Bond Vigilantes To Have the Final Vote

Words: 1,877 Time: 8 Minutes

- Worst week since early April – as uncertainty mounts

- Fresh tariff threats and deficit concerns rattle investors

- Why Bond Vigilantes (not the Senate) will have the final say on the Budget

Markets paused to take a breath this week following a six-week ~22% surge.

The S&P 500 surrendered a routine ~2.80% – after touching a 12-week high of 5,968.

With the market now trading at 22x forward earnings (a premium in any environment) – investors are arguably more mindful of:

- Ongoing Tariff risks – with new threats from Trump on Europe and Apple; and

- Rising Bond Yields – and any potentially widening of the deficit.

Until we get more clarity on each of these (likely to be at least 60+ days) – expect heightened volatility.

With respect to the budget – whilst the 435-members of House passed Trump"s self described "big beautiful bill" by a solitary vote – it"s expected to face resistance from deficit hawks in the Senate.

For example, the bill proposes to reduce funding for safety net programs in favor of extending tax cuts (e.g., a corporate tax rate of just 15% from today"s 21%; whilst also making the individual tax cuts from 2017 permanent).

Tax cut proponents will argue this is a tailwind for growth – turbocharging business investment and growth. And that could be true.

However, it"s also possible the corporate tax rate cut could reduce federal revenue (and widen the deficit).

How will these two offset each other?

On this, some estimate we will see a revenue reduction of $460 billion (to $675 billion) through Fiscal Year 2034 (despite the expected increase in GDP growth).

But again, this is very difficult to model given all the moving parts.

Let"s explore…

As the deficit risk is front and center for the market and bonds.

Debt: A Ticking Time Bomb

As a preface, I"m not here to argue whether the proposed budget is good or bad.

That"s a function of your own ideological lens – outside the scope of this blog.

But as an investor solely focused on capital allocation and managing risk – my concern is how this will impact financial assets (e.g., stocks, bonds, cash and gold).

Consider some of the following:

- The Tax Foundation estimates the proposed budget could add between $3 to $4 Trillion to the existing $37 trillion national debt over the next decade

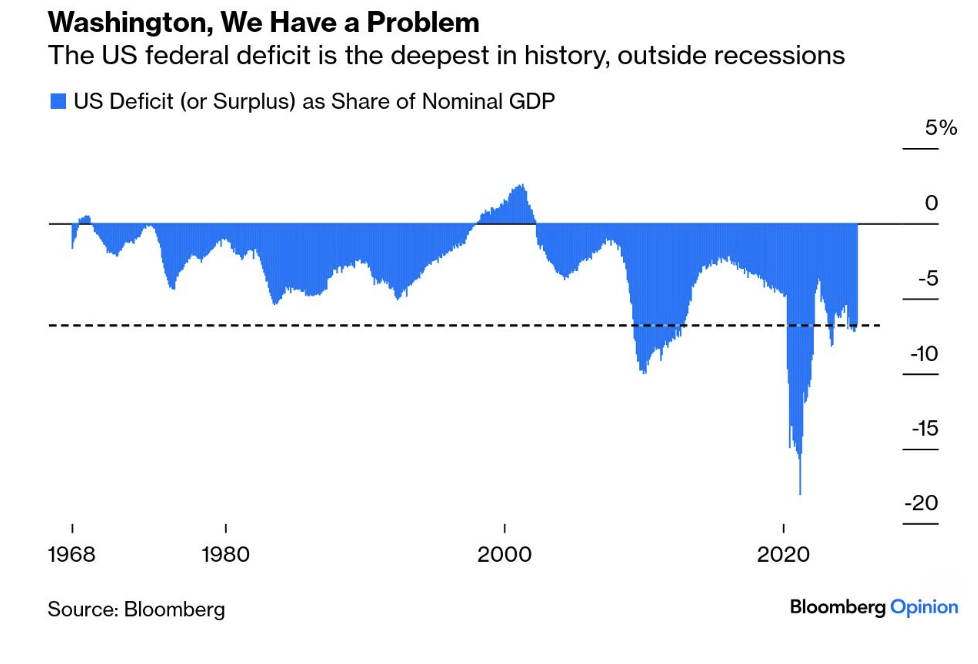

- The Congressional Budget Office"s (CBO) predicts deficits to remain at 5% GDP or higher throughout the next decade, the largest sustained budget gap in records going back to 1930

- The chronic deficits are partly due to rising interest on the debt, which is set to exceed defense spending this year for the first time ever and grow to a record high of 3.2 percent of GDP next year before rising higher to 3.9 percent in 2034.

