A Textbook Reversal

A Textbook Reversal

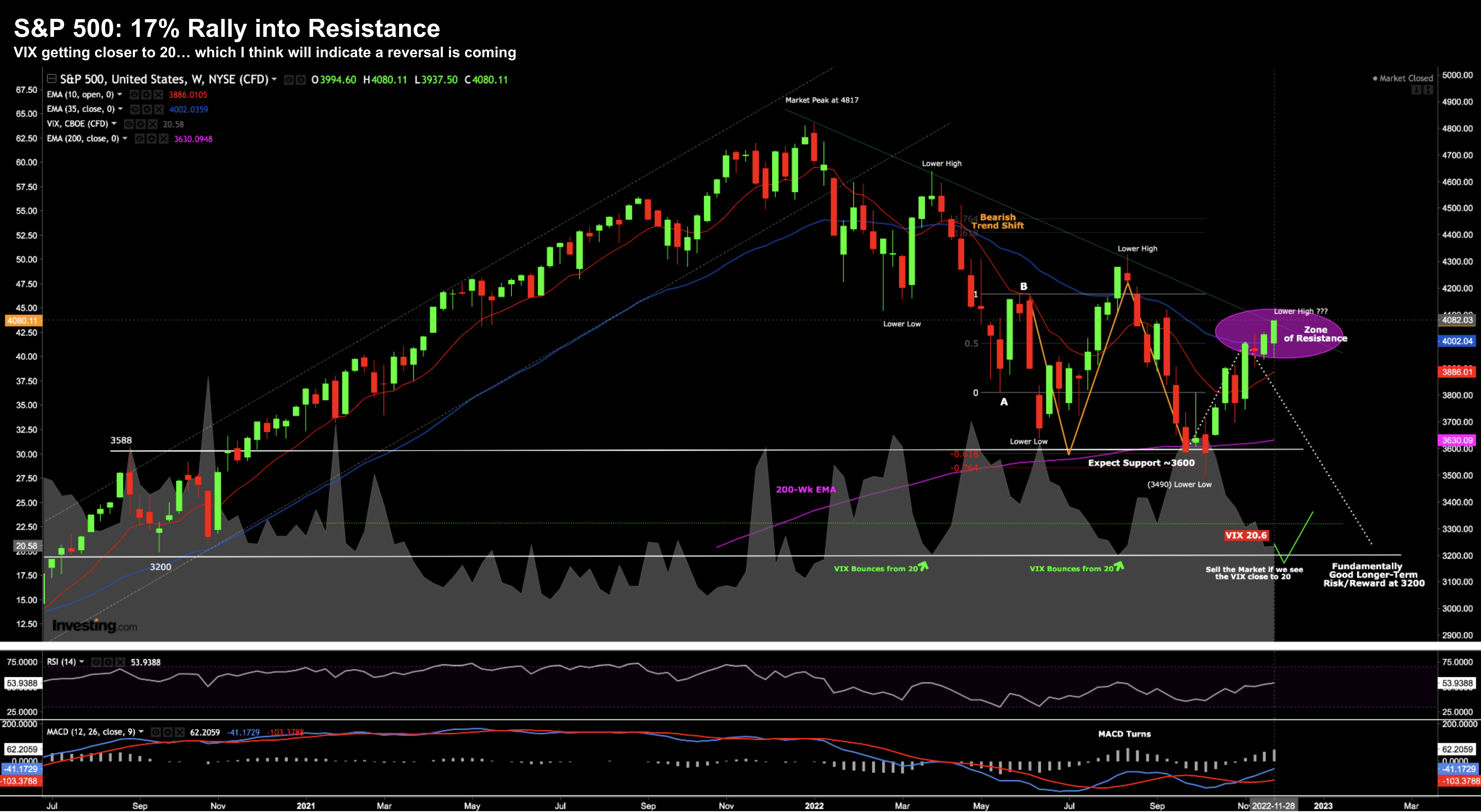

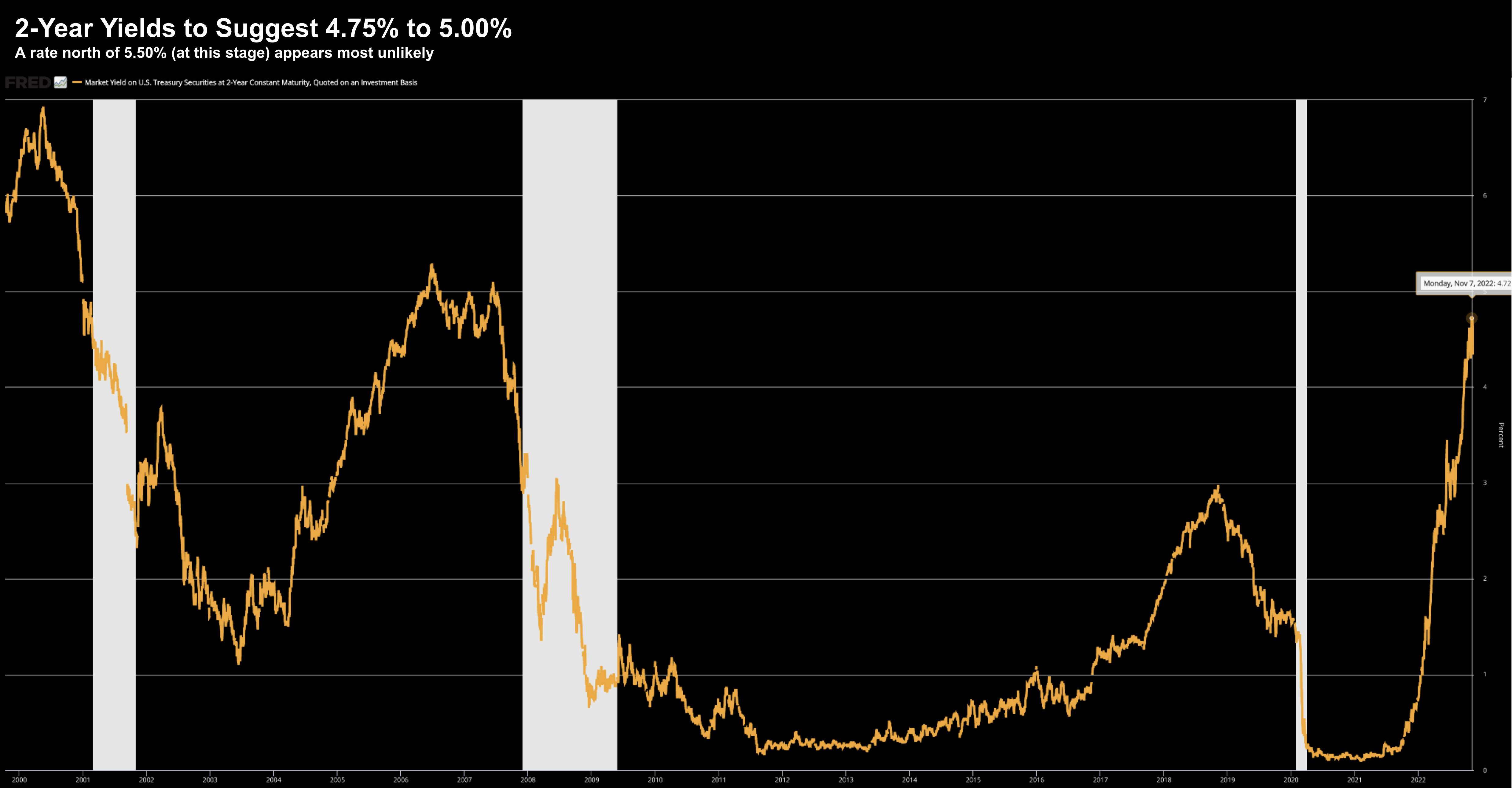

