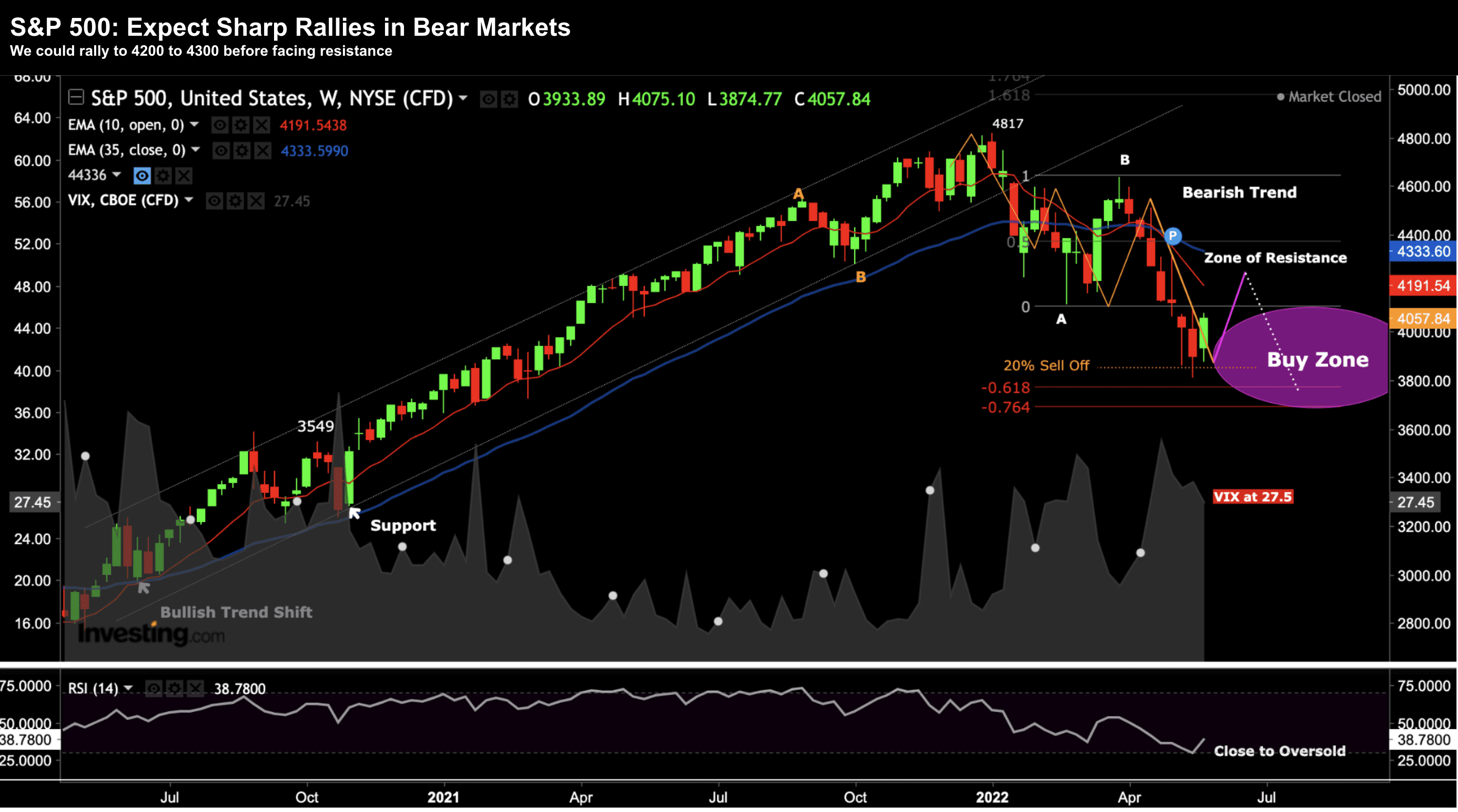

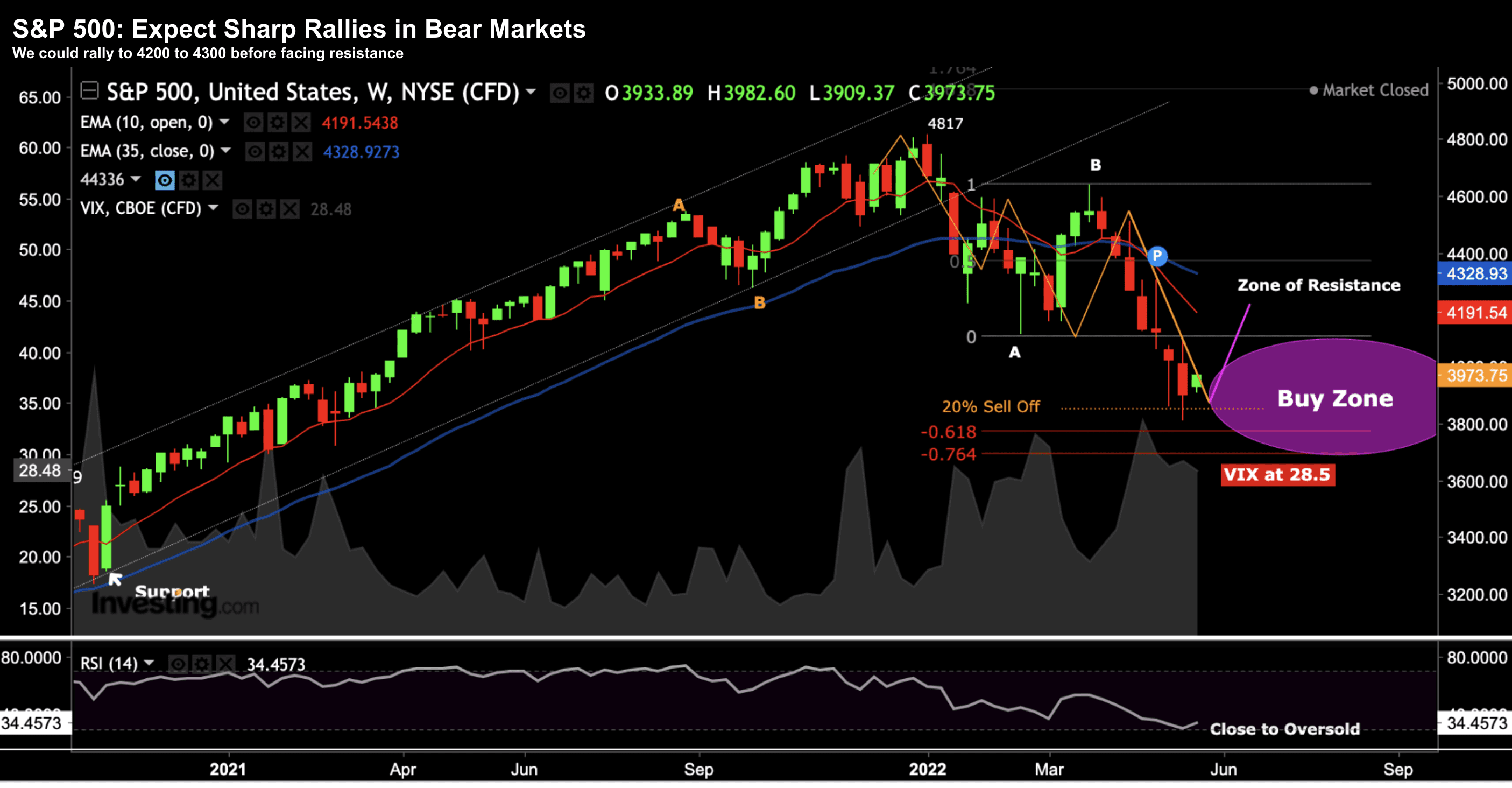