Irrespective of your political lens – left or right – none of this is good news.

For example, an annual interest bill which exceeds the money required for Defense and Medicaid is unacceptable.

In response to (long-running) fiscal recklessness – bond yields are moving higher – which is having an impact on how investors allocate capital (see "Equity Risk Premium Isn"t There").

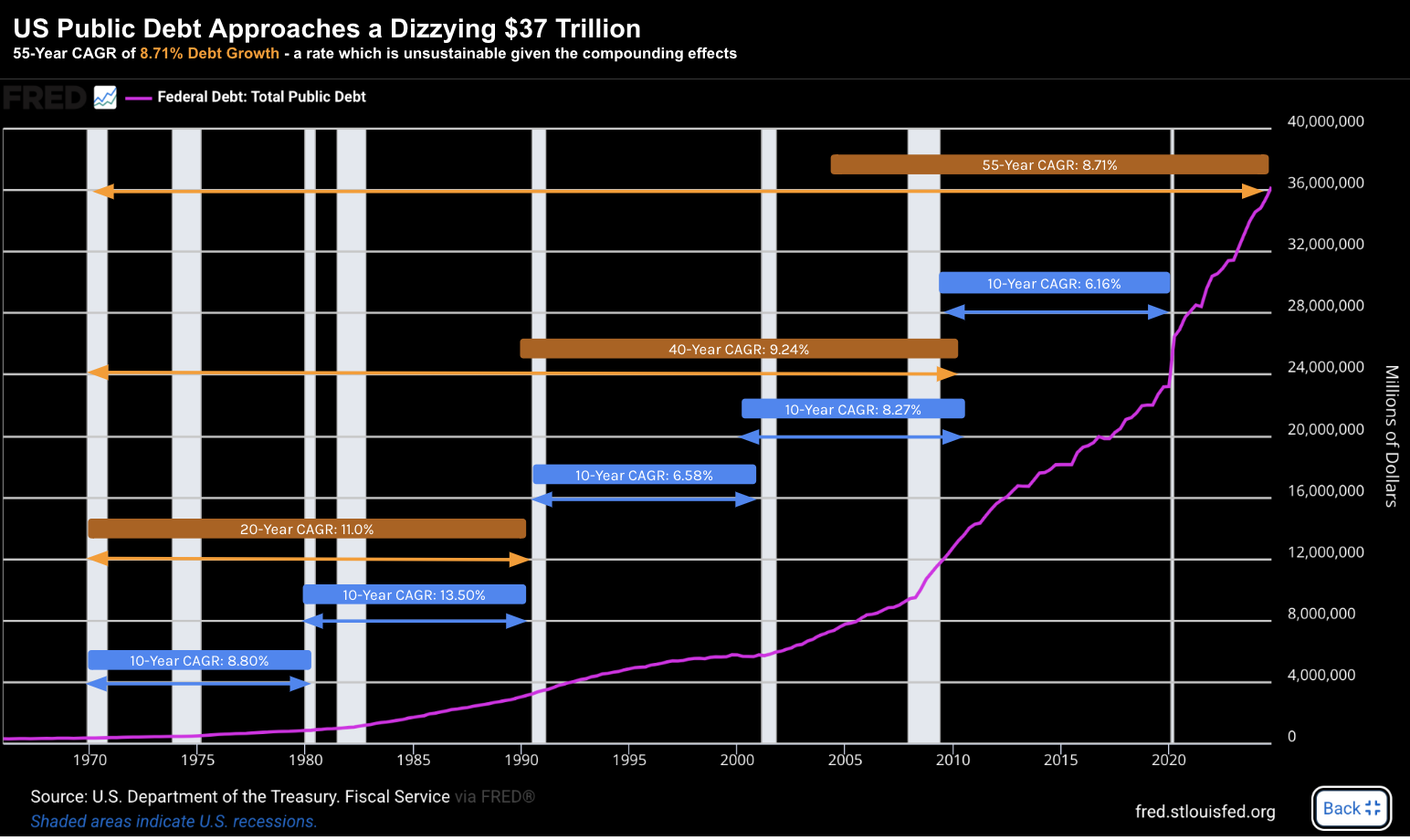

Adding more color – I shared this 55-year US public debt chart – showing the (frightening) 8.7% average annual rate of growth.