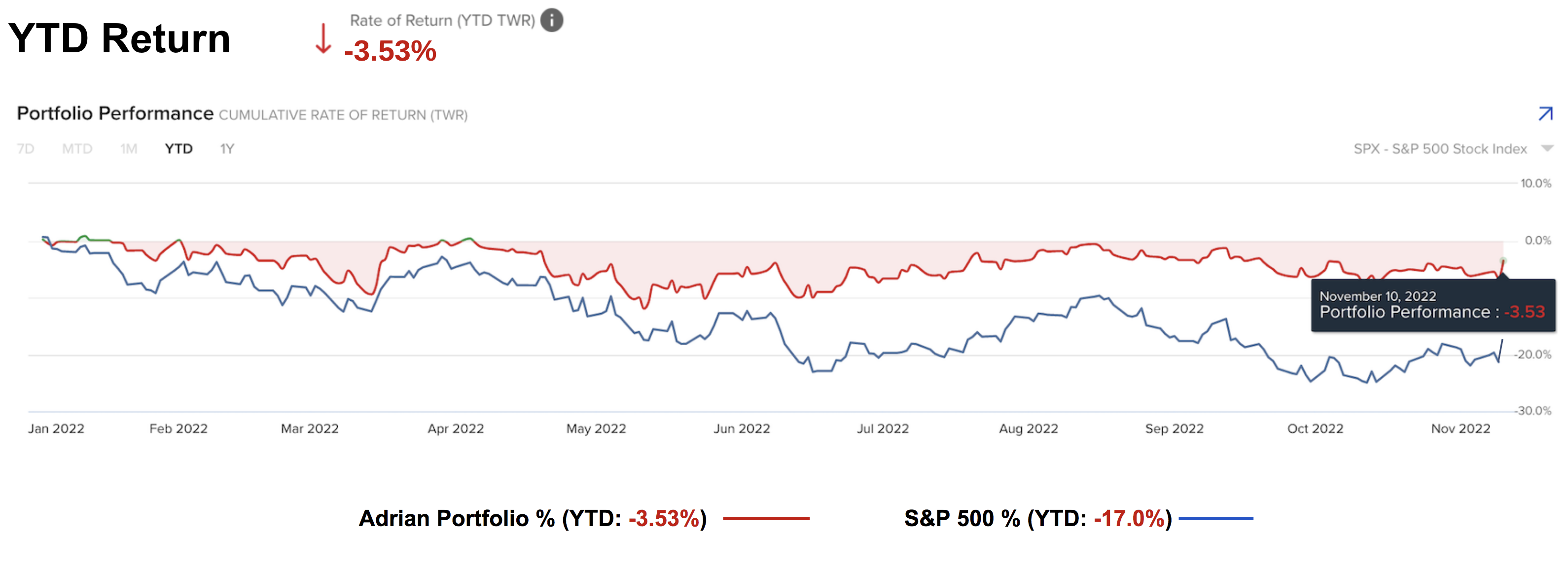

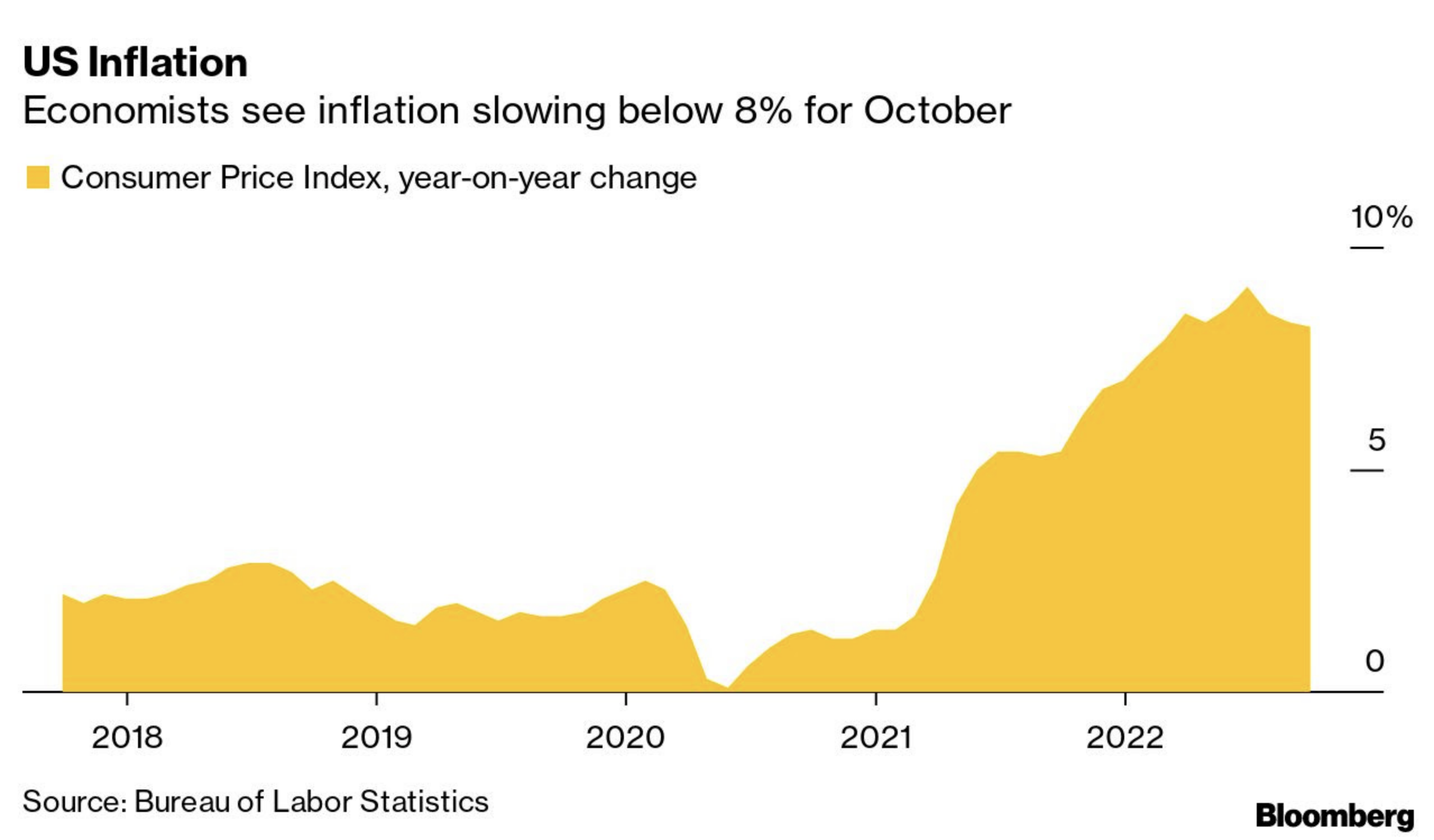

We've experienced a 16% rally off the October lows. And it's happened in short time. Why? Traders see a far more dovish Fed on much lower inflation / coupled with a mild recession. I'm not buying it... not yet.