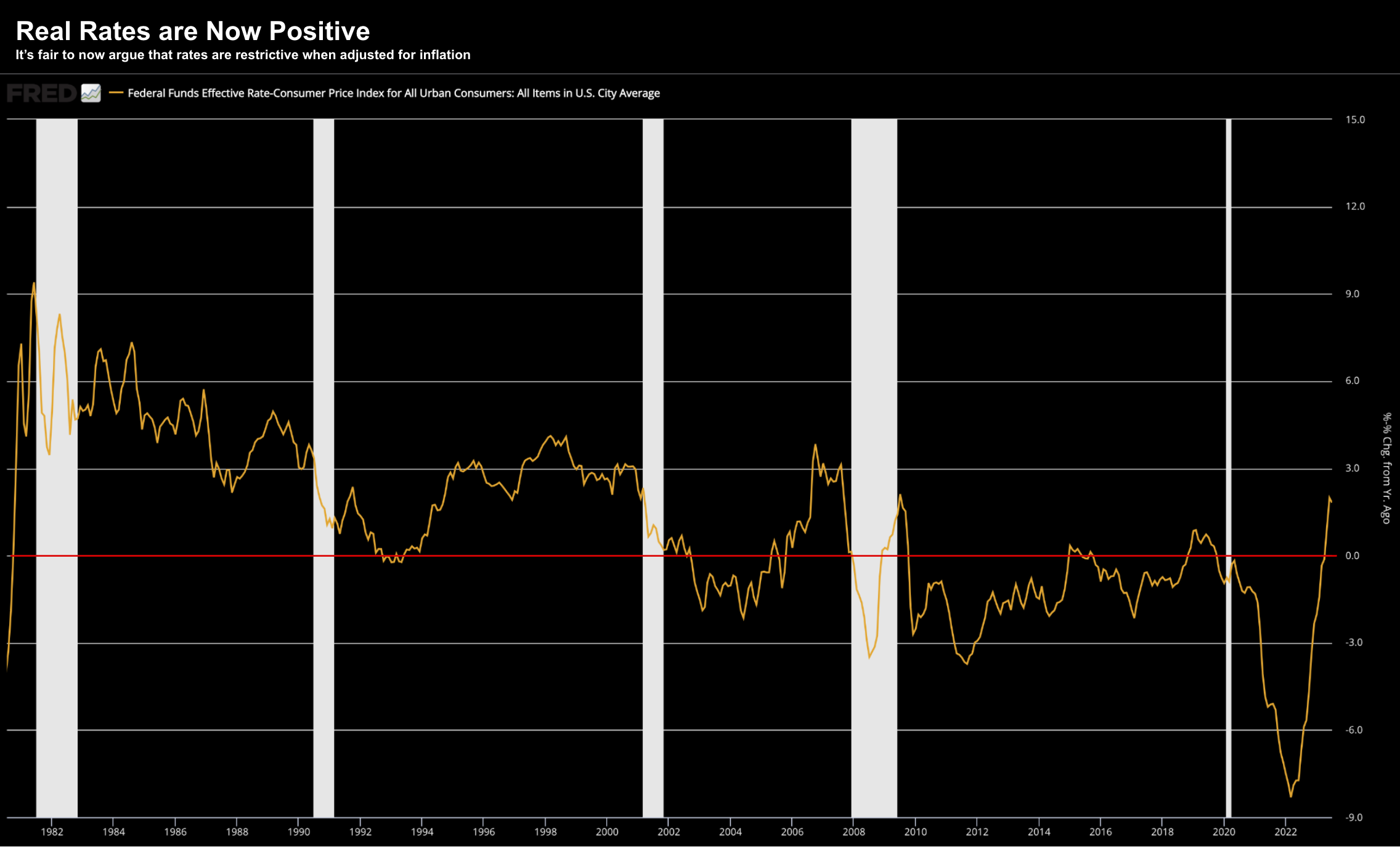

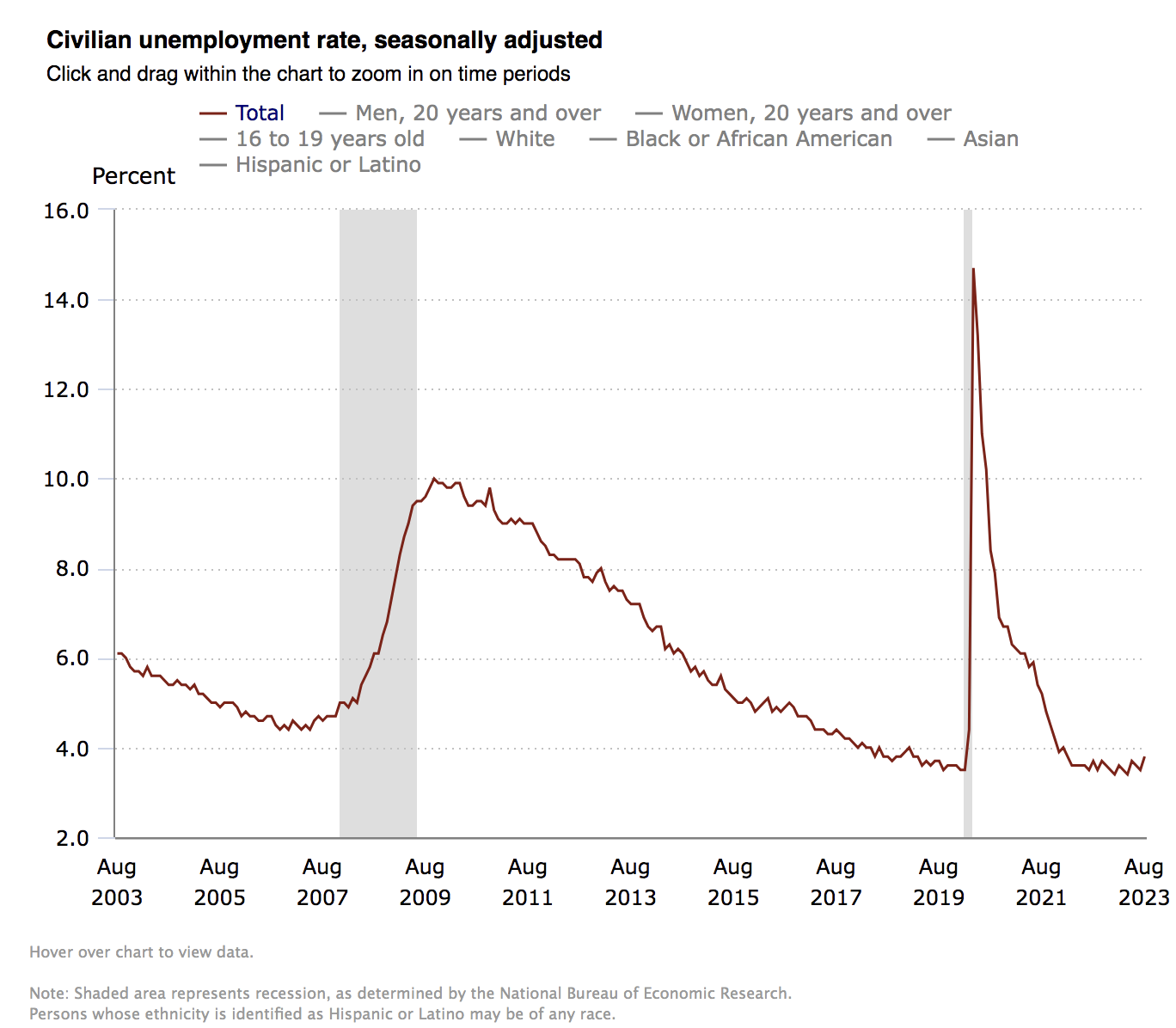

Last week offered plenty of macro data for traders (and the Fed) to consider. Core PCE remains stubbornly higher at 4.2% YoY - moving higher month on month. However, there is signs of a slowing labor force - with job additions missing expectations. The question is whether the jobs market is now slowing enough for the Fed to end rate hikes? For example, total unemployment is very strong at 3.8% and there are almost 9M open jobs. That's not a weak labor market...