And on the basis Uncle Sam continues to run deficits to the tune of ~5% of GDP (something you only see during an economic emergency) – this will compound what is already unsustainable:

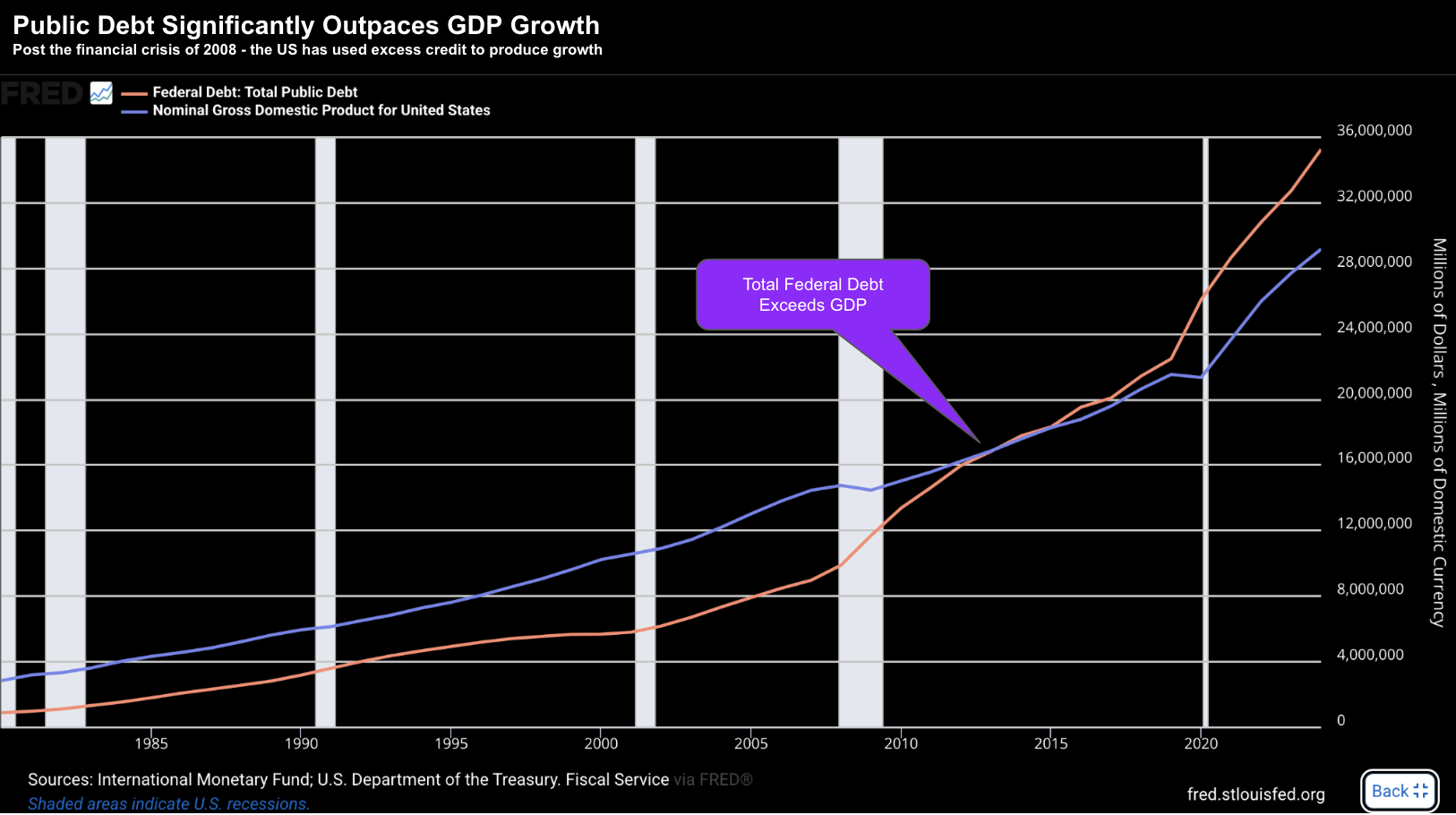

But there are some who will argue expanding debt is fine if we see growth expanding at a faster rate.

