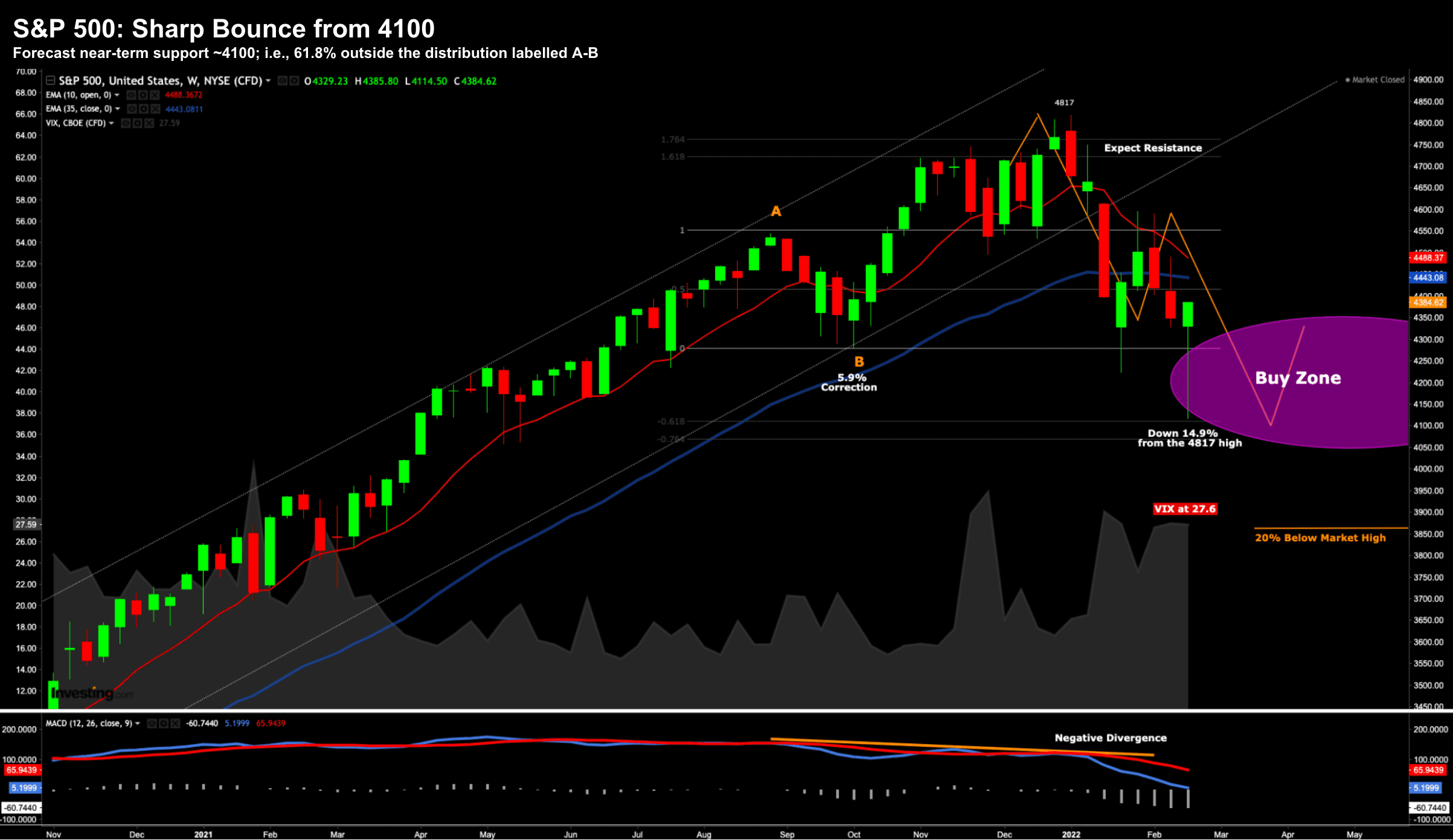

What Typically Happens after Rate Rises?

What Typically Happens after Rate Rises?