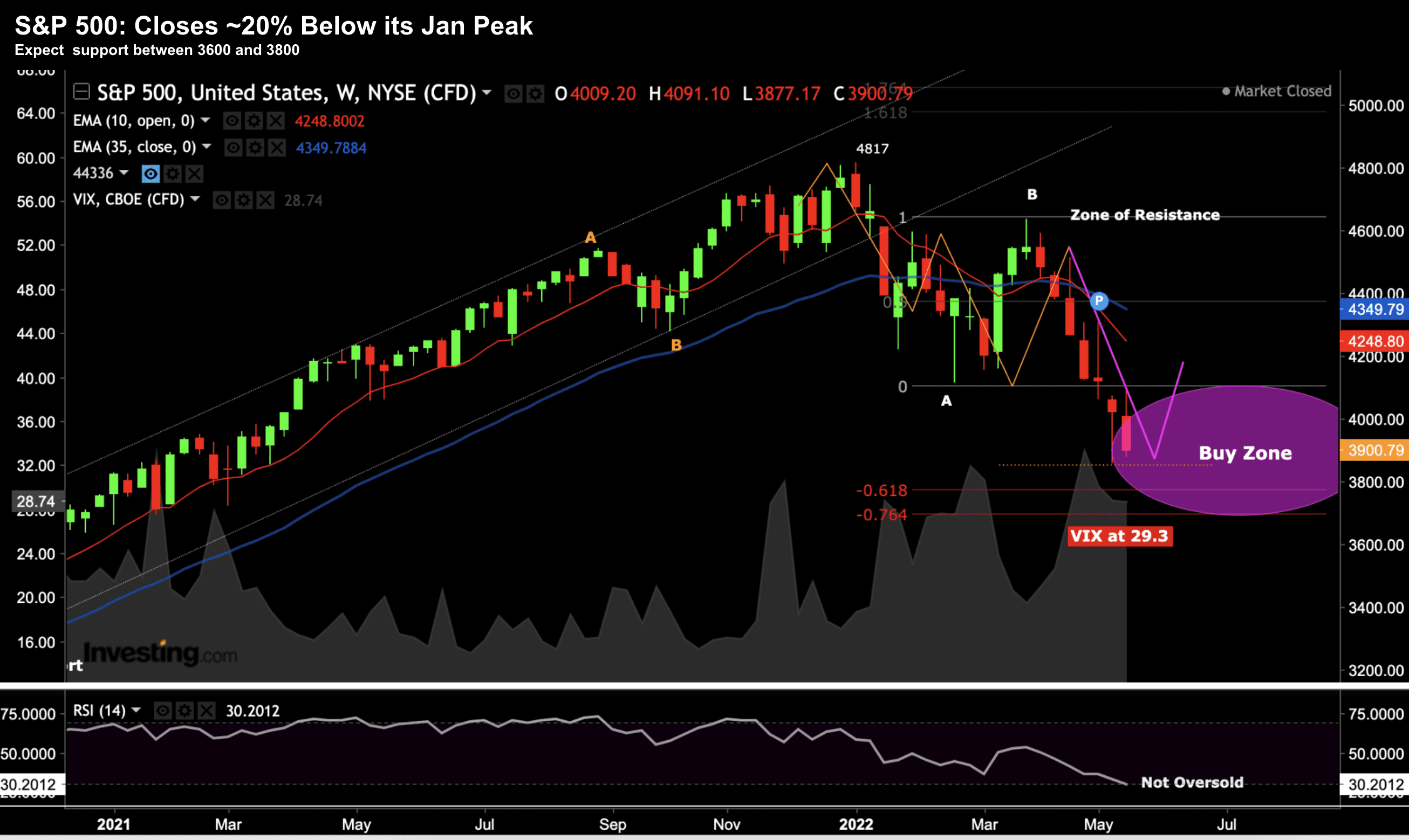

We Haven’t Seen the Lows for 2022

We Haven’t Seen the Lows for 2022