For example, this is the (economic) argument that Treasurer – Scott Bessent – is trying to sell (playing down the ballooning debt)

"Bessent insisted that the administration is on track to produce economic growth that will outpace the rise in debt. "We are determined to bring the spending down and grow the economy," he said

In other words, the Treasurer is of the view that their plans to accelerate growth via tax cuts, deregulation and other stimulus — will more than pay for the increase in debt.

But that remains to be seen… and what bond vigilantes will vote on (more on this in a moment).

However, what we can say is for the past 15+ years – debt (orange line) has meaningfully outpaced growth (blue line) – where credit has simulated growth.

Let"s now shift to where the government is spending taxpayer money (and specifically on interest servicing the debt).

The numbers below are current to the end of 2024:

| Category | 2024 | Total % | Description |

|---|---|---|---|

| Social Security | ~$1.4T | ~22% | Retirement benefits for seniors and disabled individuals. |

| Health (Medicare & Medicaid) | ~$1.7T | ~26% | Medicare for seniors & Medicaid for low-income Americans. |

| Defense (Military) | ~$860B | ~13% | Pentagon, weapons systems, salaries, overseas operations. |

| Interest on Debt | ~$850B | ~13% | Payments on $37T+ in federal debt. |

| Other Discretionary | ~$940B | ~15% | Education, transportation, R&D, etc. |

| Other Mandatory | ~$650B | ~10% | Food stamps (SNAP), unemployment, veterans" benefits, etc. |

Therein lies the rub…

Should bond yields continue to rise – it will mean less money that could be invested in critical areas such as social security, health, education and defense.

For what it"s worth, bond vigilantes are neither conservative or progressive.

So far they"re not buying what Bessent is trying to sell…

They see the problem for what it is… the US continues to spend well beyond what it earns.

And that"s sending bond yields higher.

Bond Vigilantes Will Decide

This week we saw a lot of volatility in the bond market as they sweat the outcome of the budget.

And as I mentioned earlier – until the "clouds clear" over the budget – this will continue.

To help us understand the pain in the bond market – below is the 6-year price action in the widely held iShares 20-Year Treasury ETF (TLT).

For those less familiar, this bond based ETF will:

- Rise when long-term bond yields fall; and

- Fall when long-term bond yields rise

In other words, bond prices trade inversely to their yields.

Here we see the ~57% drop in TLT as longer-term bond yields rose from ~1% to levels of near 5%.

May 23 2025

The question for bond holders is how high could yields rise?

Obviously it"s a very difficult question to answer.

Stock market investors (and the government) will start to get very nervous when the 10-year yield hits levels of 4.75% and above.

Perish the thought of anything above 5.0%!

Now should the US" fiscal situation worsen (e.g. the bill is passed by the Senate) – this chart could break down – leaving bond investors exposed.