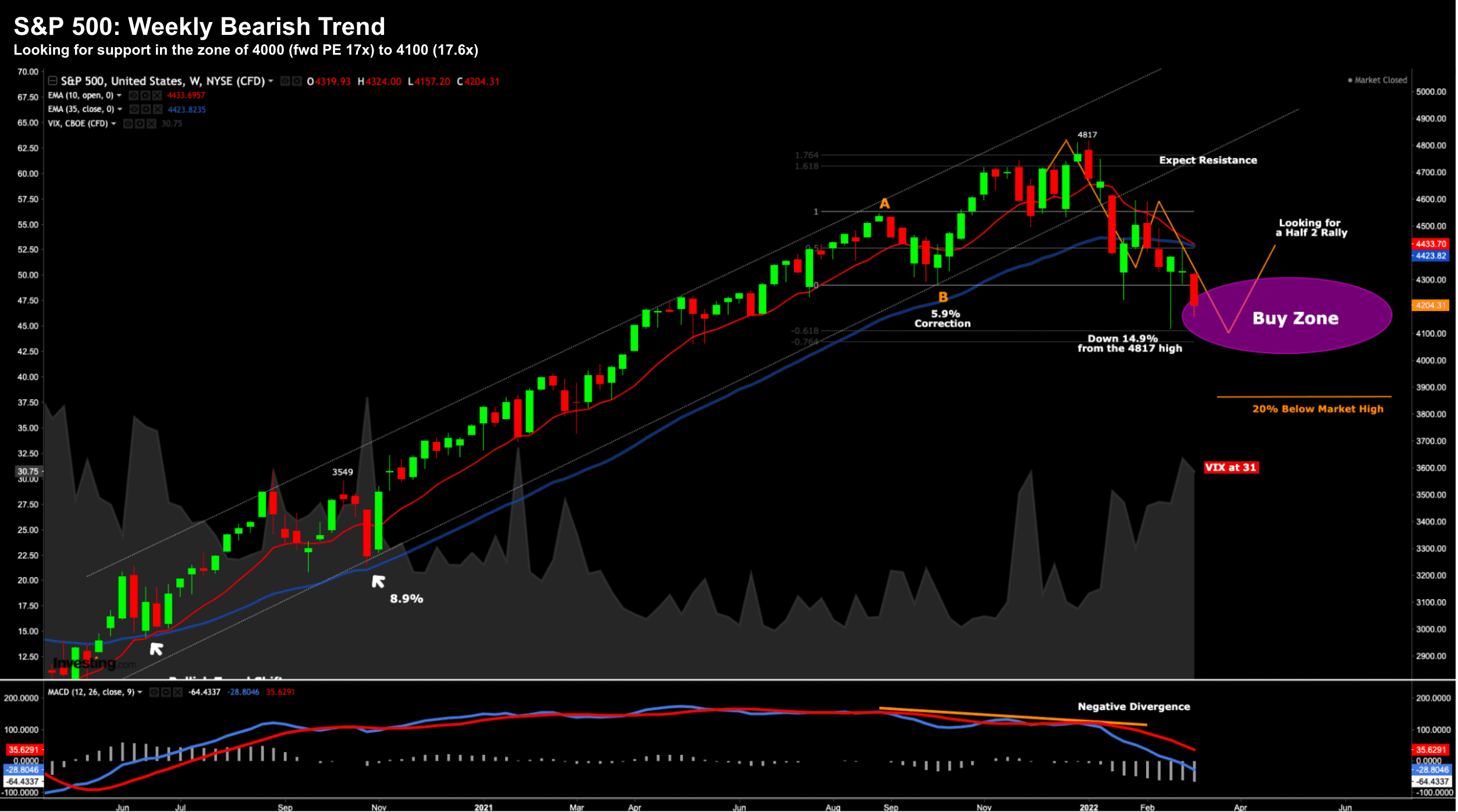

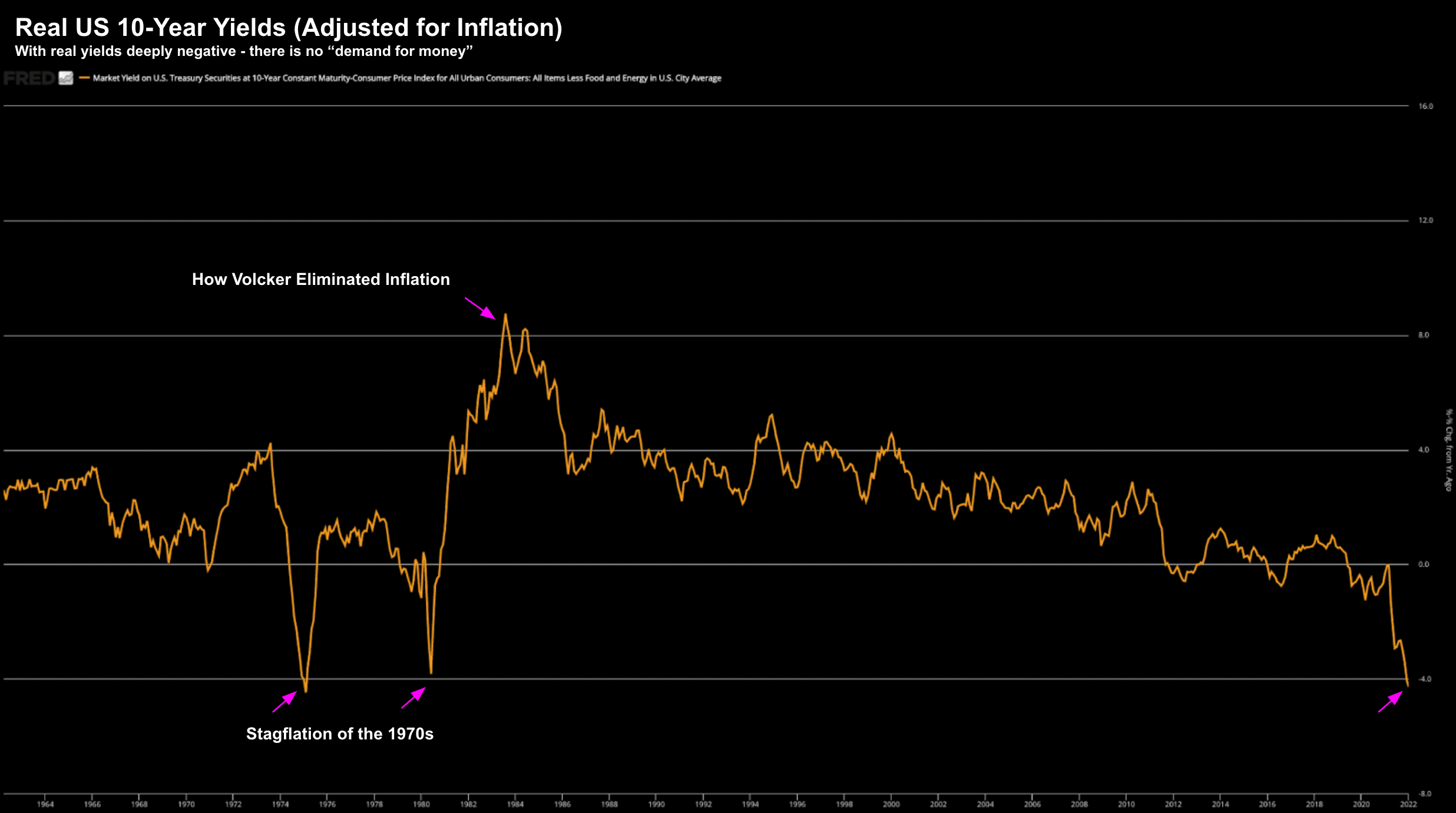

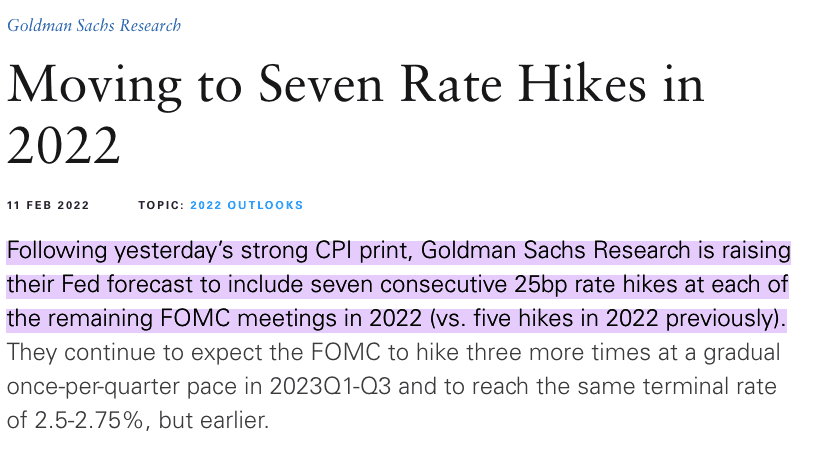

This post looks at how equities have reacted over the past 40 years to the initial rate rise from the Fed. In short, markets generally react positively to the first rate hikes... averaging more than 6% gains in the first 6 months.