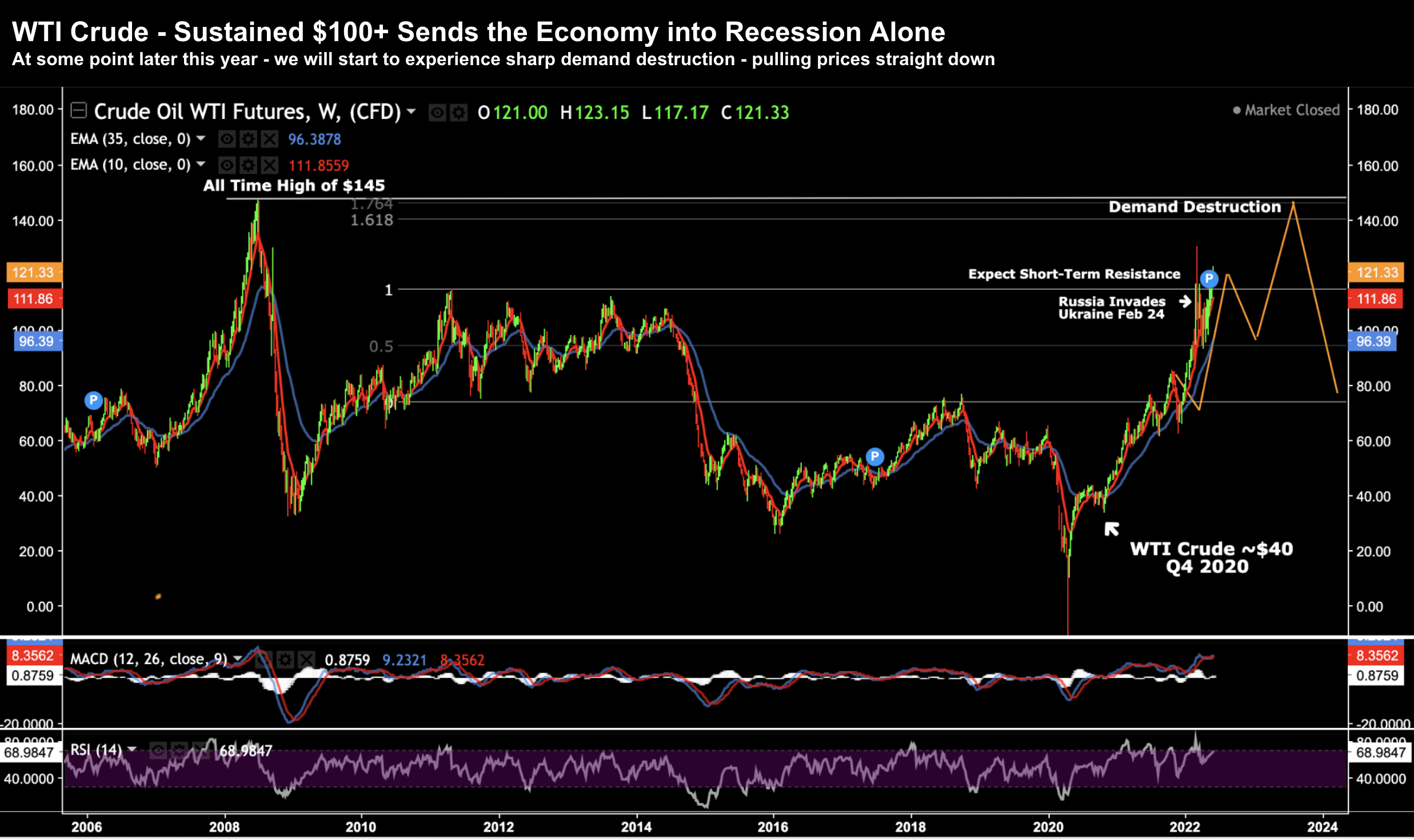

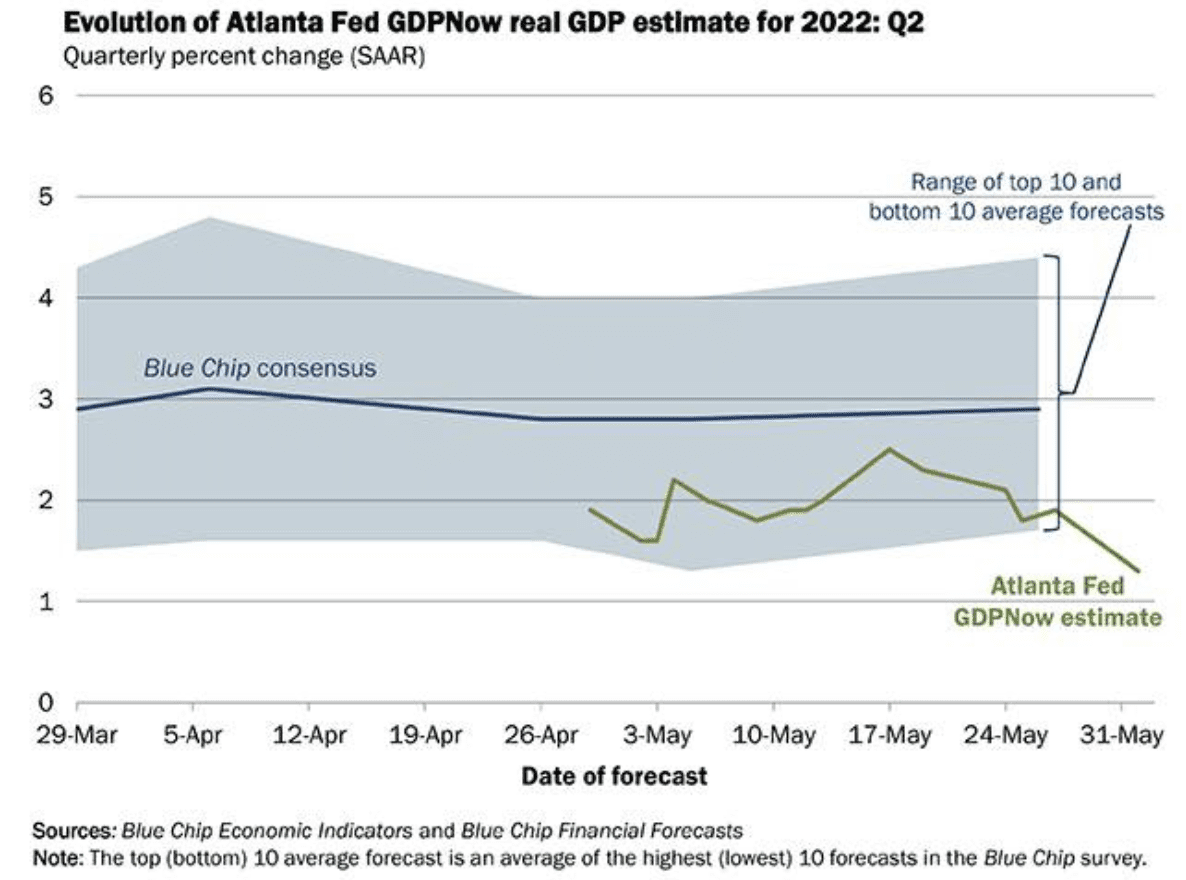