One further data point before I turn to equities…

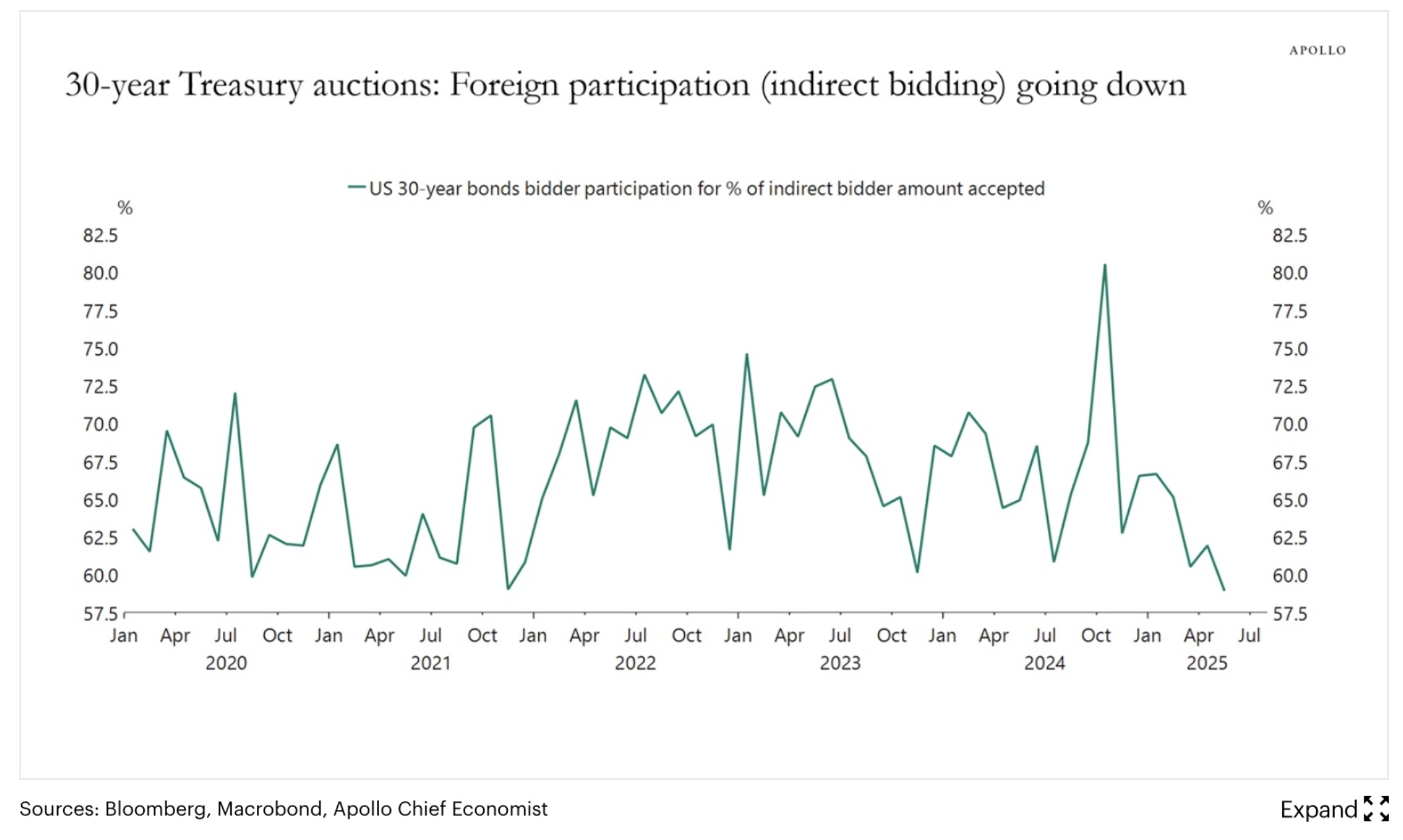

The U.S. government auctioned 20-year bonds this week — however demand was tepid.

Put another way – yields are not high enough for bond investors to be sufficiently compensated.

From Reuters:

The U.S. Treasury Department saw soft demand for a $16 billion sale of 20-year bonds on Wednesday with investors worried about the country"s increasing debt burden as Congress wrangles with a tax and spending bill that is expected to worsen the fiscal outlook.

The poorly received auction, which saw stocks and the dollar sell off while U.S. Treasury yields rose, shows intensified investor worries about the country"s ballooning debt that could spur bond market vigilantes who want more fiscal restraint from Washington

And that"s my point…

It won"t be the House or Senate which determines the "responsibility" or "health" of the budget.

It will be Bond Vigilantes who decide on whether it"s fiscally responsible.

And right now – that answer is no – with 10-year trading above 4.50%

The team from Apollo asset management produced this chart showing the declining demand for treasuries:

This should be top of mind for all investors.

Let"s close with a look at the weekly chart for the S&P 500.

