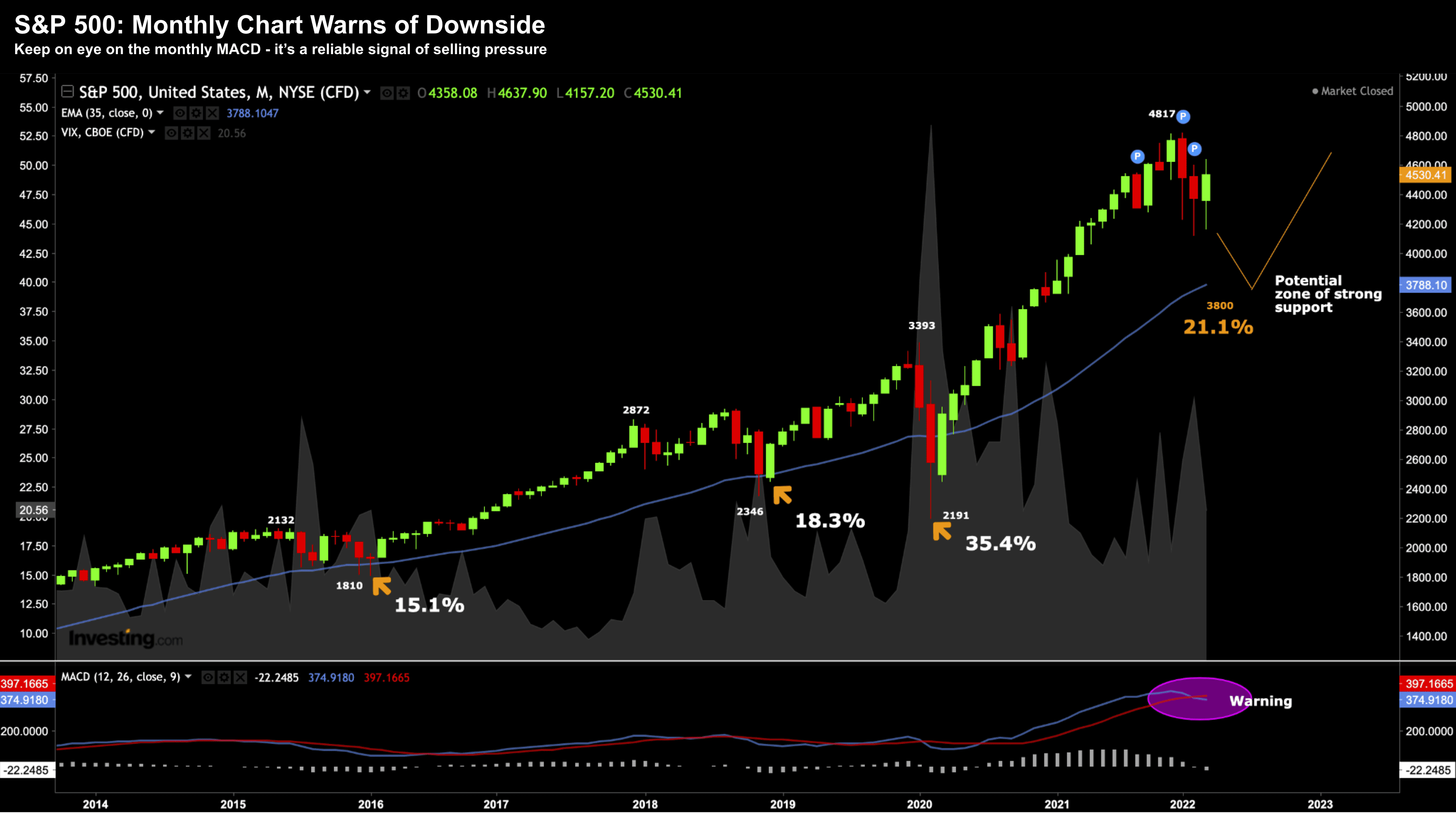

S&P 500 Loses 5% for Q1 2022

S&P 500 Loses 5% for Q1 2022

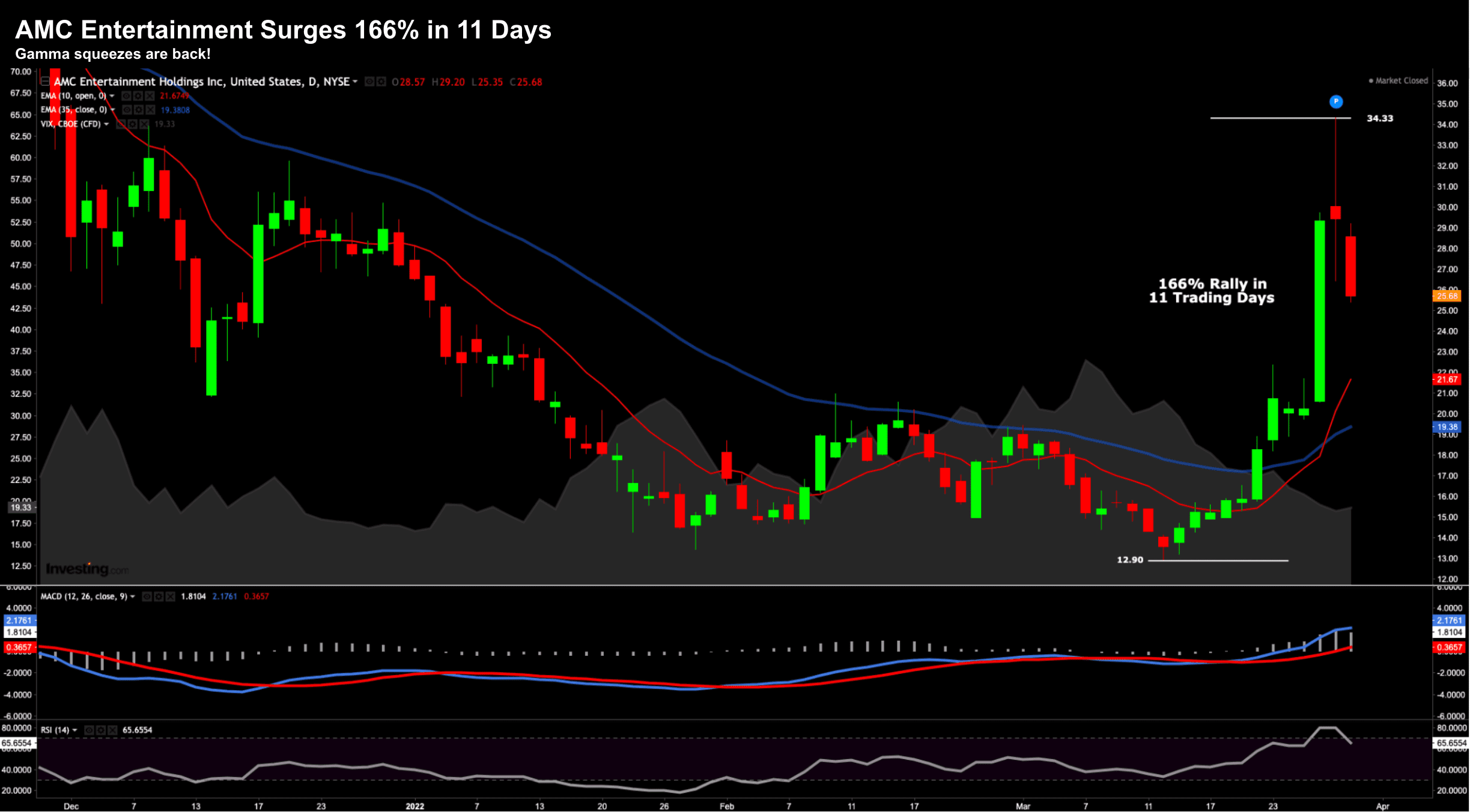