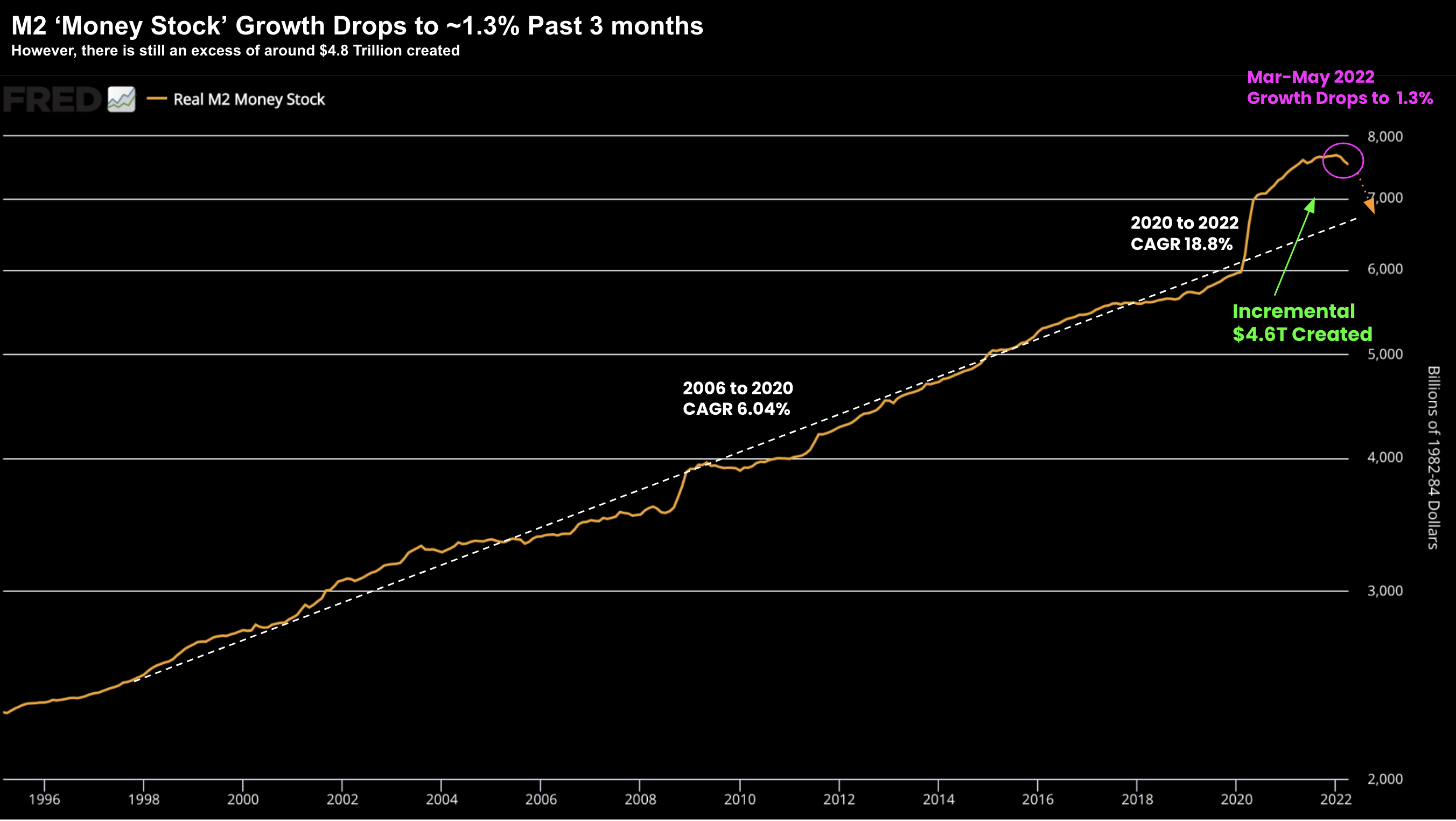

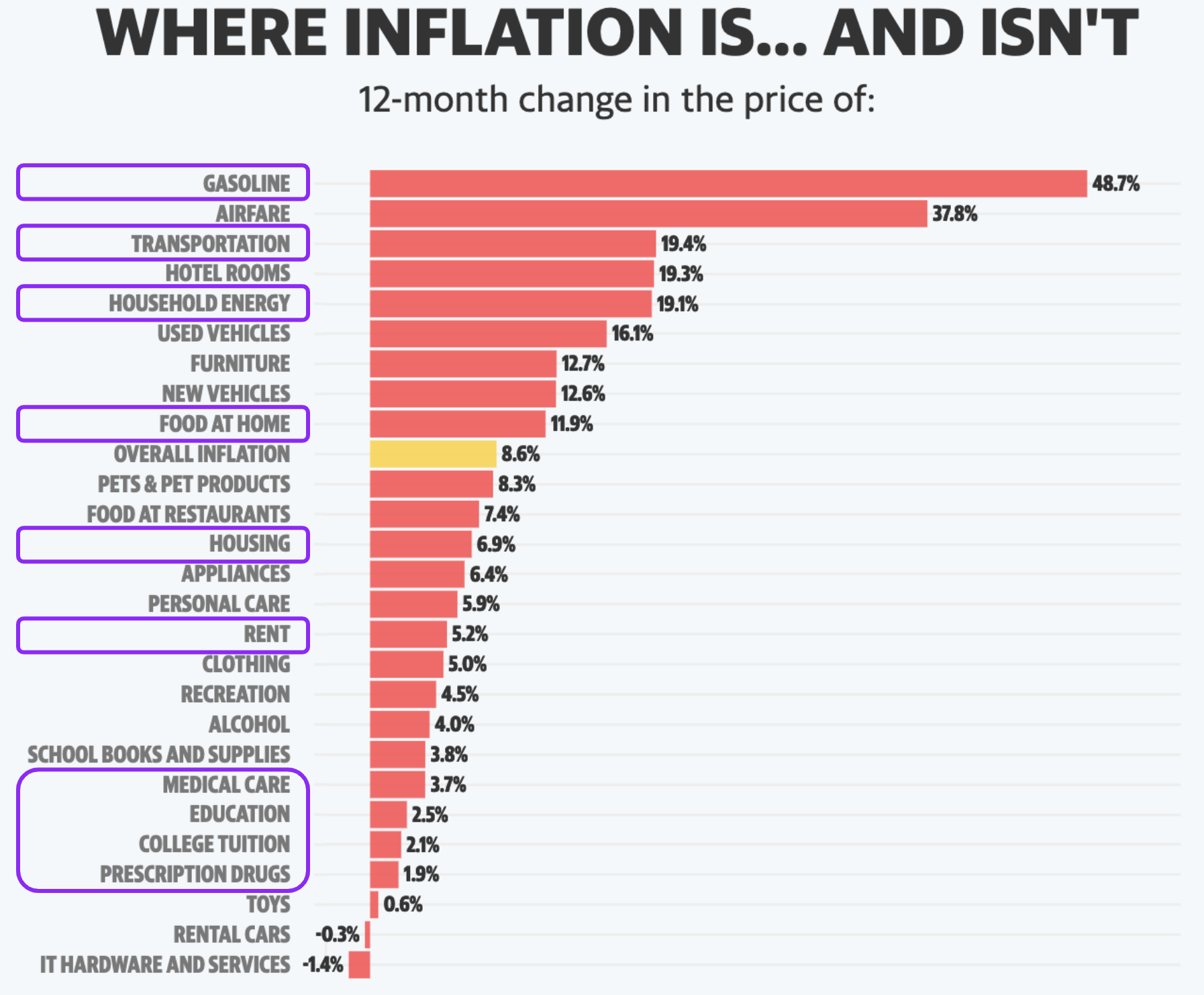

Consumer Price Inflation (CPI) continues to run at a 41-year high 8.6%. It's not hard to explain - look no further than monetary and fiscal policy. From mine, the Fed has no choice but to remain very aggressive - where a 75 basis point raise is not off the table. This is not conducive for higher stock market prices in the near-term