S&P 500 Takes a Pause

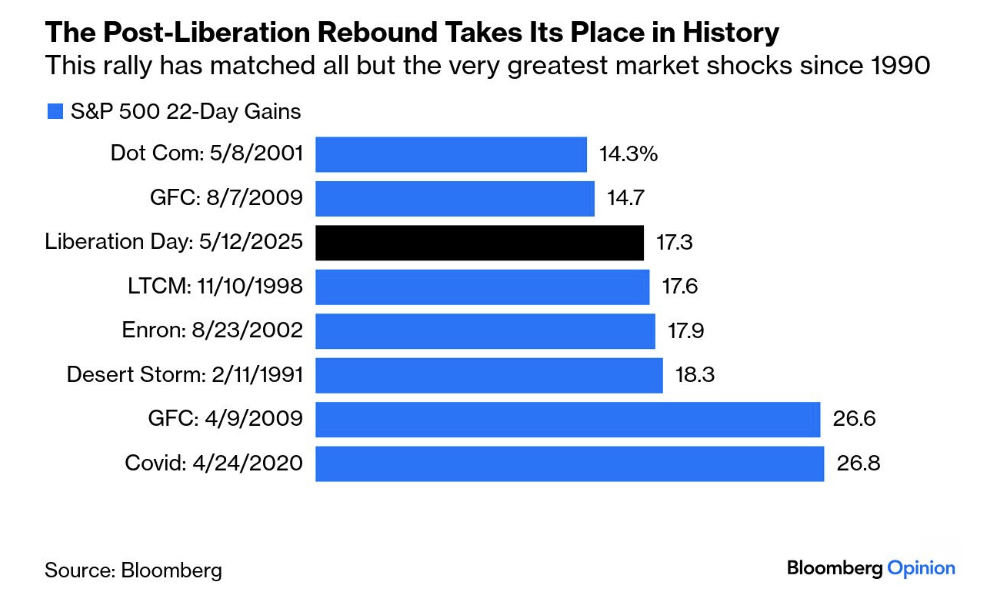

The run-up in stocks the past 6 weeks was one of the record books.

We have seen the market rally from a low of 4,835 in the first week of April – to test 5,969 this week.

From peak-to-trough – it"s a whopping 23.5% gain over 34 trading days (I shared this chart from Bloomberg the other week)

From mine, the ~3% pullback this week was largely routine.

Nothing rises or falls in a straight line.

But let"s examine if there could be more in the weeks to come – and any key zones to watch:

May 23 2025

Despite the 20%+ rally – the market is far from being in the clear (see this post).

From mine, the zone of 5700 will be its next litmus test. Two thoughts:

- This was the major high made in July 2024; and

- It"s also the current zone of the 35-week EMA

With respect to the 5700 high last year – previous highs will often act as a new area of support.

However, if this level breaks, the trading range above 5700 from October to February – would be considered a "false break" higher.

Therefore, I will be watching to see whether it can effectively hold the upper range.

For what it"s worth – I don"t think it does for all the reasons I outlined earlier (also see this post).