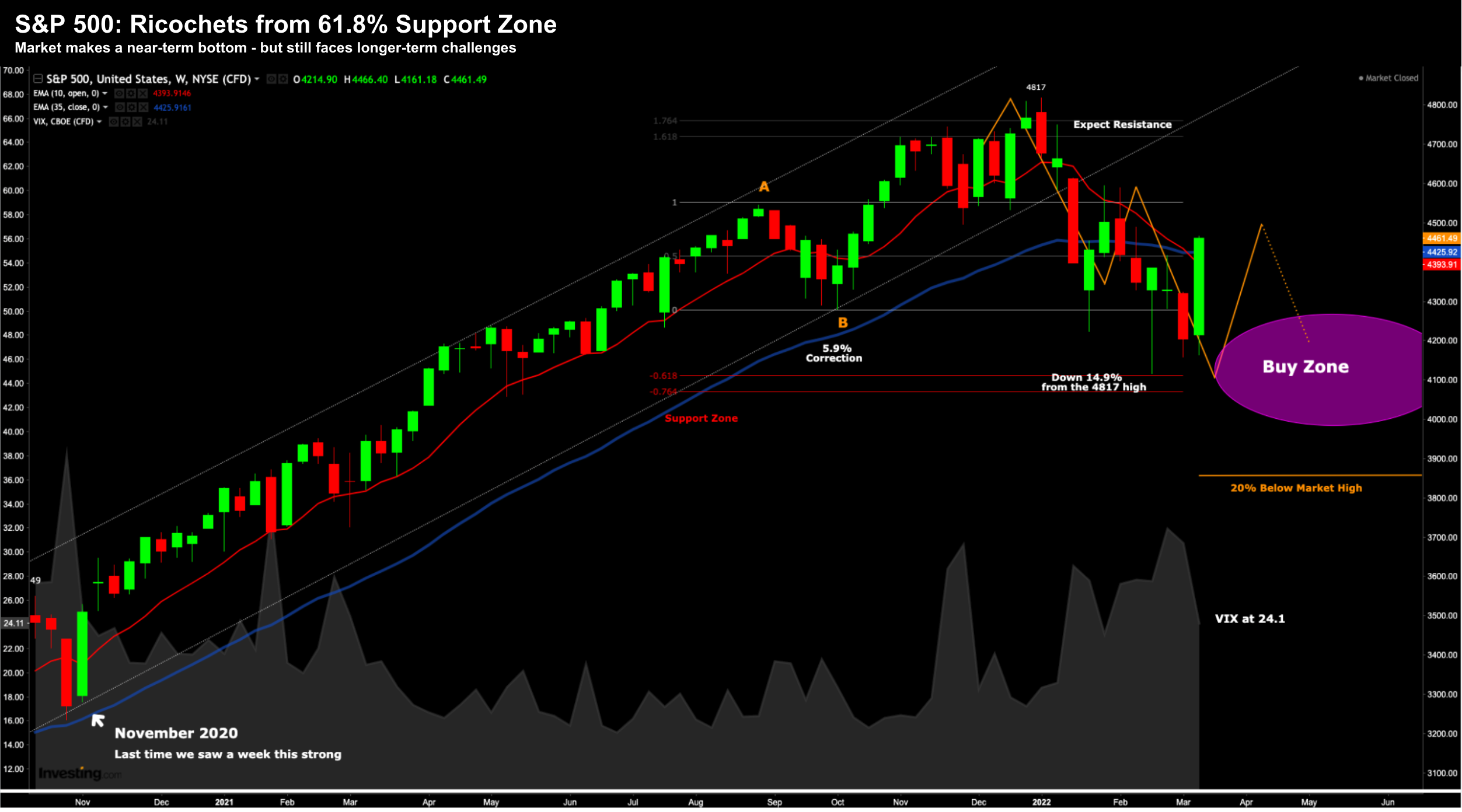

Yesterday I warned readers to treat this rally with caution. Let's just say it was "tripping a few wires". For example, meme stocks were rallying more than 150%... Cathie Wood's ARKK ETF was starting to move sharply... and short-term option trading hit 2021 frenzy levels. Market froth was back...