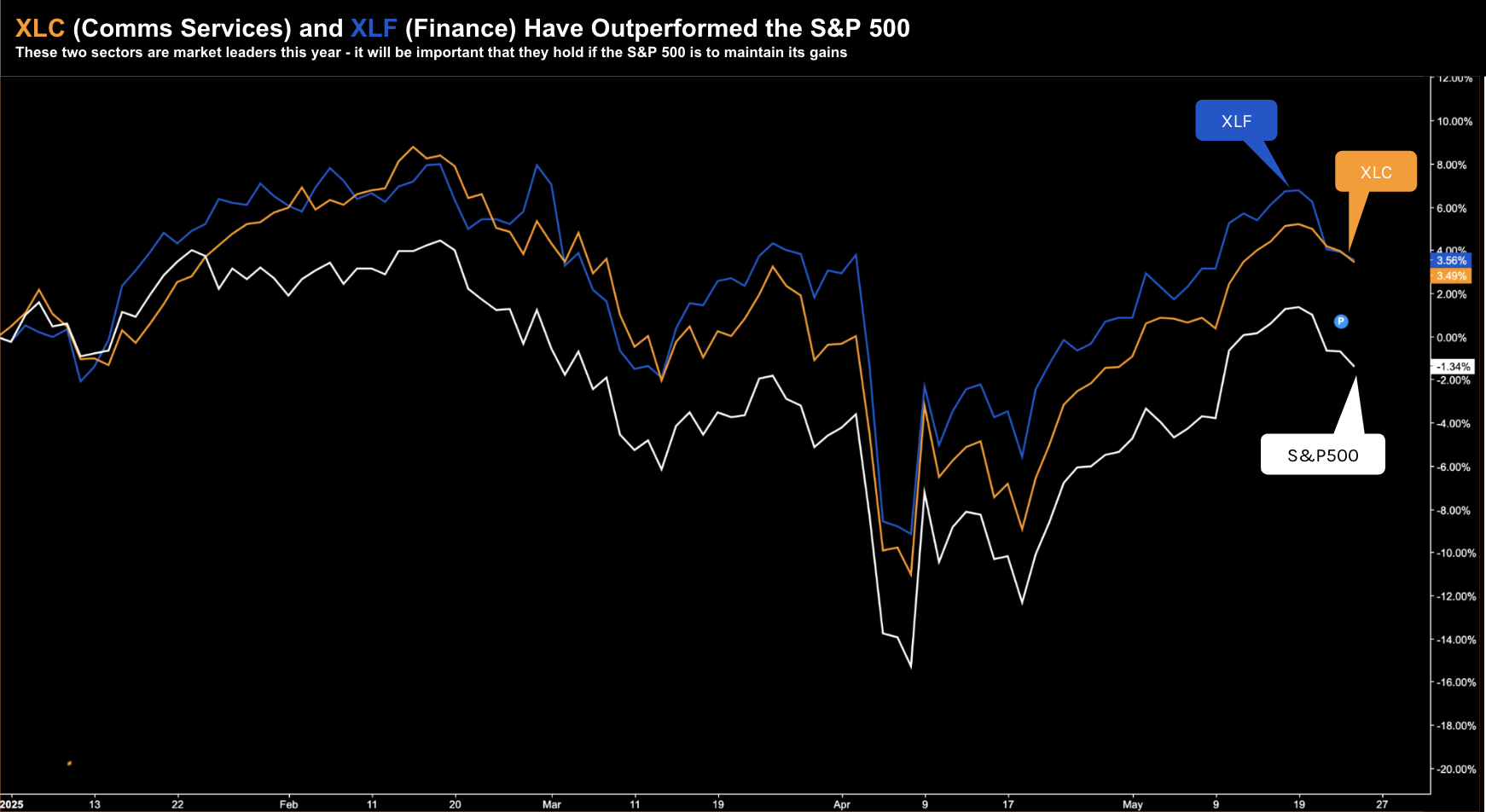

As an aside, the rally"s leadership has primarily come from two sectors:

- Communications Services (internet stocks)

- Financial Sector (banks etc)

Both of these have outperformed the Index by a good margin so far this year – therefore it will be important they maintain this leadership.

May 23 2025

For what it"s worth – my largest sector allocation is communication services.

However, I remain wary of this v-shaped rally. For me to increase my confidence – I need to see:

- Closure on the budget and plans to reduce debt (i.e., lower bond yields)

- Greater clarity on tariff deals (specifically China and Europe)

- The Fed taking aggressive monetary action to either cut rates and/or re-initiate QE (bond buying -> lowering yields)

Putting it All Together

It"s unusual to see fiscal policy having an outsized impact on the market and its direction.

But given the significance of the ballooning debt and widening deficits (driving bond yields higher) – it"s front and center.

From mine, higher yields are equally as important as any tariff deals.

Now should the market get some clarity on where Trump is heading with tariffs – the market could get some respite.

We saw this with the 90-day pause and the 10% deal reached with the UK.

However, since the UK deal, we have seen nothing. And now we"re getting more noise on:

- Europe 50% tariff – effective June 1st; and

- A new 25% tariff on Apple iPhones made in India

If you ask me, Tim Cook (Apple"s CEO) should just pay the 25% tax on iPhone"s and split the difference with consumers (Trump won"t like to see the tariff impact passed on).

But all of this only reinforces how volatile and unpredictable the tariff situation is.

Despite the so-called 90-day pause (which sparked the rally) – Trump remains on a tariff war path.

And when I put all this together (e.g., rising yields; the deficit widening; tariff and inflation risks) – with the market trading at 22x forward earnings – why would you pay the premium?

For me, the risk reward is simply not there. Remain patient.